Bitget Research Institute: Japan, a pioneer in the crypto market

Original author: Bitget Research Institute

Summary

• Japan is the earliest market to explore cryptocurrencies. Currently, the average number of people participating in transactions in the region is about 350,000 per day.

• In terms of regulatory environment, the Japanese government has long been aware of the importance of cryptocurrency regulation and has successively studied and issued relevant policies. Japans cryptocurrency policy focuses on industry guidance and encourages industry development;

• In terms of on-chain preferences, Japanese users are more familiar with NFT transactions and DEX transactions, and are keen to participate in on-chain task platforms, metaverse games and other sector projects;

• In terms of trading preferences, Japanese users prefer spot trading, mainly trading mainstream currencies and Japanese local project tokens, and are keen to participate in investing in old project tokens;

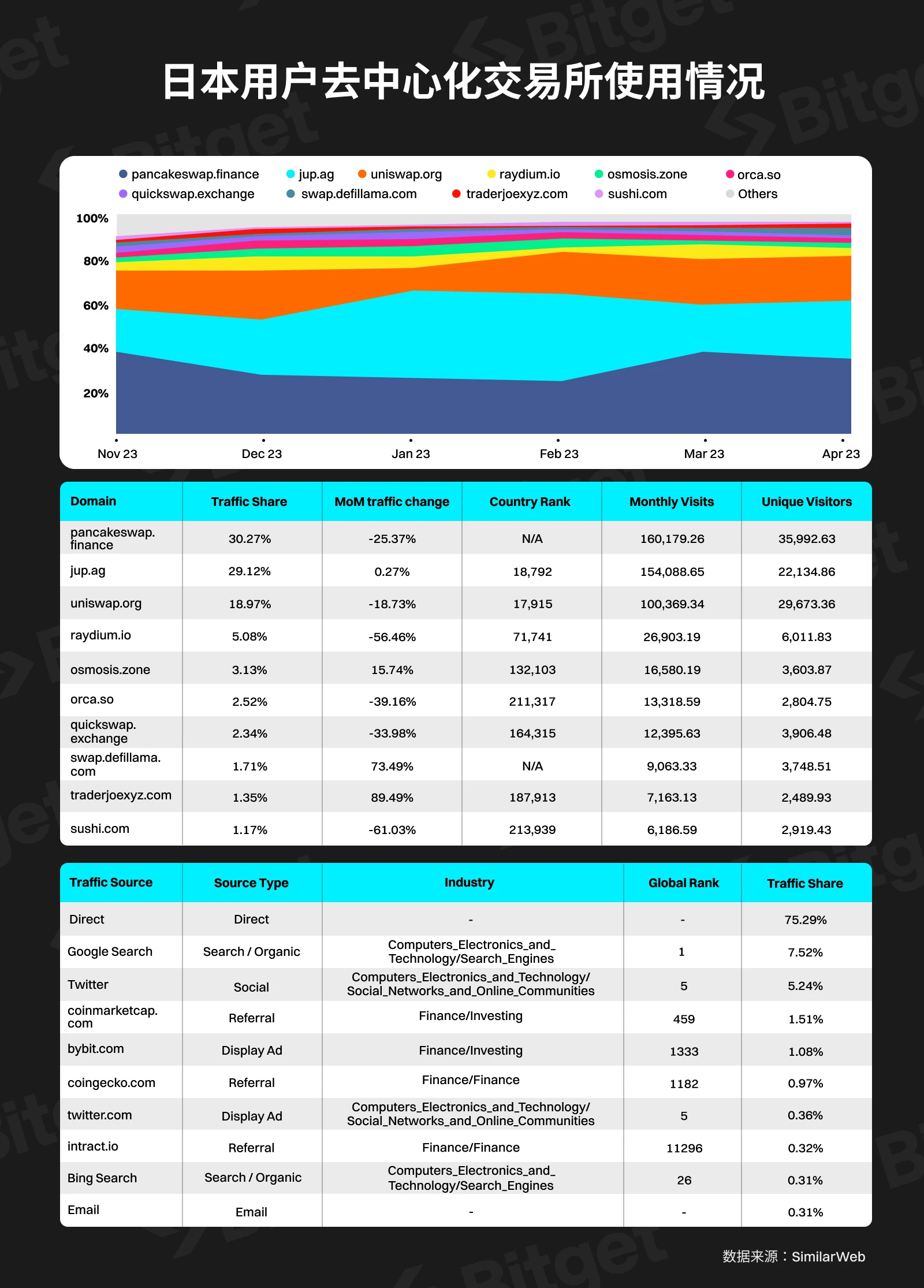

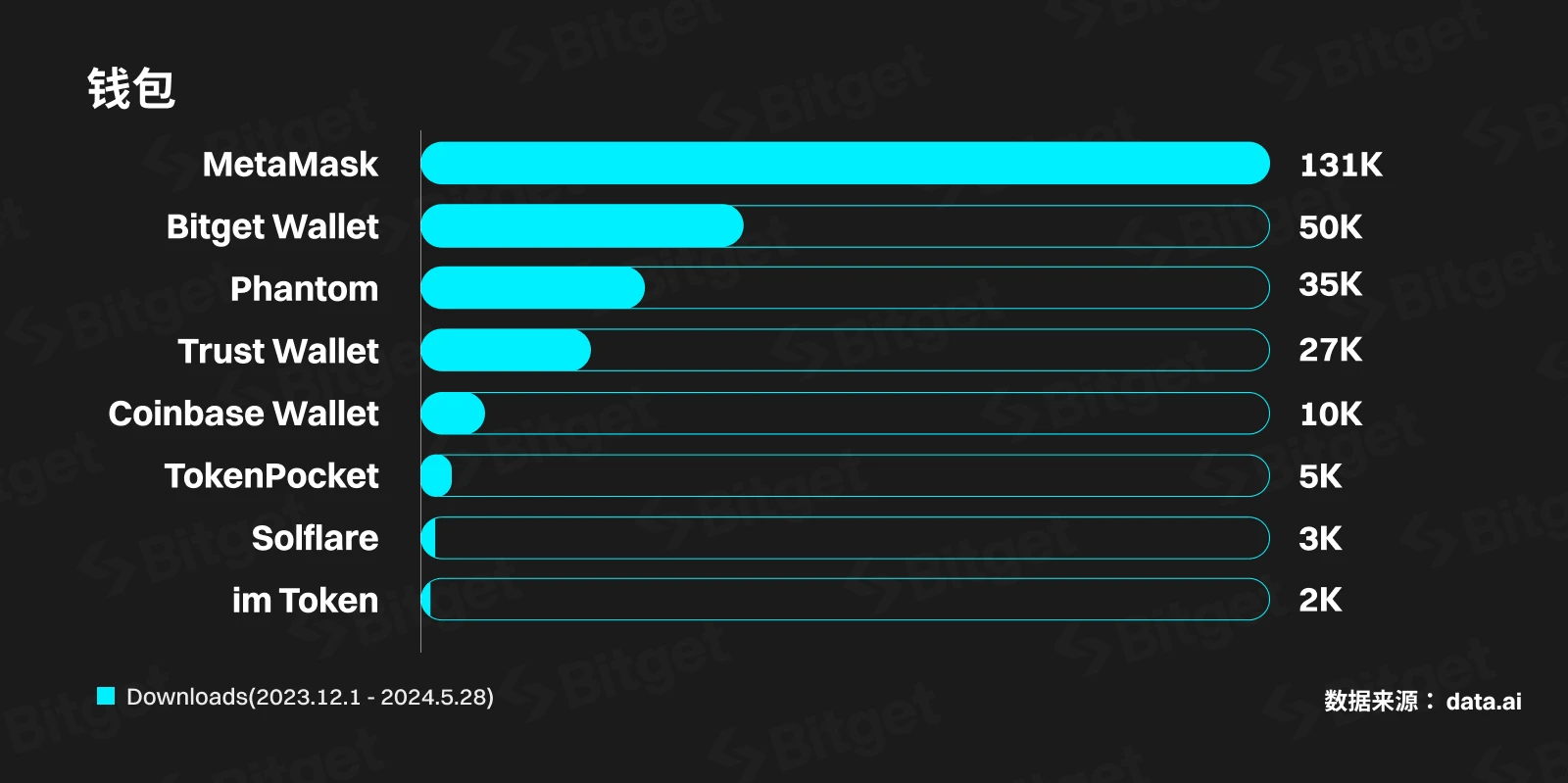

• In terms of preference for centralized exchanges, unlike most regions, Japanese users have a higher demand for localized centralized exchanges; in terms of decentralized exchanges, Japanese users mainly use decentralized exchanges such as Uniswap and Pancakeswap, which are the top public chain exchanges; the most commonly used wallets are MetaMask, Bitget Wallet, Phantom, Trust Wallet, and Coinbase Wallet;

• Finally, based on the above analysis, Bitget Research Institute made five predictions for the future trend of the Japanese crypto market.

Introduction

Japan is a country full of history and culture, famous for its unique traditional culture and modern innovation. Japan enjoys a global reputation in technological innovation and finance. Its sound financial system and innovative financial technology make Japan an important player in the global economy. Japan is also one of the first countries to understand, pay attention to, and encourage the development of cryptocurrency. In the field of cryptocurrency, Japan is the mainstay of the global market.

The popularity of cryptocurrency in Japan is currently at the top of the world. In addition, Japan has gradually introduced a regulatory framework for the cryptocurrency industry in recent years, and its policies focus on industry guidance and encourage the development of related industries. Therefore, cryptocurrency is becoming an important choice for Japanese users to invest in alternative assets.

Through in-depth market research, this article provides a panoramic introduction to the current status of the Japanese crypto market, which not only helps Japanese users find their own ecological positioning and communities with similar interests, but also helps Web3 project teams and crypto institutions better understand and develop the Japanese market.

1. Overall market situation

1. Regional Overview

In terms of the overall volume and acceptance of cryptocurrencies, Japan is in a leading position in the world. According to Chainalysis 2023 Adoption Index data, Japan ranks 18th in the world, similar to the UK and Canada, and better than major Western European countries such as France, Germany, and the Netherlands.

Judging from the component index sub-rankings of the Japanese Cryptocurrency Adoption Index, the region presents the characteristics of the adoption rates of CeFi and DeFi are similar in the world rankings, and P2P transactions are far below the global average.

Japan shows two obvious characteristics in the cryptocurrency market: average and specific hobbies.

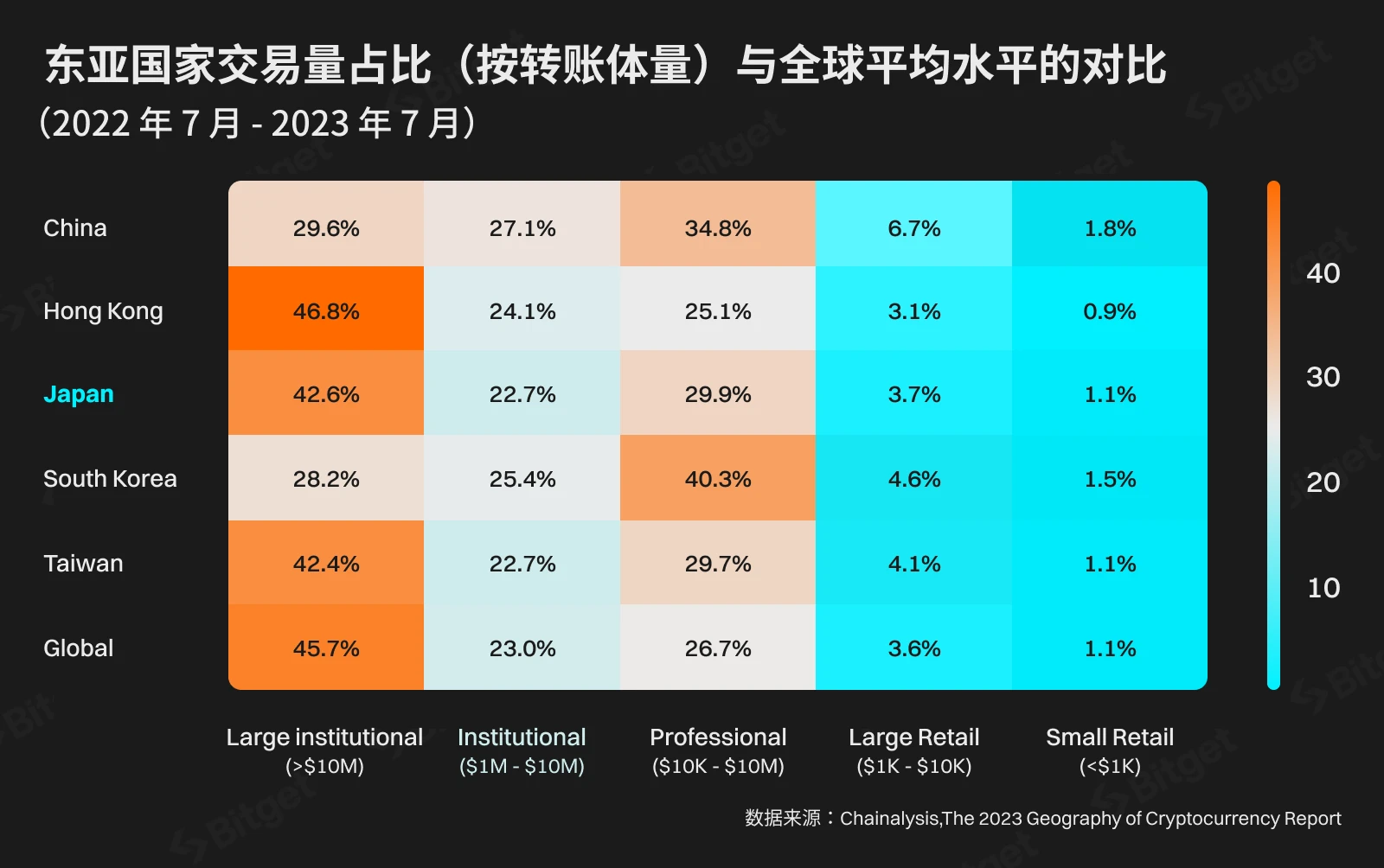

Average means that among the East Asian countries with their own characteristics, Japans major indicators are closest to the global average: as shown in the two figures below, in terms of the volume of cryptocurrency transfers and the types of platforms used, Japans data is very close to the global average, while other East Asian countries show huge differences.

Specific hobbies means that while a large number of traders are chasing hot spots such as Solana Meme, AI, DePIN, etc., Japanese users still have a relatively high enthusiasm for first-generation memes such as SHIB and early blue-chip tokens such as XRP and ADA.

In addition, Japan has strong local exchanges such as Bitbank, Bitflyer, and Coincheck, which account for half of the local CEX market share. Traders aged middle-aged and above show a stronger tendency to use these local exchanges.

2. Encryption policy and human impact

2.1 Japan’s Encryption Policy

Japan’s early regulatory stance

Back in 2014, Japan experienced one of the industry’s worst setbacks when Mt. Gox, a major global bitcoin exchange, was hacked and shut down, causing retail investors to lose up to 850,000 bitcoins.

In 2018, the Japanese exchange CoinCheck was also hacked, causing users to lose $534 million in virtual assets. Coincheck later announced compensation for user assets. These two incidents highlight the importance of introducing relevant laws to protect investor funds, maintain the stability of the crypto market, and regulate crypto assets. The Japanese government has since actively planned a plan to regulate virtual assets.

Japans current regulatory stance

Recently, the Japanese government has introduced a clear regulatory plan to enable innovation in the cryptocurrency field to develop reasonably and safely, including:

• In 2017, Japan amended the Payment Services Act to bring cryptocurrency exchanges under the regulatory scope and implement a licensing system supervised by the Financial Services Agency (FSA).

• Japan’s cryptocurrency industry has been dealing with the Travel Rule since 2021, when the Financial Services Agency (FSA) of Japan required virtual asset service providers to implement the Travel Rule.

• In April 2022, the Japan Virtual Currency Exchange Association (JVCEA) introduced the Travel Rule into its self-regulatory rules for virtual asset service providers.

• In October 2022, the Japanese government approved a cabinet resolution to amend existing laws to curb money laundering using cryptocurrencies in accordance with the guidelines of the Financial Action Task Force (FATF).

• In June 2023, Japanese lawmakers confirmed plans to impose stricter anti-money laundering (AML) rules on the digital currency industry.

In general, due to the Mt. Gox hack and CoinCheck theft, the Japanese government realized the importance of cryptocurrency regulation very early and has successively studied and issued relevant policies. Recently, with the introduction of regulatory policies, Japans cryptocurrency regulation has become clearer and stricter. Japans cryptocurrency policy focuses on industry guidance and encourages industry development.

2.2 Japanese cultural influence

Japans humanistic characteristics are deeply rooted in its history. The characteristics of Japanese humanities not only shape the daily life of Japanese society, but also have a profound impact on its art, education and business practices. The impact on the crypto industry is mainly reflected in the following aspects:

1. Emphasis on education: Education is extremely important in Japanese society, and families and schools have high expectations for students. This has led to a relatively high average education level for Japanese residents, and Japanese users participating in crypto market transactions are generally highly educated.

2. Focus on innovation: Japan is a world leader in technology and innovation, and this innovative spirit has also permeated into the Web3 field, such as some innovative localized game projects;

3. Emphasis on art: Japan has a rich tradition of art and literature, and its animation culture and IP industry are relatively developed. Artists such as Murakami Shu have achieved secondary creation and copyright protection by putting art on the blockchain, which has led to a good NFT user group in Japan.

3. Market size

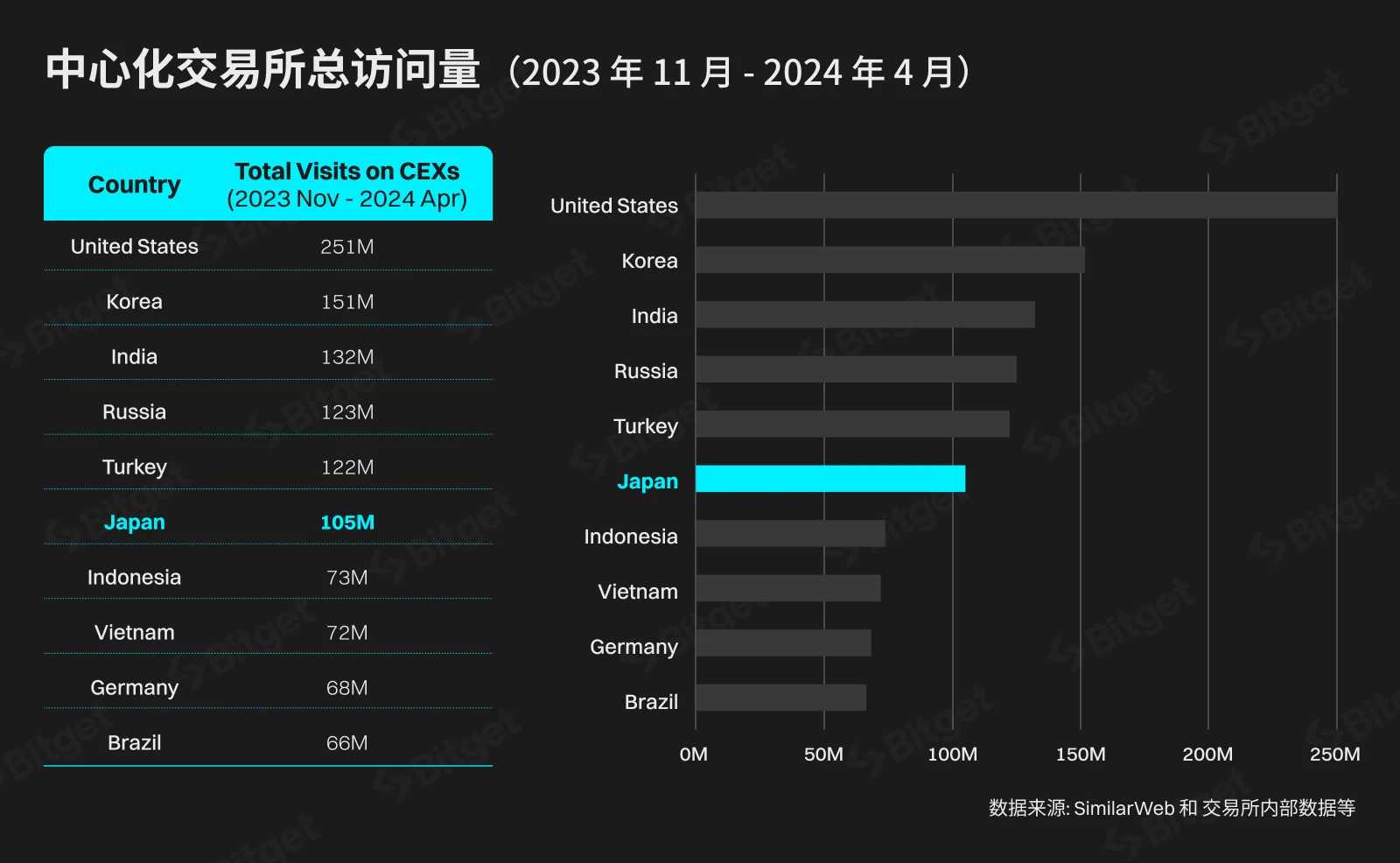

Judging from the total number of user visits to CEXs in the past six months: Japans market size is between Turkey and Indonesia, and about 2/3 of South Koreas.

It is estimated that in April this year, there were 310,000 to 360,000 Japanese users trading on CEX every day.

2. Characteristics of local cryptocurrency users

1. User trading habits

1.1 Overall portrait of Japanese users

Image: Japanese cryptocurrency user habits word cloud

Source: Google Hot Words

Japanese users are open to cryptocurrency transactions and project interactions, and generally have the following characteristics:

• Japanese users are very receptive to cryptocurrencies, accounting for a high share in the world;

• Japanese users pursue hot asset sectors in the market, mainly reflected in the keywords such as Pepe, AI, and GPT on the word cloud;

• Japanese users pay attention to the interaction of on-chain assets, especially the NFT sector, and are more concerned about Wallet, NFT and Blur.

1.2 Transaction and Interaction Habits of Japanese Users

In terms of trading, Japanese users prefer spot trading, mainly trading mainstream currencies (BTC, ETH, XRP, SOL, DOGE) and Japanese local project tokens. The reasons for this are: 1. Due to the restrictions of Japanese laws and regulations, local exchanges can only trade currencies that have passed the review of the Financial Services Agency/and derivative transactions cannot exceed 2 times leverage. Therefore, some Japanese contract trading users and altcoin trading users will choose overseas exchanges for trading; 2. Japanese users English level is generally average, and they are not timely enough to understand new projects; on the contrary, they pay more attention to buying the previous generation of Meme coins (such as SHIB, DOGE) that have been born for a long time, forming a continuous rising market and making profits. In addition, Japanese users are mainly long-term holders, mainly because Japanese users need to pay taxes after making profits from cryptocurrencies, and the tax rate is even as high as 45%. In this way, Japanese users focus on long-term investment returns rather than short-term profits.

In terms of application interaction, since Japan has a very good foundation in traditional games, there are many localized on-chain game projects in Japan. These project parties often tokenize the items and assets in the game to form encrypted assets such as NFT and tokens. Therefore, Japanese users are more familiar with on-chain DEX transactions, NFT transfers, and on-chain contract interactions.

In terms of payment and asset deposits and withdrawals, most users deposit funds after exchanging cryptocurrencies on local Japanese exchanges, but some users also use legal currency transactions (P2P, third-party, card purchases, etc.). Japan has a relatively good crypto payment environment. There are offline stores in prosperous areas such as Roppongi and Ginza that accept BTC and ETH tokens for payment.

2. Popular sectors and projects

(1) Popular projects popular sectors

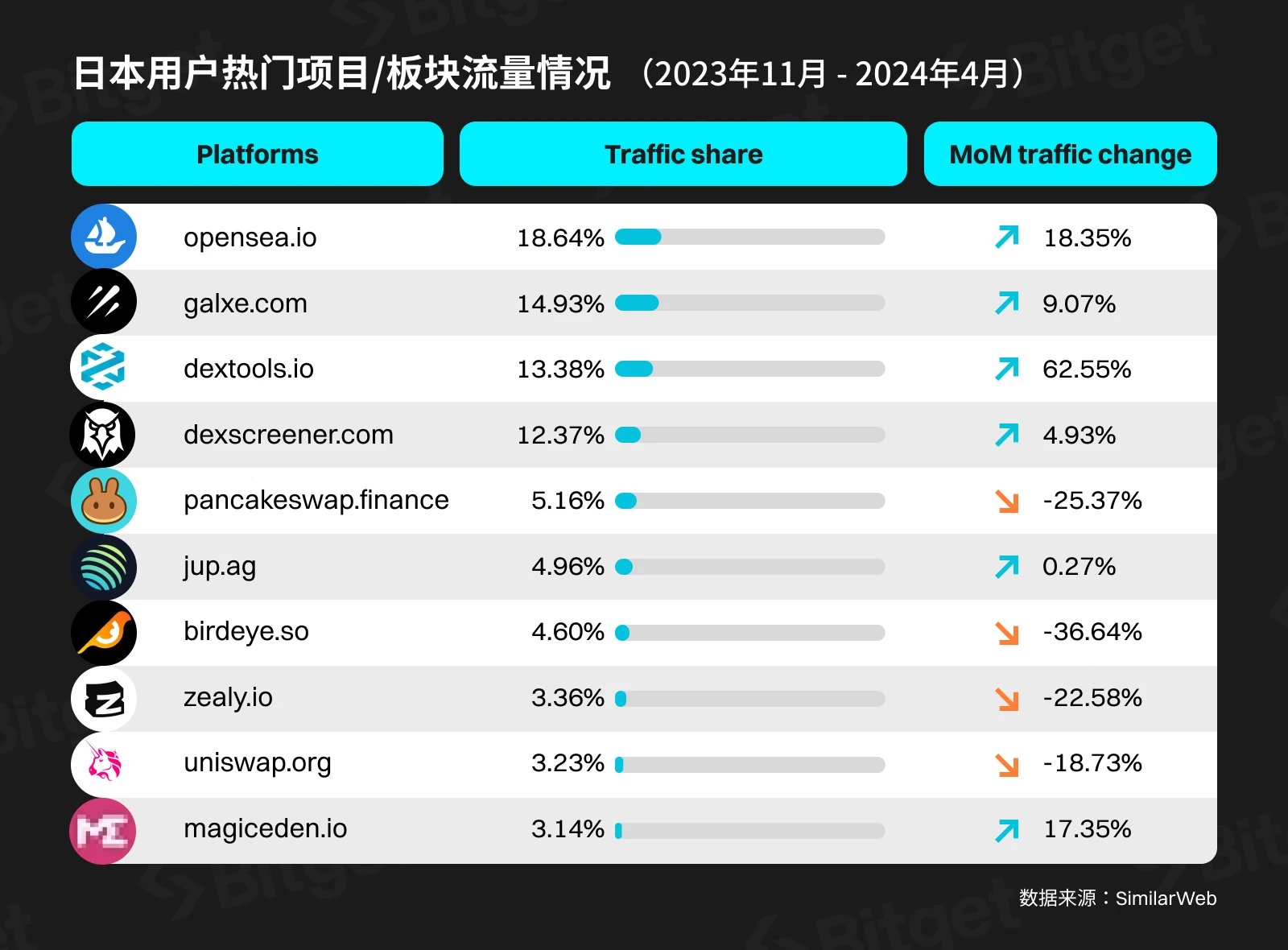

Japanese users have high participation in NFT transactions, on-chain task platforms, on-chain transactions, and Web3 games. Two of the top ten visited projects are NFT trading websites (Opensea, Magiceden), indicating that Japanese users are very enthusiastic about NFT transactions; followed by Web3 task platforms and DEX market trading websites, indicating that Japanese users have a certain degree of attention to participating in airdrop activities of various projects and trading on-chain assets.

In addition, there are some local projects in the Japanese market that are favored by investors. For example: Cardano (ADA), an early blue-chip token, is called the Japanese Ethereum. Its founder, Charles Hoskinson, has held many lectures and events in Japan to promote Cardanos technology and vision. JasmyCoin (JASMY), an Internet of Things platform founded by former Sony employee Kazumasa Sato, has also begun to promote the AI+IoT narrative, which has increased by 3 times in Q2 this year and has gained a lot of traffic in Japan. In addition, projects led by Japanese teams such as Astar (ASTR) and Oasys (OAS) have a high reputation and trading demand locally.

It can be seen that among Japanese local projects, traditional DeFi projects, Layer 2 and other infrastructure projects are scarce, and more of them are extending Web2 businesses, such as the chain transformation of Web3 game projects, Web2 IP to Web3, and the Internet of Things. Therefore, this makes Japanese local projects appear not so Crypto Native, but in terms of combining blockchain technology with the real world and implementing it, Japanese projects are relatively cutting-edge.

(2) Cryptocurrency is the most popular topic among Japanese users in the past three months

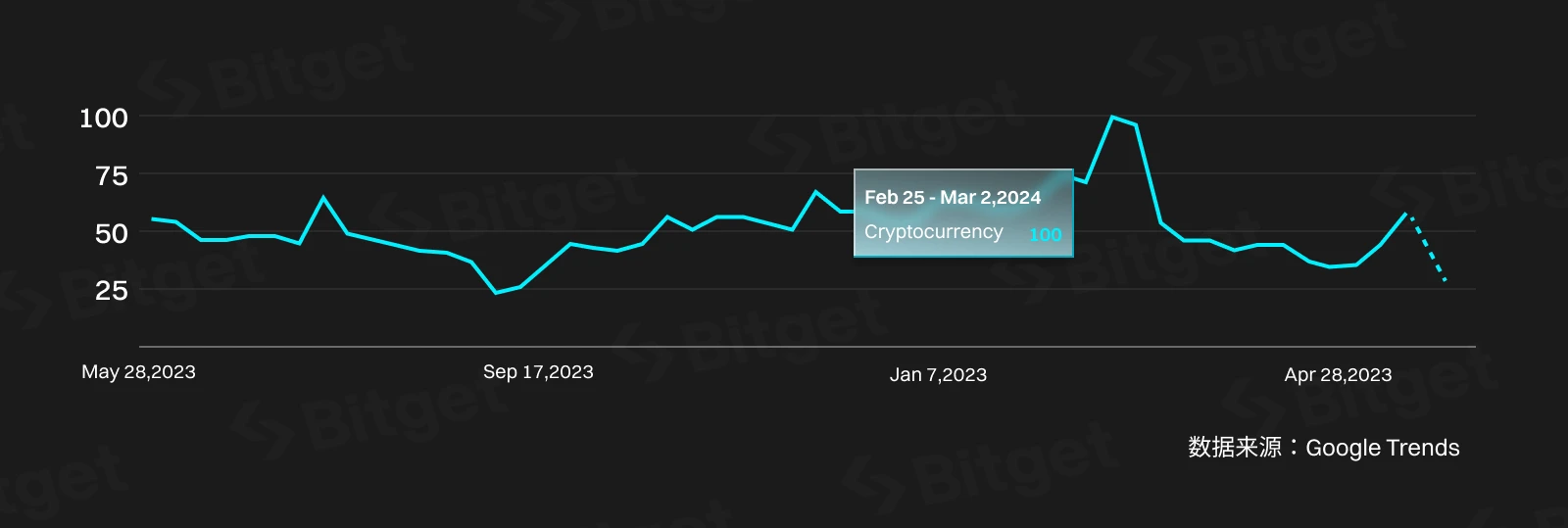

Judging from the search popularity of Cryptocurrency terms among Japanese netizens, the period from late February to early March this year was the period when Japanese netizens paid the most attention to cryptocurrencies in the past year. This happened during the rapid rise of BTC and the test of new highs.

Interestingly, the peak of this hot search in the world, including the United States, the United Kingdom, the United Arab Emirates, etc., appeared between Mar 3 and Mar 9. That is , the peak of hot searches for cryptocurrency-related terms in Japan appeared earlier, which may indicate that Japanese netizens are more sensitive to the price of BTC.

Judging from the hot search terms in the past year, Japanese users are keen on searching for:

○ SHIB, DOGE, Solana, XRP, ADA

In the past three months (2.28 – 5.28), we can see the following trending searches in Japan:

○ PEPE, QUBIC, AEVO, NOT

It can be seen from this that:

(1) Japanese users have a high interest in the first generation of meme coins, including DOGE and SHIB. This may also indicate that Japanese users have a special liking for dog memes such as Shiba Inu and Akita Inu. According to data from some exchanges, BABYDOGE is also one of the most popular meme coins traded by Japanese users. The latest generation of popular memes such as BOME and SLERF did not appear in the hot searches.

(2) Japanese users are still keen on speculating on old blue-chip tokens, such as XRP and ADA, which have not appeared on the hot search lists of most other countries in the past year. At the same time, the cooperation between Japanese financial giant SBI Group and Ripple has also boosted XRPs enduring high traffic in Japan.

The above two points also confirm that the Japanese region has a specific interest in cryptocurrency trading.

3. Local social media

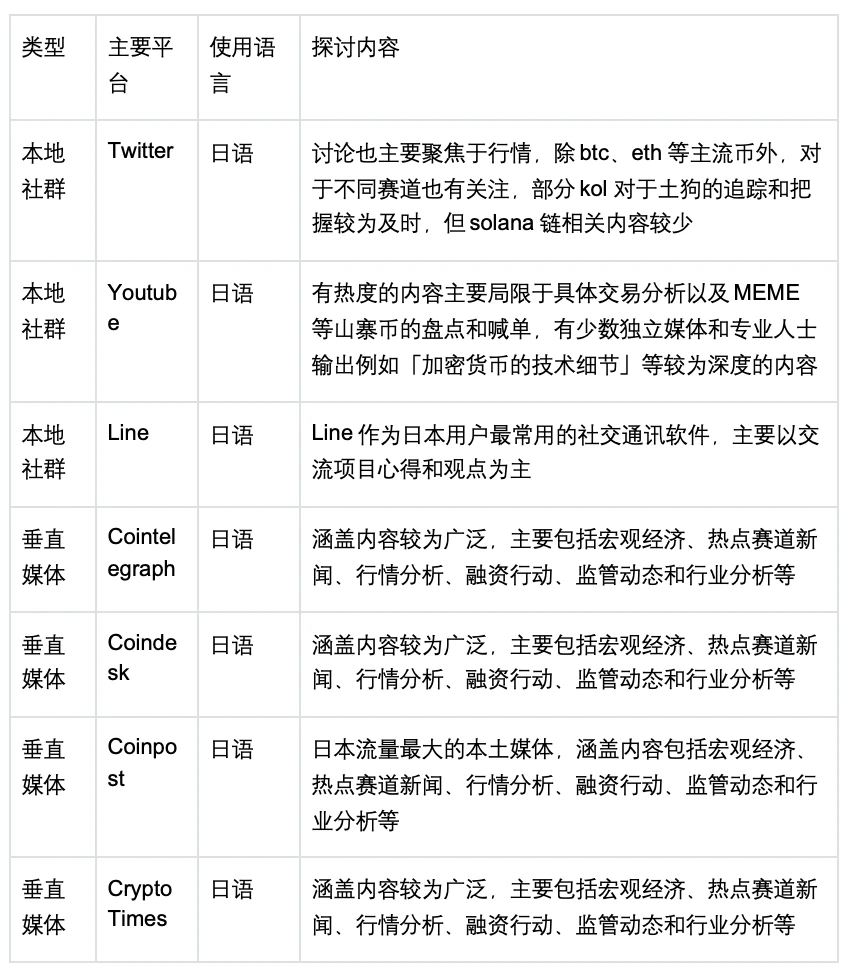

The main battlefields of the Japanese local community are Twitter, Youtube, Line and Telegram. The language used is mainly Japanese, the official language of the country, with English content, but Japanese content generally dominates. Compared with other countries, Japan prefers vertical media. Coindesk and Cointelegraph have dedicated Japanese websites with separate domain names and all-Japanese content. Coinpost has the largest traffic among vertical media, with monthly visits of up to 2.5 million times, followed by Cointelegraph, which is relatively more popular, with monthly visits of about 1.5 million times.

In terms of discussion content, each channel has different levels of understanding and focus on blockchain, ranging from macroeconomics, hot track news, market analysis, financing actions, regulatory dynamics and industry analysis, specific transaction analysis, and inventory and calls of altcoins such as MEME to more in-depth content basics such as technical details of cryptocurrency.

3. Competition landscape and advantages of each platform

1. Centralized Exchanges

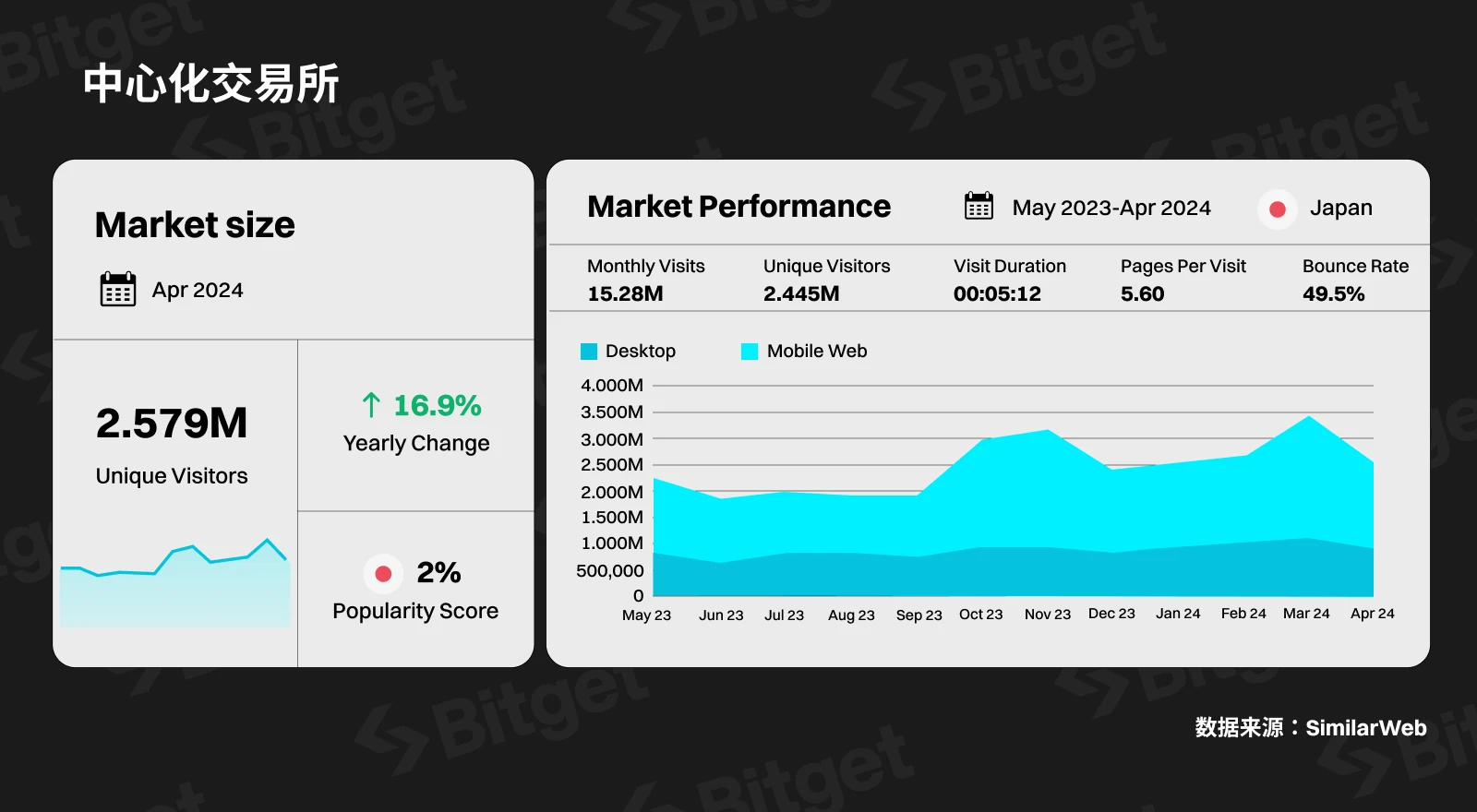

Over the past year, Japanese users visits to CEXs have fluctuated upward, with UV= 2.58 M in April 2024, up about 17% year-on-year.

Coinbase and Kraken began to withdraw from the Japanese market in Q1 2023, giving Japanese local exchanges and other global exchanges more room for development. Japan has several strong local exchanges, such as Bitbank, bitFlyer and Coincheck, which together account for more than 42% of CEXs traffic share, which is very different from the data presented by most European and Southeast Asian countries. The three local exchanges mentioned were established as early as 2014, earlier than several well-known head international exchanges. The accumulation in the early years has laid a deep foundation for them in Japan.

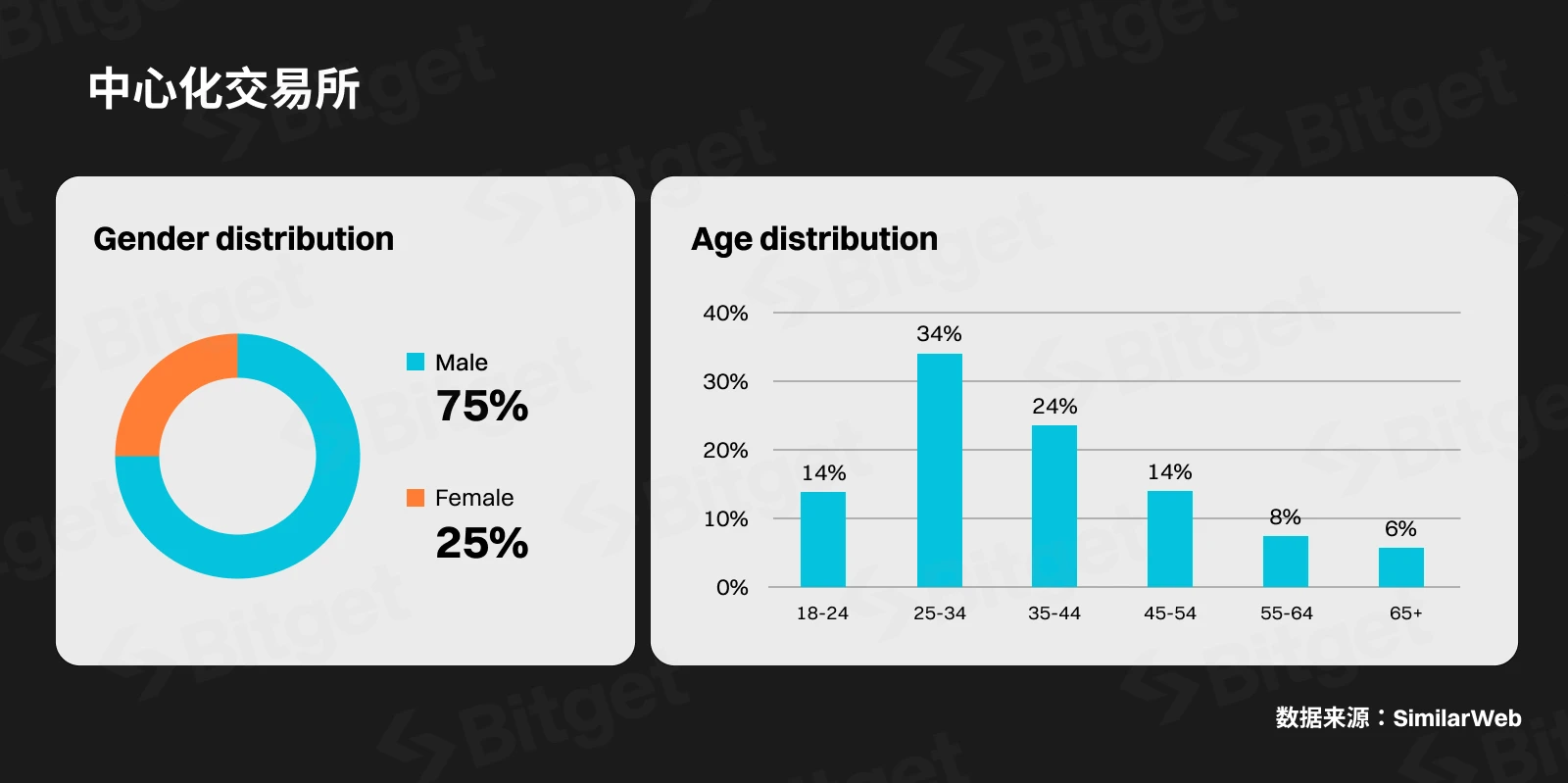

From the user portrait, the ratio of male to female users of CEXs in Japan is about 3:1. In terms of age distribution, the number of users aged 18-34 and those over 35 is equal, accounting for half each. In addition, it is interesting that the young group aged 18-34 prefers to use international exchanges than the group over 35, while the group over 35 prefers to use Japanese local exchanges.

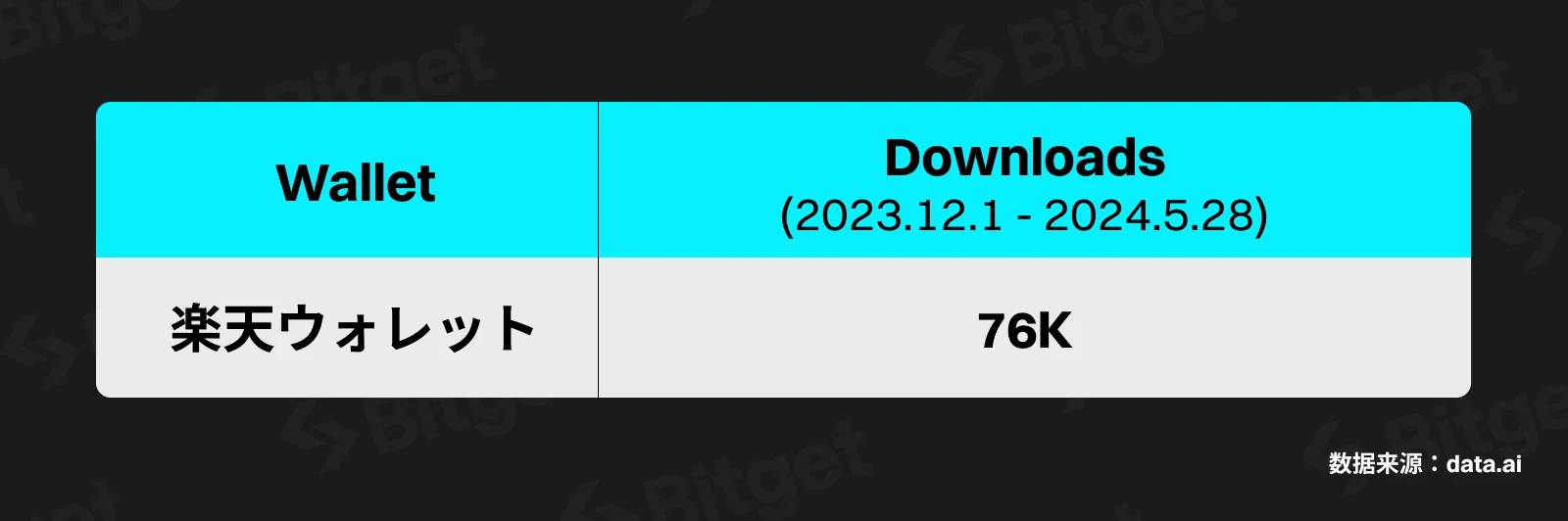

In addition to the above local exchanges, Rakuten Wallet is also popular among many users. It is essentially a CEX backed by the Rakuten Group. Its core business logic is that users deposit Japanese yen to obtain Rakuten Cash (R Cash), and then users use Rakuten Cash to invest in cryptocurrencies. Rakuten Cash runs through the platforms users deposit and withdrawal needs, as well as cryptocurrency investment and payment scenarios. This model also links Japanese users cryptocurrency investment with daily consumption.

2. Decentralized Exchanges

The top 3 rankings of DEX websites visited by Japanese users are very different from those in other regions: Pancakeswap > Jupiter > Uniswap. Japan is one of the few regions where Uniswap is not ranked first, and even has lower traffic than Pancakeswap. This reflects to a certain extent that Japanese users are less interested in transactions on the ETH and Base chains than on Solana and BSC chain tokens.

Most users log in to these decentralized exchanges directly, and some log in through Google search and social media links. This shows that Japanese users pay more attention to brand awareness when using decentralized exchanges, and once they form a habit of using them, they will have a certain degree of loyalty to the brand. In actual operations, Twitters traffic diversion plays a certain role, but the proportion is not high.

3. Wallet

(Note: Some well-known wallets, such as Binance and OKX wallets, share the same APP with their centralized exchanges and cannot extract traffic separately, so they are not shown in the above table)

In terms of wallet usage, MetaMask, Bitget Wallet, Phantom, Trust Wallet, and Coinbase Wallet are the top 5 wallets in Japan.

As one of the earliest wallets in the Ethereum ecosystem, MetaMask has a good first-mover advantage. Most EVM-compatible public chain ecosystem projects generally give it priority support. It is very popular not only in Japan, but also in all regions around the world.

Bitget Wallet has ranked second in downloads in Japan, second only to Metamask Wallet, thanks to its rapid iteration after keen market insights. Currently, Bitget Wallet supports hundreds of public chains. Its innovative liquidity aggregation algorithm in Swap provides users with a smoother trading experience. At the same time, it has recently supported the Solana public chain in terms of chain changes, smart market recommendations and other functions, expanding users perception of Solana chain dynamics and helping users quickly capture more on-chain Alpha in the hot MEME market. In terms of NFT, Bitget Wallets NFT market is the first platform to support the purchase of NFTs with any cryptocurrency. Insights into user needs and rapid support have brought it to second place in downloads in Japan.

Recently, due to the popularity of Solana ecology, Phantom, as the most popular native wallet of Solana network, ranked third. Phantom has accumulated a lot of high-quality partners in Solana ecology in the last round. In this round of Solana market, Phantom and high-quality ecological projects have formed a huge traffic matrix, which has led to a rapid growth in the number of Phantom users, and it has been circulated in social media that Phantom has the possibility of issuing coins and airdrops. Thanks to the strong recovery of Solana ecology, the wealth opportunities of MEME market and ecology, plus the potential airdrop expectations and other multiple factors, Phantom wallet is very popular in Japan.

Trust Wallet, ranked fourth, was launched in 2017 and has a good first-mover advantage. Its simple and easy-to-use design conforms to the habits of Japanese users and is also popular among many users.

Ranked fifth is Coinbase Wallet. Although Coinbase announced its withdrawal from the Japanese market in January 2024 and Japanese users are currently unable to use the Coinbase exchange, Coinbase Wallet can still be used normally. Backed by the authority and security of Coinbase, Coinbase Wallet has become the choice of many Japanese users.

Summarize

Japan is known for its unique traditional culture and modern innovation, and is more receptive to new things than most countries. Japan is one of the first countries to understand, pay attention to, and encourage the development of cryptocurrency. This report mainly investigates the cryptocurrency market in Japan from three aspects: overall market situation, characteristics of local cryptocurrency users, and competitive landscape and advantages of various platforms.

From the overall market situation, Japans total volume and acceptance of cryptocurrency are in a leading position in the world, ranking 18th in the world. The daily active users of Japanese users on centralized exchanges are about 350,000, which is comparable to Turkeys user volume.

From the perspective of regulation and cultural influence, due to the Mt. Gox hack incident, the Japanese government realized the importance of cryptocurrency regulation very early and has successively studied and issued relevant policies. Since Japanese society attaches importance to education, innovation, art and other fields, Japanese users are generally well educated and pay more attention to blockchain games and NFTs.

Japanese users are generally familiar with cryptocurrency transactions and the interaction with on-chain projects, and generally have the following characteristics:

• Japanese users prefer spot trading, mainly trading mainstream coins and Japanese local project tokens;

• Japanese users are highly interested in first-generation meme coins, including DOGE and SHIB, and are also keen on earlier blue-chip coins, such as XRP and ADA;

• Japanese users have high participation in NFT transactions, on-chain task platforms, on-chain transactions, and Web3 games;

In terms of competition and platform advantages, local exchanges account for more than 42% of the market share, far higher than Western Europe, Southeast Asia and other countries and regions. The data of decentralized exchanges is not very different, and the usage habits are concentrated on Solana, BSC and Ethereum, the leading decentralized exchanges of public chains. In terms of wallets, MetaMask, Bitget Wallet, Phantom, Trust Wallet, and Coinbase Wallet are the top 5 wallets used by Japanese users.

Finally, after Bitget Research Institute’s thorough market research, looking forward to the second half of 2024, we expect the following developments in the Japanese market to occur for readers’ reference:

• With the introduction of global compliance policies and the listing of ETFs for crypto assets in the United States, more institutional users and retail investors in Japan are participating in investing in the crypto market;

• The cryptocurrency penetration rate among Japanese users continues to increase, remaining in the top 20 globally. The DAU participating in cryptocurrency transactions in the Japanese market will continue to rise from 350,000 in 2024 to around 500,000 by the end of 2024;

• Japanese users are still keen to participate in localized projects, such as blockchain games, and their participation in NFT and on-chain task platforms will continue to increase;

• There may be 1-2 on-chain gaming projects in Japan that receive capital support and become important global cryptocurrency projects;

• NFT trading wallets with transaction aggregation functions will be more favored by Japanese users.

This article is sourced from the internet: Bitget Research Institute: Japan, a pioneer in the crypto market

Original article by: Avichal – Electric Capital Original translation: TechFlow The US House of Representatives votes on FIT 21. Biden just said he wants comprehensive cryptocurrency regulations. So, What is FIT 21? Why is this bill important? What does FIT 21 reveal about the changing dynamics of political alliances and power in the United States? What is FIT 21? FIT 21, the 21st Century Financial Innovation and Technology Act , is the first bill that attempts to comprehensively define how the United States should regulate the crypto market. There are several key areas and provisions of FIT 21: Delineating the jurisdiction of the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) Providing consumer protection around transparency and disclosure by promoters and endorsers Ban institutions from preventing…