When the market is sluggish, take this guide to increasing the value of stablecoins

Original | Odaily Planet Daily

Author | Azuma

The cryptocurrency market suffered another setback today. Although Bitcoins own decline has narrowed to less than 1%, the altcoin sector has seen a collective dive along with BTCs short-term trend. Representative altcoins in different tracks such as SOL, PEPE, ORDI, ARB, and TIA have all recorded declines of more than 10% or even 20%.

Although the current secondary market is turbulent, for ordinary investors, in addition to directly trading, there is actually another relatively slow but stable operation mode – through major DeFi protocols, using stablecoins to achieve a relatively low-risk, high-yield interest-bearing strategy.

In the following, Odaily Planet Daily will combine its own operating experience to recommend multiple stablecoin interest-earning strategies on multiple networks. Although these strategies are quite simple in operation, they can generally achieve a stable return of 10% or even 20%. Some strategies can also interact with some underlying networks or DeFi protocols that have not issued coins, achieving killing two birds with one stone.

It should be emphasized that no DeFi protocol can completely avoid contract risks. Some DeFi protocols will also face certain liquidity risks, combination risks, etc. due to their business models . Therefore, when choosing to implement a specific strategy, please be sure to understand the specific risks in advance and try not to put all your eggs in one basket.

Ethereum Mainnet

Recommended Strategy 1: Ethena sUSDe

-

How to operate: Buy USDe on the Ethena official website first, and then exchange it for sUSDe through staking;

-

Real-time yield: 17.5%;

-

Revenue composition (i.e. the type of reward tokens obtained): sUSDe appreciation (can be exchanged for more USDe);

-

Other potential benefits: ENA Phase II airdrop;

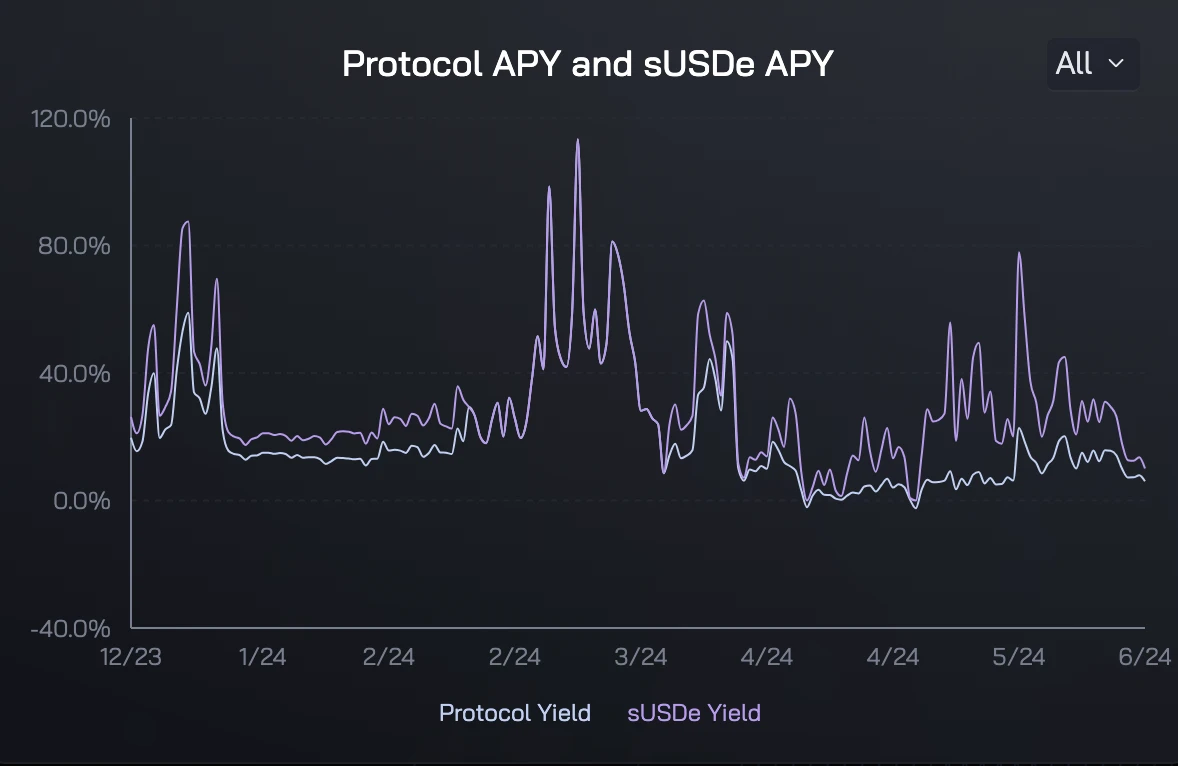

Note: Ethenas sUSDe is the highest APY yield opportunity among the current stablecoin mining pools of scale (billions of dollars) in the cryptocurrency market, far higher than tokenized treasury products such as MakerDAOs sDAI. The real-time APY of sUSDe will vary with the leverage of the market, but it has always been stable at a high level based on past volatility records. In addition, through sUSDe, you can also accumulate Ethenas second-phase airdrop certificate sats (the accumulation efficiency is low, but the advantage is stable income), thereby obtaining the next airdrop of ENA.

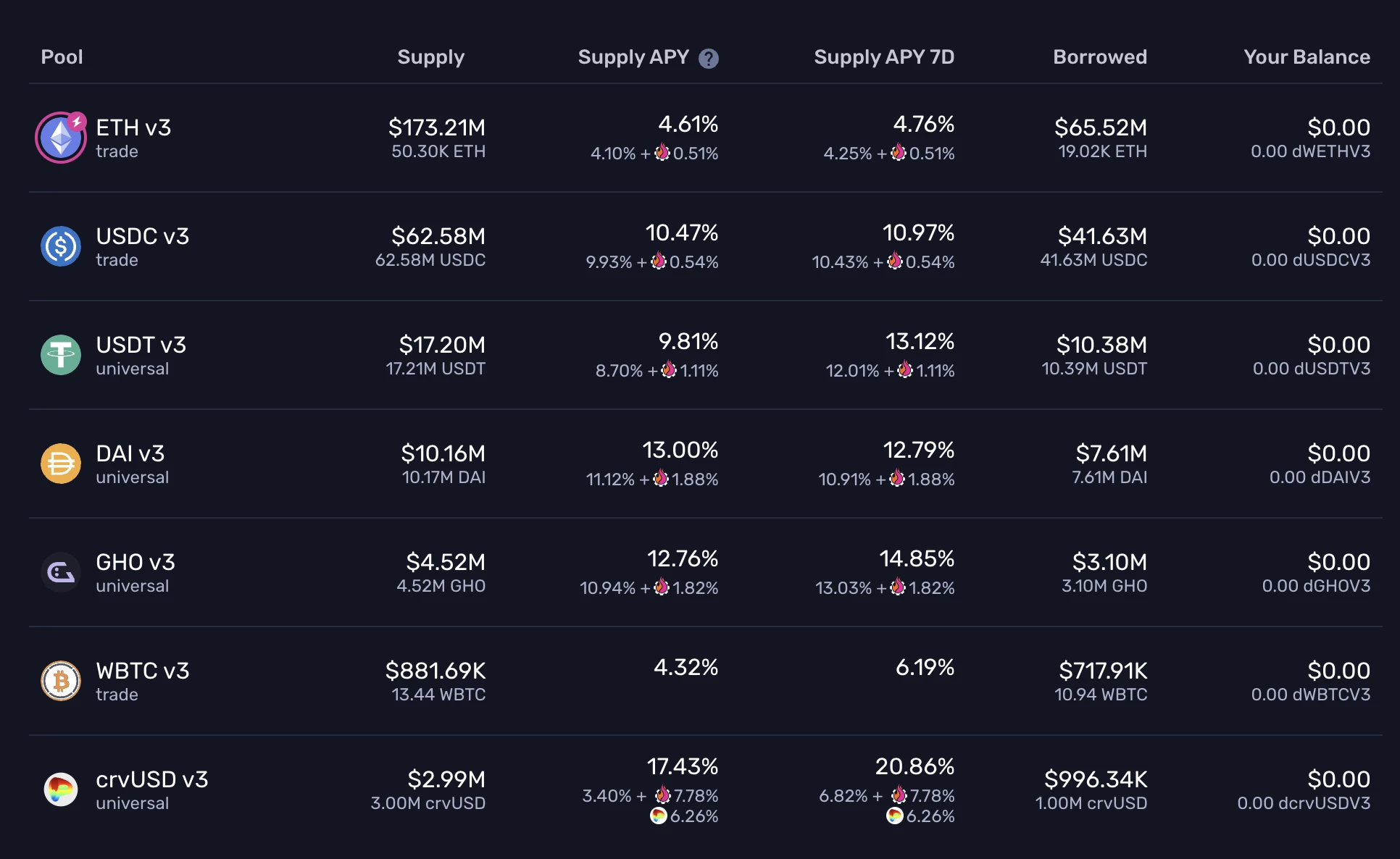

Recommended strategy 2: Gearbox loan deposit

-

How to operate: Deposit various types of stablecoins through Earn on the Gearbox official website;

-

Real-time yield: except for USDT, generally greater than 10%;

-

Income composition: mainly stablecoins, supplemented by a small amount of GEAR incentives;

Note: As a leveraged lending protocol, Gearbox actually supports leveraged gameplay (Farm) with higher yields, but this operation has a certain threshold for ordinary users, so the relatively simple deposit gameplay (Earn, which is essentially a loan deposit) is recommended here. The reason why this mining pool is recommended is that Gearbox wins because its revenue structure is mainly based on stablecoins, so its actual revenue will be relatively more stable, and there will be no substantial reduction in actual revenue due to the plunge of incentive tokens.

Solana

Recommended strategy 1: marginfi and Kamino loan deposit

-

How to operate: deposit USDT or USDC on marginfi or Kamino to earn interest;

-

Real-time yield: 12% – 16%;

-

Revenue composition: stablecoin;

-

Other potential benefits: marginfi airdrop and Kamino Phase II airdrop;

Note: marginfi and Kamino are the first and second lending protocols on Solana, respectively. Since the trading of Solana ecosystem is relatively active, the lending demand on this ecosystem is generally higher than that of other ecosystems. Therefore, the lending yields on marginfi and Kamino are generally higher than those of other ecosystems. In addition, marginfi has not yet held TGE, and Kaminos second phase of points activities are also in progress. Both have certain potential airdrop incentive expectations.

Starknet

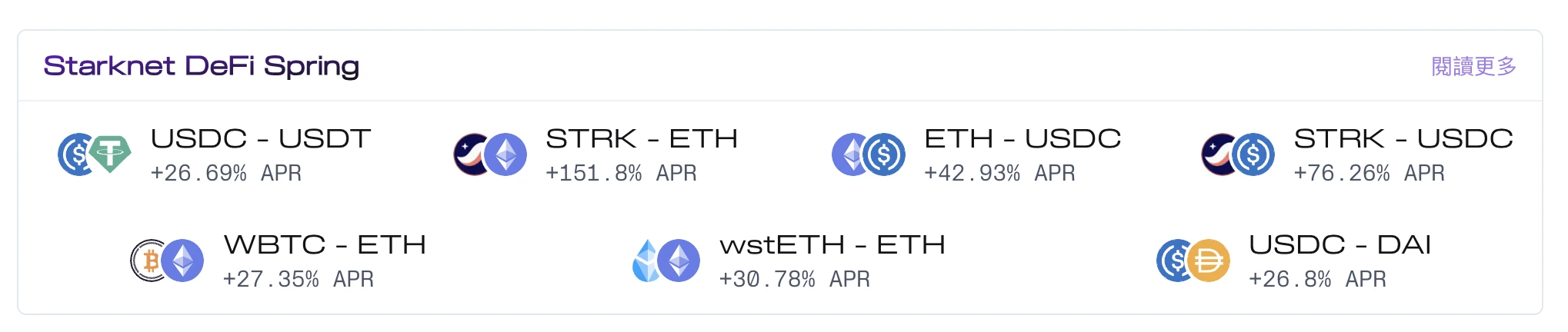

Recommended strategy 1: Ekubo LP

-

How to operate: Use USDT and USDC to form a trading pair on the Ekubo official website and participate in market making;

-

Real-time yield: 26.69%;

-

Income composition: STRK is the main source, supplemented by native market making income;

Note: Thanks to Starknets DeFi Spring incentive plan, the current returns on participating in various DeFi protocols on Starknet are very considerable. Among them, Ekubo, as the DEX protocol with the largest liquidity and trading volume in the ecosystem, will be a better choice in terms of balancing security and returns.

Recommended Strategy 2: zkLend and Nostra Market Making Deposits

-

How to do it: On zkLend and Nostra 聽 Deposit USDT or USDC to earn interest;

-

Real-time rate of return: about 20%;

-

Income composition: STRK is the main source, and stablecoin native income is the supplementary source;

Note: The basic lending protocol is similar to marginfi and Kamino on Solana, but the income structure is mainly composed of STRK incentives (similar to Ekubo). Users who are optimistic about STRKs future performance can participate as appropriate.

Scroll

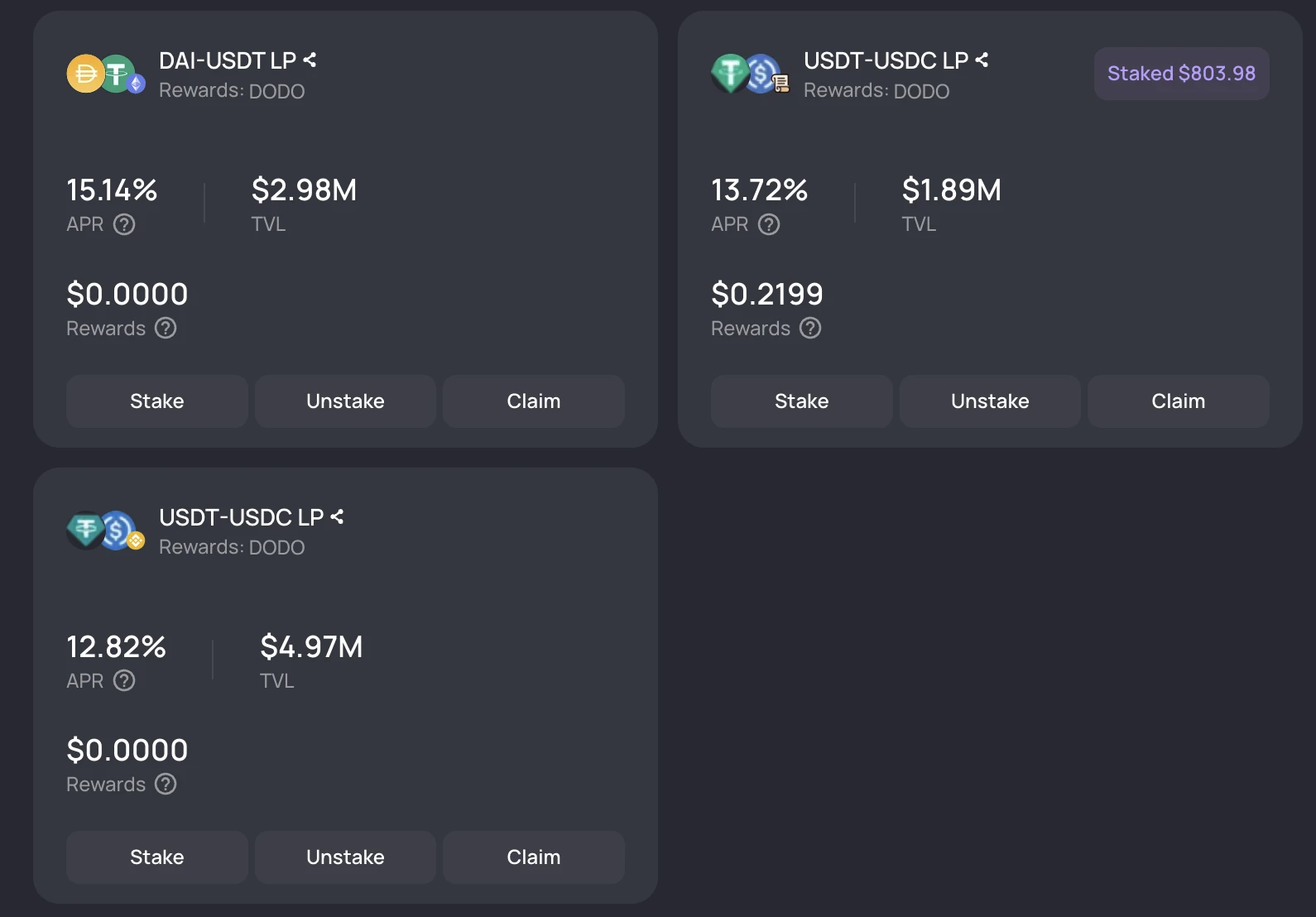

Recommended strategy 1: DODO LP

-

How to operate: Use DAI, USDT, USDC, etc. to form trading pairs on the DODO official website and participate in market making;

-

Real-time yield: 12% – 15%;

-

Income composition: DODO is the main source, and stablecoin native income is the supplementary source;

-

Other potential benefits: Scroll airdrop incentives;

Note: As major Layer 2 tokens are issued one after another, Scroll, which has not yet issued tokens, has also received more attention and liquidity. Based on the major DeFi protocols on Scroll, DODO, as an old DEX, is relatively trustworthy in terms of security, and benefits from DODOs own liquidity incentive plan. Its stablecoin trading pairs also have a high APY performance, so users are recommended to use it as a major position for interactive Scroll.

Aptos

Recommended strategy 1: Echelon loan deposit

-

How to operate: Deposit various stablecoins on Echelon to earn interest;

-

Real-time yield: 11% – 17%;

-

Income composition: stablecoin native income plus APT incentive income;

-

Other potential benefits: Echelon airdrop benefits;

Note: Echelon is the second-largest lending protocol on Aptos in terms of TVL, second only to Aries Markets. However, perhaps due to its inclusion in the Aptos incentive program, the current comprehensive APY of the platform is significantly higher than that of Aries Markets. In addition, Echelon has launched a points program, which means that there is a certain potential airdrop expectation for participating in the protocol.

Sui

Recommended Strategy 1: Cetus LP

-

How to operate: Use USDT, USDC, etc. to form trading pairs on Cetus and participate in market making;

-

Real-time yield: 16.28%;

-

Income composition: SUI incentives as the main source, supplemented by CETUS and stablecoin native income;

Note: The largest DEX protocol above Sui, its income mainly comes from the ecological incentives given by Sui.

Again, be aware of the risks

The above are some of the stablecoin interest-earning strategies that we currently recommend.

For the sake of risk control and replication difficulty, the above strategies only cover some relatively simple DeFi operations, involving only some relatively basic operations such as staking, deposits, and LP, but the potential income that can be obtained is generally higher than the passive financial management interest in the exchange. For users who do not know how to operate in the secondary market at present and do not want to leave stablecoins idle, they can consider the above strategies as appropriate.

Finally, it needs to be emphasized again that the DeFi world is a dark forest that is always accompanied by risks. Please be sure to understand the risks in advance before operating, DYOR.

This article is sourced from the internet: When the market is sluggish, take this guide to increasing the value of stablecoins

Related: Bitwise: $20 trillion market, long-term opportunities for AI+Crypto

Written by: Juan Leon, Bitwise Cryptocurrency Analyst Compiled by: Luffy, Foresight News I recently attended Consensus in Austin, one of the largest cryptocurrency conferences in the world. At the 15,000-plus attendee event, countless industry experts discussed a wide range of topics, from tokenization and regulation to monetary policy and Bitcoin ETFs. But if I had to point to the biggest takeaway from the conference, it would be this: The intersection of artificial intelligence (AI) and cryptocurrency is more promising than people think. By 2030, these two industries could contribute $20 trillion to global GDP. It won’t happen overnight, but we’re already seeing the beginnings of its huge potential. Bitcoin Mining and Artificial Intelligence: An Emerging Partnership You’ve no doubt heard about the recent AI boom, which has propelled Nvidia (the…