After one and a half months on the market, how do the six virtual asset ETFs in Hong Kong perform?

Original author: Weilin, PANews

It has been one and a half months since the six virtual asset ETFs in Hong Kong were listed on April 30, and the market is still in the running-in period. On the one hand, traditional banks have not yet distributed these virtual asset ETFs, but on the other hand, some brokerages are actively promoting the layout. For example, Victory Securities VictoryX trading app has now opened the deposit and withdrawal functions of USDT and USDC to professional investors.

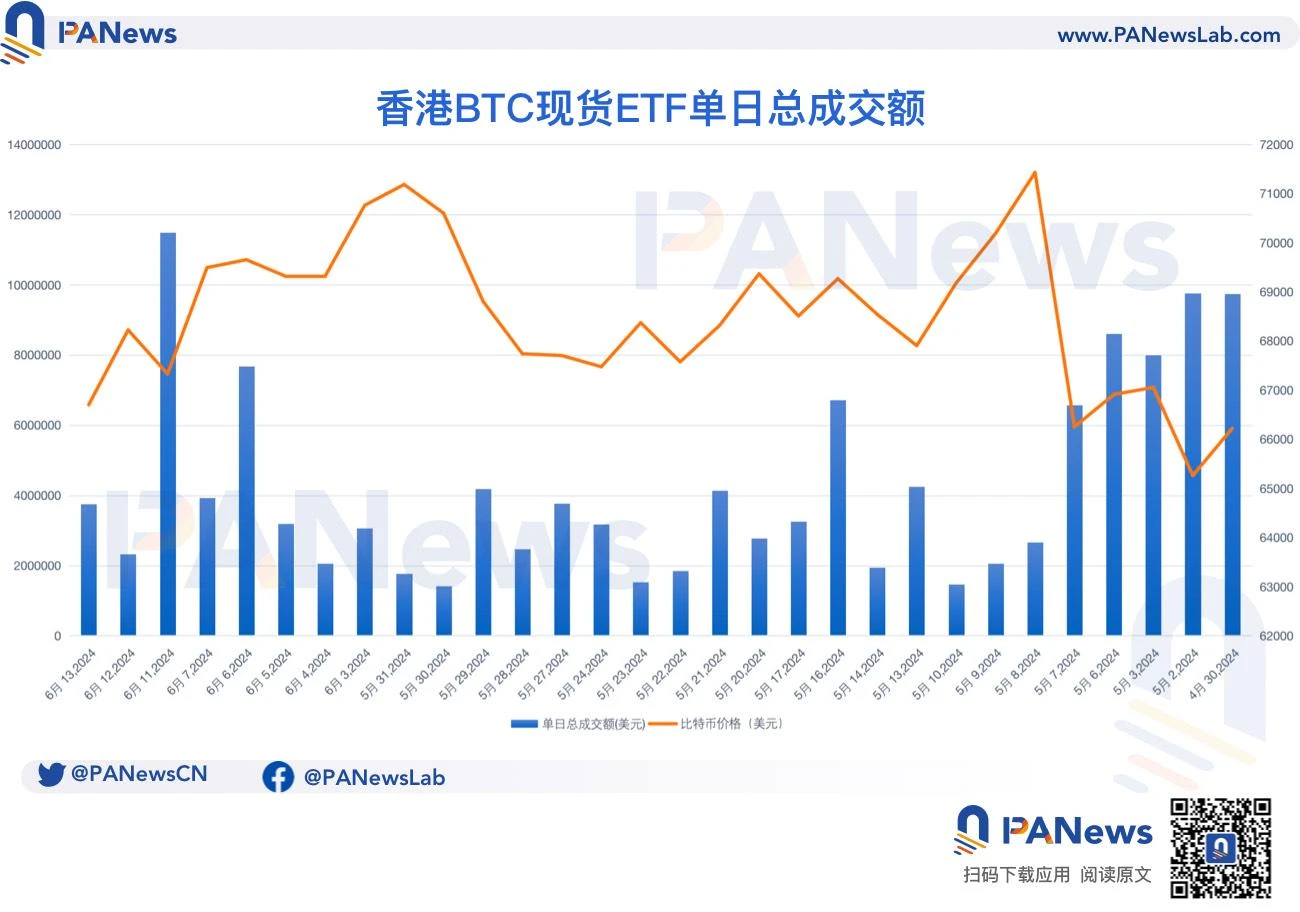

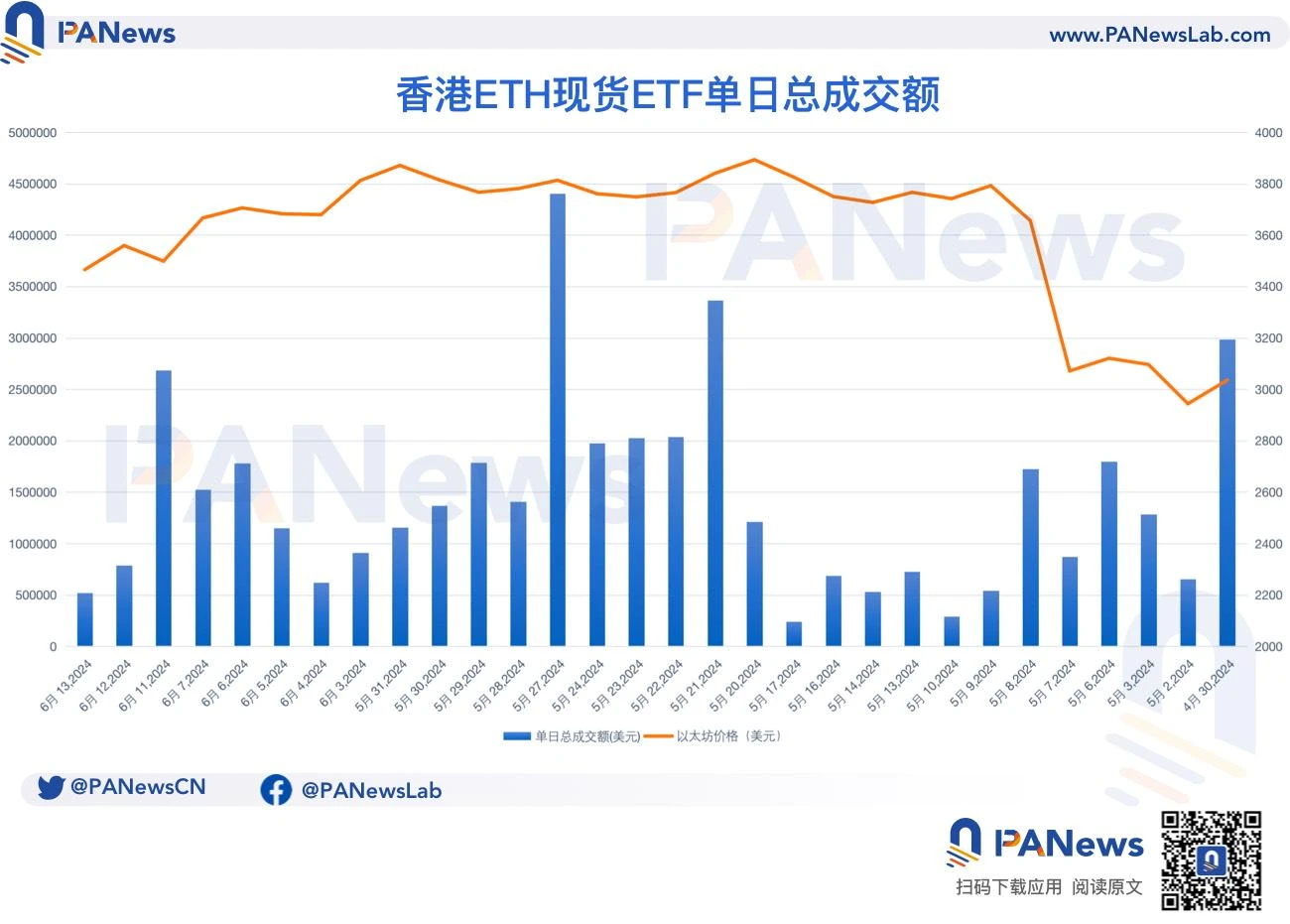

Specifically in terms of market trading volume performance, data from SoSo Value shows that during this period, the average daily total transaction volume of the Hong Kong BTC spot ETF was US$4.3215 million, reaching a historical high of US$11.4984 million on June 11; the average daily total transaction volume of the Hong Kong ETH spot ETF was US$1.4354 million, with the highest point occurring on May 27, at US$4.4042 million.

Industry experts have analyzed that the trading volume and scale of Hong Kong virtual asset ETFs are inverted, and the stakeholders are making up for the early approval of ETFs and different institutions are running in and unblocking the bottlenecks. Two months later may be the key node for volume growth.

After one and a half months on the market, how do the six virtual asset ETFs perform?

According to public data, the issuance scale of Hong Kongs three Bitcoin spot ETFs on the first day on April 30 reached US$248 million (Ethereum spot ETF was US$45 million), far exceeding the initial issuance scale of the US Bitcoin spot ETF on January 10 of approximately US$125 million (excluding Grayscale), which also shows that the market has high expectations for the subsequent performance of Hong Kongs crypto ETFs.

Judging from the initial trading volume, the markets criticism of these six Hong Kong crypto ETFs is concentrated on their sluggish performance relative to US crypto ETFs: on the first day of listing, the total trading volume of Hong Kongs six crypto ETFs was HK$87.58 million (about US$11.2 million), of which the trading volume of the three Bitcoin ETFs was HK$67.5 million, which is less than 1% of the total trading volume of the US Bitcoin spot ETF on the first day (US$4.6 billion).

According to SoSoValue data, as of June 13, the total number of Bitcoins held by Hong Kong ETFs was 4,070, with a total net asset value of US$275 million. In terms of Ethereum spot ETFs, the total number of ETH held by Hong Kong ETFs was 14,030.

Looking at the situation over the past month, from the perspective of the total daily transaction volume of the Hong Kong BTC spot ETF, the total daily transaction volume on June 11 reached 11.4984 million US dollars, reaching a historical high, but it quickly fell back in the next two days. Since its listing, the average daily total transaction volume has been 4.3215 million US dollars. During this period, the average daily total transaction volume of the US Bitcoin ETF was 1.965 billion US dollars.

Data: SoSo Value, Coingecko

The highest daily total transaction volume of Hong Kong ETH spot ETF was US$4.4042 million on May 27. Since its listing, the average daily total transaction volume has been US$1.4354 million.

Data: SoSo Value, Coingecko

Traditional banks have not yet distributed, and two months later may be the key to increasing volume

However, despite the listing of virtual asset spot ETFs in Hong Kong for more than a month, no bank has yet listed them. Chris Barford, head of data and analytics at Ernst Young Hong Kong Financial Services Consulting, told the Hong Kong Economic Times that traditional banks are concerned about anti-money laundering and know-your-customer (KYC) regulatory risks, so they are more cautious about participating in the distribution of products.

Some issuers admitted that banks and securities firms are regulated by different entities, and distribution in banks still needs to wait for the approval of the corresponding regulatory body, and the bank may need time to evaluate. Barford explained that talent shortage is a major challenge. The global market is facing a talent shortage problem. Talents who are more familiar with the world of distributed ledgers and virtual assets are needed, and combined with financial services and regulatory knowledge. While implementing technical solutions, it is necessary to reach the risk control level of traditional banks or financial institutions before these products can be more accepted.

At the same time, as traditional financial institutions, some Hong Kong securities firms are planning to provide trading services for virtual assets such as Bitcoin.

For example, Hong Kong-based Victory Securities, Tiger Securities, Interactive Brokers and other brokerages have launched corresponding services, allowing investors to trade virtual assets such as Bitcoin on brokerage apps. According to China Securities Journal, some brokerages said that revenue related to virtual assets may account for about a quarter of the companys revenue. According to PANews, although many brokerages support the purchase of the above-mentioned ETF products, some larger brokerages also do not actively recommend virtual asset ETFs to customers for regulatory considerations.

On May 6 this year, Tiger Brokers (Hong Kong) announced the official launch of virtual asset trading services, supporting 18 currencies including Bitcoin and Ethereum, becoming the first online brokerage in Hong Kong to support securities and virtual asset trading through a single platform. On June 17, Tiger Brokers (Hong Kong) announced that it had been approved by the Hong Kong Securities Regulatory Commission to upgrade its license and officially expand the service to retail investors in Hong Kong. At present, retail investors in Hong Kong can trade Bitcoin and Ethereum, as well as stocks, options, futures, U.S. Treasury bonds, funds and other global assets at an affordable cost through Tiger Trade, the flagship investment platform of Tiger Brokers, to achieve seamless allocation and management of virtual assets and traditional financial assets.

In addition, on November 24 last year, Hong Kong Victory Securities stated that it became the first licensed corporation in Hong Kong to be approved by the Securities and Futures Commission to provide virtual asset trading and consulting services to retail investors. Also on November 24 last year, Hong Kong Interactive Brokers also obtained a license for virtual asset trading for retail customers in Hong Kong, allowing trading in Bitcoin and Ethereum.

Investors need to open a virtual asset account to trade virtual assets such as Bitcoin on brokerage APPs. Brokerages have set a low entry threshold for virtual asset trading, starting at $100.

Jupiter Zheng, a partner of Hashkey Capitals secondary fund, recently wrote that the trading volume and scale of Hong Kongs virtual asset ETFs are inverted. This actually reflects a structural undercurrent – the various stakeholders are polishing the process and unblocking the bottlenecks. Especially for physical subscription and redemption, it is necessary to promote the process and promote the running-in between different institutions such as dealers (PD), securities companies, custodians/exchanges, and market makers to unblock the bottlenecks. Two months later may be the key node for volume growth.

In addition, the key force for the scale of Hong Kong virtual asset ETFs in the future will come from institutional investors. Ernst Youngs survey found that many institutional investors expect to increase their allocation to virtual assets in the next 2 to 3 years. If the assets under management exceed US$500 billion, most of them will invest about 1% of their assets in some form of virtual currency, and most family offices also dabble in virtual currency. Large investors believe that the return rate of virtual assets may outperform the market in the future, but the value is volatile. If this risk can be managed, virtual assets are an attractive asset class.

Looking ahead, although the current performance of Hong Kong virtual asset ETFs needs to be improved, the market potential of Hong Kong virtual asset ETFs is still worth looking forward to as more brokerages provide related services, the possibility of bank distribution increases, and institutional investors interest in virtual assets increases.

This article is sourced from the internet: After one and a half months on the market, how do the six virtual asset ETFs in Hong Kong perform?

Related: jam: New hope for the creator economy in the Base ecosystem?

Original|Odaily Planet Daily Author: Wenser On April 21, according to official news , the jam.so creator economy app launched by Farcaster and LensProtocol ecological project jam had a transaction volume of over 10 million US dollars within 72 hours of its launch, with a total of over 47,000 transactions. According to Dune data , the current transaction volume of jam.so has exceeded 270 million DEGEN. As another new seed of Farcaster and DEGEN ecosystem SocialFi, jam has currently received a donation of 1 million DEGEN tokens , which will be used for ecological development in the future. Today, Odaily Planet Daily will share with you about this small and beautiful creator economy application. jam.so: A blockchain version of Instagram that allows creators to earn their first dollar? As a creator…