The founder was finally liquidated, is Curves flywheel completely bankrupt?

In the general decline of cryptocurrency, CRV was unexpectedly the worst hit.

This morning, Arkham published a post stating that Curve founder Michael Egorov currently has lent out $95.7 million in stablecoins (mainly crvUSD) on 5 accounts in 5 protocols with $140 million in CRV as collateral. Among them, Michael has $50 million in crvUSD borrowed on Llamalend, and Egorovs 3 accounts have accounted for more than 90% of the crvUSD borrowed on the protocol.

Arkham pointed out that if the price of CRV drops by about 10%, these positions may begin to be liquidated. Subsequently, the decline of CRV continued to expand, once falling below $0.26, reaching a new historical low, and the CRV lending positions on Michaels multiple addresses gradually fell below the liquidation threshold.

In the past, Michael would cover his position to save his hospitality position, but this time, he seemed to have “given up”.

According to Ember’s monitoring, some CRV in Michael Egorov’s main address’s lending position on Inverse has begun to be liquidated. According to Lookonchain’s monitoring, Michael Egorov currently holds 111.87 million CRV (US$33.87 million) in collateral and US$20.6 million in debt on four platforms.

Liquidation crisis 2 months ago

The crisis of CRV began to emerge as early as 2 months ago, when Michaels loan position had fallen below the liquidation threshold, but Michael was not liquidated at that time, nor did Michael take any remedial actions.

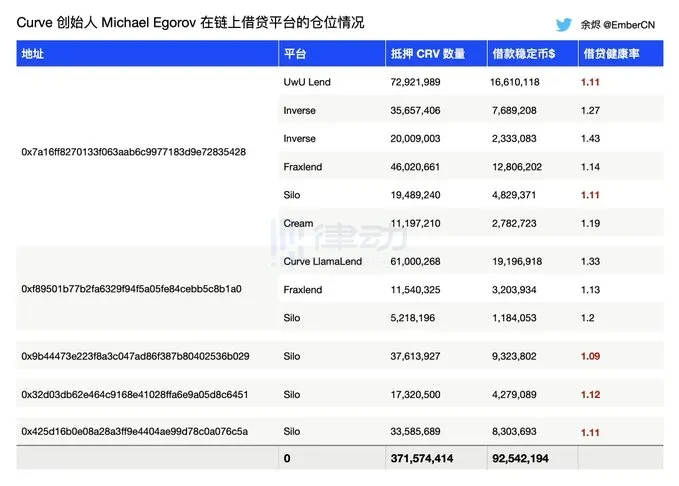

On April 14, as the market fell, CRV prices also fell to $0.42, and Curve founder Michael Egorovs lending position entered the red line again. According to Embers monitoring, Michael pledged a total of 371 million CRVs on 6 lending platforms through 5 addresses and lent out $92.54 million in stablecoins. Among the 12 debts, silo lending positions are the most dangerous.

Starting from November 2022, when the on-chain big short ponzishorter attempted to short its token CRV, by the end of July 2023, Curve was attacked due to a Vyper compiler failure. Michael took frequent actions to save his positions, stirring the DeFi soup. People also compared this series of actions to the DeFi Defense War.

The first defense battle may be Michaels attempt to lure short sellers, which caused the price of CRV to rise instead of fall, and he made a profit in the fight against short sellers. The second defense battle relied on the power of OTC, and although the holdings decreased, it gained a group of powerful supporters including Wu Jihan, Du Jun, Sun Yuchen and other top players, as well as DWF and other institutions. It can be said that CRVs two defense battles were quite victorious.

Related reading: Curves problem is a symptom of DeFis yield disease

At noon on April 14, the price of CRV fell to $0.42. According to debank data, among Michaels 12 positions, 5 positions had a health value of 1.12 or even lower. Yu Jin monitored the red line of Michaels debt position and tweeted to speculate on liquidation. He pointed out that if the price of CRV continues to fall by 10% without replenishment or repayment, the liquidation procedure will be initiated.

All debt positions have not been liquidated

However, just as people were thinking about how CRV should respond to the third DeFi Defense War, something interesting happened.

People noticed that at 4 a.m. that day, the price of CRV fell to $0.3592, having already fallen below 10% of $0.42. However, Michaels debt position was not liquidated as Yu Jin said, and even Michael himself did not seem to take any remedial measures.

Michaels debt positions are distributed across 6 different lending protocols, among which the most controversial lending protocol is silo.

After Curve was attacked, most lending protocols tightened their policies as they were unwilling to bear too much risk associated with CRV. More than half of the loans Michael raised came from silos. In the process of Michael repaying his AAVE debt position, silos provided almost all the required loans. It can be said that silos became the biggest reinforcement for Michael to repay his debts, and many community members joked that they were Michaels personal bank.

At that time, of Michaels total debt position, the silo protocol had a total of about 113 million CRV deposited, and a total of about 27.9 million US dollars worth of stablecoins were borrowed, accounting for 30% of Michaels total debt position. However, Curve LlamaLend, UwU Lend and FraxLend protocols also provided most of the loans to Michael. Although the proportion was not as high as silo, it was still higher than 15%, of which Curve LlamaLend accounted for 20.7%, UwU Lend accounted for 17.9%, and FraxLend accounted for 17.3%.

On the other hand, silo has forked a new protocol, Silo Llama , which is an isolated lending protocol designed specifically for crvUSD. Although this protocol is full of doubts, DeFi should be designed to be independent of user emotions. Compared with borrowing, the lock-up rate of CRV has a greater impact on the selling of CRV. Setting up a separate pool for CRV is one of the working methods of DeFi lending vaults, and silo team members have also explicitly denied the accusation of creating Silo Llama for one person.

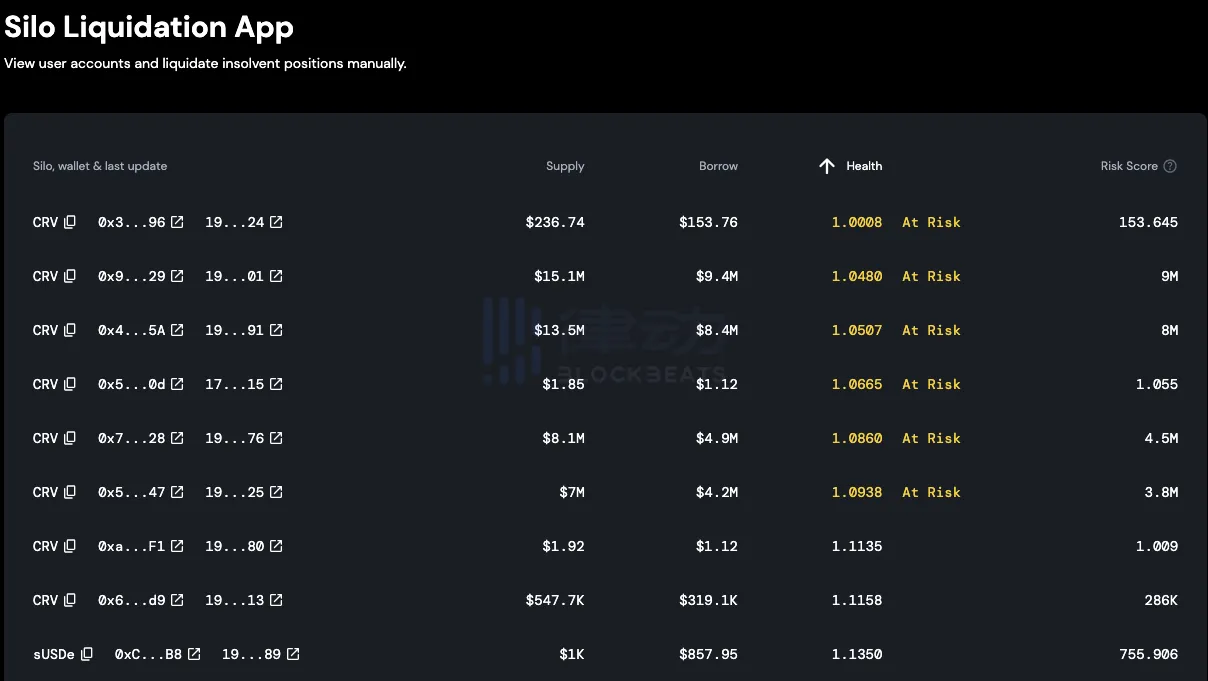

Putting aside the relationship between silo and curve, the essence of the dispute is that silo did not liquidate CRV. Insiders said that because the CRV position on silo uses Chainlink oracle, the price update will lag behind debank, so it is questionable whether the oracle tracks the liquidation price.

According to Chainlink data , the CRV prices recorded at that time all showed that it fell below $0.4 at 5:30 a.m. on April 14, and was in the range of $0.36 to $0.38. Then the author checked the data from dexscreener, coingecko, tradingview, coinmarket, etc. At that time, CRV fell to around $0.36 on the 30-minute line.

Since the lowest price of CRV occurred in the early morning, the author is currently unable to verify whether the health factor at that time was zero. But no matter what happened to CRV and various lending agreements that night, the only thing that can be confirmed is that not only silo, but all of Michael’s debt positions are still there.

During this crisis, some people have focused on the manual liquidation mechanism of silo. Since silos liquidation is completely open, liquidators can choose manual or machine. When asked whether they would not be liquidated by machine after choosing manual liquidation, an insider said that manual liquidation is only a personal liquidation entrance provided by the platform. When faced with a debt to be liquidated, individuals still need to compete with the machine for orders, and often cannot compete with the machine.

Therefore, the key to whether liquidation is triggered lies in whether the price of the collateral actually falls to the liquidation value.

The “Price Game” of the Liquidation Mechanism

According to the silo documentation, the lending protocol has a liquidation application that the core team uses to monitor risky positions and liquidate insolvent positions if liquidation robots (including Silo) do not liquidate first for any reason.

On April 19, CRV fell again to $0.4. According to Michaels address provided by Ember, the debt health factors of the addresses starting with 0x9, 0x4, and 0x7 in silo are all below 0.1, which is in a dangerous state.

According to the silo finance collateral factor table , CRV in the silo protocol has a loan-to-value ratio (LTV) of 65% and a liquidation threshold (LT) of 85%. This means that Michaels silo liquidation price is in the range of $0.41 to $0.44, so the health factor is theoretically 0.

Calculation formula:

Liquidation price = total loan amount / (collateral amount * LTV * LT)

Health factor = 1-total amount of loans/(total amount of collateral*LTV)

In this regard, BlockBeats verified with the project team that its price tracking is not simply checking the oracle feed price, but using a weighted average algorithm. This means that the liquidation price of a token will be affected by the prices of the lenders other loan assets, so the price drop of CRV alone is not enough to liquidate the position. However, when asked about the liquidity supply issue, the project team did not respond.

As for Llamalend, the platform where Michael has the largest position, its automatic liquidation mechanism can defend against soft liquidation. Simply put, its liquidation process is that when the price falls, the collateral is automatically converted into stablecoins, and when the price rises, the collateral tokens are sold back, and only a small amount of crvUSD needs to be repaid to increase the health factor.

In addition, insiders told BlockBeats that in fact, in the case of large market fluctuations, liquidators need to consider the slippage problem, which involves the slippage of crvUSD and CRV at the same time. In the past few large floating fluctuations, it was normal for the lending agreement machine to not liquidate.

Was he cut by Michael this time?

The impact of tens of millions of dollars of debt position liquidation on the liquidity of the entire crypto market cannot be underestimated. The crisis in April was still avoided due to the protection mechanism of the lending platform, but this time CRV fell below $0.26, and the crisis finally arrived.

Liquidator Profit

Whether or not to buy at the bottom when the price hits a new low is also a topic of concern for investors, but at least in the case of CRV, liquidators have already begun to make profits.

According to ai_9684 xtpa monitoring, the address 0xF07…0f19E is one of the main liquidators of Michaels position. In the past hour, the address liquidated 29.62 million CRV at an average price of $0.2549, spending a total of 7.55 million FRAX. At present, all of these tokens have been recharged to Binance, with an average recharge price of $0.2792.

As a liquidator, a more economical way may be to open a CRV short order on Binance (or borrow coins to sell) and then perform liquidation. In this way, the tokens obtained from liquidation are only used to close the short position (or repay the loan), without having to bear the profit or loss caused by the price fluctuations during the period.

But even if 0xF07…0f19E did not do this, he could still make a profit of $720,000 by selling at the average recharge price.

Investors suffer losses

But on the other hand, investors are facing disaster.

On the one hand, the price drop triggered the liquidation of other lending platforms. Fraxlends lenders suffered millions of dollars in liquidations. According to Lookonchain monitoring , some users had 10.58 million CRV (3.3 million US dollars) liquidated on Fraxlend.

In comparison, Fraxlends liquidation mechanism is easier to trigger, and its risk isolation and dynamic interest rate mechanism do not require any additional measures to allow Michael to repay the money on his own initiative. In the previous liquidation crises, Michael borrowed a large amount of assets from Aave and sold coins through OTC to repay Fraxlends debts.

On the other hand, early CRV investors faced huge losses.

Since the CRV crisis last year, there has been no shortage of comments in the community saying that Curve had a good hand but Michael messed it up. The most noteworthy thing about this CRV crisis is the major investors who helped Michael before.

After Curve was stolen at the end of July last year, various OGs, institutions and VCs all helped. Bitmain and Matrixport co-founder Jihan Wu posted on social media: In the upcoming RWA wave, CRV is one of the most important infrastructures. I have bought it at the bottom, which does not constitute financial advice.

Huang Licheng confirmed on social media that he purchased 3.75 million CRV from the founder of Curve through OTC and pledged them in the Curve protocol. The next day, Sun Yuchens related address also transferred 2 million USDT to Egorovs address and received 5 million CRV.

Then projects such as Yearn Finance, Stake DAO, and a number of institutions and VCs such as DWF joined in the firefighting operation of CRV.

Now CRV has fallen to a new low, and Michael himself has not yet made any statement to save it. As the community said, the party that cut people was finally cut by Michael.

This article is sourced from the internet: The founder was finally liquidated, is Curves flywheel completely bankrupt?

On May 24, ALIENX Chain officially launched the HAL testnet and launched a 3-week interactive airdrop event. ALIENX is an AI node-driven and EVM-compatible staking public chain that aims to solve the data security and privacy issues of traditional AI projects by combining AI technology and the decentralized nature of blockchain, and to achieve large-scale applications of AI Dapp, NFTs and GameFi. ALIENX has received $17 million in financing from institutions including OKX Ventures, C² Ventures, Next Leader Capital, etc. In the latest round of financing, ALIENX Chain is valued at $200 million. The release of the ALIENX HAL testnet means that the development of its mainnet has basically entered the final stage. This testnet airdrop event will last for 3 weeks. After the testnet airdrop, ALIENX will release the…