SignalPlus Volatility Column (20240612): Pre-market Rebound

Tonights CPI data, FOMC meeting decision and the Feds outlook on interest rates are undoubtedly the focus of market attention. The 10-year U.S. Treasury yield has slightly given up its gains to around 4.40%. The BTC price still maintains a high correlation with it, rebounding at the $66,000 support level, recovering half of yesterdays losses and rising to below $68,000.

Source: Investing

Source: TradingView

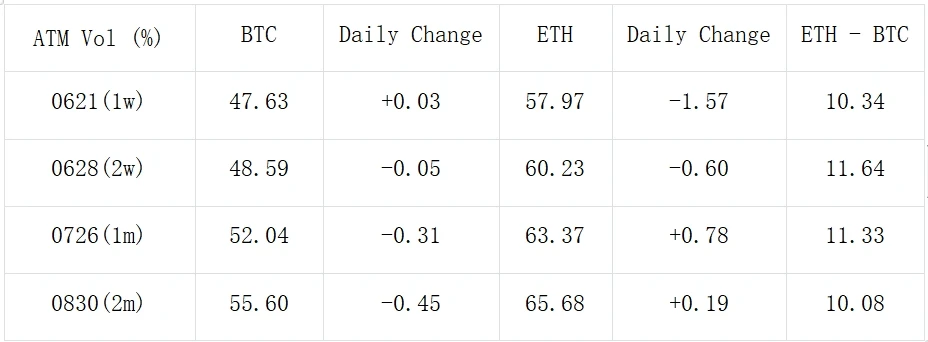

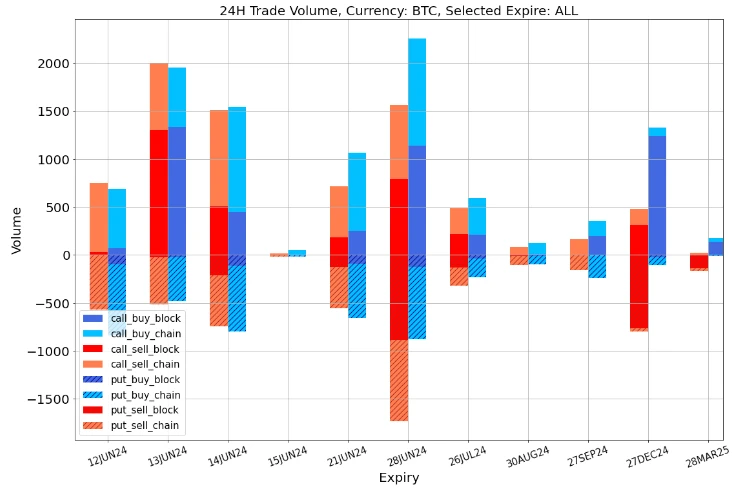

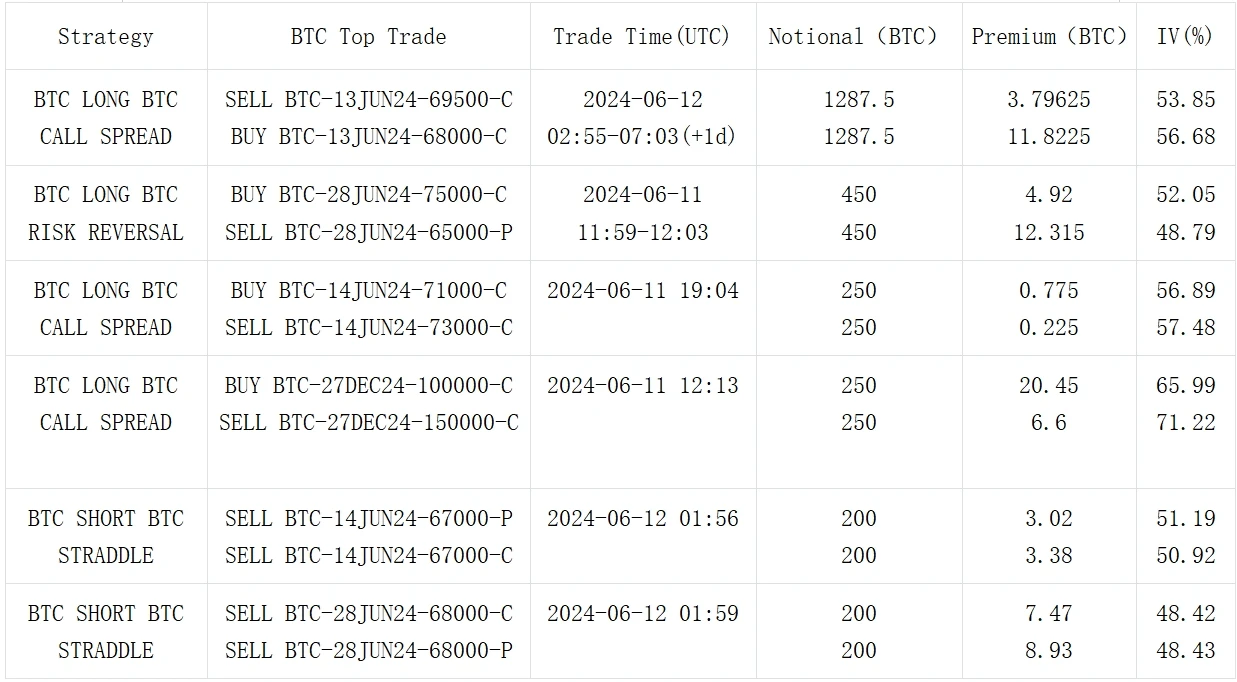

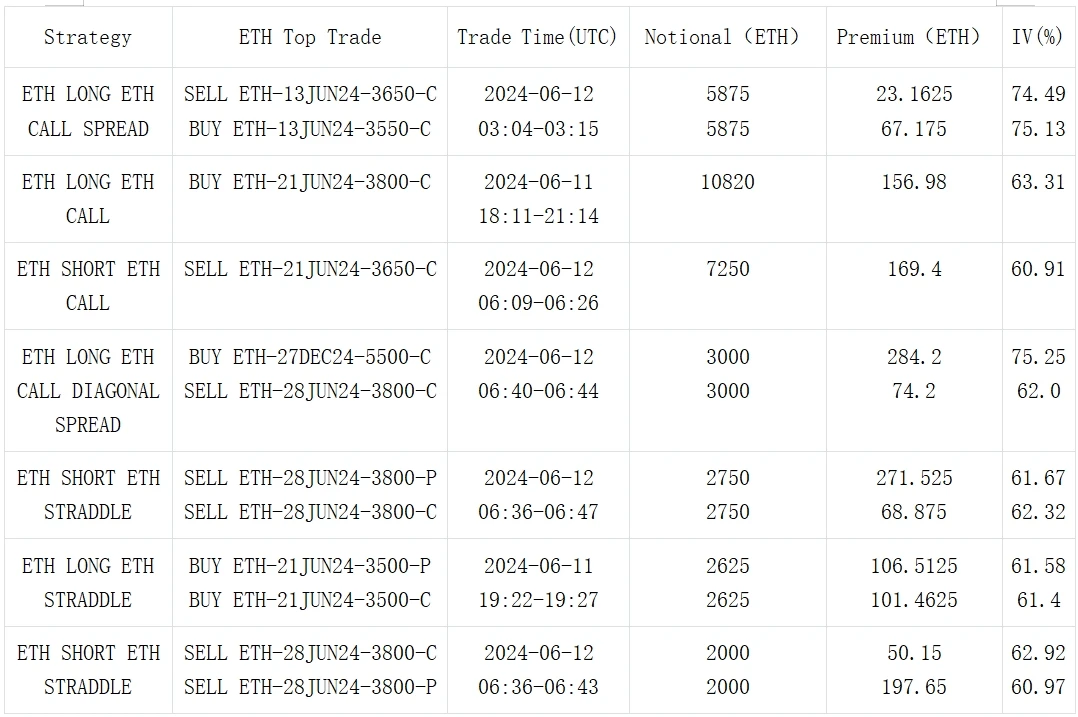

In terms of options, the front-end IV rose sharply as the US economic event gradually approached, and the far-end was also slightly adjusted upward. In terms of trading, with the price rebound, low Vol Skew and a sharp increase in IV, the front-end did not continue to buy Put Flow yesterday. On the contrary, a large number of bullish strategies were established yesterday. The more representative ones on BTC are 13 JUN 68000 vs 69500 Call Spread (1287 BTC per leg) and 28 JUN 65000 vs 75000 Risky (450 BTC Per leg); on the other hand, the president of The ETF Store expects that the ETH Spot ETF S-1 document will be approved before the end of June, and the overall call option purchase ratio of ETH has also increased significantly. 25 dRR has risen above zero as a whole, close to the highest value of the data in the past three months; in addition, under the overall upward trend of IV, ETH 28 JUN 24 IV has slightly declined, and the main driving factor may be from several large Short Straddle strategies.

Source: Deribit (as of 12 JUN 16: 00 UTC+ 8)

Source: SignalPlus, Front-End IV surges ahead of release of important US economic data

Source: SignalPlus, ETH Vol Skew has risen sharply overall

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240612): Pre-market Rebound

Related: Dogecoin, Solana, and XRP’s Open Interest Declined: Is This a Bearish Signal?

In Brief Dogecoin’s open interest plummeted 64%, Solana and XRP also saw major drops. Open interest across major cryptos, including DOGE, SOL, and XRP, fell by 51%. Decline hints at reduced trading activity and potential market sentiment shift. Recent data highlights a significant downturn in the open interest of major cryptocurrencies such as Dogecoin (DOGE), Solana (SOL), and Ripple (XRP). With a combined drop of 51%, these altcoins spark debate over the implications for their future market positions. Open Interest Declines Across the Crypto Market Open interest, a crucial indicator of market sentiment and liquidity, reflects the total value of outstanding futures contracts yet settled. For cryptocurrencies, these metrics provide insights into investor behavior and market dynamics. Dogecoin led the recent decline, with its open interest plummeting by 64% to…