Nervos Network: Native Bitcoin L2 Architecture and RGB++ Asset Issuance Protocol

1. Project Background and Introduction

As the largest cryptocurrency, Bitcoin continues to gain adoption and recognition. However, its success has also exposed some limitations and challenges, especially in terms of scalability. For example, after the Segwit upgrade, the Bitcoin blockchain has limited the block size to 4 MB, which limits the number of transactions that can be processed in a given time. As the network grows, this limitation leads to longer confirmation times and higher transaction fees, making Bitcoin less efficient when handling large transaction volumes. Compared to other blockchains, Bitcoins scripting language currently lacks the flexibility and expressiveness required to develop complex smart contracts in addition to value transfer. To address these limitations, a variety of Layer 2 (L2) solutions have been proposed, such as payment channels, sidechains, and Rollups. Most of them aim to scale Bitcoin by processing transactions off-chain, trying to increase transaction throughput without affecting the security of the base layer. For example, the Lightning Network creates a second-layer payment channel network that allows near-instant small payments. Another approach is sidechains – independent blockchains connected to the Bitcoin main chain, with greater scripting possibilities and faster transactions. However, these solutions often come with trade-offs, such as increased complexity, trust assumptions, and potential security vulnerabilities.

Nervos Network is one of the Bitcoin scalability solutions. It adopts a more native approach and modifies the UTXO model that supports Bitcoin. It improves the RGB protocol to provide Turing-complete contract capabilities for Bitcoin without the need for cross-chain bridges. Nervos Network was established in the first quarter of 2018 by Terry Tai, Kevin Wang, Cipher Wang and Daniel Lv. It is a Layer 1 blockchain designed to improve scalability. To promote the development of the network, the project team raised more than $100 million from seed rounds, private rounds and public offerings. In November 2019, Nervos Networks Layer 1 blockchain, Common Knowledge Base (CKB), went online. In February 2024, CELL Studio, led by Nervos co-founder Cipher Wang, launched RGB++, a Bitcoin layer asset issuance protocol. Inspired by the RGB protocol, the RGB++ protocol uses CKB as the data availability and execution layer to enable smart contract capabilities and asset issuance for Bitcoin. Since RGB++ was launched on the mainnet in April 2024, the number of projects using RGB++ to issue assets on Bitcoin has continued to increase. As of June 2024, the existing 15+ ecological projects have revitalized CKBs on-chain activities.

2. Technical architecture and features

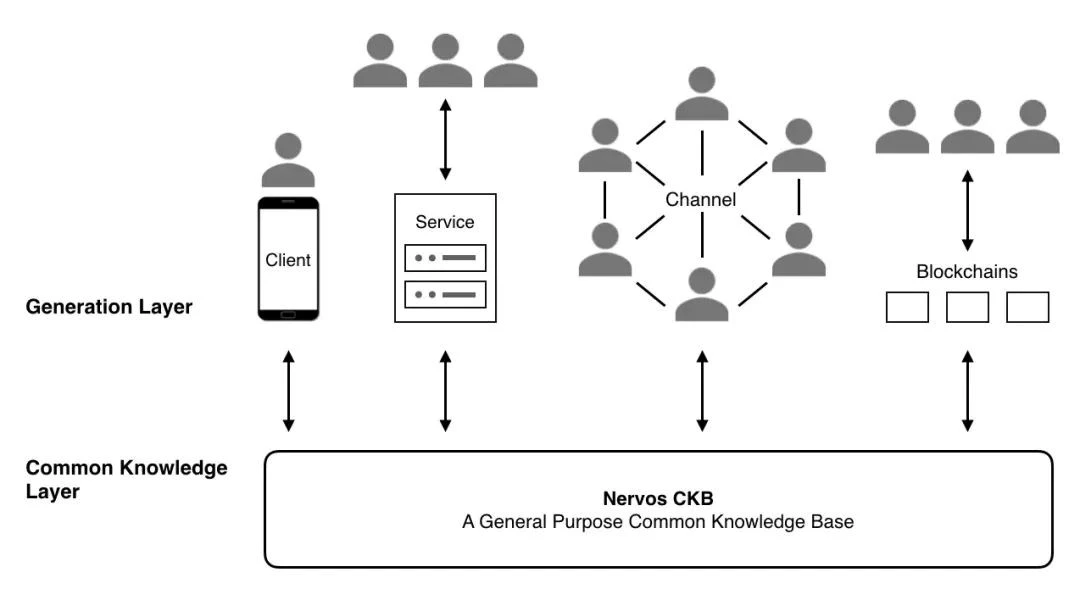

Source: Nervos Network

Nervos Network adopts a layered architecture, including an L1 blockchain (Common Knowledge Base, CKB) that can be expanded through payment channels and RGB++. The Cell model is an improved version of Bitcoins UTXO accounting model, and CKB-VM is a customized virtual machine that supports the layered design of the network. CKB-VM provides a flexible execution environment for initiating transactions or building applications on the network. This design allows the network to scale vertically by running dedicated components at each layer, similar to a modular blockchain.

Common Knowledge Base: CKB is the underlying L1 blockchain of the Nervos Network, which operates in a similar way to Bitcoin, using a Proof of Work (PoW) consensus mechanism. It uses NC-MAX, an upgraded version of the Bitcoin algorithm, to improve network efficiency and responsiveness by speeding up transaction confirmation time and reducing the orphan block rate. Bitcoin targets a 10-minute block interval and adjusts mining difficulty approximately every two weeks. CKB dynamically adjusts the block interval (approximately every four hours) based on changes in network activity to optimize performance.

CKB uses Eaglesong function to secure the network, which is an ASIC-neutral custom hash function that replaces the widely used SHA 256 hash function. Eaglesong is a sponge function that optimizes multiple cryptographic elements to provide the same level of security as other proof-of-work (PoW) hash functions, while being tailored specifically for the Nervos Network.

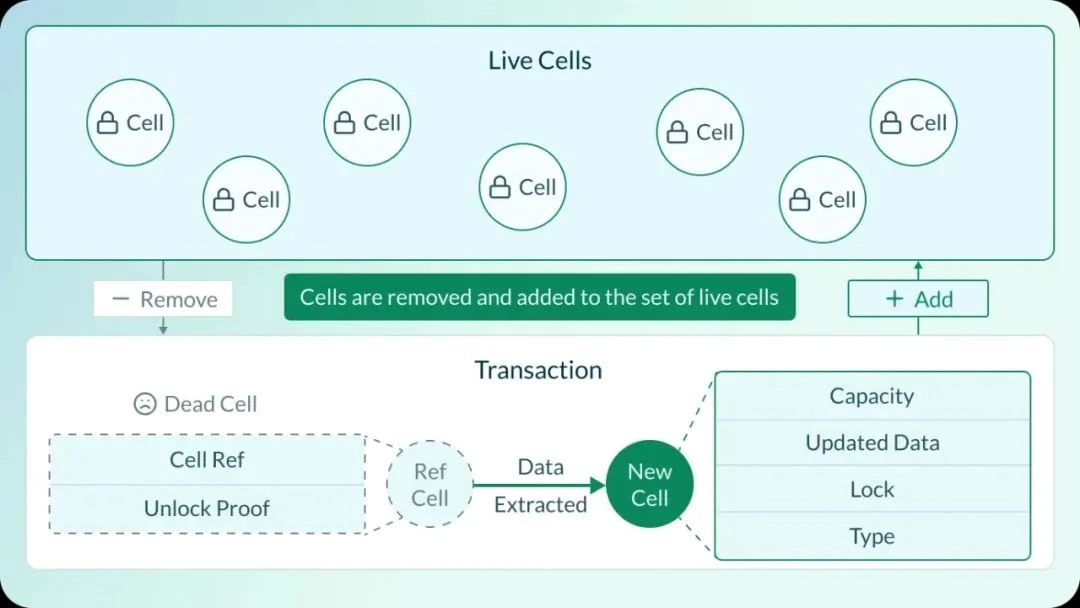

Source: Nervos Network

Cell Model: The Cell model is the core of CKBs data structure, which can store and verify any data on the chain. Bitcoins original script language and UTXO model limit its ability to perform complex calculations required by smart contracts. In contrast, CKB generalizes the UTXO model to allow more flexible data storage and verification. Unlike Bitcoin, which uses a single script to verify transactions, CKB introduces dual scripts in its Cell model:

The Lock Script ensures that only authorized users can access and use the contents of the Cell, similar to Bitcoin.

Type Script is an optional script that sets rules for how the Cell can be used or changed in future transactions.

Compared to Bitcoins limited options, this system enables CKB to support more features, making it more suitable for a variety of applications. Each Cell in CKB is a programmable Cell that can save different data types such as tokens, smart contracts, and specific application states. It can also run complex scripts similar to those in Turing-complete languages. Cells run independently, which means they can be updated or referenced without affecting other parts of the blockchain, improving scalability through parallelism.

CKB-VM: CKB-VM is CKBs execution engine for running smart contracts and decentralized applications. The virtual machine uses the RISC-V instruction set, a flexible, simple, open source hardware architecture set (ISA) that supports multiple programming languages, including popular languages such as C and Rust. This wide compatibility sets CKB-VM apart from other blockchain virtual machines that are typically limited to specific languages, opening it up to a wider developer community. The CKB network also supports SDKs for mainstream languages such as JavaScript, Rust, Go, and Java, making it easier for developers to develop with familiar tools. This makes it easier for developers to create complex decentralized applications using familiar programming languages.

In addition, CKB-VMs architecture provides predictable gas fees, secure execution, and efficient integration with the Cell model, which helps to effectively manage states and verify transactions. The predictable gas fee model avoids unexpected fees, improves user experience, and simplifies contract development.

RGB++ Protocol

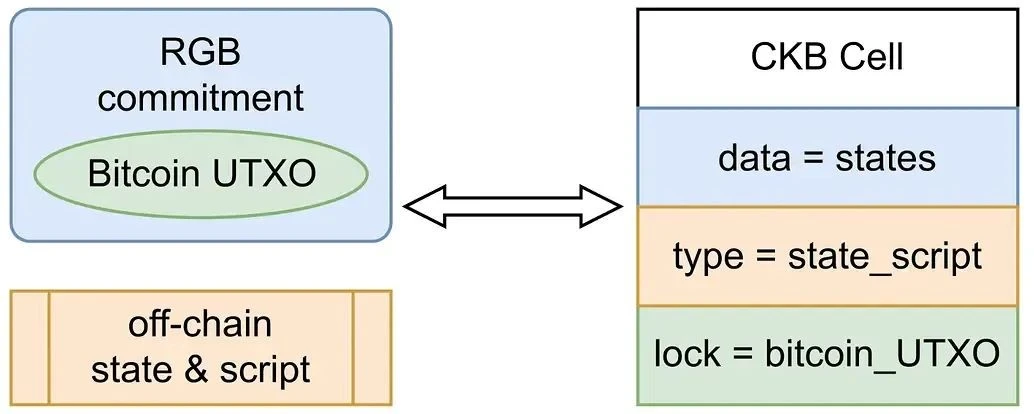

Source: Nervos Network

CKB extends Bitcoin using the RGB++ protocol, an asset issuance standard that extends Bitcoins functionality on CKB. The RGB++ protocol enables complex smart contracts and asset management operations that are generally not possible on the Bitcoin network. The original RGB protocol was an L2 solution designed to enable smart contracts and asset issuance for Bitcoin without changing the Bitcoin mainnet. It works by binding assets to specific Bitcoin UTXOs, allowing those assets to be transferred as the UTXOs themselves are transferred. The RGB protocol relies primarily on client-side validation, with transactions processed and validated off-chain, reducing the load on the Bitcoin network. However, this approach also has limitations, such as potential issues with data availability — since data is not stored on-chain, it may not be readily accessible when needed. In addition, the reliance on client-side validation adds complexity that may affect the user experience.

Nervos Network addresses these limitations through the RGB++ protocol, which extends and enhances the principles behind the original RGB protocol by using CKB as the data availability and execution layer for Bitcoin. RGB++ maps Bitcoin UTXO to CKBs Cell through isomorphic binding technology, enabling seamless integration with CKBs Turing-complete smart contracts. This is achieved by leveraging CKBs layered architecture and Cell model, allowing Bitcoin assets to interact with dApps on CKB. By using RGB++, CKB can execute more complex smart contracts for Bitcoin, which was not possible in the original RGB protocol. RGB++ also introduces on-chain verification of key transaction elements, improving security and data availability. In addition, the RGB++ protocol also enables transaction folding, masterless contracts with shared states, and non-interactive transfers, and cross-chain transfers of Bitcoin without the need for a cross-chain bridge.

Payment channels: As an underlying public chain, CKB can be extended through payment channels, such as Perun, a payment channel framework developed by Polycrypt. By processing transactions off-chain and settlements on-chain, these payment channels can support a variety of applications from small payments to payment gateways, thereby improving the performance of CKB. Perun leverages CKBs Cell model, where Cell carries capacity, Lock Script, Type Script, and data to manage the state of the channel. One of the channel implementations (PerunLockScript) can manage the access rights of the channels real-time Cell, while the other implementation (PerunTypeScript) can handle the verification logic of state transitions. These transitions are automatically managed from the channel being funded to being closed. As of press time, Perun is still in testing and has not yet been launched on the CKB mainnet. Nervos core developers are also working to connect CKB to Bitcoins Lightning Network, enabling users to exchange BTC and CKB without relying on third parties.

Token Economic Model

Nervos Network’s native token CKByte (CKB) plays an important role in maintaining network security and incentivizing efficient storage. The main roles of CKB in the network include:

Granting token holders data storage rights.

As transaction fees on the chain.

Distributed to miners as block rewards to ensure network security.

In addition, CKB tokens have three sources: (1) Genesis block; (2) Basic issuance; (3) Secondary issuance.

Genesis Block: When the mainnet was launched in November 2019, the genesis block minted 33.6 billion CKB tokens, of which 8.4 billion CKB tokens (25% of the initial issuance) were immediately destroyed. Of the 8.4 billion CKB destroyed, 5.04 billion tokens were used for on-chain storage (occupying on-chain space), and the remaining 3.36 billion tokens were in a liquid state (liquidity). The corresponding status distribution of these destroyed tokens is intended to allow miners to initially receive at least 15% of the secondary issuance, and the treasury fund to receive at least 10%. It is worth noting that all CKB tokens currently allocated to the treasury fund have been destroyed, and this setting can only be changed through a network hard fork.

The CKB distribution in the genesis block is as follows:

Public Sale (~21.50%): The largest portion of the genesis block was provided to public sale investors in 2018 and all was released when the mainnet was launched in November 2019.

Ecosystem Fund (17.00%): The Ecosystem Fund will support third-party developers within the Nervos ecosystem. In the Genesis Block plan, 3% of this grant will be in place when the mainnet is launched, and the rest will be distributed over two years, ending in December 2022.

Team (15%): Reserved for the project team, with a four-year lock-up period ending in May 2022.

Private placement (14%): offered to private placement investors in July 2018. 66.60% of the total was released at the launch of the mainnet, and the remainder was locked up for two years in 2020.

Partners (5%): This grant is reserved for strategic partners who help build the Nervos Network and has a four-year lock-up period.

Testnet Rewards (0.5%): These rewards are distributed in full to testnet and bug bounty program participants at mainnet launch.

Destruction (25%): In the genesis block, this portion is directly destroyed to ensure that miners and treasury funds continue to receive secondary issuance.

Base issuance: The goal of CKB base issuance (primary issuance) is to improve the security of the network in its early stages of development. The base issuance of CKB is fixed per Epoch and is awarded entirely to miners for processing transactions on the network. The base issuance is capped at 33.6 billion CKB tokens and follows a similar inflation schedule to Bitcoin, halving every four years until the supply cap is reached. In November 2023, CKB experienced its first halving event, with the base issuance dropping from 4.2 billion CKB per year to 2.1 billion.

Secondary issuance: CKB manages state explosion in two ways. First, to store data on-chain, users must lock CKB tokens. CKB does not directly charge users who lock CKB tokens to pay state rent, but indirectly charges fees through an inflation mechanism called secondary issuance. Every year, 1.344 billion CKB tokens are minted through secondary issuance and distributed to miners, Nervos DAO depositors, and the treasury fund. Therefore, secondary issuance introduces inflation for users who store data, because locked CKB tokens automatically face value dilution, which is an indirect way to pay state rent. As of writing, more than 600 million CKB tokens have been distributed to miners as state rent, about 1.15 billion CKB tokens have been awarded to Nervos DAO depositors, and more than 4.27 billion CKB tokens allocated to the treasury fund have been directly destroyed.

Nervos DAO: Through the Nervos DAO, CKB token holders can natively avoid being diluted by secondary issuance. By locking their CKB tokens into the Nervos DAO smart contract, users can receive token rewards from secondary issuance, ensuring that their tokens are protected from inflation. Nervos DAO depositors receive a yield that is the same as the inflation rate of secondary issuance, and the APR will continue to decline as the total supply increases. Users can deposit into the Nervos DAO at any time, with a minimum amount of 102 CKB, but withdrawals can only be made after the 30-day deposit cycle is over. CKBs deposit-to-circulation ratio is 20.84%, which has been on a downward trend over the past two years. This downward trend may be due to the increasing number of unspent cells on CKB.

4. Network Activities

Over the past year, the CKB network has continued to be active. As of now, CKB has an average daily transaction volume of 43,600 transactions. This is an increase of 110% compared to the daily average of 20,800 transactions in the fourth quarter of 2023. In terms of new addresses, on-chain activity increased significantly in April. 387,600 new addresses were created in April, a month-on-month increase of 181% compared to March. Cell activity on CKB has been steadily increasing since April, partly due to the launch of the RGB++ protocol. Cell activity is divided into unspent cells and spent cells. Unspent cells can be used for future transactions, smart contract execution, and data storage, reflecting the increase in network activity and adoption. Spent cells, although no longer used as transaction inputs, still contain valuable data that can be accessed and referenced, contributing to the history and data traceability of the blockchain. As of May 15, 2024, there are 1.7 million unspent cells, a 13% increase from the end of the first quarter. As for spent cells, there are 57.6 million spent cells on CKB at press time.

There have been over 13,200 transactions and 4,400 unique addresses using the RGB++ protocol since it went live on April 3, 2024. Network activity has been on a downward trend throughout May and June, but more ecosystem projects utilizing RGB++ should help reverse that trend.

5. Security and Decentralization

As a PoW network, miners secure CKB by solving cryptographic puzzles to verify transactions and add new blocks to the blockchain. For each block mined, miners receive the entire “base issuance” reward and part of the “secondary issuance” reward for that block. Miners can also receive proposal rewards or submission rewards from transaction fees for processing network transactions. In order to manage changes in network activity without degrading performance, CKB’s customized NC-MAX consensus protocol adjusts the mining difficulty approximately every four hours based on the network’s orphan block rate. In this way, the network can optimize block times while reducing the likelihood of block reorganizations, which can destabilize the network.

Hashrate is a measure of the basic computing power of miners on a PoW blockchain. Therefore, hashrate represents the security of the CKB network. In 2024, the hashrate of the CKB network continued to set new historical highs. On April 27, CKBs total network hashrate reached 397.5 PH/s, the highest hashrate value ever on the CKB network. The increase in hashrate is partly due to Binance opening the CKB mining pool on April 18, 2024. Similar to hashrate, the average mining difficulty in 2024 also hit a record high (3.96 E on April 21).

6. Ecosystem

Nervos Network continues to promote the development of the ecosystem through funding, infrastructure, and tool support. At the time of the mainnet launch in November 2019, approximately 5.7 billion CKB (17% of the genesis block CKB allocation — $62.4 million at the time of writing) was reserved for the Eco Fund. Over the years, the Eco Fund has provided seed funding for multiple ecosystem development initiatives to advance the networks development plans. One of these is the CKB Eco Fund (formerly InNervation), which focuses on incubating and investing in early-stage and seed-stage projects that use RGB++ to connect CKB and Bitcoin. CKB Eco Fund supports ecosystem projects in building critical infrastructure and cross-domain decentralized applications, including DeFi, games, tools, NFT markets, and more. In January 2024, CKB Eco Fund launched the BTCKB program, which aims to strengthen the integration between Bitcoin and CKB blockchains through the PoW consensus mechanism and UTXO model. The BTCKB plan introduces new smart contract features to incorporate BTC, Taproot Assets, and RGB++ assets into the CKB blockchain, thereby enhancing the functionality of the Bitcoin blockchain. As part of the plan, CKB Eco Fund also incubated CELL Studio, a blockchain software company led by Nervos co-founder Cipher Wang, who is also the lead of the BTCKB plan. CELL Studio develops infrastructure and applications to enhance and expand the Nervos ecosystem, similar to how ConsenSys develops foundational tools such as Infura and MetaMask for Ethereum. So far, well-known ecosystem tools developed by CELL studio include:

CoTA: Aggregation protocol for fungible and non-fungible tokens on CKB.

ForceBridge: A cross-chain interoperability protocol that connects CKB and other blockchain networks, currently supporting Ethereum and BNB Smart Chain.

Spore: A protocol for on-chain digital objects (DOBs) powered by CKB.

Since the launch of the RGB++ mainnet in April 2024, more than 15 existing ecological projects have used the protocol to issue assets. Ecological projects worth paying attention to include:

UTXO Stack: Bitcoin L2 “OP Stack” based on the RGB++ protocol.

JoyID: A non-custodial wallet that leverages biometrics for user authentication and supports multiple networks including Ethereum, Bitcoin, and RGB++ assets.

HueHub: Decentralized exchange and launchpad that supports RGB++ assets on Bitcoin.

Stable++: A decentralized stablecoin protocol that supports CKB and BTC.

World 3: Autonomous world game based on RGB++ protocol and DOB.

Nervape: A multi-chain composable digital object based on Bitcoin, whose base assets are issued on Bitcoin and subsidiary assets are issued on CKB.

Haste: RGB++ asset management solution.

d.id: A decentralized identity protocol for the Bitcoin ecosystem.

The RGB++ development roadmap released by CELL Studio highlights the important plans to be completed by 2024, including:

Release a cross-chain protocol for issuing RGB++ assets across UTXO chains.

Bridge-free cross-chain transfer of Atomicals, Orderals, and other UTXO-based assets to CKB via the RGB++ protocol.

Propose and implement a solution for extending RGB++ to support multiple networks.

Connect RGB++ with CKB Lightning Network.

As part of the BTCKB plan, CKB Eco Fund also intends to launch a cross-chain bridge connecting BTC and CKB and a UTXO-based DEX. In addition, a payment channel network will be developed for CKB using the RGB++ protocol, and the relevant proof of concept has been completed. This payment channel network will be connected to the Lightning Network, making CKB more scalable and suitable for various blockchain applications.

7. Competitive Product Analysis

As Bitcoin L2, Nervos Networks approach to extending Bitcoin is primarily to enhance Bitcoins functionality through the RGB++ protocol. Competitors like Stacks offer customized execution environments and programming languages, while Rootstock hooks transactions between the two chains. In contrast, Nervos aims to enhance the native Bitcoin experience without adding complexity or compromising decentralization. With the RGB++ protocol, CKB can provide Bitcoin with a smart contract execution environment that is closely integrated with Bitcoins original UTXO model. This design could bring advantages to Nervos Network, attracting users who are skeptical of solutions that deviate from Bitcoins core ideals of decentralization and security.

Compared to scaling solutions like the Lightning Network, CKB’s smart contracts offer a wider range of functionality, enabling developers to build more complex applications on Bitcoin. While the Lightning Network is effective in facilitating fast, low-cost transactions, it does not support complex decentralized applications. Meanwhile, platforms like Liquid Network, Merlin Chain, and Bouncebit require trust in a semi-centralized consortium to manage the cross-chain bridge between the sidechain and the Bitcoin mainnet. CKB avoids this level of centralization by using an off-chain computation and on-chain settlement approach.

Still, Nervos’ approach to scaling Bitcoin with the RGB++ protocol is not without limitations. The reliance on external networks (particularly the CKB blockchain) for data availability and asset issuance introduces additional complexity and potential delays to Bitcoin. Additionally, the lack of comprehensive development tooling and multi-party interaction solutions limits the protocol’s ability to effectively support decentralized applications. Finally, the transparency of transactions on the CKB blockchain undermines the privacy benefits that the RGB protocol originally provided.

8. Conclusion

The Bitcoin L2 market continues to develop as demand for scalability and functionality beyond Bitcoins original functionality continues to grow. Various L2 solutions, such as Lightning Network, Sidechains, and Rollups, aim to address these issues by moving transactions off the main chain, thereby increasing Bitcoins throughput without compromising security. However, these solutions often introduce new complexities and security challenges. What makes Nervos different is the extension of the RGB protocol through RGB++. RGB++ provides native extensions to Bitcoin, integrating deeper smart contract functionality that is directly related to Bitcoins UTXO model. These features, in turn, facilitate a more seamless and secure expansion of Bitcoins utility. In addition, work is underway to connect the Payment Channel Network with the Lightning Network, which will make CKB more scalable and suitable for many blockchain applications.

Ultimately, Nervos aims to strengthen its position in the Bitcoin L2 space by simplifying the user and developer experience. In addition, Nervos can also prioritize RGB++ support for a wider range of asset types and complex applications, thereby increasing its utility in the Bitcoin ecosystem. By doing so, Nervos can play a key role in the wider adoption and functionality of Bitcoin as a decentralized application and smart contract platform.

This article is sourced from the internet: Nervos Network: Native Bitcoin L2 Architecture and RGB++ Asset Issuance Protocol

Original title: From Staking to Restaking Original article by Arjun Balaji, Dave White, Georgios Konstantopoulos, Paradigm Original translation: Ismay, BlockBeats Editors Note: On June 11, Symbiotic announced its official launch and said it had completed a $5.8 million seed round of financing, led by Paradigm and Cyber Fund. This morning, the re-staking protocol Symbiotic tweeted that Symbiotic reached the staking limit of 41,290 wstETH in 5 hours. Symbiotic, which has been the focus of the market since its birth, can be said to be very successful. Last month, it was reported that Lido co-founder and Paradigm were secretly funding a new company, Symbiotic, which would compete in the re-staking track. Symbiotic allows users to use Lidos stETH to re-stake with other assets that are natively incompatible with EigenLayer. This means…