Bitget Research Institute: The market continues to fluctuate, BGB breaks through 1.2 US dollars and the trend is good

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including:

-

The sectors with relatively strong wealth creation effects are: Solana sector, Bitget platform currency

-

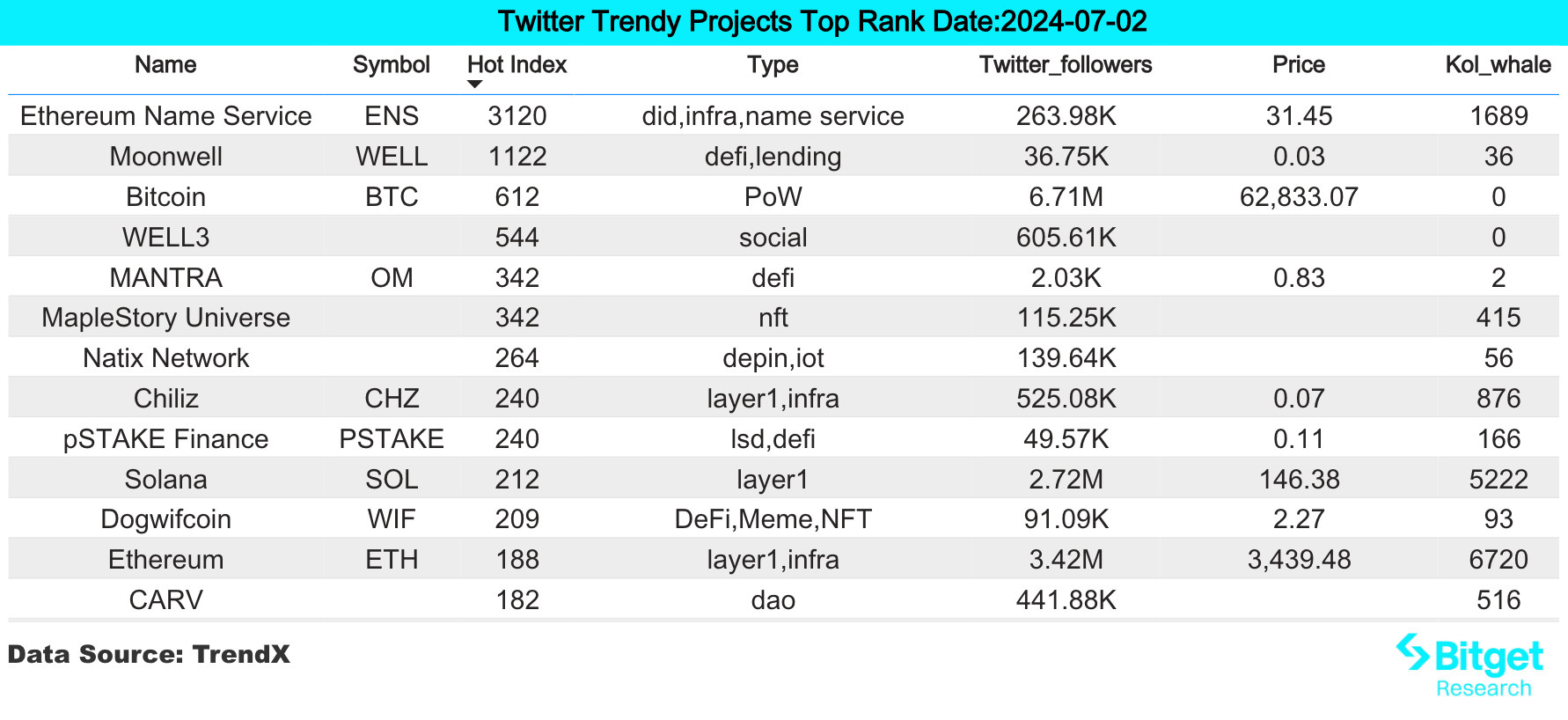

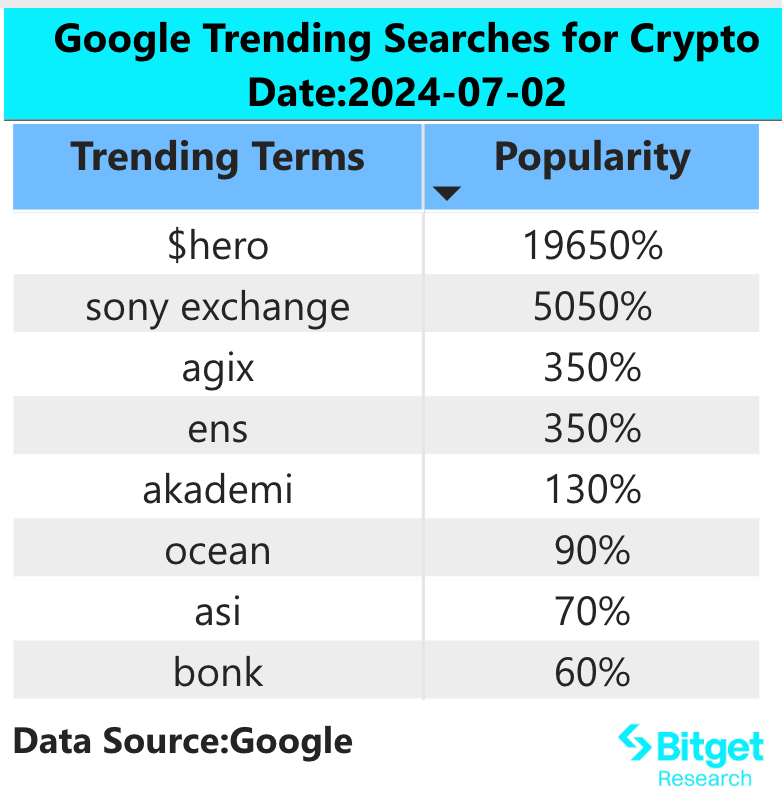

The most popular tokens and topics searched by users are: Pixels, ENS, HERO, Sony Exchange

-

Potential airdrop opportunities include: Mitosis, GaiaNet

Data statistics time: July 2, 2024 4: 00 (UTC + 0)

1. Market environment

The market continued to fluctuate yesterday, with BTC fluctuating in a narrow range of $62,500 to $63,500, with a certain amount of intraday trading space. ETH has a higher volatility, and in the options market, the implied volatility of BTC and ETH is 44 and 59 respectively. Generally speaking, if the implied volatility of ETH is 10 higher than that of BTC, it is a more obvious signal to be bullish on ETH/BTC. The main reason is that funds will be more inclined to higher volatility targets, resulting in a net inflow of funds into the ETH ecosystem.

The US dollar index maintains a strong position, and the 10-year US Treasury yield has risen to 4.44%, which puts some upward pressure on the crypto market. With the expectation of interest rate cuts in the second half of the year being priced in ahead of time, along with the decline in 10-year Treasury yields, the US dollar index is likely to weaken. The interest rate cut will be good for crypto assets, so you can consider planning for the second half of the year in advance.

2. Wealth-making sector

1) Sector changes: Solana sector (BONK, DRIFT, HNT)

main reason:

-

The SOL token showed strong resistance during the pullback;

-

Events such as SOL Blinks and SOL ETF have attracted traffic to the SOL ecosystem;

Rising situation: BONK, DRIFT, and HNT rose by 13.4%, 10.4%, and 8.8% respectively within 24 hours;

Factors affecting the market outlook:

-

SOL token trend: In the Solana ecosystem, the trend of SOL tokens will affect the price of the entire ecosystem token, because many tokens on DEX are priced in SOL. Continue to pay attention to the price trend of SOL. If SOL maintains an upward trend, you can continue to hold SOL ecosystem assets.

-

Increase or decrease in open interest: SOLs open interest rose yesterday, indicating an influx of hot money. Use the contract data on the tv.coinglass website to understand the movement of the main funds. First, look at the increase in net long positions on the contract; then look at whether the contract data shows a net increase in long positions, an increase in OI, and an increase in trading volume. If so, it means that the main force continues to buy up and can continue to hold;

2) The sectors that need to be focused on in the future: Bitget platform coins (BGB, BWB)

Main reason: BGB recently broke through 1.2 USD, and the trend is very stable from the technical indicators. Bitget recently announced that in order to help the long-term development of Bitget Token (BGB) and enhance the rights and interests of BGB holders, Bitget will upgrade the token smart contract and expand the use of BGB in decentralized applications such as DeFi, DEX, and GameFi.

Specific currency list:

-

BGB: Bitget platform currency, the smart contract of the token will be upgraded recently. In the future, BGB will be deeply integrated into the development of DeFi, DEX, Gamefi and other applications. The potential demand for BGB may surge in the future, so it is recommended to pay close attention.

-

BWB: Bitget Wallet token, with a total market value of only US$500 million. The wallet track has good growth potential in the future and is suitable for long-term holders.

3. User Hot Searches

1) Popular Dapps

Pixels:

When the gameplay of Pixels Chapter 2 was released, Pixels founder Luke revealed that the studio is developing other games in the Pixels universe and working with external developers to expand the series, and is considering trying to launch it on Telegram.

2) Twitter

ENS:

ENS has become one of the ETH ecosystem tokens with the largest increase during the market rebound. Yesterday, ENS surged 30%, breaking the highest level in the past 29 months.

3) Google Search Region

From a global perspective:

HERO:

A celebrity coin issued by YouTube celebrity SteveWillDoIt, who is famous for his prank and challenge videos, has more than 4.6 million subscribers on YouTube and 860,000 Twitter followers. The token has a large trading volume and TGE has risen strongly in the past two days. The current total market value has exceeded 50 million US dollars, but there is still a problem of chip concentration. The top 10 addresses hold more than 60% of the chips.

Sony Exchange:

Sony Group of Japan has acquired Japanese crypto trading platform Amber Japan for billions of yen. Singapore market maker Amber Group acquired Japans regulated cryptocurrency trading platform DeCurret in early 2022 and renamed it Amber Japan.

From the hot searches in each region:

(1) Yesterday, no countries in Asia showed any obvious hot altcoins. “ETH, DCA, staking crypto” became the hot search in most countries, which may reflect the market’s attitude towards ETH hoarding, fixed investment, and staking before the ETH Spot ETF was approved.

(2) European and American countries: Kaspa (KAS) appeared on the hot searches in Poland, Switzerland, Italy, Belgium and other countries. Blum and Grass, two popular un-issued coin projects, appeared on the hot searches in many European and American countries and CIS countries.

Potential Airdrop Opportunities

Mitosis

Mitosis is a liquidity protocol for the modular era that aims to redefine cross-chain liquidity. It makes cross-chain LPing more attractive by making it liquid. Mitosis LPs receive derivative tokens that are redeemable 1:1 with their locked assets. LPs can use these derivative tokens to participate in various DeFi applications on supported Ethereum L1 chains and L2 Rollups, essentially enabling LPs to earn additional returns on their cross-chain assets on top of the default fee sharing.

In May 2024, Mitosis completed a US$7 million financing round, led by Amber Group and Foresight Ventures, with participation from Big Brain Holdings, Folius Ventures, Citizen X, GSR and others.

Specific operation method: (1) Use ether.fi to deposit ETH on Linea to convert it into weETH; (2) Deposit weETH into Mitosis to convert it into miweETH; (3) Remember to activate it on Linea The Surge, so that you can obtain the triple benefits of Mitosis points, Linea points and certain ether.fi future airdrops.

GaiaNet

GaiaNet is a decentralized network that provides secure and monetizable AI agents that incorporate everyone’s proprietary knowledge and skills while preserving privacy. Instead of building centralized servers, GaiaNet builds a distributed network of edge computing nodes controlled by individuals and enterprises to host fine-tuned AI models based on the node operators’ proprietary domain knowledge and expertise.

In May 2024, GaiaNet completed a $10 million seed round of financing, with participation from EVM Capital, Mirana Ventures, Mantle EcoFund, Lex Sokolin of Generative Ventures, and Brian Johnson of Republic Capital.

Specific operation methods: (1) GaiaNet announced the launch of the Beta test version on June 5, and nodes can be run; (2) Professional developers can use proprietary data to train AI models to win airdrops; (3) Ordinary users can contribute idle hardware computing power to become nodes (similar to io.net) to win airdrops. The specific method of running nodes needs to refer to the official documentation.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603812051

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

This article is sourced from the internet: Bitget Research Institute: The market continues to fluctuate, BGB breaks through 1.2 US dollars and the trend is good

Related: How can strategic investment products liberate investors’ productivity and enhance returns?

As AI technology continues to liberate human productivity, can crypto investment save worry and effort and generate excess returns? Passive strategy products can! Not only can they reduce investors’ operating costs and avoid emotional decisions caused by market fluctuations, but they also support multiple usage scenarios such as slow bull market, shock, and medium- and long-term layout. This article will help you understand what passive strategy investment products are and how to use them. What are passive strategy investment products? Passive strategy products are not affected by emotional decisions and have the characteristics of high transparency, low fees, and low risks. They aim to obtain returns that exceed the market average by minimizing transaction steps and transaction fees, and are suitable for users who want to simplify the investment process…