Original author: William M. Peaster, Bankless

Original translation: Deng Tong, Golden Finance

Ethereum is always moving forward.

In March 2024, the network launched the Dencun upgrade. Dencun is a fusion of Deneb and Cancun that aims to significantly reduce L2 transaction costs.

What’s next? Pectra is the next major upgrade to Ethereum and it will be even more important than Dencun.

Scheduled to launch in Q4 2024 or Q1 2025, Pectra combines two previously planned upgrades: Prague (for the execution layer) and Electra (for the consensus layer). Through the merger, Pectra aims to bring multiple ambitious improvements to Ethereum, making it more flexible and optimized than ever before.

What does Pectra contain?

Pectra is more than just a minor upgrade, it’s packed with updates.

Ethereum Improvement Proposals (EIPs) are proposed modifications to Ethereum. They ensure that changes to the network are discussed and agreed upon transparently, with involvement from the community and core developers.

For the Pectra upgrade, there are currently plans to include 9 standard EIPs and one meta-EIP consisting of 11 additional constituent EIPs.

These EIPs include enhancements to account abstraction, validator operations, and overall network performance. Some of the most notable additions are listed below.

-

EIP-2537 — Introduces precompiles for BLS 12-381 curve operations, making BLS signature operations faster and cheaper, thereby improving accessibility and performance for Ethereum validators and reducing gas costs.

-

EIP-2935 — Implements saving hashes of previous blocks in special storage slots to improve the efficiency and reliability of verifying Ethereum data before stateless execution.

-

EIP-7002 — Allows validators to trigger exits and partial withdrawals via their Execution Layer withdrawal credentials, providing more flexible options for re-staking and staking pools.

-

EIP-7251 — Increases the maximum valid balance of Ethereum validators from 32 ETH to 2048 ETH, reducing the total number of validators required and simplifying the computational load of the network.

-

EIP-7594 — Introducing Peer Data Availability Sampling (PeerDAS) to further optimize L2 and enhance transaction processing and scalability.

-

EIP-7702 — Adds a new transaction type that sets an EOA (Externally Owned Account) code during a transaction, allowing regular wallets to be temporarily converted into smart contract wallets to improve user experience.

-

EIP-7692 — A meta-EIP consisting of 11 constituent EIPs that aims to enhance the EVM Object Format (EOF) to improve contract deployment and execution efficiency.

The New and Improved Ethereum

In the post-Pectra era, Ethereum will meet a wider range of use cases and user needs.

Regular Ethereum accounts will be more programmable, L2 will be more affordable, smart contracts will be more efficient, and validators will be more flexibly managed!

With these enhancements, Ethereum will be better able to handle growing adoption, integrate with other networks, and introduce new features, keeping the platform at the forefront of on-chain innovation.

What happens after Pectra?

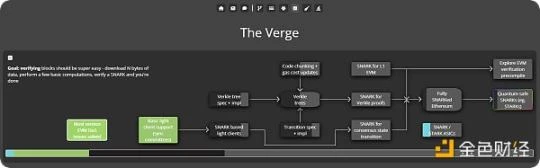

While nothing is set in stone yet, the Ethereum community is eyeing the implementation of Verkle trees in the Osaka upgrade following Pectra.

“I’m really looking forward to Verkle trees,” Vitalik said earlier this year. “They will enable stateless validator clients, which can allow staking nodes to run on almost zero disk space and sync almost instantly — a much better user experience for solo staking.”

That being said, each of Ethereum’s next upgrades will significantly improve the chain’s usability for both users and developers. Ethereum can’t be built in a day, but when it comes to building the future-proof network that Ethereum is enabling, slow and steady is the way to go.

This article is sourced from the internet: Understanding Pectra: Ethereum’s next upgrade

Original author: Crypto_Painter (X: @CryptoPainter_X) Recently, there has been a hint of panic in the entire market, which is largely related to the huge short positions of CME. As an old investor in the cryptocurrency circle, I vaguely remember that when CME officially launched BTC futures trading, it just ended the epic bull market in 2017! Therefore, it is of great significance to study these huge short orders on CME! First, some background: CME refers to the Chicago Mercantile Exchange, which launched BTC futures trading at the end of 2017 with the commodity code: [BTC 1!]. Subsequently, a large number of Wall Street institutional capital and professional traders entered the BTC market, dealing a heavy blow to the ongoing bull market, causing BTC to enter a 4-year bear market. As…