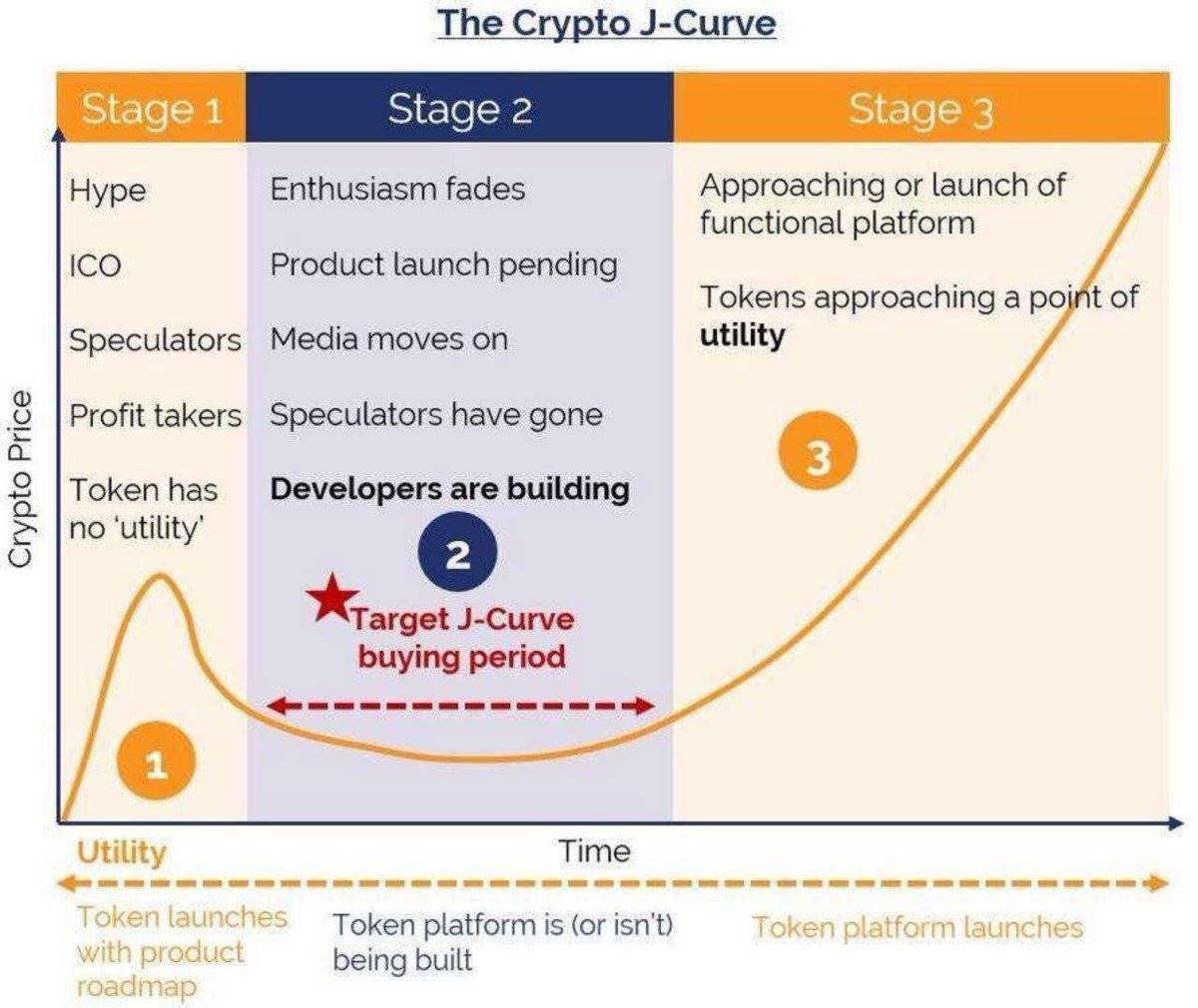

The J-Curve Law of Crypto Investing: Maximizing Gains When Enthusiasm Fades

Original author: IT4I岬嶀祼

Original translation: TechFlow

The Cryptocurrency J Curve is perhaps one of the most important methods we as traders in this market need to learn.

If you are not an experienced sniper, prefer to buy cryptocurrencies only when it is safe, or are just an emotional trader trying to sort out your thoughts, then this short article is for you.

The first stage

The main players are snipers with technical advantages, insiders/pre-sellers with unfair advantages, and speculators who focus on quantity over fundamentals.

This is where the average trader loses out in most cases, and when speculators move on to the new shiny thing, it can go down just as fast as it went up.

second stage

Enthusiasm fades, speculators exit, volume shrinks, average uPNL for holders is below profit, Indians raid TG with marketing suggestions, Kols scammers slowly fade out of TL.

This is the most important stage because it brings the greatest opportunities.

The second phase is the cat-to-tiger phase, and to achieve this, one must assess whether the project is dead or if the sacred J-curve is loading.

Important indicators to watch

-Team Wallet:

Bundle sale?

Are the top wallets on sale?

Are taxes (if any) transferred to Cex or kept/used on-chain?

– Social image:

Is the handling of Weibo/Tg careful and consistent?

Are social metrics increasing or decreasing?

-Roadmap Execution:

Were the commitments mentioned by the team in the first phase implemented?

-New Buyers:

Should I buy a well-known wallet?

Should I buy a new wallet?

Dormant wallet whether to buy?

There are many more, but I think these are the most important ones to look at the risk/reward of a potential Stage 2 buy.

There have been countless examples of the J-curve over the past few months, here are some I鈥檝e collected lazily;

The third phase

The product has achieved initial success. For practicality, the actual use of the technology has generated real income, and for meme, the admirers are huge, KOLs promote it widely, etc.

This is where you sell because the risk is high, profits should be secured and the focus should be on the second stage of the J curve.

In summary, studying the J-curve will give opportunities to people who don鈥檛 have any advantages (most of my buying in phase 2 was done through Uniswap with lower gas).

Hunting in phase 2 can help us fight fomo and prevent us from becoming the receiver of snipers and big players selling.

Hope you learn something new, bye.

This article is sourced from the internet: The J-Curve Law of Crypto Investing: Maximizing Gains When Enthusiasm Fades

Original | Odaily Planet Daily Author | Azuma LayerZeros witch purge is underway. Due to the flexibility of the cleaning mechanism (using multiple designs such as self-exposure, screening, and reporting), the strength of the cleaning (it is expected that only 6.67% – 13.33% of the addresses will be retained), and the precision of the cleaning strategy (more witches can be deduced based on the behavioral patterns of the self-exposed addresses), Bryan Pellegrino, the founder of LayerZero, who is nicknamed Stinky Penguin in the community, has also been dubbed the Master of Human Nature. What is less known is that Bryan had already demonstrated his amazing talent in human nature games long before he founded LayerZero – between 2009 and 2013, Bryan, who used the pseudonym PrimordialAA, was once considered one…