You have a SOL or RFND token to claim: Could token return be a way out for project transformation?

Original锝淥daily Planet Daily

Author: Wenser

The ZK airdrop gradually came to an end amid a lot of dissatisfaction. LayerZero, Blast and other airdrops are on the way, but now, perhaps none of them can be as exciting as the return tokens that can be received in the wallet with just a few moves.

Previously, the Claim Your SOL project of the Solana ecosystem had launched a project to claim the account rent withheld by the Solana network; and now, a similar project has appeared in the Base ecosystem of the Ethereum L2 network – RefundOnBase , which also focuses on the concept of token return. The difference is that this project returns a certain amount of RFND project tokens based on the amount of Gas consumed by users on the Ethereum network.

Odaily Planet Daily will briefly introduce and compare the two projects in this article for readers reference. (Note: Odaily Planet Daily is only for information sharing and does not constitute investment advice. Users need to pay attention to asset security and carefully choose investment targets.)

Claim Your SOL: You have a SPL account closing rent, please check

According to the official website of the Claim Your SOL project , every time a user receives an NFT/token in their wallet, the Solana network will create a specific SPL token account for it. When the user sends or sells the NFT/token to someone else, there are 0 NFT/token units in the token account. In other words, this SPL account remains in your wallet, but it is no longer of any use. In order to create an account, users need to pay a rent withheld by the Solana network, which is approximately 0.002 SOL (about 0.3 US dollars). If the user does not take any action, these rents are also static.

Claim Your SOL: Your account is closed by the service intermediary

What the Claim Your SOL project does is to help users close the selected SPL token account, and the released rental deposit will be sent to the users wallet balance. For example, it is equivalent to you going to Solana Bank to transfer money to someone else. There is an account opening fee for each transfer (that is, interacting with a token contract). This project is equivalent to an intermediary that can help you close the account, so that you can get an account closing rent. Of course, since it is an intermediary, it must also make a profit – 20% of the account closure rent will be used as donation funds to support the website maintenance and subsequent development of the project.

Official website introduction interface

The natural fission brought by the rebate model

It is worth noting that when users collect SOL for account closure rent, they need to pass a full statement of the project and sign a transaction before they can receive the locked SOL rent. The specific operation method can be viewed on the website .

In addition, the project also has a rebate mechanism. Sharing the corresponding invitation link will earn you 20% of the SOL donation amount returned by the invitee. (Note: If you do not want to share this part of SOL with the inviter, users can also directly click on the official project official link or official website link to enter).

Remarkable achievements: Nearly 20,000 locked SOLs were released

As of the time of writing, the Claim Your SOL official website shows that there are currently 11.75 million accounts participating, and 19,207 SOL SPL token account rents have been released, which can be said to be a remarkable achievement. After all, this is $2.785 million in idle funds, which is also a considerable amount of liquidity in this volatile market.

Official website interface

RefundOnBase: Gas consumption in exchange for tokens, please keep this RFND

Coincidentally, the Claim Your SOL project, which was created based on the unique conditions of the Solana ecosystem, may have also inspired the Base ecosystem-related project team, and RefundOnBase came into being. After all, the world has suffered from Ethereums high gas fees for a long time, and as one of the representative ecosystems of the L2 network with low gas fees, the Base ecosystem also has the inherent advantage and soil environment of returning tokens based on gas fees.

RefundOnBase: As long as you have used Ethereum, you are our user

According to the projects official website , users who spend more than 0.3 ETH on Gas on the Ethereum mainnet can receive RFND token rewards. Currently, there are 10,873 wallet addresses linked; more than 18,000 users have logged in to participate; there are 199 payment accounts; and the cumulative Gas fee consumption is 657.43 ETH.

The official website display interface is for reference only

Introduction to the operating principle and token economics behind it

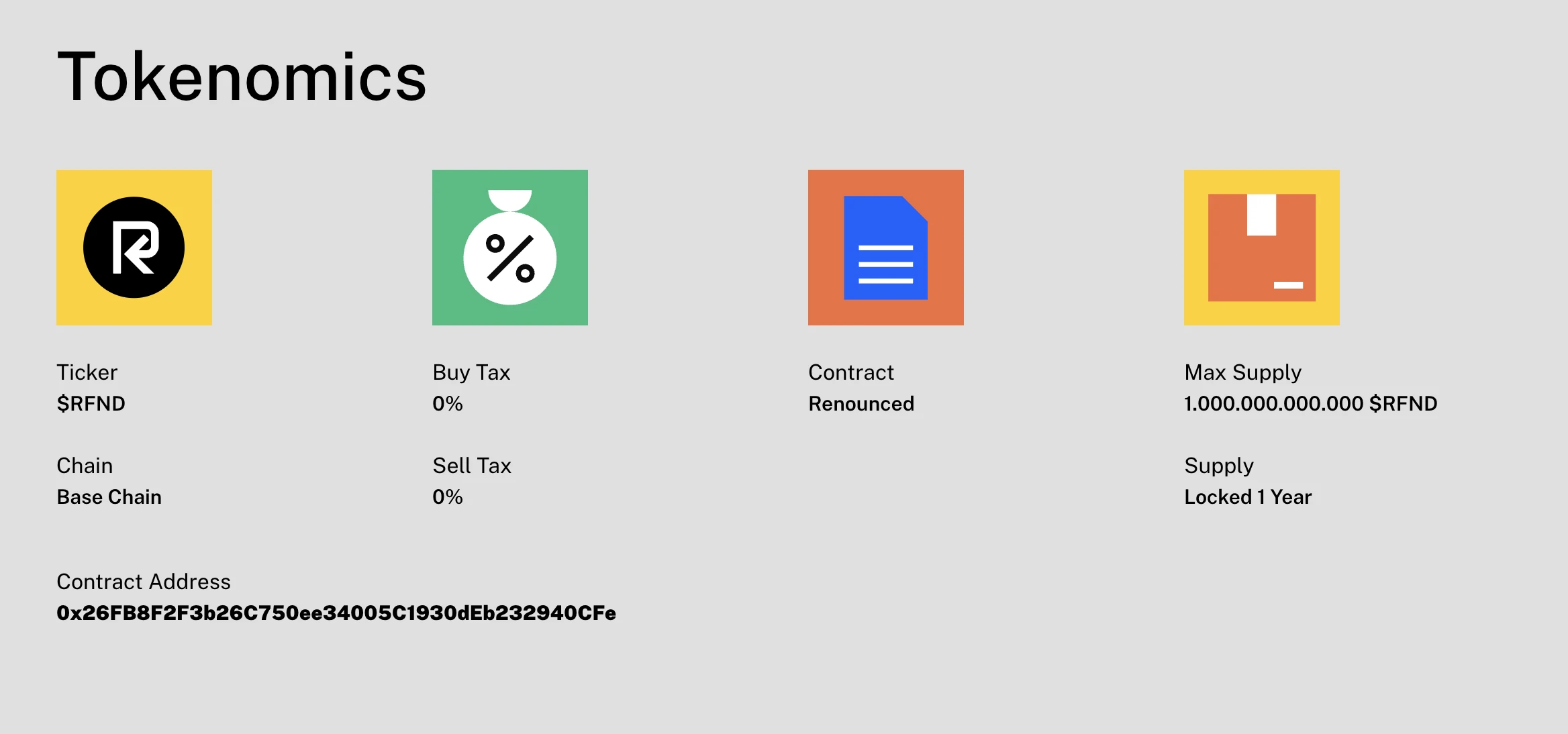

Also according to its official website information, RFND tokens are deployed on the Base network. No gas fees are required to collect the corresponding tokens. The contract address is 0x26FB8F2F3b26C750ee34005C1930dEb232940CFe. The transaction tax is 0. The maximum supply of tokens is 1 trillion, and the tokens are locked for 1 year.

Rough token economics

According to information on the Dexscreener website , the price of RFND tokens has been falling since briefly breaking through $0.000005. The current price is temporarily reported at $0.00000018, and the remaining market value is only $185,000.

Official website interface information

Lessons Learned: Token Return Model is Different from Meme Coin

To some extent, the current RFND has already been considered a failure, after all, the coin price is close to zero, and the website is not stable. And this is not the first attempt of Ethereum and L2 ecology.

In December 2023, the Frame project initiated by Electric Capital also attracted a lot of attention from the market. Under the banner of building a blockchain network for creators and collectors, the project will give corresponding FRAME token airdrop amount feedback based on the number of NFT projects participated by users and the Gas cost spent. Leading NFT players at home and abroad, including Zeneca and Lasercat, are all participating.

But as time went by, the last post of the project was published on January 30 this year. Although it was stated that after listening to community feedback, it was decided to postpone the mainnet launch and the airdrop claim deadline, in terms of the result, this project can be declared dead.

Therefore, we can also draw some lessons from these two projects in stages:

-

Token return projects are greatly affected by the blockchain network ecology, and it is difficult to create such a mechanism without a corresponding network mechanism;

-

Tokens of token return projects are unlikely to become meme coins, as they are somewhat lacking in both human planning and meme attributes.

-

Token return projects are highly dependent on the projects operational and marketing rhythm, and it is easy to fall into the situation of dumping the market after all the tokens are received, and then the project spirals into death.

We can also get a glimpse of this in the previous article A 50-fold increase in three days, revealing the Base chain data DAO token RDAT . The death of RDAT is not only due to the projects ill-considered operations, but also due to the rapid decay of the related narrative.

Summary: Stay on the sidelines, the token return project is far from over

Despite the many problems, the token return project track has clearly not come to an end. If more projects try from more angles, combined with different market environments and operating rhythms, they may also create a unique wave in the cryptocurrency field.

After all, as a currently popular project, the Meme coin project may also be one of the subsequent considerations for the transformation of the token return project.

And this means endless possibilities.

This article is sourced from the internet: You have a SOL or RFND token to claim: Could token return be a way out for project transformation?

Related: SignalPlus Volatility Column (20240426): Macro data exceeded expectations

Yesterday (25 APR), the US GDP in the first quarter was significantly lower than expected, while the PCE price index rebounded sharply to 3.7%, indicating that the PCE inflation index to be announced tonight is likely to be higher than the markets previous forecast. Weak economic output and rising prices have hit risk sentiment, and the three major indexes have fallen. The two-year US Treasury yield, which is sensitive to interest rate policy, once jumped to 5.016%, and gradually fell back below 5.0% during the day. Feds Goolsbee said that after a series of higher-than-expected inflation data, the Fed must re-adjust and must wait and see. Source: TradingView In terms of digital currency, the correlation between BTC and US stocks has been strengthened recently. The price of the currency once…