Babylon in-depth research report: Innovative solutions to unlock Bitcoins potential

Summary

As an innovative solution in the Bitcoin ecosystem, the Babylon project aims to activate idle Bitcoin assets through a trustless staking mechanism. This report will deeply analyze Babylons technical principles, market positioning, development prospects and potential investment opportunities.

Background of the project

The current state of the Bitcoin ecosystem

As the leader of the cryptocurrency market, Bitcoin currently has a market value of approximately $1.3 trillion. However, except for the Bitcoin in the exchange, most Bitcoin is in a hibernation or pseudo-hibernation state, failing to fully realize its potential.

Bitcoin holder psychology analysis

The concept of Not your key, not your coin is deeply rooted in the minds of Bitcoin holders. This pursuit of extreme security makes them unwilling to participate in any project that may lose control of their assets, even if the project promises high returns.

Market demand

The cryptocurrency market urgently needs a solution that can both ensure the security of Bitcoin holders assets and activate idle assets. Babylon was created to break this deadlock.

Babylon Project Overview

Project Definition

Babylon is a project that uses a self-limiting solution to achieve trustless staking of Bitcoin, using staking certificates for the security layer of the POS chain to generate revenue for participants.

Core Concept

-

Trustless: Users maintain full control over their assets

-

Self-limiting design: ensuring security through technical means rather than multi-signature and other methods

-

Cross-chain value: Providing Bitcoin-based security for POS chains

Technical highlights

-

Bitcoin Timestamp Protocol

-

Schnorr Signature and time-lock technology

-

Integration with Cosmos IBC

Technical in-depth analysis

Self-Limiting Agreement

Babylon adopts a zero-trust approach to self-limitation and does not use multi-signatures as a basic design. The project continues to develop the Bitcoin Timestamp protocol as one of the foundations of the project.

Trustless staking mechanism

Babylon is not a custodial solution. The users assets are locked in the address controlled by the user through time-lock and Schnorr Signature. Although the operation is restricted, the user does not need to trust a third party.

Generation and use of pledge certificates

The staking event is processed into a certificate through technical means, which can be used in different places. What is important is that BTC is not transferred to the target chain for staking, but the certificate is used as confirmation of the staking.

Interaction with the Bitcoin network

Babylon uses technical means to ensure that users BTC is always on the Bitcoin mainnet, but operations are restricted. This design meets the extremely high security requirements of Bitcoin holders.

Market positioning and competition analysis

Detailed explanation of the three-chain integration strategy

Babylon is described as a three-chain-in-one project that integrates the Bitcoin, Cosmos, and potentially Ethereum ecosystems to form a unique market positioning.

Comparison with Eigenlayer

Although not directly compared, both Babylon and Eigenlayer are committed to providing cross-chain staking solutions, with Babylon specifically focusing on activating Bitcoin assets.

Competitive Advantages in BTC Staking

The main advantage of Babylon is that it does not require users to transfer control of BTC, which is very attractive to Bitcoin holders.

Ecosystem Development

Impact on the Cosmos ecosystem

As a project built on Cosmos technology, Babylon has the potential to bring a large amount of value and security of Bitcoin assets to the Cosmos ecosystem.

Impact on the Bitcoin Network

Babylon can slowly activate Bitcoin holders idea of utilizing BTC and gradually cultivate this habit, which is expected to increase the overall utilization rate of Bitcoin.

Potential Ethereum Ecosystem Synergy

As part of the three-chain integration, Babylon may explore ways to collaborate with the Ethereum ecosystem.

Economic Model and Token Economics

Analysis of revenue sources

Babylon is a project that earns income, and the income comes from the reward for providing security for the POS chain. It is important to note that the pledged BTC cannot directly participate in DeFi, but the income or points generated can participate in DeFi through certain means.

Token Allocation and Release Plan

None

Token Utility and Value Capture

None

Development Roadmap and Milestones

Completed testnet

Bitcoin Staking Pioneer Pass NFTs for Testnet-3.

Upcoming Testnet-4

The upcoming Testnet-4, the rewards are uncertain.

Mainnet launch plan

Although there is no specific launch date, investors are advised to accumulate BTC and wait for participation in staking after the mainnet is launched.

Investment value assessment

Potential market size estimation

To estimate Babylon’s potential total locked value (TVL), we can use the following method:

Bitcoin total market value: Currently about $1.3 trillion

Assumed participation rate: Considering the conservatism of Bitcoin holders, we assume that 5-10% of Bitcoin may be staked

calculate:

Conservative estimate: 1.3 trillion * 5% = $65 billion

Optimistic estimate: $1.3 trillion * 10% = $130 billion

Taking into account market competition and adoption curves, we can narrow this range to $20-50 billion.

Valuation Model

To predict Babylon’s potential valuation, we can refer to the valuation multiples of similar projects:

Select similar projects: Lido Finance (LDO)

-

Lido is the leading Ethereum staking solution

-

Current TVL: ~$19 billion

-

Current market value: approximately $1.8 billion

-

Market Cap/TVL Ratio: Approximately 0.095

Applied to Babylon:

-

Assuming Babylon reaches $30 billion TVL (mid-range estimate)

-

Using a similar market cap/TVL ratio: 30 billion * 0.095 = $2.85 billion

Considering Babylons innovation and potential growth, we can give it a certain premium:

-

Assuming a 50% premium: 2.85 billion * 1.5 = 4.275 billion USD

Considering the token supply and unlocking schedule (assuming 30% of total supply is in circulation):

-

Estimated fully diluted valuation (FDV): 4.275 billion / 30% ≈ $14.25 billion

Investor Participation Channels

-

Trading Testnet-3’s Bitcoin Staking Pioneer Pass NFTs

-

Participate in the upcoming Testnet-4

-

Accumulate BTC to prepare for staking after the mainnet is launched

Risk factors

Technical risks

As an innovative project, Babylon may face challenges in terms of technical implementation and security.

Market acceptance risk

The success of the project depends largely on the acceptance of the solution by Bitcoin holders and PoS chains. Although Babylon is designed with the security needs of Bitcoin holders in mind, it will take time to build trust and acceptance.

Regulatory risks

Bitcoin staking may face regulatory scrutiny in different countries and regions. As the cryptocurrency market continues to develop, changes in the regulatory environment may affect Babylons operations and development.

Competing risks

Although Babylon has unique advantages in the field of Bitcoin staking, as the market develops, more competitors may emerge. The project needs to continue to innovate to remain competitive.

Team Background and Investors

Core Team Introduction

Leadership:

-

David Tse and Fisher Yu as co-founders

-

Shalini Wood joins as Chief Marketing Officer (CMO)

-

Xinshu Dong appointed Chief Strategy Officer

-

Sankha Banerjee joins as Chief Protocol Economist

-

Adam Ettinger Appointed Chief Legal Officer

Technical Team:

-

Vitalis Salis joins as Head of Engineering

-

Several senior research engineers, software engineers and developers, including blockchain developers, front-end developers and DevOps engineers

business development:

-

Sina Vaziri joins as Head of Strategy

-

Coleman Maher joins as Head of Growth

-

Trudy Liu, Partner Relations

Market and Community:

-

Jay Mehta is Digital Marketing Manager

-

Spyros Kekos as Community Director

-

Multiple community managers for different regions (such as Asia)

Advisory Board:

Including Sandeep Nailwal, Sunny Aggarwal, Sreeram Kannan, Zaki Manian and other industry celebrities

Recruiting positions:

Including security director, chief growth officer, senior software engineer and other positions

Overall, Babylon has a diverse team covering technical development, business strategy, marketing, and community management. Team members appear to have extensive experience in blockchain and software development. The company is also actively expanding and looking for more talent to join the team.

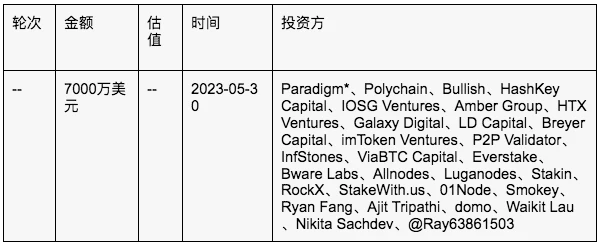

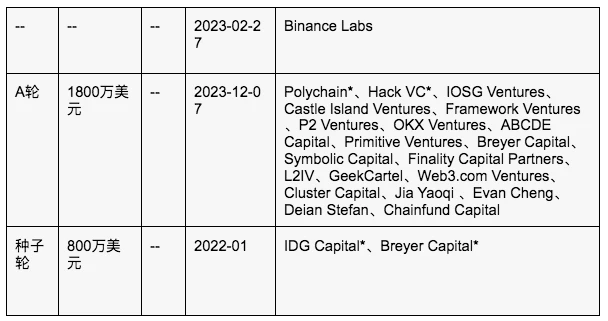

Investment agency

Conclusion and Investment Recommendations

Project Potential Summary

Babylon has the potential to become an important bridge between the Bitcoin network and the PoS ecosystem through its innovative Bitcoin trustless staking solution. Its unique technical solution and market positioning provide it with significant competitive advantages.

Short-term observation points

Testnet-4 participation metrics:

-

Number of participants: Target > 10,000 unique addresses

-

Total amount of simulated BTC pledged: Target > 50,000 BTC

-

Community feedback: monitor discussion heat and sentiment on social media and forums

Technical Milestones:

-

The degree of perfection of Bitcoin’s timestamp protocol

-

Integration progress with Cosmos IBC

-

Publication and results of security audit reports

Partnerships:

-

Number of new PoS chain partners: Target: 3-5 new PoS chains in Q3

-

Endorsement or cooperation announcement from well-known institutions or projects

Long-term investment value

If Babylon successfully implements its vision, it could have far-reaching implications for the entire cryptocurrency ecosystem, providing new avenues for value capture for Bitcoin holders while enhancing the security of PoS networks.

Market share forecast:

-

Assume that the Bitcoin staking market reaches $100 billion in 5 years

-

Goal: Babylon occupies 30% market share, which means 30 billion US dollars TVL

Revenue Model Forecast:

-

Assuming the average staking yield is 5%

-

Babylon charges 10%

-

Estimated annual revenue: 30 billion * 5% * 10% = 150 million USD

Valuation forecast (using revenue multiples):

-

Assuming 20x revenue multiple (considering high growth potential)

-

Estimated market value: 150 million * 20 = 3 billion US dollars

Potential Return Analysis:

-

Assuming an initial investment valuation of $500 million

-

5-year potential return: (3 billion / 500 million) – 1 = 500%

-

Annualized rate of return: about 38%

It should be noted that these forecasts are based on multiple assumptions and actual results may differ significantly. Investors should continue to pay attention to project progress and adjust their expectations based on new information.

risk warning

Investors should note that Babylon is still in its early stages and faces multiple risks including technical, market and regulatory risks. Investment decisions should be based on a comprehensive risk assessment and personal risk tolerance.

Future Outlook

Technological development

As the project progresses, we look forward to seeing more details about Babylon’s technical implementation, especially innovations in security and scalability.

Ecosystem expansion

Babylon has the potential to attract more PoS chains to join its ecosystem, providing Bitcoin holders with more staking options.

Market Education

The project team may need to invest significant resources in educating the market, especially relatively conservative Bitcoin holders, to increase understanding and acceptance of the concept of trustless staking.

Conclusion:

The Babylon project represents an important innovation for the Bitcoin ecosystem and the broader cryptocurrency market. It attempts to solve a problem that has long plagued Bitcoin holders: how to earn additional returns while keeping their assets safe. Although the project is promising, investors still need to remain cautious and pay close attention to the projects development progress and potential risks. As more information is released and the mainnet is launched, we will be able to more fully evaluate Babylons long-term value and impact.

(Note: This report is prepared based on available public information and is for reference only. It does not constitute investment advice. Investors should assess risks and make investment decisions on their own.)

This article is sourced from the internet: Babylon in-depth research report: Innovative solutions to unlock Bitcoins potential

Original author: Min Jung Original translation: TechFlow Summary Market makers contribute significantly to reducing volatility and transaction costs by providing significant liquidity, ensuring efficient trade execution, enhancing investor confidence, and making markets function more smoothly. Market makers use a variety of structures to provide liquidity, the most common being token lending protocols and retention models. In token lending protocols, market makers borrow tokens from projects to ensure market liquidity for a specific period (usually 1-2 years) and receive call options as compensation. On the other hand, the retention model involves market makers being compensated for maintaining liquidity over the long term, usually through monthly fees. As in traditional markets, clear rules and regulations for market maker activities play a vital role in the smooth functioning of the cryptocurrency market. The…