Why You Should Diversify Your Digital Asset Portfolio

Institutions need to broaden their holdings of crypto holdings in order to capture the full range of innovation in the market, says Felix Stratmann, head of research at Outerlands Capital.

Digital assets may be one of the few markets where diversification still seems underappreciated. Bitcoin and Ethereum remain dominant by market cap despite a growing number of innovative new projects, and many investment products provide only a handful of concentrated positions.

At Outerlands Capital we have written about the benefit to risk-adjusted returns from diversification. Individually, smaller projects may carry higher risk, but investing across a broad mix of projects can reduce volatility and improve risk-return metrics like the Sharpe ratio (returns normalized for volatility). However, there’s more to diversification than higher Sharpe ratios.

In a market as dynamic as crypto, diversification is essential to gain exposure to the varied and evolving mix of themes and sectors built around blockchain technology. Diversification is about solving for the power law distribution of returns, whereby a portfolio’s return is driven by a small number of highly positive outcomes against a larger number of investments that deliver lower, or negative, returns. This phenomenon is well documented in venture capital (VC) investing, and the concept carries over to digital asset investments, which are akin to investments in disruptive tech startups. Diversifying makes sure your portfolio has enough shots-on-goal to capture the biggest winners over time.

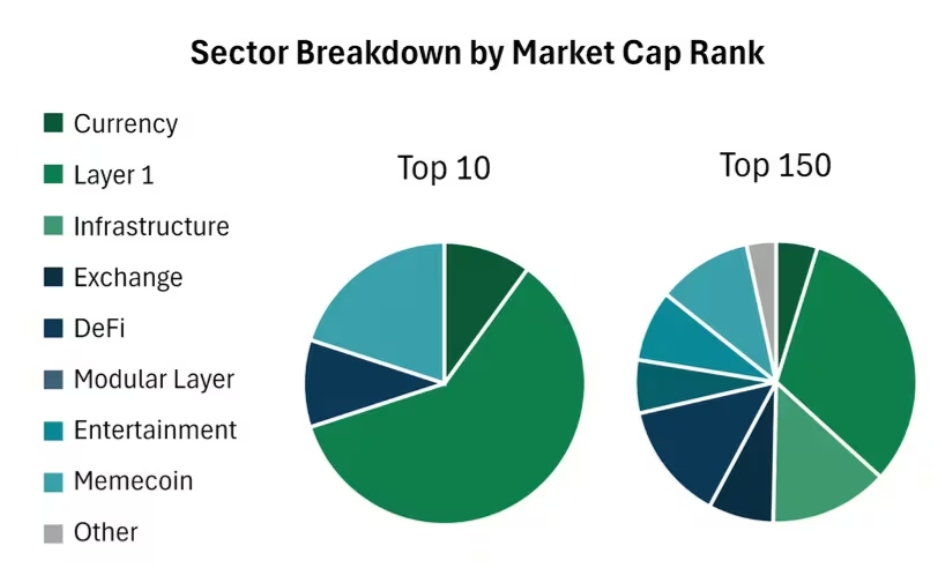

A concentrated portfolio of just a handful of tokens will struggle to capture the range of exciting crypto use-cases being developed today. Take, for example, the 10 largest cryptocurrencies by market capitalization – a popular take on a ready-made “diversified” portfolio. You have here, essentially, a mix of currencies and Layer 1s. While these larger tokens are sometimes seen as less risky on account of scale, such a selection fails to capture much of the current innovation happening in crypto.

Expand to an actively managed portfolio encompassing tokens from the Top 150 by market cap and you start to see a much more dynamic picture, spanning Layer 1s and related infrastructure (like scaling solutions and interoperability), DeFi (from trading and lending to asset management), entertainment (including gaming and the metaverse), decentralized physical infrastructure networks (DePIN, including projects for distributed compute power with tie-ins to AI), real-world-assets (RWAs), and more. While some of these projects may carry greater risk on their own, diversification helps manage the risk of the overall portfolio.

Portfolios should be positioned to capture emerging themes and new directions as projects across the space continue to innovate, searching for product-market-fit. Even in the more developed parts of the crypto ecosystem, such as payments or Layer 1s, we believe it is still much too early to call winners. The pace of innovation means disruption will continue to be the norm.

The nascency of the market and its fast-paced evolution also mean that an active approach to portfolio management is imperative: Diversified is not equal to passive. Building a well diversified portfolio does not mean just buying more, smaller assets. It means taking a long-term perspective on the scale and scope of the digital assets ecosystem, and positioning a portfolio to take advantage of the many different potential outcomes.

Coming out of crypto conferences like Consensus, AIMA Digital Assets, Token2049, and DAS, we are again emboldened in our assessment that the average institutional crypto portfolio is simply not exposed to enough of the disruptive use-cases being tested in digital assets today. Budding themes such as DePIN, innovative scaling solutions for Ethereum and also Bitcoin, and bringing real-world-assets on-chain all require a deep look past the largest tokens, and should encourage portfolios of digital assets spanning many sectors and project sizes.

Remember that diversifying doesn’t make a portfolio less potent – it actually gives investors more opportunities to capture winners, while still providing time-tested risk benefits. In essence, diversification gives you more for less.

Related: Don’t apply for a Bee crypto card… unless you really need one.

Since the first 1,000 Bee Network co-branded crypto cards were issued, we have received unanimous praise from cardholders worldwide. The Bee core team works with partner Coin 50™ and 30+ banking institutions and issuers to provide cardholders with the most convenient web3 consumption experience. The proof of the pudding is in the eating. Only the cardholders will understand its benefits. To allow more people to experience those crypto Visa cards, we are officially opening a new tier of card application: You can now click on the card icon of your Profile page in-app to apply for your own Bee Network co-branded Platinum Card! The first 10,000 cards will enjoy an 80% discount on the card opening fee and a 3-year exemption from the annual fee. From cryptocurrency top-up to fiat…