1. Background

Thanks to the introduction of the Ordinals protocol and the BRC-20 standard, Bitcoin today has not only revolutionized payment methods and value storage, but also changed the traditional financial system.

Further reading: Interpreting the Bitcoin Oridinals Protocol and BRC 20 Standard Principles, Innovations and Limitations

Moreover, the exploration of the ecosystem is becoming more and more diversified, especially those involving Bitcoin staking, which is still a long way off compared to BitVm. However, projects such as Babylon and PStake are already promoting the use of Bitcoin’s security features to implement POS chain operations without changing the Bitcoin core protocol.

The connection layer of pledge has been initially breached. Traditional pledge has brought about borrowed security. Now PStake has further expanded and evolved into liquidity pledge, allowing BTC to retain its liquidity while staking. It seems that BTCFI is not far away.

2. BTCFi

2.1 What is BTCFi

In fact, Bitcoin has never been considered an active asset , and its trillions of dollars in market value are basically idle. The BTC ecosystem pays much more attention to security than other ecosystems, so any attempt to expand BTC is particularly cautious.

BTCFi, decentralized finance built on the Bitcoin public chain, refers to the introduction of decentralized finance (DeFi) functions into the Bitcoin ecosystem, making Bitcoin not only a store of value, but also able to play a role in financial applications.

In fact, BTC and ETH users are essentially two different groups of people. For C-end users, they care more about equal profit opportunities, decentralized culture and equal power, so they are less sensitive to gas fees and tend to explore the potential of assets. In contrast, institutions and large users who have been deeply involved in BTC infrastructure and robust finance for many years tend to take a long-term and conservative approach to gaining returns, and first consider security and robustness.

BTCFi can meet the needs of B-side users and ordinary users who are not too Fomo, that is, transforming Bitcoin from a passive asset to an active asset.

The author has discussed various DeFi infrastructures on Ethereum. In fact, most of the various stablecoin lending protocols still rely on the over-collateralization model. It is no longer a consensus that they are stable.

For further reading, please refer to One article explains clearly – the latest stablecoin GHO proposal of DeFI king AAVE .

In fact, they are all over-collateralized models, and the only difference is whether the operating platform has the original technical constraints of smart contracts. So do Bitcoin holders also have the opportunity to participate in staking, lending and market making, and thus obtain new income opportunities? At present, the total locked value (TVL) of BTCFi accounts for only 0.09%, which is very low, and the gap is too large compared with other public chains. You should know that DeFi accounts for as much as 14% of the Ethereum ecosystem, Solana accounts for 6%, and Ton also accounts for 3%.

3. The dilemma of BTC expansion plan

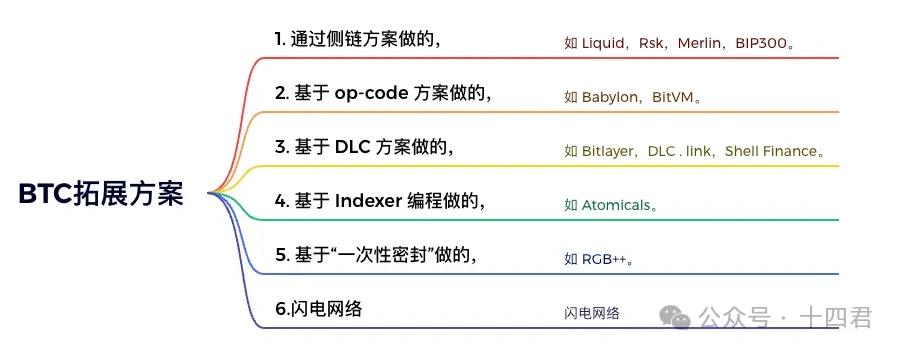

BTCFI often relies on various BTC expansion plans. The current attempts to expand on BTC are mainly:

Many projects are already familiar to everyone, and the expansion plans seem to be diverse, but they all have something in common, which is the cautiousness of the BTC native protocol upgrade.

3.1 BTC community game from BIP-300

Let me briefly explain the evolution of BIP-300, which is often referred to as Bitcoin Drivechain . It was first launched in 2017, and built a sidechain concept called Drivechain on top of the Bitcoin blockchain. It runs as a blockchain connected to the Bitcoin mainnet, using BTC as the native token, which allows BTC to be transferred between the mainnet and these Drivechains in a two-way peg (2 WP) without trust. In fact, in my opinion, it is basically not a technical challenge, because Drivechain is based on BIP, and BIP is equivalent to a soft fork to modify the BTC source code, which is not an additional extension of the above that does not rely on soft forks.

However, BIP-300 soon fell into repeated discussions and could not be smoothly promoted. The advantages were obvious, but

Opponents believe that the definition of digital stored value is out of the question , which easily opens the door to Bitcoin network fraud and leads to more scrutiny from regulators. Moreover, a two-way peg could completely undermine the economics and assumptions of Bitcoin. There is even discussion about miners profits, because joint mining essentially allows miners to earn free money by doing what they are already doing.

Eventually, it got stuck in the discussion of the orthodoxy of BTC Classic, and it was difficult to continue pushing forward. Looking back on this process, I think the core community is essentially guarding the idea that what Bitcoin needs is another system to complement Bitcoin, rather than competing with it by trying to create a new alternative .

Therefore, it is more difficult to obtain the consensus of the BTC Core community than to conquer the ZK Holy Grail (laughs) . Therefore, it is not difficult to understand why many subsequent innovative ideas no longer rely on directly changing BTC itself, but continue to innovate in gameplay.

3.2 Limitations of Native Programming Capabilities

Although the exploration directions are very different, the difficulties they face are similar in two main aspects:

-

Lack of native smart contract functionality: Bitcoin itself does not support complex smart contracts and can only run basic time locks or multi-signature locks such as BTCscript.

-

Limited interoperability: Bitcoin has limited interoperability with other blockchains, and most solutions rely on centralized institutions.

Constrained by points 1 and 2, liquidity will also be dispersed . Since users currently believe that Bitcoin is mainly used for value storage on the chain, off-chain liquidity is concentrated in centralized exchanges, or packaging tokens WBTC to ETH, which also limits users ability to conduct efficient transactions and provide liquidity in the decentralized financial ecosystem. Although the original design of Bitcoin is relatively simple, two important updates in recent years have brought possibilities to BTC.

SegWit

Activated in August 2017, its core change is to separate the signature (Witness Data) in the transaction from the transaction data, making the transaction data smaller, thereby reducing transaction fees and increasing the capacity of the Bitcoin network. SegWit increases the capacity limit of Bitcoin from 1 MB to 4 MB.

Taproot Upgrade

Similar to the SegWit upgrade, the Taproot upgrade is also a soft fork upgrade, which aims to promote the deployment of smart contracts and the expansion of use cases in Bitcoin. Bitcoin itself does not have smart contract functions, but after the upgrade, Taproot allows multiple parties to sign a single transaction using a Merkle tree. Taproot introduces a new script type called Tapscript to support conditional payments, multi-party consensus and other functions.

In fact, the development of these solutions based on BTC native technology is relatively slow. For example, RGB took more than 4 years to develop, Lightning took many years to develop, and Babylon took several years to develop the timestamp protocol. Perhaps making money is the best driver of the market. If there is a safe solution that allows most users to make money during the participation process, it can attract many people. After all, it is difficult to drive the geek group who have already achieved wealth freedom only by relying on the dream of technology.

You may complain that the above upgrades take a long time, but even Taproot, the upgrade that the community has almost reached the fastest consensus on (proposed in 2018 and launched in 2020), took more than two years to be launched.

However, even so, the ecological infrastructure is still incomplete, and recent hot topics are still exploring possibilities around BitVM, BitVM 2, RGB++, etc.

Of course, let’s put aside the old-fashioned BTC L2 and the typical multi-signature wallet pledge wrapped BTC model, and let’s not discuss the future of BitVM for now. Returning to the present, the current explorations all have significant flaws.

3.3 Limitations of other models

Inscription and other superposition protocols

Although the popularity of BRC-20 has brought traffic and attention to the Bitcoin ecosystem, subsequent standards such as ARC-20, Trac, SRC-20, ORC-20, Taproot Assets, and Runes have appeared to solve the problems of BRC-20 from different angles. However, the core problem of such superimposed protocols is the decentralization of their indexes, which may lead to information mismatch between indexers and the risk of irreparable damage after the indexer is attacked.

The biggest problem with the Lightning Network is the limitation of scenarios. It can only carry out transactions but cannot realize more scenarios.

Not to mention various other expansion protocols, RGB, DLC, and side chains Rootstock, Stacks, etc., which are still in the early stages, and are relatively weak in expansion effects and smart contract functions, or their security basically relies on multi-signature wallets for management.

Therefore, more and more community voices are emerging, suggesting that Ethereum applications should not be copied to the Bitcoin network.

Then, a more realistic original chain liquidity staking solution gradually emerged. It refers to the implementation of the staking mechanism directly on the Bitcoin network without relying on external smart contracts or side chains, and introducing liquidity to earn profits.

The author believes that this model is cleverly borrowing the strongest security of the BTC network, and can also achieve a relative balance between speed and benefits. In a recent research report by Binance Research, four heavyweight BTCFi protocols were also mentioned, namely Babylon, Bouncebit, PSTAKE Finance and Lorenzo.

4. pSTAKE Finance on Bitcoin

pSTAKE has been providing staking and income services on various chains since 2021, and pSTAKE in BTC is built on Babylon. This system is not rejected by the BTC core community (for example, Inscription is strongly rejected, and even a soft fork was once planned to kill the Inscription protocol), because this original chain liquidity staking solution will not essentially transfer BTC to other chains. It is Babylons remote staking mechanism, which means staking on the Bitcoin chain, but transferring the security effect of BTC to other chains) to maximize the value of BTC assets.

This two-way security sharing protocol not only provides security verification for the POS chain, but also provides benefits for BTC holders who participate in staking.

So how does Babylon do it, and what exactly is pSTAKE on top of it?

4.1 The cornerstone of pSTAKE liquidity income, Babylon’s traditional pledge protocol

In fact, Babylon is not complicated. It is a Bitcoin security sharing protocol, which consists of three modules at its core: BTC pledge contract , extractable one-time signature scheme (EOTS), and BTC timestamp protocol. First, the pledge contract is a set of BTC script contracts, and the core uses two types of operation codes:

-

OP_CHECKSEQUENCEVERIFY: This is to implement a relative time lock. After the time expires, the transaction output can be spent.

-

OP_CHECKTEMPLATEVERIFY: Set conditions for spent transaction outputs, for example, create mandatory spending targets, rebind inputs, etc.

Taken together, there are only two paths for users to participate: normal staking (unbinding upon expiration) and illegal operations (asset confiscation).

The core here is the slashing method, which makes use of the extractable one-time signature scheme EOTS. In addition to participating in the block production activities of the PoS chain consensus protocol, users must also complete the EOTS signature round on Babylon.

The cryptographic mechanism here is that when the signer only signs a message once, the private key is safe, but when he uses the same private key to sign two different messages, the Babylon system will extract the private key information through signature comparison. With the private key, the users BTC pledged assets can be burned (the assets are still pledged in the BTC contract at this time). After the expiration, the user has to compete with Babylon in transaction speed. Since BTC only produces a block once every 10 minutes, it is likely to be discovered, and all assets will be treated as mining fees and packaged and burned first.

“Oops, I did it again” – Security of One-Time Signatures under Two-Message Attacks:

The BTC timestamp protocol is also a clever design to circumvent the longest chain attack of POS. Simply put, it publishes the event timestamps of other blockchains to Bitcoin, so that these events can enjoy the timestamps of Bitcoin. BTC itself is extremely secure, so the timestamps above are also subject to rules and restrictions. Each new block must be greater than the average timestamp of the previous 6 blocks.

The above-mentioned Babylon pledge mechanisms are also modular and easy to reuse, which brings opportunities for pSTAKE to cooperate with it.

4.2 What is pSTAKE Bitcoin Liquid Staking?

pSTAKE is a liquidity staking protocol, which is similar to Babylon in mechanism and essentially operates in the PoS (Proof of Stake) ecosystem. Its biggest feature is that it allows users to stake their cryptocurrency assets while maintaining liquidity. Does it sound familiar? The effect is similar to Lidos sETH.

There is one very obvious difference between liquid staking and traditional staking: liquidity.

Traditional staking is when users deposit tokens into a PoS protocol to increase economic security, liquidity is given up. This means their tokens are locked and cannot be used elsewhere, which is also the current situation of Babylon, who focuses more on security.

Liquidity staking solves the liquidity dilemma in traditional staking by allowing pledgers to retain the liquidity of their assets and continue to use them elsewhere.

In practice, when a user deposits assets on BTC, the official mints a liquidity pledge token (LST) for the user on the POS chain. The user can then freely trade or use it on other DeFi platforms, and the LST can be redeemed back to the underlying assets at any time.

So where is the source of the benefits?

-

In fact, users first pledge BTC to pSTAKE, and then pSTAKE will pledge the assets to Babylon to obtain income and then distribute dividends to users.

-

When users pledge BTC, pSTAKE also distributes a liquidity token pToken to users. Users can continue to use this liquidity token like sETH generated by lido and others.

-

When users want to redeem BTC, they only need to destroy pToken on the pSTAKE application. At this time, the reward will be stopped and your BTC will be exchanged back from the liquidity exchange pool.

The BTC pledged to pSTAKE also uses MPC institutional custody providers such as Cobo on BTC to provide associated services, which is the same for Merlin.

What is ultimately formed is a dual-token system, where pTOKENs represent unstaked assets that can be used freely in DeFi, while stkTOKENs represent staked assets that can accumulate staking rewards.

4.3 Summary

pSTAKE itself has many years of experience in asset management and security audit records for multiple contracts, and has cooperated with Babylon to build it.

-

Further Enhanced Liquidity: Partnering with Babylon, a platform focused on improving asset utilization efficiency through advanced blockchain technology, can further optimize and expand this liquidity.

-

Increased yield potential: Babylon’s platform and technical expertise may provide more value-added opportunities for assets staked in pSTAKE. Through Babylon’s network, assets in pSTAKE may be able to access a wider range of DeFi protocols and yield strategies, which may include more complex trading algorithms or high-yield liquidity pools. This will not only provide users with more diversified investment options, but also potentially increase the overall return on these assets.

-

Improved security and compliance: Cooperation with Babylon may bring additional security and compliance advantages. Since Babylons own asset management security is extremely high, combined with the support of MPC service providers such as CoBo, the system can be further strengthened to ensure the rate of return.

In short, through pSTAKE’s Bitcoin liquidity solution, BTC holders can pledge their assets, and the source of income comes from Babylon’s services, giving liquidity tokens to users to maintain liquidity.

At present, pSTAKE has not yet fully launched its official version, and the current experience can only be tested online. Therefore, many asset management mechanisms and profit expansion mechanisms have not yet been announced, and naturally there is no TVL data to reveal.

However, the support of Binance Labs attracted the authors attention, because Binance has always invested a lot in staking gameplay, and they understand better what users need because of financial gameplay, which is also the most realistic demand of the blockchain industry.

Therefore, it is not a big deal after all that trillions of BTC remain idle for a long time.

Finally, returning to the security that BTC is most concerned about, MPC asset management service providers such as CoBo have now been further understood and recognized by users on projects such as Merlin. After all, instead of waiting for BITVM several years later to achieve ZK-level trust, it is better to cherish the present and operate the system optimistically like OP, providing certainty in asset management security through the certainty of underlying returns.

appendix

Why pSTAKE is Building BTC Liquid Staking on Babylon – pSTAKE

pSTAKE | Bitcoin Liquid Staking and Yields

pSTAKE Finance: The Orange Road Ahead x Bitcoin Yields

Bitcoin Liquidity Staking Testnet Now Available on Babylon – pSTAKE

This article is sourced from the internet: Interpreting the dilemma and future of BTCFI from PStake