The four kings of Layer2 compete on the same stage, with the latest development direction and technical advantages at a

Original author: Asher Zhang, Bitpush

On June 11, ZKsync released information on the distribution of protocol tokens. As a former top-tier project in Layer 2, ZKsync has finally arrived, which also means that the four former top Layer 2 projects have begun to compete on the same stage. This article briefly sorts out the latest development directions and technical advantages of the four major Layer 2 projects: Arbitrum, Optimism, Starknet, and zkSync.

Arbitrum鈥檚 monthly active users surpass Ethereum, L3 gaming strategy shines

After the Dencun upgrade, the transaction cost on Ethereums second-layer blockchain has been reduced by up to 99%, and Arbitrum may become the biggest winner of the Dencun upgrade. In the week before the upgrade, the number of transactions on Arbitrum was only 747,000, and in the week after the upgrade, this number jumped to 1.5 million. On June 3, according to Token Terminal data, the number of monthly active users of Arbitrum exceeded Ethereum for the first time, with Arbitrums monthly active users exceeding 8 million, while Ethereums monthly active users were about 7 million. At the same time, it also attracted a number of companies to participate in the construction of the ecosystem, including heavyweight company Franklin Templeton and Securitize, a company that helps BlackRock tokenize assets.

Arbitrum has made full use of the advantages of L3 and has made an all-out effort in the field of Web3 games. The Web3 ecosystem has already taken shape. This highly customized strategy of L3 not only significantly improves blockchain performance, but also better meets the needs of game users. The Arbitrum Foundation also strongly supports it. On June 8, the Arbitrum community voted to pass the proposal for the 200 million ARB game catalyst plan, which is currently pending execution. The proposal aims to provide a three-year incentive plan for Arbitrum ecological games with a total of 200 million ARBs, with the goal of powering the Arbitrum game ecosystem through studios and games in the Web3 industry. There are already many Web3 games in the Arbitrum ecosystem. On the evening of March 27, the Arbitrum Foundation announced that it would work with the popular NFT brand Azuki and the Weeb 3 Foundation to jointly create a Web3 network AnimeChain that attracts anime fans. On April 26, ApeCoin voted to adopt Arbitrum technology development and Horizen Labs to lead growth. In addition, other popular Web3 games on Arbitrum include Xai and XPET.

Optimism and Coinbase jointly build Op Stack, Base soars

Optimism develops horizontally, and Op Stack expands its territory. Superchain is a newer concept proposed by Optimism, which seeks to integrate the originally isolated L2 into a single interoperable and composable system by maintaining the OP Stack code base as a public product. In this process, the concept of blockchain itself can become abstract, and this interoperable blockchain network can be regarded as a unit, such as a store, and each Op chain can be regarded as a commodity, that is, interchangeable computing resources. Each Op chain is required to be built by OP Stack and managed by Optimism Collective. Optimism Collective is like an operating system, coordinating the resource allocation of various applications (Op chains), etc. There are many Layer 2s built with Op Stack, among which the well-known ones are Base, opBNB, Zora Network, DeBank Chain, etc.

In the Op Stack, Base has developed rapidly and has an extremely close relationship with Optimism. In February 2023, the crypto trading platform Coinbase announced the launch of Base, an Ethereum layer 2 network built on the OP Stack, and reached a cooperation with Optimism. Coinbase joined OP Labs as a core developer to contribute to the mission of the Optimism Collective and expand the leading position of the OP Stack as the most powerful public product. Base will also return a portion of the transaction fee income to the Optimism Collective treasury to further realize the sustainable future vision of influence = profitability. Base launched its testnet in February 2023, and its ecosystem is expanding rapidly. In the past 90 days alone, UAW has increased from 20,000 to 270,000, and the BASE network currently generates $3-4 million in revenue per week. From the data on Deflama, Bases monthly capital inflow increased by 162%, and its TVL has risen to 7th place, surpassing many well-known public chains. Relying on the strong support and users of Coinbase, the Base ecosystem has blossomed in many aspects and still has great potential in the future.

Starknet is advancing technology while preparing to explore new paths

StarkNet adopts the STARK-based Rollup route. Although this solution has obvious advantages over other solutions in terms of decentralization, trustlessness, and anti-censorship, it is difficult to develop and StarkNet is still continuously improving its performance. Recently, the most important update of StarkNet is the Starknet application chain and integrity verifier.

In 2023, Starknet announced the launch of the Starknet application chain (Appchain) and announced the launch of Starknet Foundry, an extremely fast toolkit for developing Starknet contracts. After the launch of the Starknet application chain, a number of chain game projects such as Cartridge, Influence, Matchbox DAO, Briq and Cafe Cosmos chose to migrate to Starknet. However, compared with Arbitrums layout in the chain game ecosystem, Starknets ecological development is still insufficient. In addition to the Starknet application chain, with the support of StarkWare, storage proof innovator Herodotus launched its integrity verifier, which enables developers to verify Stone proofs on Starknet. With this new verifier, developers can verify Cairo programs executed elsewhere on Starknet, just like verifying Starknet execution on Ethereum. This is also one of Starknets most important technical upgrades in recent times.

Recently, StarkNet has been rumored to enter the Bitcoin extension layer, which has become its main strategy different from other Layer 2, but from the current news, this is still uncertain. On June 7, Starknet clarified Starknets entry into the Bitcoin extension layer on the X platform: Starknet will continue to focus on the expansion of Ethereum. Since the launch of Starknet, our goal has remained the same, that is, to develop STARK proofs to enhance the scalability and integrity of the blockchain we believe in. No new layer (Layer) or new exclusive tokens will be created on Bitcoin. Instead, Starknet will try to expand the execution layer of Bitcoin and Ethereum at the same time. Its security, governance, and ecosystem will be driven by STRK tokens.

Whether StarkNet can be expanded on Bitcoin depends on whether the OP_CAT proposal can be passed. Bitcoin Core developer Peter Todd posted on the X platform that Starknets entry into the Bitcoin extension layer is a good reason to oppose the activation of OP_CAT. Starknet may bring destructive MEV pranks to Bitcoin, just like Ethereum, and it is unreliable to invest large amounts of money in the nascent STARKS. Elis Zcash has repeatedly (maliciously) exploited token inflation.

After much anticipation, zkSync still needs time to be tested

At present, zkSync has become the focus of the entire network, and the long-awaited token airdrop is finally here. According to official news, the total supply of ZK tokens is 21 billion tokens. In addition to airdrops, the community allocation accounts for 66.7%, the ecosystem incentive accounts for 19.9% (distributed by the zkSync Foundation), the investor allocation accounts for 17.2%, the team allocation accounts for 16.1%, and the Token Assembly allocation accounts for 29.3%. The tokens allocated to investors and teams will be locked in the first year, and then unlocked in 3 years between June 2025 and June 2028.

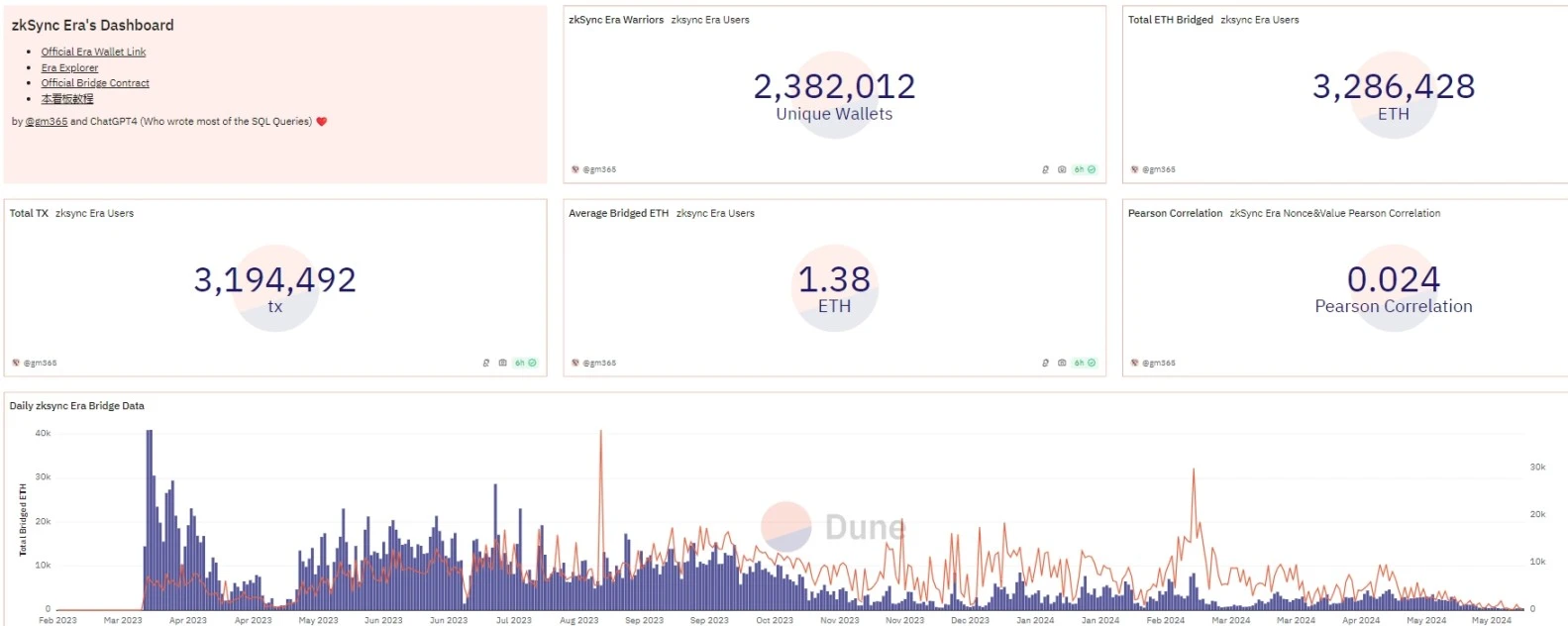

According to Dune data, as of June 11, the total value of zkSync bridge storage (TVB) was approximately 3,286,428 ETH, and the total number of bridge user addresses was 2,926,969. Compared with other L2s, the total value of Optimism bridge storage was 770,890 ETH, Arbitrum was 3,794,152 ETH, and Starknet was 904,659 ETH.

However, according to Deflama data, as of June 11, the TVL of zkSync Era is about 130 million US dollars, currently ranking 35th. This shows that a lot of funds on zkSync are still being used for airdrops, and there is still a big gap between the funds that are truly retained for the ecosystem and other Layer 2 leaders.

In addition to airdrops, the most important thing for zkSync is to promote the decentralization of the Prover network. According to the official introduction, the Prover network is now open to participants from the entire ecosystem. The introduction of new participants will make the zkSync Era Prover network more scalable, more powerful, and eliminate the reliance on any entity to maintain the key mechanism responsible for calculating proofs to verify transactions. Prover network milestone information: 1) Phase 0: Test integration (early third quarter of 2024); 2) Phase 1: Proof verification (mid-to-late third quarter of 2024); 3) Phase 2: Real-time proof verification (late third quarter of 2024); 4) Phase 3: Live test verification (early fourth quarter of 2024); 5) Phase 4: Real-time verification (fourth quarter of 2024).

Summarize

Compared to ZKsync, StarkNet issued its tokens relatively early, and there are also some well-known projects in the ecosystem. Recently, it has begun to plan to enter the Bitcoin ecosystem, which is also a different approach, but this road may also have twists and turns. From the data, Arbitrum may become the biggest beneficiary after the Decun upgrade. At the same time, its ecosystem has also developed rapidly, but it may be due to the large number of tokens unlocked that the ARB token has performed poorly. Optimism has great development potential through cooperation with Coinbase, and the Base built on Op Stack, but Optimisms own development is slightly less than Arbitrum.

As the last project to issue a token among the four major Layer 2 projects, many people have high hopes for zkSync. However, judging from the communitys reaction, many of the people who have signed up for the token may not be satisfied. Some participants said, The overall witch rate is very high. After all, there are less than 700,000 addresses left among millions of addresses. The hit rate of individual addresses is about 15%, all of which are low-income addresses. In addition, the price of ZK is so low, it is not interesting. In addition, from the data, although zkSync has many bridged assets, its TVL is still relatively small. Compared with other Layer 2 projects, the construction of the zkSync ecosystem is obviously slow. At the same time, GemSwap, a decentralized trading platform on ZKsync, ran away with the money before issuing the token, which also added some clouds to the ZKsync ecosystem. How the Zk system will develop in the future remains to be further observed.

This article is sourced from the internet: The four kings of Layer2 compete on the same stage, with the latest development direction and technical advantages at a glance

*The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice. Market summary: Last week, BTC price recorded the biggest rebound in the past 10 weeks, with a low of $60,738 and a close at $66,261, an increase of 7.82% and an amplitude of 11.33%. The biggest rebound came on May 15. Unsurprisingly, the impetus was the unexpectedly positive data of interest rate cuts in the United States: the data released by the U.S. Department of Labor on the same day showed that the U.S. CPI in April and the core CPI excluding food and energy were both lower than expected on a month-on-month basis. This shows that the rebound in U.S. inflation seems to be…