In a falling market, which AI tokens are worth paying attention to?

Written by Shawred (₿, τ)

Compiled by: TechFlow

AI tokens are currently presenting an excellent buying opportunity in the market. I believe these tokens will outperform in the upcoming utility bull run and become market leaders.

In order to help everyone better understand and choose the right investment targets, we divide AI tokens into three categories:

-

Safe Play: Expected returns are 10x to 20x.

-

Decent Play: Expected returns are 20x to 50x.

-

Aggressive strategy (Degen Play): expected return is 50x to 100x.

This is an unbiased review of AI × Cryptocurrency.

Since the start of this bull run, artificial intelligence has been the hottest and most profitable niche, along with meme coins.

The launch of OpenAI and the fall of Sam Altman triggered two major AI waves, leading to a large number of launches of AI and cryptocurrencies, but also a large number of scams.

In the first and second waves of artificial intelligence, many projects brought exponential returns to early investors, but caused heavy losses to latecomers.

Each wave has different sub-catalysts, narratives, and models that drive the development trend of artificial intelligence.

In the first phase, people were negative about this niche, viewing it as a short-term hype. Most people forgot about it until they came across projects like $TAO, $RNDR and $AKT that were actually adding value and had real use cases that could advance the crypto x AI space. GPU n compute related projects like $RNDR and $AKT, and AI layer 1 chains like $FET and $ORAI, were all hyped during this phase.

Some of these projects were perpetually listed on Binance, which further fueled the AI craze and led to a large number of liquidations, helping the AI hype to continue. When the first wave of AI ended and most projects collapsed by 85%-90%, some CT cult groups claimed that they predicted that AI was just a short-term fantasy product and boasted that they were right. Most people dumped their AI stocks, but there were still a few who did not lose their faith.

The second wave of AI began with the fall of Sam Altman, which attracted real attention from mainstream individuals and venture capital. During this phase, many new AI projects emerged, including tax tokens, leading to many scams.

During this phase, projects such as $PAAL, $ENQAI, $AGC, and $NMT were launched one after another, providing exponential returns to individuals who paid attention and conducted research. One benefit of this phase is that it is not led by venture capital firms, but by retail investors on the chain.

I think we are at the end of the second wave, and most AI projects have collapsed 80%-90% from their start-up stage. This is the best buying period before entering the third wave of AI. I divide it into three categories: based on funds, teams, and risk-return ratio.

-

A safe choice

-

A gentle choice

-

Radical Choice

Safe Gaming Strategies

@zero 1 _labs $DEAI is a decentralized AI ecosystem focused on empowering developers in the field of AI by providing tools and support.

-

Publicly identified team

-

Continuously building new partnerships

-

Remove 82-90% of circulating supply in the next 12-18 months

-

Market value: $25 million

-

Price: $0.25

The $DEAI team continues to grow and form new partnerships. They recently made a major change to the token vesting schedule, preventing the new token supply from reaching market levels until 2025-2026. I believe in $DEAI, and in the next wave of AI, it may break the $2 mark.

@fluence_project $FLT The first decentralized cloud-free computing project built since 2017, backed by @multicoincap and other notable VCs, with no significant unlocks until Feb 2025.

-

Market value: $20 million

-

Price: $0.35

$FLT is one of the most underrated AI + DEPIN projects out there. It has great potential to perform like $AKT and $RNDR. Even though the team has done very little marketing, it has managed to build a decent community and the team is very active in product development.

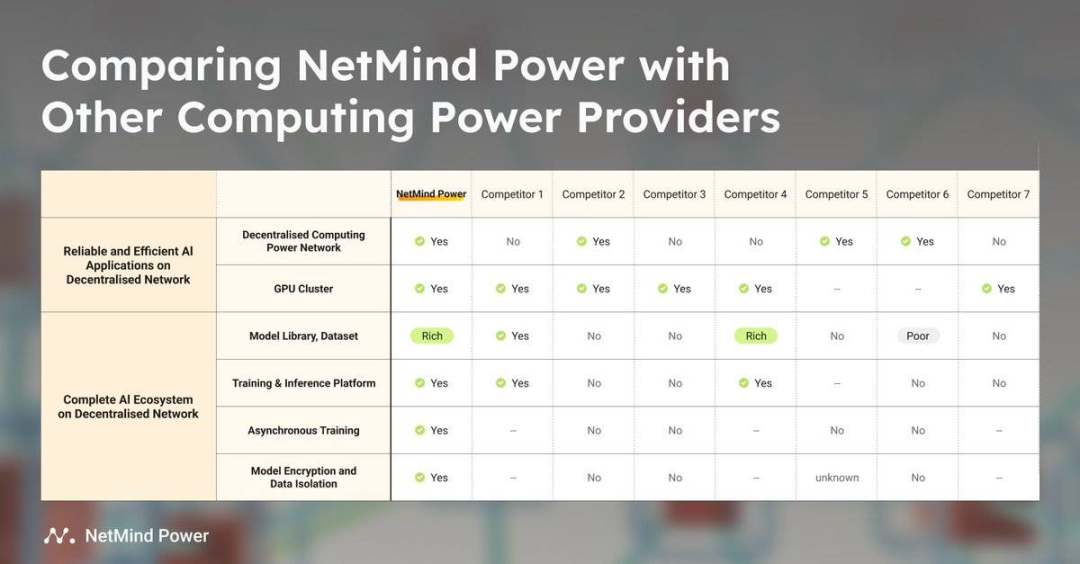

@NetmindAi $NMT is a decentralized AI ecosystem that provides a variety of products such as computing services, model training, chat services, etc., including AI + DEPIN + GPU.

-

Won the British Business Technology Award

-

Human flesh search experience team

-

A true AI company focused not only on cryptocurrency

-

Market cap: $200 million

-

Price: $5.6

I believe $NMT will be a top 5 AI project by the end of this bull run. It allows users to rent computing power at an affordable cost to train and run machine learning models, making it accessible to the masses.

@opentensor $TAO is a decentralized AI network that facilitates a market-driven ecosystem for machine intelligence where valuable work is evaluated and incentivized by peers.

-

Top 2 Crypto× AI Projects

-

Public and experienced team

-

Listed on top exchanges

-

Great community

-

Market cap: $1.9 billion Price: $275

$TAO is the leader of the Crypto × AI narrative and IMHO it is the safest bet in AI. It has also recently been listed on Binance and other top exchanges, which could inject more liquidity and push up its price in the next wave of AI. I think $RNDR and $TAO will remain the top two leading AI projects.

Gentle gaming strategy

@Spectral_Labs It develops AI and blockchain tools like Grammarly that allow users to easily create on-chain agents by converting natural language into code.

-

Publicly identified team

-

Backed by renowned venture capital firms

-

Listed on top exchanges and base chains

-

Market value: $65 million

-

Price: $6.2

Spectral Labs provides infrastructure tools for creating autonomous agents on-chain. Most $SPEC tokens are locked until November so there is no internal selling pressure. This is a solid AI bet on the base chain that will perform well during the AI season.

@PhalaNetwork $PHA It acts as an AI co-processor for the blockchain, utilizing TEE to handle sensitive computations off-chain while maintaining verifiability through the blockchain

-

AI Agent Contracts and Collaborative Processing

-

Listed on Binance

-

Publicly identified team

-

Market cap: $88 million

-

Price: 0.12

@SturdyFinance $STRDY is the first Defi subnet on $TAO supported by @SoftBank, @PanteraCapital and @ycombinator.

-

Defi lending platform

-

TVL exceeds 30 million

-

Market value: $5 million

-

Price: $0.83

-

I believe it will be a great addition to the AI season and is the best $Tao beta game yet

Aggressive Gaming Strategy 5 0X-10 0X Profit

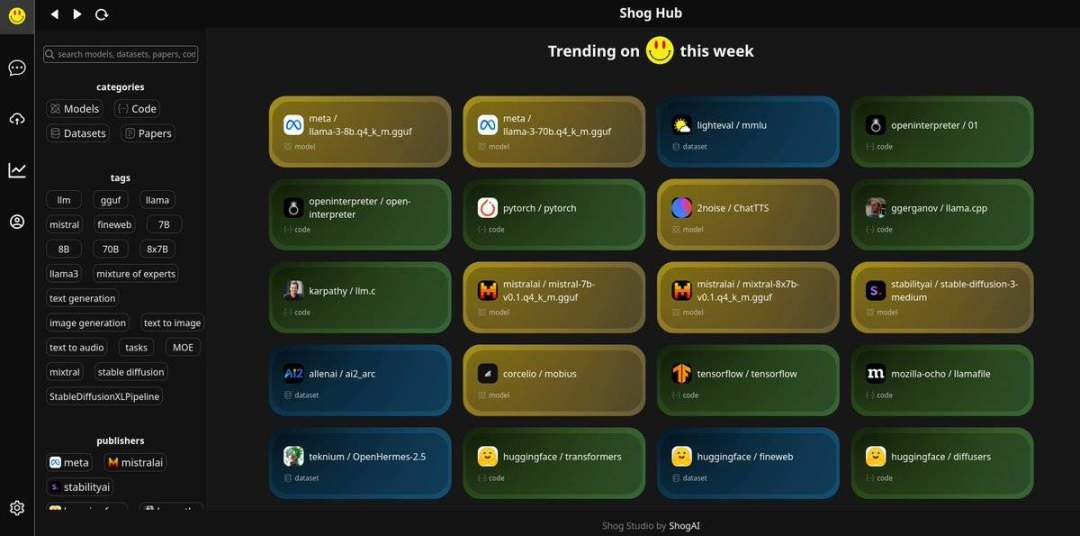

@shog_AGI is trying to build a distributed and open source AGI. It provides a set of tools and datasets to build and train models, while also providing some kind of incentives for users.

-

Market value: $8 million

-

Price: $0.04

I think it will be tough when AI season comes back, still not many people are talking about this, @balajis has been promoting this project since last year when there was no token. Also indirectly tweeted about it recently. I believe we are still too early and $SHOG still has a long way to go.

Artificial intelligence is the next big technological revolution and I believe that cryptocurrencies × AI will play a big role in it. Although cryptocurrencies operate in cycles, people buy, sell and profit in cycles.

Most projects suffered losses in the bear market due to lack of funds and interest, and most projects will slowly die out after this bull market, with only a very small number of projects surviving, so don’t be too talkative and don’t hold on to the mentality of holding on forever.

Take advantage of the trend and make profits.

This article is sourced from the internet: In a falling market, which AI tokens are worth paying attention to?

Related: In-depth analysis: How did MEV Robotics make $30 million in 2 months?

Original author: Frank, PANews The world has suffered from MEV for a long time. Despite complaints, the MEV robot has not been restricted and is still accumulating wealth through the sandwich attack. On June 16, a researcher named Ben exposed on social media that a sandwich attack robot with an address starting with arsc (hereinafter referred to as arsc) made more than 30 million US dollars in 2 months. PANews conducted an in-depth analysis of the behavior and operation of this MEV robot to understand how this MEV robot achieved tens of millions of wealth. A pile of sand makes a tower, indiscriminate attack A sandwich attack is a market manipulation strategy in which an attacker inserts his own transactions one after the other in a blockchain transaction with the…