With the traffic dividend, can Solana Wallet still produce new players?

What wallets are available on Solana? For most crypto community users, the first thing that comes to mind is Phantom and Backpack. These two wallets were born in different bull markets and came into the communitys attention in 2021 and 2023 respectively. Although in the same narrow wallet market, the competition between Backpack and Phantom did not result in a life-and-death fight, but both took advantage of this bull market dividend and made good progress.

Since the beginning of this year, the attention Solana has received has continued to grow, and the meme fever has continuously pushed the Solana ecosystem transaction volume to new highs. As a traffic entrance wallet market, in addition to Phantom and Backpack, there are other wallets in the Solana ecosystem that are still alive, and new players are entering the market. Although the emergence of Backpack proves that even under the halo of Phantom, there can be a phenomenal wallet that stands out, but the resource advantage that Backpack relies on is unique. So, in the cycle of narrative fatigue, how much space is left for new players in the wallet market of the Solana ecosystem? Solanas performance in this round is brilliant, and the surge in trading volume and the influx of a large number of new users are obvious to all. In the link of new traffic conversion, how can latecomers get a share of the pie?

Reviewing the success of Longtou

Before looking into the future, let’s first talk about the “starting path” of the two leading wallet projects. The advantages of Phantom and Backpack are not replicable, and they have accumulated scale effects that are difficult to challenge.

Hit the right spot and secure first-mover advantage

Phantom was launched in 2021. At that time, MetaMask had already established a firm foothold in the wallet market. However, with the arrival of the bull market, a large number of new users poured into the crypto community, and many new wallets began to emerge, trying to challenge MetaMask by creating differentiated experiences such as newbie-friendly.

But the differentiated experience can only get some short-term attention for the wallet, and few of these wallets survived. Arianna Simpson, founder of A16z, described the highly competitive wallet market as a graveyard. Among them, Phantom first gained attention with its elegant and silky user experience, and most importantly, Phantom chose Solana as its first launch. Jesse Walden, co-founder of Variant and an investor in Phantom, said: It can be said that Phantom has a lot to do with Solanas growth. The Solana ecosystem is very easy to get started. There is a symbiotic relationship between Solana and Phantom, and they power each other.

With the rise of Solana in 2021, Phantom was able to quickly accumulate scale and become one of the wallet projects that went viral. In 2022, Phantom seized the NFT craze and reached a strategic cooperation with the NFT market Magic Eden. Phantom users can directly list NFTs on Magic Eden in their wallets.

Since then, Phantoms leading position has been unshakable. Even in the bear market of 2023, Phantom still occupies an important position in the Solana trading market, with more than 170 million transactions. During this period, Phantom also completed an important strategic advancement and entered Polygon and Ethereum. During the hot period of Bitcoin ecology, Phantom also followed and inherited the Bitcoin network. At the end of last year, Unisat, a Bitcoin inscription market and wallet supplier, also supported Phantom wallet access.

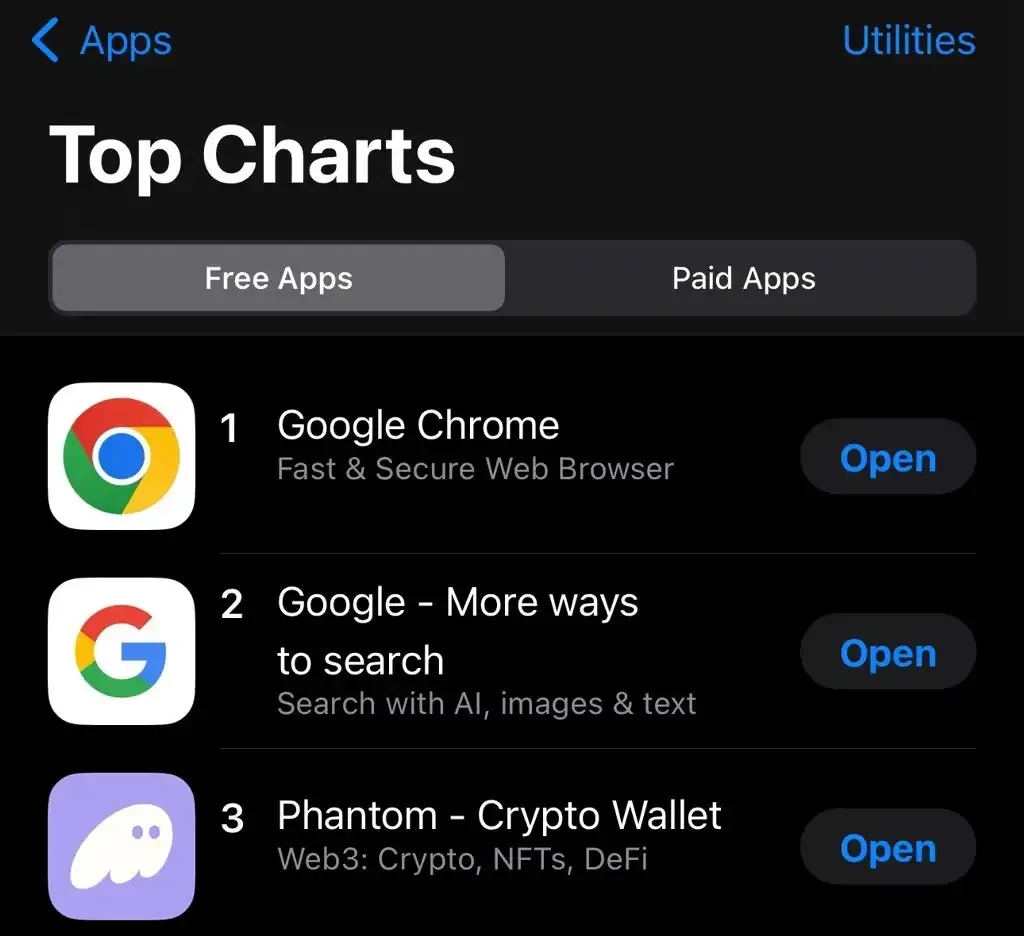

Back to this year, Solana has returned to the center of the crypto community, and Phantom has also performed well. A month ago, Phantom became the third most downloaded free application in the App Stores Utilities category, second only to Google Chrome and Google Search.

Backed by CEX, creating a closed-loop ecosystem

In September 2022, Coral, the developer of Solanas development framework Anchor, announced the completion of a $20 million financing round, led by FTX Ventures and Jump Crypto, with participation from Multicoin Capital, Anagram, K 5 Global and other strategic investors. The company launched an interactive wallet product, Backpack, that provides a crypto-native experience through executable NFTs (xNFTs).

However, the development of Backpack came to a halt with the collapse of FTX. It was not until October last year that Backpack announced the launch of its own trading platform, Backpack Exchange, which obtained a VASP license issued by the Dubai Virtual Assets Authority.

Backpack clearly released the airdrop expectations at the beginning of its launch. In February this year, Backpack announced on its official Twitter account that the 24-hour trading volume of Backpack Exchange exceeded 1 billion US dollars. At the same time, the 24-hour trading volume of SOL/USDC on Backpack Exchange exceeded Binance, reaching 800 million US dollars. This also brought a large number of users to the Backpack wallet.

In addition to relying on CEX resources, Backpack is also characterized by being a wallet designed specifically for xNFT, a token standard on the Solana blockchain that represents ownership of the use of executable tokenized code. Based on this, Backpack can combine the functions of traditional wallets with the wallets own ability to support and run decentralized applications (dApps). These applications, in turn, promote each other with trading platforms, allowing Backpack wallets to

In addition, Backpack is the only wallet in Solana that supports user-defined RPC nodes. Users can pay to purchase RPC and add it to Backpack, which is also considered the most important step to get ahead of others in trading on Solana.

Where are the new opportunities for Solana wallets?

What are the differentiating directions that new wallet projects can choose? At present, other players can only look for directions that leading projects are unwilling to try and reduce the user scale, such as focusing on embedded scenarios, serving enterprise-level users and other vertical directions. Find space in these small markets and survive first.

Embedded scenes

In addition to DEX trading, another important use case for wallets is dapps, but now the opportunities in this scenario are gradually being squeezed. Many decentralized applications are beginning to tend to vertically integrate wallet functions. Take the recent rise of Friend.Tech and its branches as an example. In order to eliminate the mnemonic requirement for new users, Friend.Tech integrated an embedded wallet that leverages the Privy infrastructure.

Analyst MICHAELLWY believes that this trend changes the wallet paradigm from one wallet for all dapps to one wallet for each dapp. Users may no longer use a single application to manage assets, but may have multiple addresses and balances for various dapps used, which challenges the theory of fat wallets and implies a more decentralized wallet ecosystem.

But as the traditional Internet market has experienced, late-stage projects with real potential value will often be acquired by leading projects that already have scale effects. A month ago, Phantom acquired Bitski, a wallet-as-a-service platform backed by well-known investors such as a16z and Galaxy Digital. Bitskis team (including its co-founders) will join Phantom and expand its current team of more than 80 people. As part of the Bitski acquisition, Phantom plans to introduce an embedded wallet to Solana to provide an easy entry experience similar to web2.

Developer Orientation

If you search for Solana wallet recommendation, the wallet project that is often mentioned after Phantom and Backpack is Solflare, which is a wallet product created by the team at the end of 2020. Solfare is a Solana wallet launched earlier than Phantom. One of the advantages that has enabled it to operate to this day is that Solflare attaches great importance to community governance and developer orientation.

Solflares open source platform allows users to actively participate in the development and improvement of the wallet, such as protocol upgrades and feature additions. Compared with other wallets, Solflare places more emphasis on decentralization and community governance, making it an attractive option for users who value transparency.

In February this year, Solfare encountered a traffic surge during the JUP airdrop, and 30% of Solflare users experienced a decline in performance during use. Solflare founder Vidor published a long article to explain the specific process of the problem and the improvement measures to be taken in the future. This response won Solflare the favor and recognition of the community.

Enterprise Applications

On June 10, Squads, a multi-signature protocol based on Solana, completed a $10 million Series A financing round led by Electric Capital. Coinbase Ventures, Placeholder VC, RockawayX, L1 Digital, and Helius co-founder and CEO and Odyssey Ventures founder Mert Mumtaz also participated in this round of financing.

The financing was used to launch its retail wallet application Fuse. This is a new wallet designed to provide security and programmability to users in the Solana ecosystem. In an interview, Squads founder Stepan Simkin said that Fuse has no intention of competing with existing wallets such as Phantom or Backpack, but instead focuses on providing advanced security features for smart accounts, such as two-factor authentication, recovery keys, and spending limits.

Unlike many projects that choose to be newbie-friendly, Fuse is designed for security-conscious users who already use hardware wallets such as Ledger, and aims to provide a more secure wallet experience by leveraging Apples security model and biometric verification. Stepan Simkin has a clear product positioning for Fuse, and he provides very specific usage scenarios, including programmable automated transactions, and locking funds in a timed vault to provide users with diamond hands.

In terms of profit model, Fuse is also different from other wallets. Fuses revenue channels include subscription fees and deployment fees for smart accounts. The account creation fee is 0.05 SOL, and the commission for each transaction is 0.2% (0% for Squads Pro subscribers). The subscription fee for Squads Pro is $399 per month, and you can also use Squads Validator to stake at least 1,000 SOL to access advanced features.

Web2 friendly

Just last week, Solana crypto wallet startup TipLink launched a product called TipLink Wallet Adapter. TipLinks slogan is the simplest wallet, which can provide services to new Web3 users without wallet browser extensions. The product is linked to the users Google account, avoiding the need to set up a complex wallet. TipLink also launched a Pro service to help developers distribute cryptocurrencies to hundreds or thousands of users through links.

With TipLink, the sender of an asset only needs to connect to a Solana wallet and create a TipLink by depositing the token or NFT they want to send, then they can copy the TipLink URL or generate a QR code and send it to anyone. The receiver does not have to have a crypto wallet and can even log in through Gmail to receive the token. With its newly launched API, TipLink allows developers and companies to deposit digital assets and create TipLinks for their users.

In February 2023, TipLink completed a $6 million seed round of financing, which was co-led by Sequoia Capital and Multicoin Capital, with participation from Solana Ventures, Circle Ventures, Paxos and other companies. Angel investors including Vinny Lingham and Sarah Guo also supported this round of financing.

In addition to wallets, the traffic entrance bonus is still there

In summary, there is not much room for new Solana wallet players. The status of Phantom and Backpack is even more difficult to shake. However, Solanas popularity is obvious to all. Do latecomers really have no chance to share the cake of a large number of new users? In the end, lets talk about user-friendly and fast transaction speed, two labels often mentioned by Solana wallets.

Theoretically, with a large number of new users pouring into Web3, the direction of user-friendliness will be more friendly to new wallet players. But this is not the case. If a wallet only has a smooth and easy-to-use interface, it will be difficult to succeed even if it has a lower threshold than Phantom. After all, the speed of wallet development may not be as fast as the speed of spontaneous dissemination by KOLs. During the period when the meme craze on Solana was set off, countless Phantom tutorials have appeared on Youtube.

Even TipLink, which features low threshold for use, is also tied to the feature of enterprise-level application and takes the needs of developers into consideration in terms of usage scenarios, which have been narrowed down a lot.

But that doesn’t mean “user-friendly” has disappeared. The Solana ecosystem Meme coin issuance platform pump.fun has attracted a large number of users in just a few months, with cumulative revenue exceeding $40 million. Just the day before yesterday, pump.fun’s 24-hour revenue reached $1.31 million, second only to Ethereum’s $3.61 million.

In terms of transaction speed, in the Solana ecosystem, which is already convenient for transactions and has low fees, faster transaction speed is important, but from the perspective of user psychology, a faster speed of discovering favorable transactions is needed.

Following this logic, it is not difficult to understand that in the process of the two most dazzling Solana ecosystem meme coins BOME and SLERF going viral, the Solana ecosystem tg bot has received huge dividends. The main profit channel of the wallet and the only profit channel of the bot are the pumping of transaction volume, but the bots pumping is generally higher than that of the wallet. For example, BONKbot charges 1% for each transaction, and some bots with high winning rates have higher pumping amounts, while Phantoms amount is 0.875%. During the meme fever, the total 24-hour income of various bots exceeded 5.33 million US dollars, and the downtime of BOT even affected the coin price.

Back to the topic, the profit opportunity of the wallet market lies in the control of the transaction channel. From this perspective, as long as new users continue to pour in, there will always be incremental opportunities in the wallet market. In addition to the first-mover advantage and resource advantage that cannot be changed, Phantoms important nodes are inseparable from the grasp of the demand for NFT asset transactions. Backpack attracted a large number of initial startup users by relying on the expectation of airdrops. The brilliance of pump.fun and various trading bots comes from the accurate understanding of user needs under the meme craze. The revenue channel of these projects lies in transactions, but transactions are only one link. The transaction scenario and narrative cycle are propositions that all participants need to think about.

This article is sourced from the internet: With the traffic dividend, can Solana Wallet still produce new players?

Related: Cryptocurrency’s killer capabilities: scale, on-chain reputation, and payments

Original author: Li Jin Original translation: Vernacular Blockchain The largest companies on the planet are all marketplaces built on network effects. Companies like Amazon ($1.9 trillion), Meta ($1.2 trillion), Tencent ($4.59 trillion) all aggregate market supply and demand, and the more supply and demand they control, the more valuable their network becomes. The same is true in the cryptocurrency space. High-value networks like Bitcoin ($1.4 trillion market cap), Solana ($79 billion market cap), and Ethereum ($460 billion market cap) are all multi-sided networks comprised of developers, users, and network operators that become more valuable as they scale. But when I look at the landscape of the Web2 and Web3 markets, I see not only markets that already exist, but also markets that don’t exist yet. In my years of investing…