Grayscale Research Report: In the battle for smart contracts, who will lead in fees and growth?

Original source: Grayscale

Original translation: Yanan, BitpushNews

-

In the cryptocurrency field of smart contract platforms, there is a value accumulation mechanism called the flywheel effect. This mechanism is like a snowball, closely linking transaction fees and network usage with the value of tokens, network security and decentralization.

-

Different smart contract platforms adopt different strategies for fee income. Some platforms increase revenue by setting relatively high transaction fees, while others attract more transactions by lowering transaction fees.

-

Grayscale’s research shows that fee income can be seen as the main factor driving the value growth of tokens in this space. Of course, there are other important fundamental factors that deserve our attention as they will have an impact on fee income over time.

-

Ethereum, as a leader in this field, has accumulated huge network fee income after years of successful operation, and successfully broke through the $2 billion mark in 2023. At the same time, other smart contract platforms such as Solana are also rising rapidly, and its fee income is expected to reach about $200 million in 2024.

Many people mistakenly believe that crypto assets have no substantial value and are difficult to evaluate using traditional investment methods. But Grayscales view is exactly the opposite. They point out that smart contract platforms like Ethereum and Solana can actually generate income by charging fees through economic activities on their networks. Grayscale suggests that if investors want to evaluate the value of smart contract platform cryptocurrencies, one possible way is to see how much fee income they can generate over time.

Smart Contract Platform Basics Overview

Smart contract platforms such as Ethereum and Solana provide developers with a network environment to build a variety of decentralized applications. These applications cover a wide range of fields, from games to finance to NFTs. The core function of these smart contract blockchains is that they can process various transactions of the applications they carry in a secure and censorship-resistant manner.

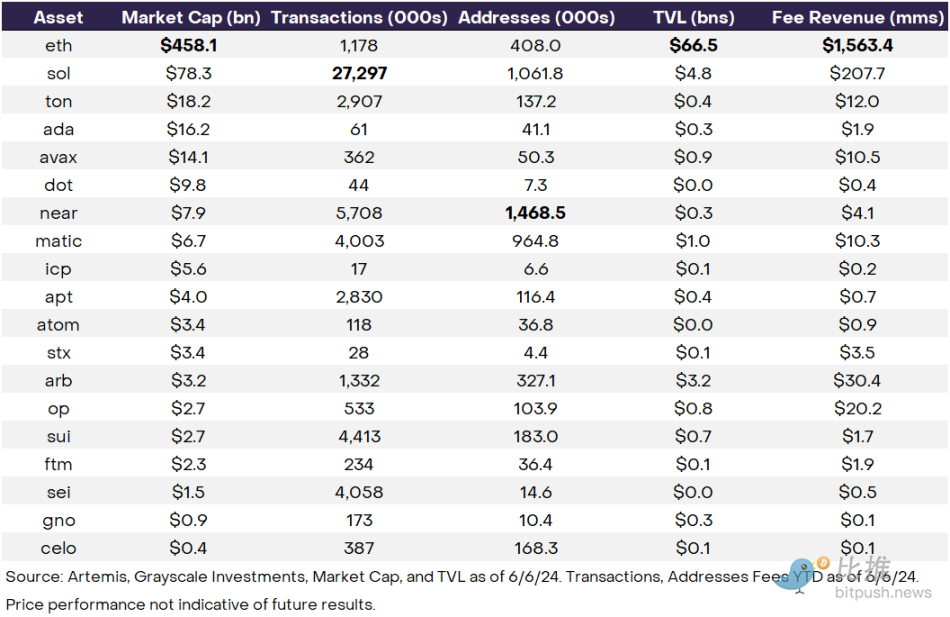

Because of this, the value of a smart contract platform is closely tied to the activity of its network. Important metrics for measuring network activity include: the volume of transactions the platform can handle, the scale of users it can support (usually measured by the number of daily active addresses); the value of assets the platform can carry, the so-called total locked value (TVL); and the platform’s ability to monetize block space, which is reflected in network fee income (more on this later).

Each indicator has its own specific meaning. For example, Ethereums significant advantage in total locked value (TVL) (up to $66 billion, seven times more than its closest competitor) fully demonstrates the platforms liquidity advantage in the field of financial applications and its unique value positioning (as shown in Figure 1). In addition, Ethereums leading position in the number of ecosystem applications has further spawned a strong network effect that attracts new developers, new applications, and new users. At the same time, Solanas daily transaction volume, a key indicator, not only highlights its advantages of high throughput and low cost, but also shows that its blockchain technology is very suitable for large-scale application scenarios, such as DEPIN, as well as retail market-related projects such as NFT and meme coins.

In addition to comparing and contrasting these fundamental metrics across assets, investors can also combine this data with market capitalization, or the market’s current valuation of a particular asset. For example, as shown in Figure 1, although Solana’s total locked value ($4.7 billion) is currently higher than Arbitrum’s ($3.2 billion), Arbitrum’s market cap to TVL ratio (1x) is much lower than Solana’s (16x). These metrics provide investors with a way to gain insight into the relative strengths and weaknesses of different assets, while also helping them identify potential value investment opportunities.

The key role of costs

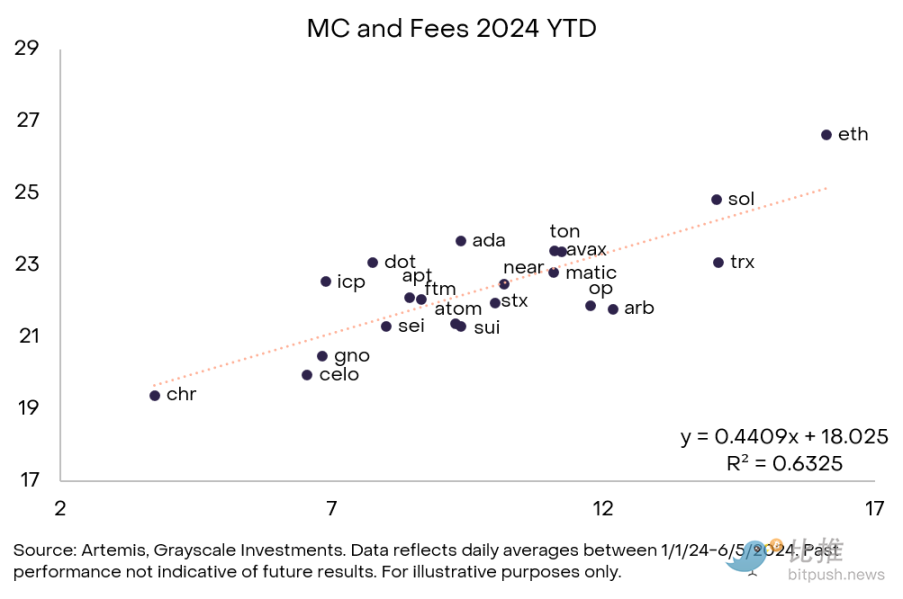

Although there are numerous ways to evaluate platform network activities in theory and in practice, network fee income has undoubtedly become a crucial basic indicator when evaluating the value of smart contract platforms (see Figure 2). This indicator can be understood as the total fee that users need to pay to enjoy network services. Smart contract platforms may have a variety of revenue models, but in the final analysis, they all need to create value for token holders by generating fees.

Similar to the competition between centralized entities in traditional industries, decentralized networks are also competing for fee income in various ways. For example, some smart contract platforms increase fee income by setting relatively high transaction costs, while others try to attract more transaction volume by reducing transaction costs. Both strategies are likely to succeed. Take two hypothetical blockchains as examples:

Example Chain 1: Small number of users and transactions, high cost per transaction

5 users, 10 transactions, $10 per transaction: Network fee revenue = $100

Example Chain 2: Large number of users and transactions, low cost per transaction

100 users, 100 transactions, $1 per transaction: Network fee revenue = $100

This case reveals a phenomenon: even though the number of users and total transaction volume of Chain 2 far exceeds that of Chain 1, the network fee income generated by the two chains is comparable. Of course, indicators such as users and transaction volume are indeed key, but we also need to consider them in conjunction with transaction costs, because this directly determines the level of fee income.

The importance of fee income is clear both from practical experience and theoretical concepts. For example, Figure 2 shows the relationship between the fee income of each component of our smart contract platform in the cryptocurrency industry and its market value (on a logarithmic scale). Although the cryptocurrency market is still in the process of maturing, investors are already able to identify different projects based on fundamental data. Grayscales analysis shows that the relationship between fee income and market value is quite stable and has a higher correlation with market value than other smart contract platform fundamentals.

Grayscale emphasizes that there is a close connection between fees and market capitalization, in part because network fee revenue plays a key role in the value accumulation of tokens. Value accumulation means that the protocol constructs tokens in a way that connects network activity to the long-term sustainable value of the token. We can observe different stages of value accumulation through the following three examples: Ethereum, Solana, and Near.

Ethereum: A proven value-accumulating “high-quality chain”

Ethereum is not only the first smart contract blockchain, but also the one with the highest market value. However, since 2022, it has begun to face severe expansion challenges. With the increase in usage frequency, network congestion has become increasingly prominent, causing users transaction fees to rise sharply: on May 1, 2022, the average network fee per transaction was as high as $200.

Nevertheless, the surge in usage and high average transaction fees have also brought huge value accumulation to Ethereum. In 2023 alone, Ethereums total network fee revenue exceeded $2 billion. Every time a user makes a transaction, the base fee will be burned, which means that this part of the coin will disappear from the network permanently, thereby reducing the total supply. At the same time, the tips paid by users will be used for priority transactions, and these fees will be rewarded to validators and network security maintainers who participate in staking.

Therefore, in 2023, the Ethereum network achieved the burning of 2 million Ethereum tokens (1.7% of the supply) through huge revenue, which not only created value for Ethereum holders, but also brought up to US$390 million in rewards to validators and stakers, thereby incentivizing them to work harder to improve the security of the network.

Ethereum has entered a mature stage and has fully demonstrated its ability to generate value accumulation. On Ethereums mainnet, users are willing to pay a premium for a premium product – in this case, block space supported by a smart contract platform with top network security. This is especially important for applications that involve large transactions and place a high priority on network security, such as stablecoins or tokenized financial assets. As of June 6, 2024, the platforms valuation has reached a staggering $458 billion, almost six times that of any other smart contract platform. This significant advantage undoubtedly highlights its superior ability and market maturity in user monetization.

Solana: Value accumulation in exploration high performance chain

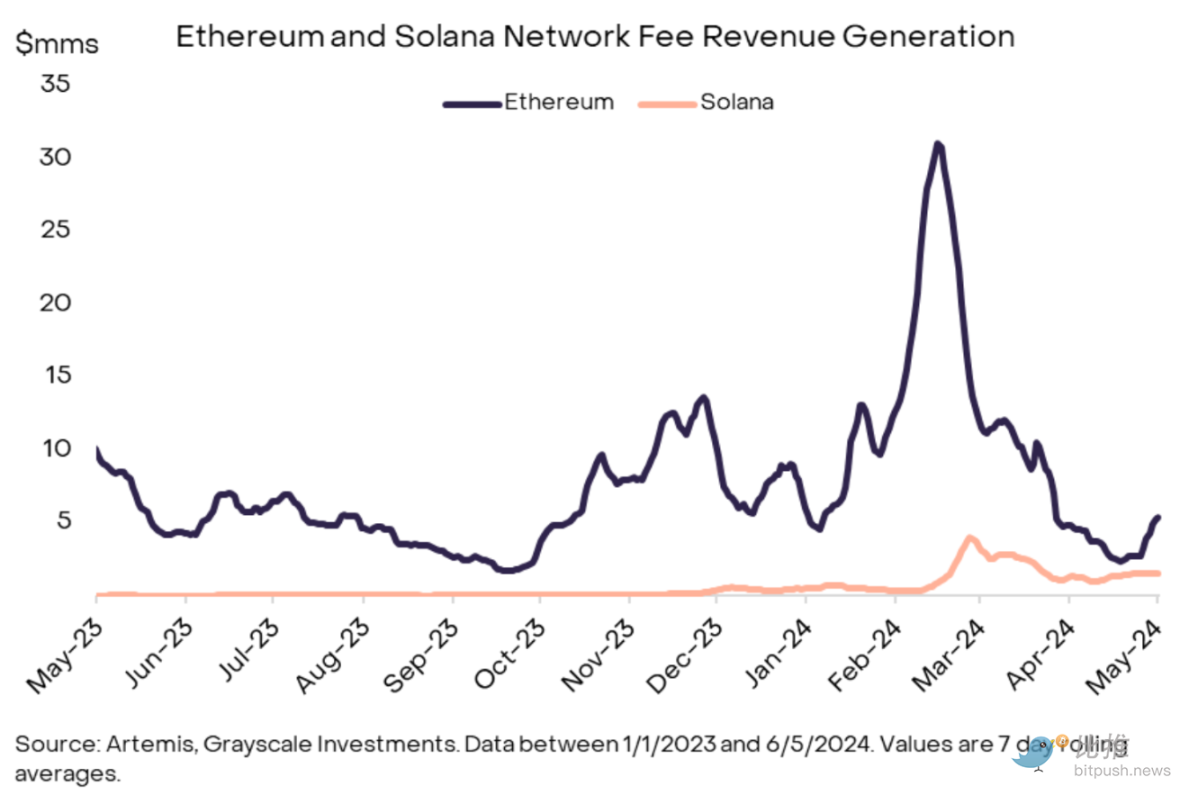

Unlike Ethereums fee revenue model, Solana has chosen a unique path and has gradually narrowed the gap with the market leader in the near term. As the second-largest smart contract platform by market capitalization, Solana has been seen as a faster and more economical alternative to Ethereum, with a speed of 335 transactions per second and an average low cost of only $0.04 per transaction. Although Solana processes far more transactions than Ethereum in 2023, its network fee revenue is only $13 million, compared to Ethereums $2 billion (a difference of 154 times).

In the past, this lack of value accumulation reflected Solana’s relative inadequacy; however, in 2024, this is changing. Solana has already generated six times as many fees so far this year as it did in all of 2023, shrinking the fee gap between Ethereum and Solana from 154x in 2023 to 16x (see Figure 4). This shift suggests that Solana’s model—low transaction costs combined with high throughput—can also create significant economic value.

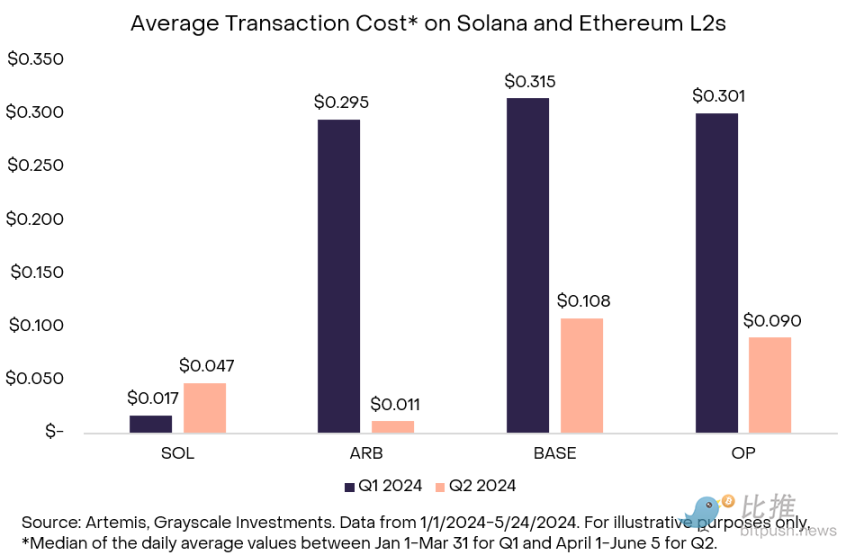

The significant growth in network fee revenue is mainly due to the significant increase in average transaction fees (up 37 times compared to last year), rather than relying solely on the overall increase in transaction volume (up only 33% compared to last year). Interestingly, while Ethereums L2 transaction fees have decreased due to the Ethereum Cancun upgrade, SOL, traditionally known as the cheap choice, has seen an increase in average fees. Since April 1, although the average transaction fee for Solana users ($0.04) is still lower than Ethereum ($4.80), it is higher than L2s Arbitrum ($0.01).

Compared to Ethereums L2 solution Arbitrum, Solanas transaction fees have increased for users, which may have a certain impact on its brand image as a low-cost, high-efficiency chain. However, Grayscale pointed out that from an overall perspective, the increase in fees is still a positive signal. It not only reflects the high activity of users, but also reflects the continued growth of the value of staking participants and token holders.

Near: Leading the way in cryptography, network monetization is emerging

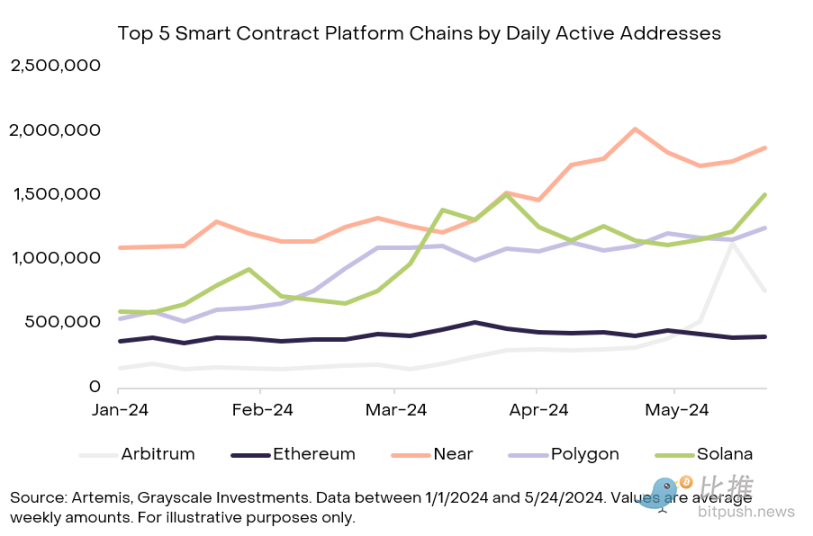

In stark contrast to the two cases mentioned above is Near, a smart contract platform that has recently been widely used in non-speculative application scenarios, but has not yet shown significant performance in terms of value accumulation. Near is the base platform for KaiKai and Hot Protocol, the two decentralized applications (dApps) with the largest user base in the cryptocurrency field. Among all smart contract platforms, Near has performed particularly well, with 1.4 million daily active users and a throughput that can compete with the fastest chains in the industry, such as Solana (see Figure 6).

Despite its significant lead in users, Near has lagged far behind its competitors in monetizing its user base, generating just $4.1 million in fees over the past year. This reflects its relatively immature stage of development, which can also be seen in its market capitalization relative to its competitors ($7.9 billion, compared to Ethereum’s $458 billion and Solana’s $78 billion). While the Near network has demonstrated the ability to process transactions at high speeds, it has not yet created enough value accumulation for token holders or depositors to justify its market capitalization reaching the level of its larger competitors.

Although Near has not achieved significant results in monetization so far, its broad application base is undoubtedly a good start. If the Near network can continue to expand its application scope or increase the average transaction fee without reducing network activity (similar to Solana’s recent progress), it is expected to achieve significant value accumulation.

Ethereum, Solana, and Near, three smart contract platforms, represent different stages of maturity of decentralized networks in terms of network fee revenue. Ethereum has had years of stable revenue and growth. Solana has a solid user base and is just beginning to generate significant revenue. And while Near has shown the appeal of its product, in part due to its low cost, it has not yet achieved substantial revenue.

Fees and valuations: key points and nuances to watch out for

The issue of fees and valuations for smart contract platforms in the cryptocurrency space does contain many key points and subtle differences that need to be carefully considered. The first is that each protocol has its own unique way of accruing value, accompanied by different token issuance rates (inflation) and consumption rates (deflation). For tokens with high inflation rates, the value accumulation effect brought by fees may be significantly reduced due to the large-scale consumption of tokens.

Furthermore, different protocols set their own fee structures. Taking Ethereum as an example, its transaction fees not only contribute to the destruction of tokens, thereby indirectly benefiting all token holders, but also the priority fees are distributed to validators and stakers. In contrast, Solanas fee distribution mechanism is different: 50% of the transaction fees are burned and destroyed, and the remaining 50% belongs to the stakers. Recently, a vote decided that Solanas priority fees will be 100% attributed to the validators. This strategy reflects Solanas higher requirements for validator hardware to a certain extent.

It is worth noting that the high level of MEV (Miner Extractable Value) activity on Solana brings additional rewards to validators and market makers, but this reward may constitute an indirect cost for token holders. Therefore, from a certain perspective, Ethereums fee structure seems to provide more value back to ordinary token holders, while in Solanas system, validators and market makers may receive more generous rewards.

Similar to how valuations of traditional assets often discount future cash flows back to the present, valuations of crypto assets may involve discounting expected future network fee revenues back to the present. This approach considers the potential growth in adoption, usage, or monetization of a particular network in a different way than the overall fee generation today. For example, it is reasonable to assume that Ethereum’s $458 billion valuation is not based solely on the fees it generates today, but also takes into account its ability to leverage network effects and the potential for future growth in adoption, usage, and fee revenues of second-layer technologies.

Additionally, the valuation of some crypto assets may also include a “monetary premium” component. In other words, users may be willing to hold an asset because it functions as a monetary medium — a medium of exchange or a store of value — and this value often exceeds the network’s ability to generate fee income. For Ethereum in particular, the concept of a “monetary premium” is particularly important when considering its valuation, especially when the token is widely used as a collateral asset across the industry.

in conclusion

If the value accumulation mechanism is properly implemented in the protocol, the growth of network usage will not only incentivize users to hold tokens, prompting them to withdraw from circulation and potentially increase the value of tokens, but will also further encourage users to become validators or holders, thereby improving the security of the network. In addition to contributing to network security, the collection of fees can also incentivize more validators to participate in the project, thereby increasing the decentralization and censorship resistance of the network. Therefore, value accumulation is like a flywheel, closely linking fees, network usage and token valuation, as well as the security and decentralization of the network.

We need to recognize that while fees can be used as an indicator of network maturity, there are many other factors in this flywheel that can affect the growth of the network and its valuation. For example, when an applications adoption rate increases, it attracts more users to join, which in turn attracts more developers to develop in the same ecosystem. Therefore, when evaluating network fees, we should consider them in conjunction with other fundamental indicators and the relative valuation (market cap) of a specific ecosystem.

Looking ahead, it will be critical to continue monitoring the developments of these growth myths. Despite relatively high average transaction costs for users (at $4.8), can Ethereum further increase its fee income on the mainnet through high-value transaction scenarios such as tokenized financial assets? Will Ethereums fee income grow with the increasing frequency of L2 activity? And how will Solana find a balance between monetization and keeping the cost of on-chain low to prevent users from switching to other low-cost, high-throughput competitors? Will Near attempt to monetize, or will it choose to continue to forgo meaningful revenue opportunities in order to prioritize the expansion of its user base?

These dynamic changes emphasize the importance of continuous monitoring of key indicators such as fees, transaction volume, active users, and total locked value (TVL). Grayscale firmly believes that as the crypto asset class matures and its adoption continues to grow, the importance of these core indicators will become increasingly significant. They can more deeply reflect the relative advantages and opportunities of smart contract platforms, help investors understand the value of the network more carefully, and thus provide them with more informed decision support.

This article is sourced from the internet: Grayscale Research Report: In the battle for smart contracts, who will lead in fees and growth?

Related: UXLINK: The “elephant in the room” in the social track?

Original|Odaily Planet Daily Author: Wenser On May 13, Web3 social infrastructure project UXLINK officially announced a new round of financing , led by SevenX Ventures, INCE Capital and HashKey Capital, with a financing amount of over 5 million US dollars. It is worth mentioning that this round of financing is less than 3 months away from UXLINKs previous round of financing. So far, the project has raised a total of over 15 million US dollars, covering many first-line institutions and well-known angel investors from Europe, America, Asia and the Middle East. At a time when mainstream applications in the Web3 social track are targeting assets with strong financial attributes and influence speculation, UXLINK is doing the opposite, striving to open up a completely different Web3 social path from acquaintance social…