Bitget Research Institute: Bitcoin rebounded weakly over the weekend, UniSat product updates drove SATS up

In the past 24 hours, many new popular currencies and topics have appeared in the market, and they may be the next opportunity to make money:

-

The sectors that are representative of the changes and worth paying attention to are: SATS, TON Ecosystem

-

The most popular tokens and topics searched by users are: Data Ownship Protocol ($DOP), BitLayer, and Tapswap;

-

Potential airdrop opportunities include: RedStone, Symbiotic;

Data statistics time: July 8, 2024 4: 00 (UTC + 0)

1. Market environment

BTC spot ETF had a net inflow of 143 million US dollars on the last working day of last week. The German government continued to sell BTC over the weekend. The market rebounded and then fell over the weekend. Bitcoins rebound was weak. Altcoins also rose and fell sharply with Bitcoin. Market sentiment was pessimistic.

Altcoins have few bright spots. UniSat product updates have driven SATS up, but the overall Bitcoin ecosystem and the inscription sector have performed poorly recently. NOT rebounded strongly over the weekend, with TON tokens rising 5% against the trend in the past 7 days while BTC fell 13%.

2. Wealth-making sector

1) Sector changes: SATS

main reason:

-

UniSat released a product update for UniSat Swap, which will launch the Swap feature on the Bitcoin mainnet and Fractal Bitcoin. Fractal Swap will be launched in September. In subsequent iterations, BTC and other mainnet assets can also exist on Fractal Bitcoin as BRC-20 packaged assets, providing greater flexibility. From a users perspective, the main difference is that Fractal has faster confirmation and lower overall fees; the similarity is that both are based on the BRC-20 protocol and use BRC-20 sats as Gas fees. Fractal Swap will implement a competitive Rollup mechanism, allowing users to package their Rollup results into the sorter and earn transaction fees (BRC-20 sats) generated by all transactions within the Rollup.

-

Unisat announced in early July that it had completed its Pre-A round of financing in May this year, led by Binance.

Factors affecting the market outlook:

-

Although UniSat has been active since July, the price of the entire BTC ecosystem, including BTC Layer 2 and the inscription track, has performed poorly. Since BRC-20 tokens are priced in BTC on the on-chain market, this track is more affected by the overall market. The entire BTC ecosystem will most likely need to perform far better than Beta during the rise of the overall market.

2) The sector that needs to be focused on in the future: TON ecosystem

main reason:

-

In the short-lived rebound of the market over the weekend, Notcoin (NOT) surged by +50%. As the market fell after the rebound, the price of NOT was relatively stable and did not plummet after the rebound like other altcoins.

-

In the past 7 days, BTC has fallen by 13%, and altcoins have generally fallen sharply, while TON tokens have risen by 5% in the past 7 days, bucking the trend.

Factors affecting the market outlook:

-

Whether subsequent high-traffic projects in the TON ecosystem, such as Catizen and Hamster Kambot, can continue to create wealth effects; whether the TON ecosystem itself can quickly make up for the shortcomings of DeFi within the ecosystem will determine the stability of TON tokens and the momentum for their continued rise to a certain extent.

3. User Hot Searches

1) Popular Dapps

-

Data Ownship Protocol ($DOP)

The Data Ownership Protocol (DOP) is leveraging zero-knowledge proofs to enable flexible transparency on top of Ethereum L1. DOP allows users and DApps to store assets and keep transaction data controlled by users, or selectively disclose token holdings and historical information. The project is now open for token claims, and more recent on-chain transfers have come from token claims. The price of the coin has performed well in the recent falling market, and it is one of the few newly launched tokens with good price trends.

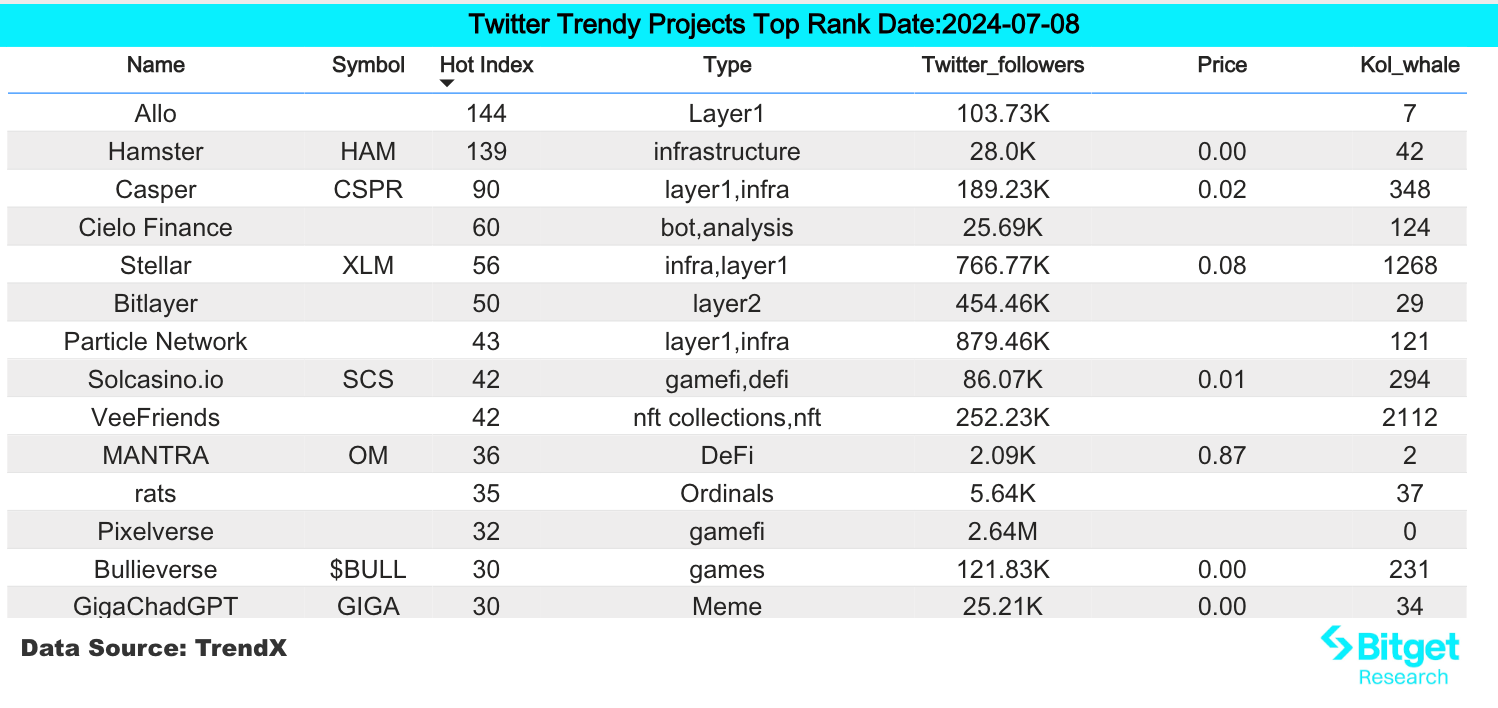

2) Twitter

-

BitLayer

Bitlayer is a layer 2 solution that provides Bitcoin-equivalent security and Turing completeness. It is also the first to be built on BitVM. Bitlayer aims to bring secure scalability to the Bitcoin ecosystem, promote asset diversity and stimulate innovation to provide a faster, more secure and more flexible user experience.

Recently, Bitlayer opened the second phase of the first mining event. The participants of this first mining event include six Bitlayer ecological projects, including GamerBoom, Macaron, Anome, Vanilla Finance, Avalon Finance and Zearn. The event will provide participants with Bitlayer tokens (BTR) rewards worth US$1.2 million, as well as a wealth of ecological project airdrops.

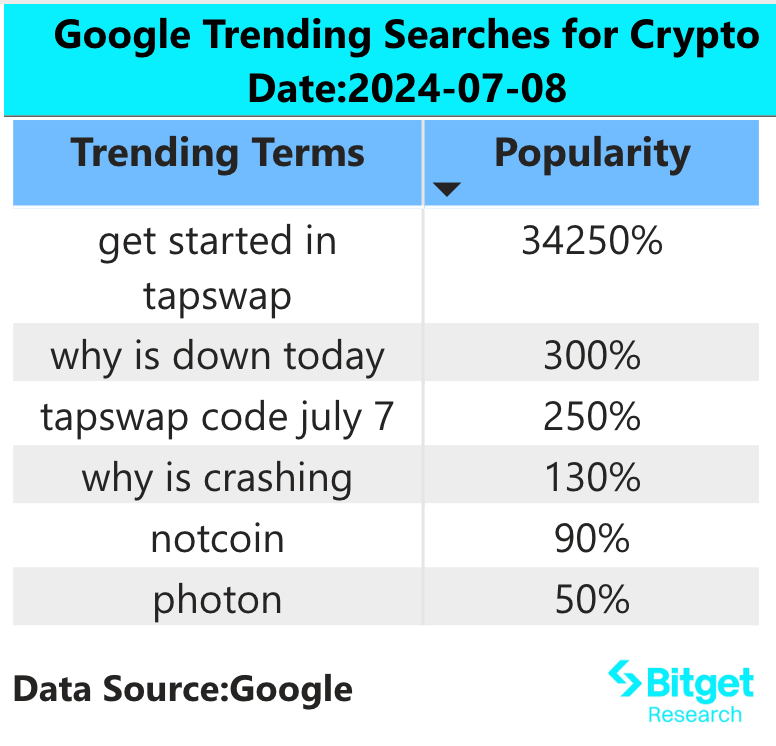

3) Google Search Region

From a global perspective:

Tapswap:

Various tap-to-earn gaming apps on Telegram have been gaining popularity in the community since the beginning of 2024. TapSwap was launched on February 15, 2024, and users can earn in-game tokens by tapping and completing tasks. Today, the app has more than 50 million users worldwide, with nearly 1 million active users online.

From the hot searches in each region:

(1) Asian countries: The terms “why crypto is down today” and “greed and fear index” appeared at the top of the hot searches in many Asian countries, and investors were most concerned about the reasons for the market crash.

(2) European and American countries: There are no obvious hot spots. The tokens and terms on the top search lists of different countries are different. For example, Australian users are concerned about how to buy cryptocurrencies through PayPal, Canadian users are concerned about meme coins such as doge, and French users are concerned about tokens such as maga, alephium, and FTM.

Potential Airdrop Opportunities

RedStone

RedStone is a cross-chain oracle project. RedStone is a modular oracle for LST and LRT, providing frequently updated, reliable and diverse data sources for dApps and smart contracts on multiple L1 and L2. The market expects the project to issue coins in the second half of 24.

At present, RedStone has completed a total of US$15 million in Series A financing, led by Lemniscap, with participation from Coinbase Ventures, Blockchain Capital, Distributed Global, Lattice, Arweave, Bering Waters, Maven 11 and SevenX Ventures. In 2023, the founder of Aave and co-founder of Polygon invested in the project in the angel round.

How to participate: (1) Earn RSG points by participating in on-chain activities, Galxe tasks, etc. released by RedStone and its various partners. (2) Creators can also earn RSG points by creating content and participating in designated activities on the RedStone Discord server (such as the best content of the week or the Hall of Fame).

Symbiotic

Symbiotic is a general purpose restaking project that enables decentralized networks to bootstrap powerful, fully sovereign ecosystems. It provides a method for decentralized applications, called Active Validation Services or AVS, to collectively ensure the security of each other.

Symbiotic recently completed its seed round of financing, with Paradigm and Cyber Fund participating in the investment, with a financing amount of US$5.8 million.

How to participate: Go to the project’s official website, link your wallet, and deposit ETH and ETH LSD assets.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603812385

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

This article is sourced from the internet: Bitget Research Institute: Bitcoin rebounded weakly over the weekend, UniSat product updates drove SATS up

Related: Are MemeCoins the Return of the Wall Street Bets Phenomenon?

Original author: Unchained Original translation: Peyton, SevenUp DAO Overseas Returnees Union Nathaniel Popper just published a new book, The Trolls of Wall Street, which explores the Wall Street Bets phenomenon. Interestingly, his book came out at a time when the current meme coin mania in the cryptocurrency space is strikingly similar. In this episode, Popper explores the rise of online investing communities like Wall Street Bets and the broader social changes they reflect, particularly among young men. He also touches on the parallels between the culture of banter in these communities and the rise of figures like Donald Trump, and dives into the potential dangers and psychological impact of memes in modern investing. Translators note: Wall Street Bets (WSB) is a sub-forum on Reddit that focuses on stocks, options trading,…