Built for a new generation of attention merchants, crypto products are moving closer to SocialFi

Original article by Mason Nystrom

Original translation: TechFlow

The Internet is a market for attention, and competition for attention is rapidly intensifying. Cryptocurrency brings a new chapter to the attention economy, providing a more efficient mechanism for evaluating the value of attention through ownable attention assets such as content, social graphs, emoticons, algorithms, and platform social activities.

However, cryptocurrency not only changes the value of attention, it also has the potential to change who owns the value of attention.

In 2016, Tim Wu proposed the concept of “attention merchants” to describe how publishers and platforms use users’ attention to make profits. Cryptocurrency opens up a new way for users to become their own attention merchants and recapture the value of attention by owning attention assets.

The most notable example of this trend is in SocialFi, where users can own attention flows of assets such as memecoins, influencer access keys, content, etc. By allowing users to directly participate in attention-based assets, the SocialFi platform challenges the traditional attention economy power structure, transforming users from passive consumers to active participants and becoming new attention merchants.

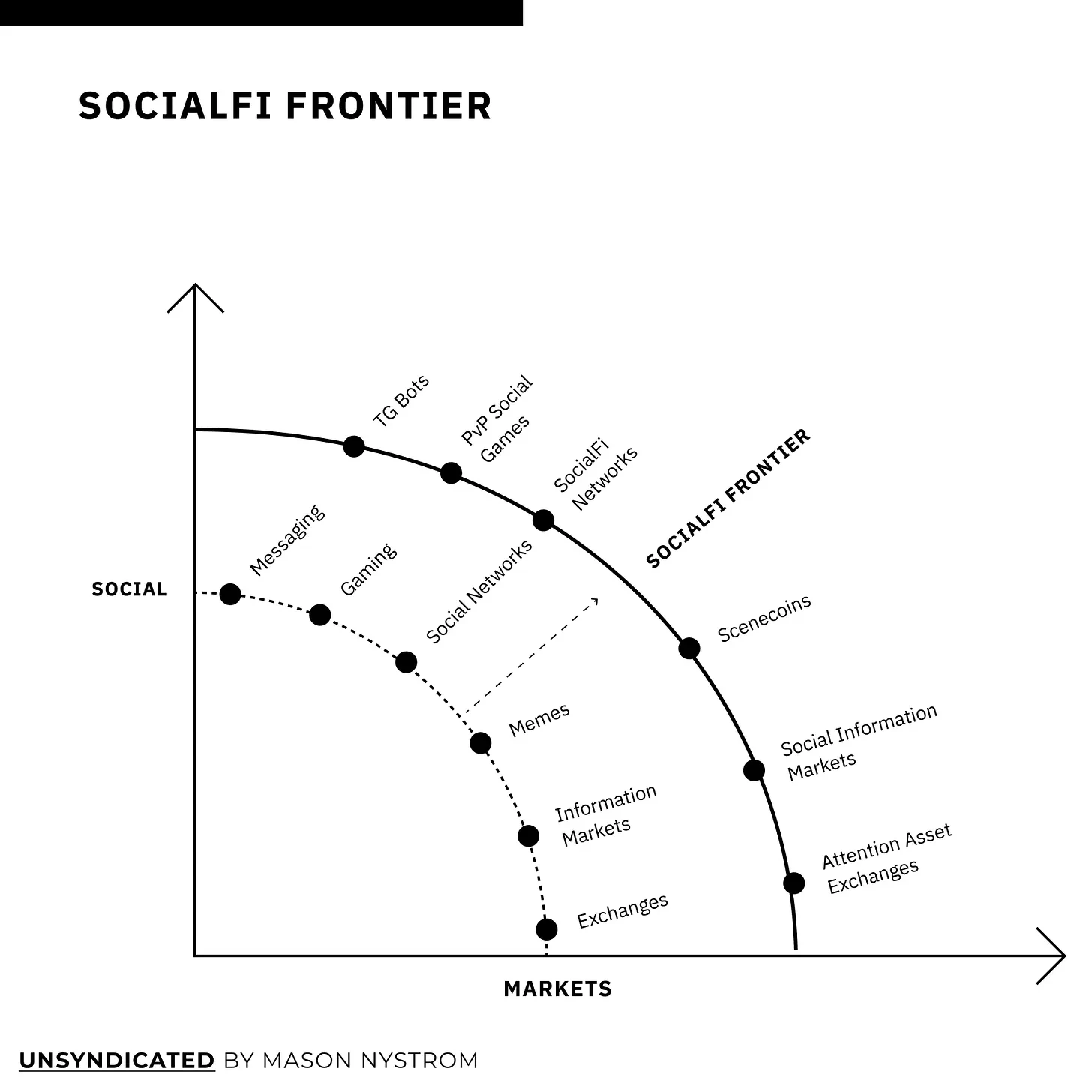

SocialFis Frontier

SocialFi is emerging as an important category in Web3. Crypto social networks like Farcaster are growing rapidly, with over 75,000 daily active users. Telegram bots that combine group messaging and trading facilitate billions of dollars in transaction volume. And information markets are also moving towards financialized social graphs (such as Twitters Trends.market, Fantasy.top and Farcasters Swaye, Perl, Arrina).

While not all social platforms come with financial incentives, SocialFi represents an evolution of social from indirectly valuing social capital to more efficiently valuing social and attention assets. As a socio-economic technology, cryptocurrency enables social applications to add other financialized elements (such as asset trading) or integrate financial primitives natively at the application layer (such as Friendtech s bonding curve). The SocialFi trend is driven by consumers strong demand for owning and trading attention assets. Users choose to spend time in applications that can earn income based on their attention or enhance the social entertainment experience through financial games.

For example, Fantasy is a fantasy sports trading card game and information marketplace built on the X (formerly Twitter) social graph. Fantasy allows creators to earn money from their social media presence while enabling players to earn rewards based on their intuition and knowledge of certain social accounts. Elsewhere, new social networks like Friendtech, Unlonley, and Sanko allow creators to directly monetize their social interactions through chat access passes. This benefits users who purchase access passes early, rewarding them for allocating attention to undervalued creators and groups.

The core benefit of the new information marketplaces and social networks is that creators and users are now attention merchants who own the attention assets in these apps and monetize their attention through usage of the apps.

Many applications have responded to users’ desire to embed commerce and finance into social experiences:

-

Message → Trade in Message

-

Games → Ownable assets and real money based in-game economies

-

Social → Ownable social graphs, channels, content, and platforms

-

Emoji → Scene Coin and Derived Emoji Assets

-

Information Market → New Market for Social-Based Entertainment, Influencers, and Social Capital

-

Exchange → Issue new protocols based on social and attention assets

Over the past year, the SocialFi ecosystem has grown rapidly, with a surge in attention asset exchanges (such as the memecoin protocol), PvP (player-versus-player) social games, new forms of information markets, and financialized social networking companies. This expansion is driven by the maturity of crypto infrastructure in terms of scalability and usability , supporting new types of consumer experiences (such as mobile PWAs), cheaper transactions (such as L2), and faster application iteration cycles through improved development tools (such as account abstraction and wallet-as-a-service tools).

Social network

Social networks can be broadly divided into two categories and their respective creator monetization models: one-way and two-way.

-

One-way networks are platforms where there is a one-sided relationship between creators and fans. This one-sided relationship is usually accompanied by a direct monetization model, such as subscriptions (e.g. Substack, OnlyFans, Patreon) or through a direct advertising revenue share to the creator (e.g. YouTube, TikTok).

-

Two-sided networks are platforms where there is a two-sided relationship between creators and fans (e.g. Twitter, Reddit, Facebook, Snapchat). Two-sided social networks allow users to monetize content by spreading it, rather than restricting its spread, such as through token-gated access (e.g. influencer gated chats). Web2 two-sided networks like Twitter and LinkedIn have historically made it more difficult for creators to directly monetize their influence. Instead, creators have had to resort to strategies like affiliate programs, directing users to other monetization sites (e.g. Twitter → Substack), or promotional campaigns.

By redefining users as new attention merchants, SocialFi offers a variety of new monetization options for both types of social networks. One-way networks offer creators the ability to further monetize their top audiences through tokenized content, influencer access, limited-time rewards, or social status. One-way networks Drakula and Friendtech tokenize content and creators respectively, enabling top creators to earn revenue from transaction volume. Sofamon showed an example of a token model where users can incrementally purchase an aesthetic item (e.g., an avatar outfit) until they own the entire item and can then wear it.

Web3 social networks offer new monetization options. For example, monetization of usernames and namespaces can generate revenue for valuable namespaces that scale to millions of users. Additionally, two-way social networks can better leverage in-app transactions. This can manifest as marketplaces within social networks, channel storefronts, or in-app games.

The key difference between Web3 two-sided networks and Web2 social networks is that the new merchants of attention, i.e. users and creators, will be better able to monetize their activities. For example, imagine if moderators of a subreddit could own their channel and earn revenue based on the ads they display, or earn a portion of the revenue from transactions that pass through their channel because of the community they manage.

PvP Social Games

As consumer infrastructure matures, PvP (player vs. player) social games are seeing new promise. Most notably, a wave of “survivor” style competition games have emerged, such as Crypto The Game and Blessed Burgers, which offer users a new digitally native and highly social gaming experience to earn prizes. Other applications, such as Rug.fun or PvPWorld, offer game theory strategy games where users can collaborate with others to win prizes. In contrast, in Web2, most mobile games monetize attention through traditional advertising or offer users to pay to play in a way that skips the cooldown period. Game developers now have new business models, with social games becoming more like content , with developers releasing multiple short-lived applications that offer shortened game cycles where users can earn significant rewards for participating and then move on to the next game.

New types of social games should focus on optimizing for: multiple winners, which increases engagement; easy-to-learn games that make average users feel like they have a high chance of winning; and social interactions, which further enhances the virality of these games. These proposed game dynamics are more incentive-aligned than web3 games, which have historically favored pay-to-win type games or games that prioritize farming over fun.

New markets and exchanges

The main use cases for cryptocurrencies revolve around market creation, specifically issuing new asset classes, on-chaining existing assets, or expanding access to digitally native assets.

-

Information Markets – Information marketplaces like Polymarket have the potential to build more efficient political markets and support the creation of new types of event markets based on real-world events, culture, and commerce.

-

Attention Exchanges — Publishing platforms like Pump and Ape.store allow users to create new assets (e.g. memecoins) based on the quality of attention. Elsewhere, Sofaman tokenizes status and culture by allowing users to create a Telegram-based digital avatar and sell branded clothing on a bonding curve.

-

Telegram Bots – Telegram bots bring markets and social finance games into the messaging experience, providing a more convenient experience for users.

-

Points and Pre-tokens – Points have always been an effective incentive strategy for teams testing user behavior and trying dynamic incentives. Points markets like Michi and WhalesMarket and pre-token markets like Aevo can help create more efficient token markets.

Multiple sub-trends are driving the creation of new markets and exchanges. First, increased verticalization of social and financial platforms is driving new types of assets to be issued by these applications. Second, increased user ownership of on-chain activity through earning points, tips, and tokens is expanding the range of assets that users can interact with, which in turn encourages the creation of new trading venues. Finally, users now interact with assets, such as memecoins, over which they feel greater autonomy. Similar to real-world cultural assets, such as sneakers or music, users feel a sense of control over the popularity and potential appreciation of these cultural assets because the value base of these assets (users’ attention) is controlled by the end consumer.

Built for a new generation of attention merchants

The social world is undergoing a paradigm shift, and the relationship between users, creators, and attention is being redefined. At the heart of these trends is that users and creators are no longer just the supply and demand sides of the attention economy, but can become merchants of their own attention.

Designing new financial or social infrastructure is hard, let alone combining the best of both worlds into a unified experience. However, early social financial tools, toys, and games that can quickly experiment, test new consumer behaviors, and capture emerging consumer behaviors and preferences will lead the way to the next generation of SocialFi networks and apps.

This article is sourced from the internet: Built for a new generation of attention merchants, crypto products are moving closer to SocialFi

In the cryptocurrency market, data has always been an important tool for people to make trading decisions. How can we clear the fog of data and discover effective data to optimize trading decisions? This is a topic that the market continues to pay attention to. This time, OKX specially planned the Insight Data column, and jointly with mainstream data platforms such as AICoin and Coinglass, based on common user needs, we hope to dig out a more systematic data methodology for market reference and learning. The following is the first issue of the content, in which the OKX Strategy Team and AICoin Research Institute jointly discussed how to perceive market changes and build a data methodology . We hope it will be helpful to you. OKX Strategy Team: The OKX…