Two months after launch, TVL exceeded 360 million US dollars, taking stock of the BTC second layer Bitlayer ecosystem

Original author: 0xewwierw

Introduction

As the FOMO sentiment of Bitcoin Layer 2 fades, projects that continue to invest sincerity in infrastructure and user-friendliness may become the ultimate winners.

According to data from the BitVM Chinese community , there are more than 50 documented Bitcoin Layer 2 projects on the market, some of which have been under construction since 2013, and some of which were launched this year, covering sub-categories such as sidechains and Rollups. In this fierce market competition, Bitlayer, a native Bitcoin Layer 2 network based on BitVm technology, is relying on its own technological innovation and continuous ecological construction to become the fastest growing Layer 2 project in the Bitcoin ecosystem.

As a Bitcoin second-layer solution based on BitVM, Bitlayer proposed layered virtual machine technology (Layered Virtual Machine), using zero-knowledge proof and optimistic verification mechanism to support various types of calculations. In addition, Bitlayer builds a dual-channel two-way locked asset bridge through OP-DLC and BitVM bridge, thereby achieving the same security as Bitcoins first layer.

Above technological innovation is ecology. A good ecology can promote project development and progress, and form a positive cycle, motivating more projects and resources to invest in ecological construction. On April 29 this year, Bitlayer launched a $50 million token airdrop incentive for developers, attracting developers to migrate to EVM and support Bitlayers native Dapp, while encouraging project parties to distribute the airdrops they received to active users on the chain to complete the cold start at the lowest cost.

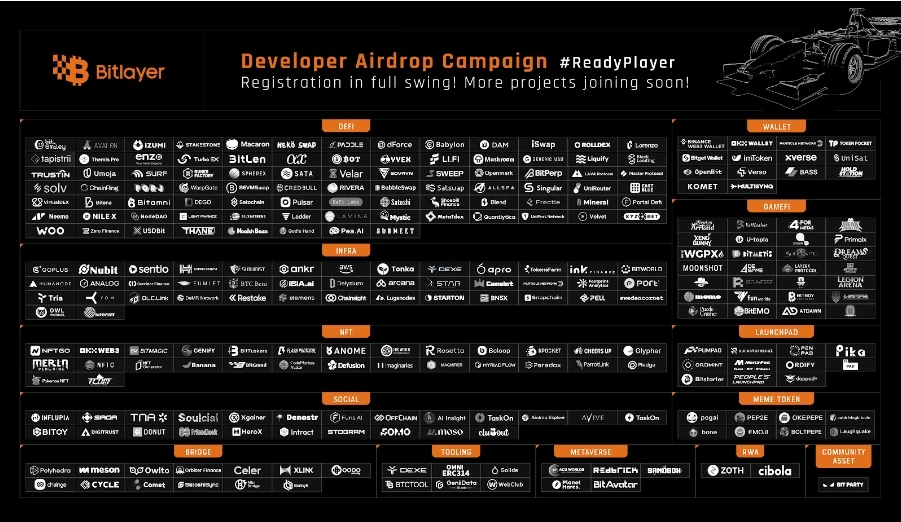

At present, Bitlayers developer airdrop plan has achieved initial results. The following figure is a panoramic view of the ecology recently released by Bitlayer officials. From the figure, we can see that although the Bitlayer ecology is still in a relatively early stage, it shows a trend of vigorous development.

Official data shows that there are currently hundreds of projects being built on the Bitlayer network, covering infrastructure and developer tools, wallets, DeFi, NFT, games and metaverse, as well as RWA and many other sections. There are relatively mature infrastructure projects such as Ankr, Polyhedra Network, Meson, Apro, imToken, which pave the way for Bitlayer to attract users, as well as Bitlayer native applications such as Bitsmiley, Avalon Finance, bitCow, Lorenzo, Pell, Bitparty, Enzo and Marcaron, which demonstrate the development potential of the entire ecosystem.

The following is a brief introduction to the important projects in the current Bitlayer ecosystem. The data related to TVL was obtained on June 19. I hope it will be helpful to users who are interested in the Bitlayer ecosystem.

DeFi

Avalon Finance

Avalon Finance is an important solution to unlock trillions of dollars of BTC, providing the first CeDeFi lending platform, allowing BTC holders to trust custody services while unlocking BTC liquidity and earning interest in DeFi. Avalon Finance aggregates all liquidity and introduces a variety of assets including BTC, ERC 20, BRC 20, BTC ETF, and real-world assets (RWA), opening the door to millions of new users. Currently, Avalon Finances products include CeDeFi BTC lending and DeFi lending (applicable to ERC 20, BRC 20, and RWA assets).

Current TVL: $287.13M

bitSmiley

bitSmiley is a Bitcoin blockchain protocol based on the Fintegra framework, consisting of three main components: a decentralized overcollateralized stablecoin protocol; a local trustless lending protocol, and a derivatives protocol. Together, these components provide a comprehensive financial ecosystem on the Bitcoin blockchain, enhancing its functionality and practicality in the field of decentralized finance (DeFi).

Current TVL: $33.83M

Lorenzo

Lorenzo is committed to building the first Bitcoin liquidity financial layer based on the Babylon ecosystem. The platform connects Bitcoin pledgers (regardless of the size of their holdings) with high-quality projects that require liquidity and security, providing crypto investors with the simplest and smoothest BTC asset re-pledge experience. By releasing the liquidity of pledged assets and capturing the best pledge returns, Lorenzo Protocol uses an innovative principal and interest separation form to make it possible to build complex DeFi products based on BTC, further exploring more possibilities of Bitcoin finance.

Macaron

Macaron is the native DEX on the Bitlayer chain, providing users with a series of tools, including liquidity farming, staking incentives, trade-to-earn, airdrops, etc. to increase user benefits. With the technical and ecological support of Bitlayer, the team is committed to creating excellent products to make Macaron DEX safer, cheaper and faster.

Current TVL: $30.82M

TrustIn Finance

TrustIn Finance is a native permissionless lending protocol on Bitlayer, powered by a Bitcoin-safe equivalent Layer 2 solution built on BitVM. Users can use crypto assets as collateral to borrow underlying assets faster and more securely on Trustin, while also earning interest by providing assets to the protocol.

Current TVL: $10.83M

bitCow

bitCow is an AMM protocol that provides stable swaps and automated pooled liquidity.

Current TVL: $33.83M

Enzo Finance

Enzo Finance is a decentralized lending protocol on the Bitlayer chain with advanced algorithmic technology and supports LP, NFT and Metaverse asset lending.

Current TVL: $10.77M

Nekoswap

Nekoswap is committed to becoming a fully community-driven, fair, transparent and decentralized exchange, including Swap, liquidity pool, Farm, Launchpad, rune trading and other functions. NekoRunes will become the first rune asset token on Nekoswap.

infrastructure

Pell Network

Pell Network is the first active verification service (AVS) network in the Bitcoin ecosystem built on the re-staking protocol. Pell Network builds a full-chain cross-chain relay network through cross-chain atomic communication technology, ZK-Rollup and other technologies, which aggregates BTC and its LSD liquidity assets scattered in various Layer 2s in a unified Pell network ledger, thereby realizing a decentralized governance AVS ecological service network, allowing Bitcoin to participate in the security verification process of a wide range of decentralized ecological applications to expand profit scenarios.

Current TVL: $76.69M

Apro Oracle

APRO Oracle is an innovative system designed to create stablecoins and build a bridge to the Bitcoin mainnet. It ensures the security and authenticity of price information through a two-step price kò aggregator while minimizing operating costs. The system also uses socket noise to generate random numbers, provides random services for various projects, and ensures network security and reliability through a two-layer network.

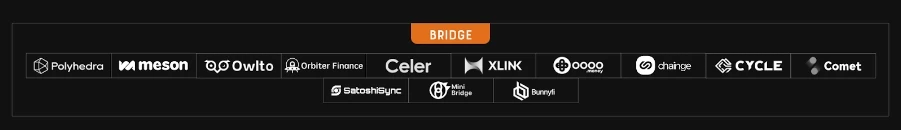

Cross-chain bridge

Polyhedra Network

Polyhedra Network is the worlds leading ZK interoperability infrastructure. Its zkBridge has become one of the largest cross-chain infrastructures in the multi-chain ecosystem, with the vision of building the worlds largest Bitcoin interoperability ecosystem. Currently, Bitlayer has reached a cooperation with Polyhedra Network to achieve fast and secure interoperability for Bitcoins second layer through zkBridge.

Meson Finance

Meson Finance now supports more than 50 public chains and second-layer networks, and is currently one of the most important Bitcoin cross-chain tools.

Owlto Finance

Owlto Finance is a user-friendly, secure, fast and low-cost cross-chain interoperability protocol that supports direct asset transfers between different Layer 2 networks.

Orbiter Finance

Orbiter Finance is a decentralized cross-rollup bridge for transferring Ethereums native assets. Orbiter sets up two roles, Sender and Maker. When the Sender initiates a transfer, the Maker provides liquidity. Smart contracts ensure the security of the entire process. If the Maker has bad behavior that causes the transfer to fail, the Sender can use the Makers margin to initiate an arbitration request to the contract and then obtain excess compensation.

Bool Network

Bool Network is a permissionless, decentralized and secure Bitcoin validation layer that aims to safely expand the Bitcoin network without changing the Bitcoin consensus, thereby promoting the prosperity of the Bitcoin ecosystem.

wallet

OKX Wallet

OKX Web3 Wallet is a non-custodial, decentralized multi-chain wallet with built-in cross-chain currency exchange trading aggregator DEX, one-stop on-chain investment tool DeFi, heterogeneous multi-chain aggregation trading platform (supporting Crypto, Ordinals and NFT), and easy access to 1,000+DApp protocols through the wallet. Currently, OKX Wallet already supports the Bitlayer mainnet and ecosystem.

TokenPocket

TokenPocket is the worlds leading multi-chain self-custodial wallet, supporting EVM-compatible networks and Ethereum Layer 2 such as Ethereum, BNB Chain, Polygon, as well as non-EVM-compatible networks such as Bitcoin, TRON, Solana, Dogecoin, etc. Currently, TokenPocket already supports the Bitlayer mainnet and ecosystem.

Bitget Wallet

Bitget Wallet is the worlds leading one-stop Web3 multi-chain wallet. It provides users with a full range of on-chain products and DeFi services including wallets, Swap transactions, NFT transactions, DApp browsers, etc. Currently, Bitget Wallet supports the Bitlayer mainnet and ecosystem.

NFT

NFTGo

NFTGo is the worlds leading one-stop NFT data aggregation platform. NFTGo aims to aggregate, analyze and present NFT data from the entire network, providing search engines, data visualization, rarity queries, whale tracking, NFT new listings and other functions.

Meme

bone

Bone is the winning project in the public beta event The Trumeme Show of the Bitcoin native stablecoin project bitSmiley. It was deployed on the Bitlayer mainnet on May 1 and destroyed on May 3.

Cat Driving Bitcoin

Cat Driving Bitcoin ($CBD) is a native MEME on the Bitlayer chain, with a cat + driving element as the main visual element. $CBD aims to subvert the meme economy by building a prosperous, modern, high-rise Bitcoin world. The project is committed to becoming the largest community asset on Bitlayer.

Demoji

Demoji is the Meme token $moji launched by DeBox on Bitlayer. 100% of the tokens will be distributed to DeBox and Bitlayer ecosystem participants (NFT holders, pledgers, lucky helmets, Bone/CBD buyers, etc.) in the form of airdrops.

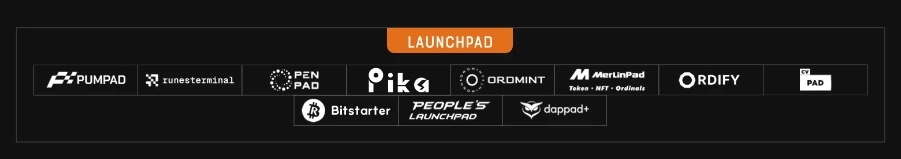

Launchpad

Pumpad

Pumpad is a Bitlayer native project. As a one-stop Launchpad for the Bitcoin ecosystem, Pumpad supports issuers to automatically add DEX liquidity after issuing VGA assets according to the IPOS standard and deploy an automated market maker protocol.

pika

Pika is the first IDO platform on Bitlayer, dedicated to helping new projects or startups grow. As a full-service provider, Pika provides projects with full support including incubation, fundraising, token listing, backend services, and community development.

RWA

Zoth

Zoth is an ecosystem that connects liquidity and RWAs between traditional and on-chain finance. Zoth’s first product, ZOTH – Fixed Income (ZOTH-FI), is an institutional-grade fixed income marketplace that provides RWAs such as cross-border trade finance, treasury bills, and sovereign bonds.

Chain Games

4 Metas

4 Metas is revolutionizing the entertainment landscape by creating a unified gaming, streaming, and virtual experience platform. Its more than just a platform; its a Web3 native ecosystem that brings together GameFi, social features, the Metaverse, and AR/VR in one dynamic space.

Moonshot

Moonshot (formerly Nearcrash) is a game for adventure and excitement lovers, aiming to become the number one multi-chain Crash game.

GamerBoom

GamerBoom is an intent-centric gaming social platform for the digital native generation, combining the best of Web2 gaming with the possibilities of Web3, while bringing Web3 to mainstream gamers.

Woof Woof West

Woof Woof West is a play-to-earn game deployed on Bitlayer with social and user interaction as basic elements.

Richverse

Richverse is the first asset gamification network that integrates four elements: business, competition, social interaction, and commitment, providing players with asset mortgage, consumption, and other game scenarios. Starting with the first Monopoly-type game, Richverse hopes to make the Bitcoin ecosystem richer and more interesting.

Anome

Anome is an NFT derivative asset issuance and lending platform that cuts into the full-chain game scenario. It is committed to helping users unlock the liquidity and value of NFT assets by building a closed-loop ecosystem that integrates DeFi, NFTFi, and GameFi, and becoming the worlds largest NFT mortgage agreement by TVL. Anomes NFT Brawl game is the worlds first AI-driven, UGC, collectible, full-chain card game that supports ERC 404 assets. Players can improve their combat capabilities and get more game fun by training the game AI.

Metaverse

Redbrick

Redbrick is a UGC-based metaverse platform that provides land builders and 3D studios, and creates a token economy where the value of creations is fairly rewarded.

summary

According to DefiLlama data (https://defillama.com/chain/Bitlayer), Bitlayers TVL is currently $361M, which still has a lot of room for growth compared to Ethereum L2. However, considering that it has only been two months since the deployment of Bitlayer Mainnet V1, the current liquidity scale and number of ecological projects gathered by the project are already far ahead of similar projects.

In general, Bitlayer is still in its early stages, and many ecological projects still need time to test and further release their potential.

However, with the continuous advancement and implementation of the official Bitlayer developer airdrop incentive plan, as well as the continued increase in the first mining festival series of incentive activities, it is expected that more and more Bitlayer native applications will soon appear, new assets will begin to circulate, and the resulting ecological prosperity will quickly increase Bitlayers valuation.

This article is sourced from the internet: Two months after launch, TVL exceeded 360 million US dollars, taking stock of the BTC second layer Bitlayer ecosystem

Related: Times have changed, and this cycle of copycat season will be absent

Original daily Planet Daily Author: Golem In the past bull market cycle, when mainstream coins such as Bitcoin rose, the rise of altcoins would start soon. But in this cycle, the times have changed. Even if Bitcoin has risen sharply, the rise of altcoins will not come.Odaily Planet Daily will analyze the impact of spot ETFs and the oversupply of altcoins. Spot ETFs draw out new funds entering the market in this cycle The advent of Bitcoin spot ETFs may be changing the market structure. During the past bull market, the path for incremental funds to enter the market was: first flow into major cryptocurrencies such as Bitcoin and Ethereum, and then the value overflowed into altcoins. But this bull market may be different. For new players, instead of investing…