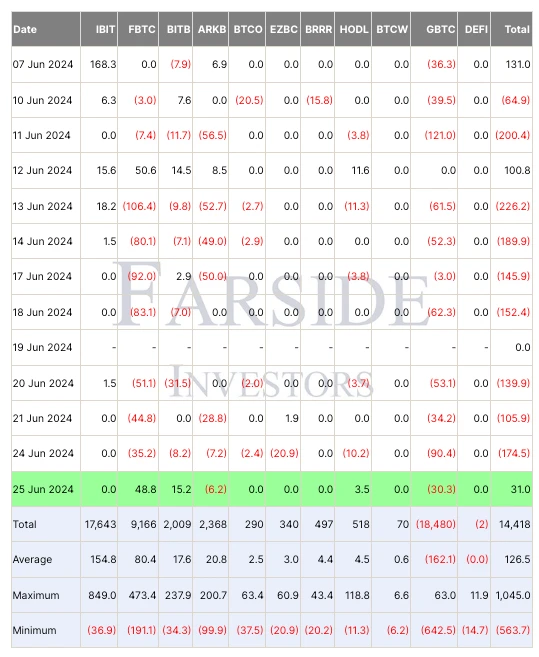

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to large institutions. In addition, the letter did not mention the specific repayment period, but it should not be too short, and these Mentougou creditors themselves are all early digital currency users who are proficient in technology. There is reason to believe that creditors clearly prefer long-term Bitcoin holders, so the maximum daily selling pressure is not exaggerated.

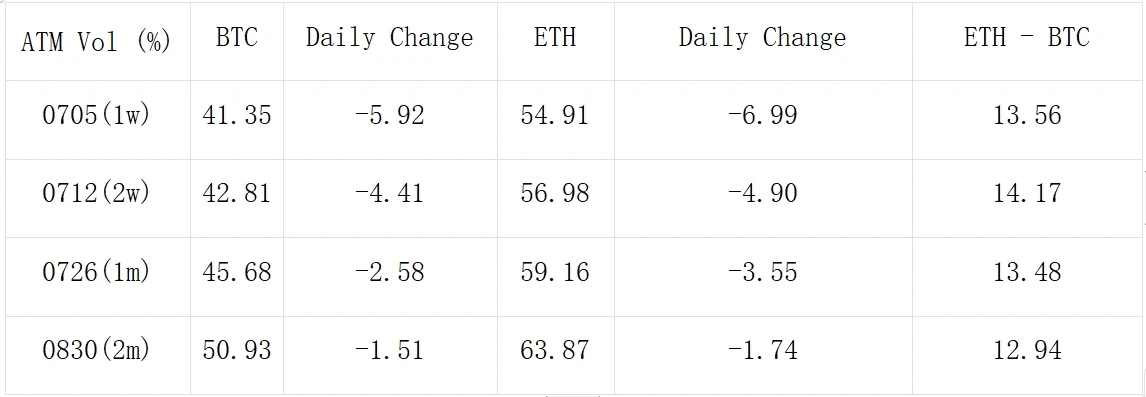

Source: Farside Investors; SignalPlus, ATM Vol.

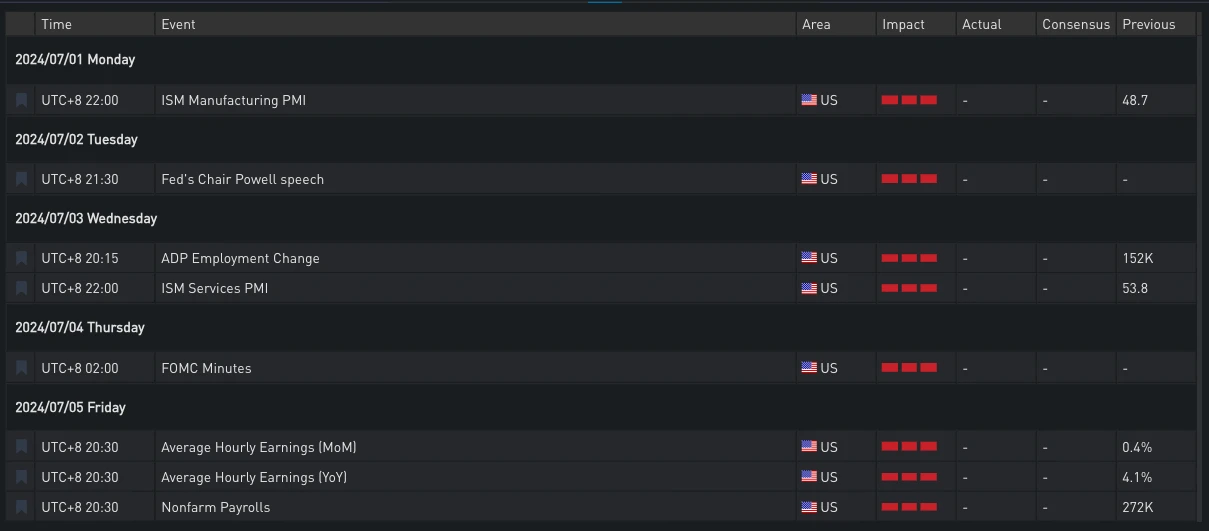

Judging from the price trend of the currency yesterday, although the price rebounded to around 62,000 and the ETF temporarily ended the outflow of funds, it still cannot change the current negative sentiment and poor liquidity. Therefore, the next macro trend should be paid attention to, such as PCE this Friday, the speech of Fed Chairman Powell next Tuesday, and the hourly wage and non-agricultural data next Friday, which will affect the market repricing and capital flow.

Source: SignalPlus Economic Calendar, Important US economic events this week

Source: SignalPlus Economic Calendar, important US economic events next week

Source: Deribit (as of 26 JUN 16: 00 UTC+ 8)

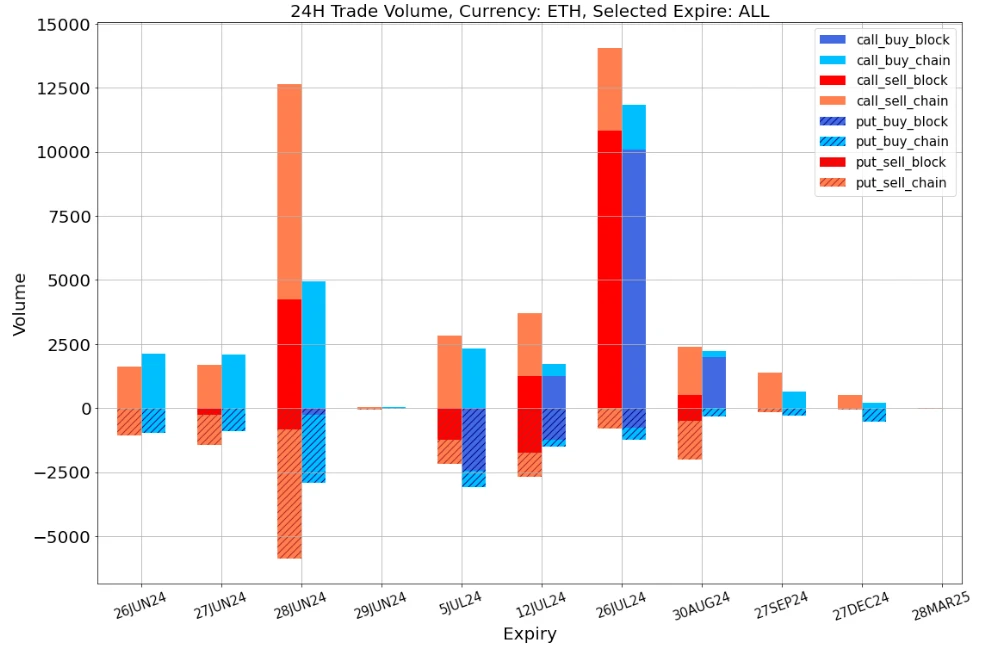

In terms of trading, after the panic subsided, BTC saw bargain-hunting of call options in late June and July. In addition, a large transaction at the end of September was also particularly eye-catching. This strategy protected the remote positions by selling 190 ATM Calls worth 62,000 in exchange for 1,140 Puts worth 48,000 at almost zero cost.

Data Source: Deribit, overall distribution of BTC transactions

Data Source: Deribit, overall distribution of ETH transactions

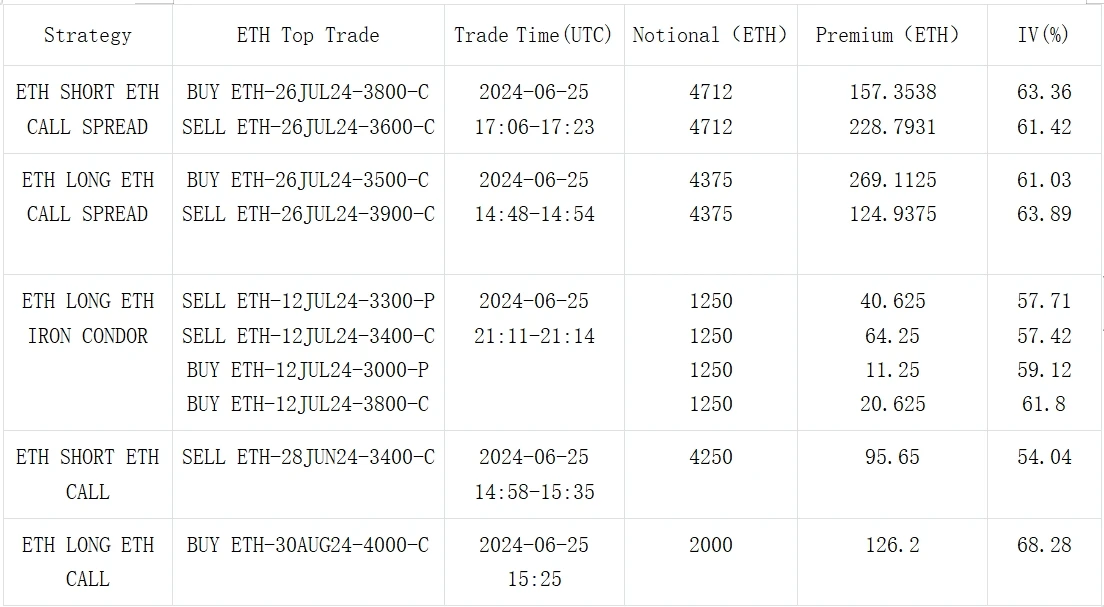

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240626): Panic subsides

Related: A quick look at 10 promising tokens held by a16z, BlackRock, and Coinbase

Original author: Atlas , Crypto KOL Original translation: Felix, PANews Venture investors invest millions of dollars into various altcoins every day, driving up the prices of these altcoins. Tracking the wallets of top venture capital institutions and whales and following their holdings may result in excess profits. Crypto KOL Atlas scanned more than 100 fund wallets and profitable whales, analyzed their wallets and reviewed all projects, and selected the best performing funds in Web3, including a16z, BlackRock and Coinbase. Here are the 10 most promising tokens it holds. PANews Note: This article is intended to provide market information and does not constitute investment advice, DYOR. Compound Labs (COMP) A DeFi protocol for lending that allows users to earn interest on cryptocurrencies deposited in one of its pools. Market value: $386…