Counting the history of Bitcoin billionaires, revealing the secrets of a new round of wealth

Original article by Daniel Phillips Ali Shutler

Original translation: BitpushNews Yanan

Many of Bitcoin’s early investors are now billionaires, among the world’s wealthiest people, but their assets may pale in comparison to the vast fortune that Satoshi Nakamoto may have.

The meteoric rise of Bitcoin and the cryptocurrency industry as a whole has made several early investors billionaires.

Following the bitcoin price surge at the end of 2020, the Winklevoss brothers once again joined the ranks of bitcoin billionaires.

However, the wealth of Bitcoins founder, Satoshi Nakamoto, is even more staggering, estimated to be as high as $40 billion, which is far beyond the reach of others.

Since Bitcoin led the cryptocurrency revolution in 2009, the space has grown rapidly. Although some early adopters have used Bitcoin to buy pizza, cryptocurrencies have mostly become a proxy for wealth.

It is reported that as of June 2024, 15 of the Forbes billionaires real-time rankings have their wealth mainly derived from the cryptocurrency field, a significant increase from 9 in 2023. But it is worth noting that at the beginning of 2024, there were 17 cryptocurrency billionaires on the list, which fully demonstrated the volatility of the cryptocurrency market.

As of the time of this report, Bitcoins market capitalization has climbed to a staggering $1.3 trillion, accounting for half of the $2.6 trillion global market capitalization of cryptocurrencies. Looking back over the past year, the cryptocurrency market has experienced tremendous growth, with the overall market value soaring by an impressive 134%. As of June 2024, the circulation of Bitcoin has reached nearly 19.7 million, accounting for 94% of its upper limit of 21 million, highlighting Bitcoins strong market performance.

In this feast of cryptocurrency, early investors play a pivotal role. Many of them keenly grasp the pulse of the market and reinvest their profits in the crypto field, thus achieving an astonishing leap in wealth, from millionaires to billionaires. However, some investors choose to hide their wealth, preferring to quietly enjoy the fruits of this capital feast rather than showing off in the spotlight.

According to authoritative data from BitInfoCharts, there are currently 56 Bitcoin wallets with assets exceeding the $1 billion mark. However, after an in-depth analysis of these data, we found that the holders of these huge fortunes are not all individual investors, but also companies or enterprises.

In addition, there are several crypto whales who choose to remain anonymous, and some of them have never even touched their huge Bitcoin assets. This makes people wonder if they have lost their private keys?

Reports show that holding Bitcoin can significantly improve the performance of an investment portfolio. Therefore, it is not difficult to infer that many billionaires may have already dabbled in Bitcoin investment. But in this list, we focus on counting the big players who have accumulated wealth mainly through Bitcoin, revealing how they emerged in the tide of cryptocurrency and eventually reached the pinnacle of wealth.

Tim Draper ($2 billion)

Tim Draper, a Silicon Valley venture capitalist, has accumulated his wealth mainly through accurate traditional investments. However, he became famous in 2014 when he bought nearly 30,000 bitcoins seized from the Silk Road dark web at a price of $630 per coin. In the same year, he asserted that Bitcoin would break through the $10,000 mark within three years, and the fact was only one month away from his prediction.

Although his prediction that Bitcoin would reach $250,000 by the end of 2022 did not come true, this did not dampen his enthusiasm for the crypto market. In April 2024, he once again made a shocking statement: From $250,000 to $10 million, there is no limit to Bitcoins price.

In addition, Draper is also well versed in the field of blockchain and smart contracts, and has invested in many related companies. In order to further explore the potential of the crypto market, he founded Draper Goren Blockchain (DGB), a venture capital studio focusing on this field, in September 2023.

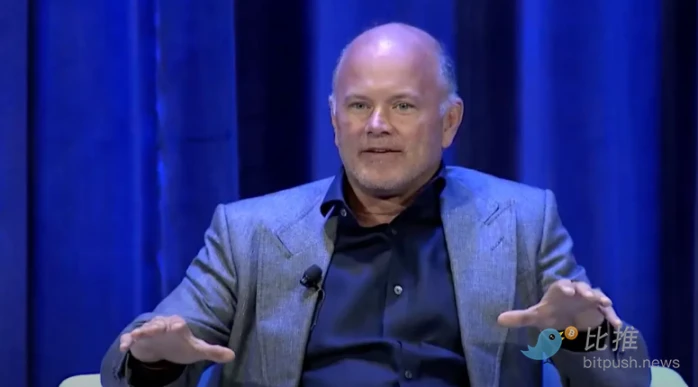

Michael Novogratz ($2.5 billion)

Novogratz started his career at Goldman Sachs in 1989 and became a regular on the billionaires list. However, in 2013, his wealth shrank by two-thirds. It was also in this year that he began to invest in Bitcoin.

Since then, he has devoted himself to the crypto market, invested extensively in start-ups and various tokens, and founded the digital asset and blockchain company Galaxy.

But his crypto investment journey has not been smooth sailing. He had high hopes for Luna, a token associated with the algorithmic stablecoin TerraUSD, but the market crash in 2022 dealt him a heavy blow. This turmoil may be an important factor in causing his net worth to shrink significantly from $4.8 billion in 2021 to $2.5 billion today. Despite this, Novogratzs confidence and enthusiasm for the crypto market have not been affected. In June 2024, he confidently predicted that Bitcoin is expected to break the $100,000 mark by the end of the year.

Winklevoss brothers ($2.7 billion)

You may know that Cameron Winklevoss and his twin brother Tyler accused Mark Zuckerberg of stealing their idea for Facebook, but you may not know that they also started a new chapter as cryptocurrency evangelists after The Social Network.

The two brothers teamed up to found the cryptocurrency exchange Gemini. However, after the crypto market suffered a heavy blow in 2022, Gemini ran into trouble due to the bankruptcy of the cryptocurrency lending company Genesi.

Still, they hold about 70,000 bitcoins, enough to make them a multibillion-dollar fortune, some of which they used to invest $4.5 million in ninth-tier American football club Real Bedford.

Jed McCaleb ($2.9 billion)

McCaleb founded the first bitcoin exchange, Mt. Gox, soon after bitcoin was created, inspired by a marketplace he built for users of Magic: The Gathering. In February 2011, he sold the startup for an undisclosed price to a developer who could take it to new heights, while retaining a minority stake in the company.

However, in the following years, Mt. Gox suffered a series of hacker attacks and was eventually forced to close in 2014, although at the time, it was still responsible for processing up to 70% of Bitcoin transactions.

It is worth mentioning that McCaleb did not stop during his time at Mt. Gox. He founded the Ripple cryptocurrency network in 2011 and co-founded the Stellar cryptocurrency network in 2014.

Matthew Roszak ($3.1 billion)

Matthew Roszak, co-founder of blockchain infrastructure provider Bloq, is a pioneer in the field of cryptocurrency. He bought his first Bitcoin in 2012 and praised it as one of the greatest technological, financial, industrial and humanitarian innovations today. He has since invested in more than 20 Bitcoin startups, including BitFury and BitGo, demonstrating his keen business acumen. In addition, Roszak also advocated giving $50 in digital assets to each member of Congress. Although the feedback was mixed, this move undoubtedly made a positive attempt to popularize and promote cryptocurrency.

Jean-Louise van der Velde ($3.9 billion)

After years in the tech sector, Jean-Louis van der Velde co-founded the cryptocurrency exchange Bitfinex in 2013, which is still regarded as one of the longest-running and most liquid large exchanges. He also served as CEO of stablecoin issuer Tether until 2023. However, he is rumored to still own about 20% of Tether.

Paolo Ardoino ($3.9 billion)

Ardoino took over as CEO of Tether after van der Velde left and became the companys new public spokesperson. He started his career as a programmer and joined Bitfinex as a senior software developer in 2014. As Tether rose to become a top crypto stablecoin issuer, he also began to participate in Tethers operations. Last year, the companys interest income reached $6.2 billion, and as a major shareholder with a 20% stake, Ardoino also reaped significant returns.

Michael Saylor ($4.8 billion)

Saylor is one of the most loyal supporters of Bitcoin. He once vividly compared the cryptocurrency to a group of network bumblebees serving the goddess of wisdom. He has long been a staunch supporter of Bitcoin, but his attitude towards Ethereum seems to have changed recently.

In 1989, he co-founded the software company MicroStrategy. Subsequently, the company purchased a large amount of Bitcoin as a corporate financial asset. As of March 2024, MicroStrategy reportedly holds Bitcoin worth $13 billion, and Saylor himself holds more than $1.2 billion in cryptocurrencies. It is worth mentioning that he revealed in 2020 that he holds 17,732 Bitcoins.

Giancarlo Devasini ($9.2 billion)

Giancarlo Devasini serves as the CFO of stablecoin issuer Tether and reportedly holds a 47% stake in the company. Tether is the third-largest cryptocurrency by market value, with more than 100 billion Tether tokens issued. The company is also one of the worlds largest Bitcoin holders, with Bitcoin holdings worth more than $5 billion.

Brian Armstrong ($10.9 billion)

Brian Armstrong, a former Airbnb software engineer, co-founded the San Francisco-based cryptocurrency exchange Coinbase in 2012. Coinbase is the top crypto exchange in the United States, and he currently owns about 19% of the company. Coinbase successfully went public in 2021 with a valuation of up to $100 billion, but as of June 2024, its valuation has fallen back to about $62.6 billion. Despite this, the exchange still achieved a profit of $273.4 million in the fourth quarter of 2023. In February of this year, Armstrong sold 2% of Coinbases shares, cashing out $53.2 million, which he then injected into some cutting-edge startups, including NewLimit, the life extension company he founded.

Changpeng Zhao (worth $33 billion)

Binance, the world’s largest cryptocurrency exchange, is reportedly controlled by founder Changpeng Zhao, who owns 90% of the company. Founded in 2017, Binance quickly raised $15 million through an initial coin offering (ICO) (although this figure has been disputed). Since then, the company has been gaining momentum. By 2023, the exchange has accounted for half of centralized cryptocurrency spot trading. But that same year, CZ suffered a setback when Binance was forced to pay a $4.3 billion fine as a result of a settlement with the US government. CZ also resigned as CEO after pleading guilty to money laundering and was sentenced to four months in prison, starting in June 2024. He will become the “richest man” in a US prison.

Satoshi Nakamoto (worth $76.67 billion)

Bitcoins mysterious creator, who goes by the pseudonym Satoshi Nakamoto, has not been seen in public since publishing a white paper titled Bitcoin: A Peer-To-Peer Electronic Cash System on October 31, 2008. The paper detailed his vision for a blockchain-based digital currency. Since then, Bitcoin has dominated the fast-growing cryptocurrency industry, but Nakamotos true identity remains a mystery.

It is worth mentioning that Satoshi Nakamoto still holds about 1.1 million bitcoins and has never made any transactions. These bitcoins are like a stone sinking into the sea, and are even generally believed to be lost by the outside world. But if these bitcoins flow out of Satoshi Nakamotos wallet one day, it will surely cause an uproar, and it will also become strong evidence to prove that the mysterious creator of Bitcoin is still alive.

This article is sourced from the internet: Counting the history of Bitcoin billionaires, revealing the secrets of a new round of wealth

Original author: Chloe, PANews Bitcoin mining company Bitfarms announced on June 10 that it has approved a shareholder rights plan, also known as a poison pill, to prevent acquisitions by peer and competitor Riot Platforms. According to the statement, this equity dilution anti-takeover measure is a defensive measure taken by the company against active acquisitions, aimed at reducing the companys attractiveness or diluting the acquirers ownership of the acquisition target. Bitfarms said the plan, which has been approved by the board of directors, is designed to prevent the company from being acquired by a hostile takeover bid at a low price during a critical strategic review period in order to safeguard the fundamental interests of the review process itself and the majority of shareholders. Bitfarms poison pill plan states that…