Detailed explanation of Sun Ges arbitrage method: 33,000 ETH to buy PT tokens and enjoy a return rate of nearly 20%

Original author: DaFi Weaver, BlockTempo

On the 4th, Justin Sun, the founder of TRON, made a large purchase of Pendle PT tokens, enjoying a low-risk arbitrage operation with an annualized return rate of nearly 20%, which became the focus of community attention. This article will explain where the benefits of this wave of operations come from, explore the related risks, and provide risk avoidance strategies for readers reference.

Sun Ge Arbitrage Method

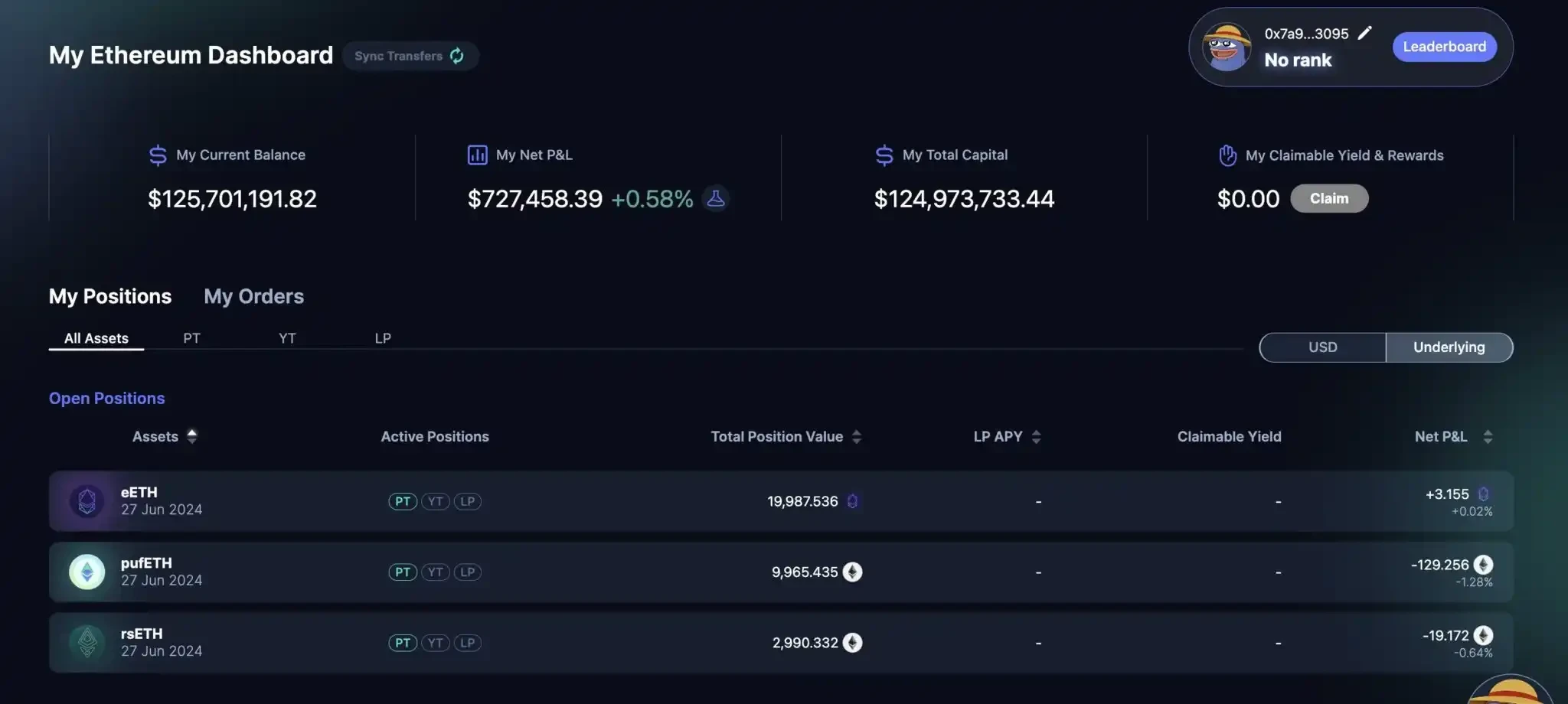

First, according to on-chain analysts Yu Jin and Aunt Ai, who monitor on-chain addresses, Brother Sun’s operations over the past two days are as follows (the following figure shows Brother Sun’s position in Pendle):

A total of 3,3000 ETH were invested in Ethereum re-staking projects that expired on June 27, namely:

-

Ether.fi: 20,000 ETH buy 20,208.93 PT-weETH;

-

Puffer: 10,000 ETH buy 10,114.11 PT-pufETH;

-

Kelp: 3,000 ETH Buy 3,025.91 PT-rsETH

Sun Ges position in Pendle|Source: Ai Aunt

Taking Ether.fi as an example, this means that if Sun holds it until maturity, he can redeem weETH equivalent to 20,208.93 ETH (note: this is not equivalent to 20,208.93 weETH, the exchange rate between weETH and ETH is not 1:1, as shown below), and how much ETH weETH can be exchanged for depends on market conditions. For simple calculations here, assuming that the exchange rate between weETH and ETH is 1:1, so if Sun holds it until maturity, he can earn a 1% return rate in 22 days, which is 17.33% annualized.

By analogy, Puffers annualized return on investment is 18.93%; Kelps is 14.33%. The total annualized return on investment is as high as 17.54%.

Pendle Chinese Community Ambassador ViNc described that Pendles PT is like a short-term debt on the chain, which has the characteristics of good liquidity, close to cash value when redeemed (if viewed in ETH), short duration, and good risk-reward ratio. So, where does the income of PT come from? This requires understanding the basic operation of the Pendle protocol.

The exchange rate between weETH and ETH is not 1:1 |Source: 1inch PT income source

Pendle is a permissionless yield-trading protocol that packages yield-bearing tokens into standardized yield tokens (SY, such as weETH → SY-weETH, this packaged version is to be compatible with Pendle AMM), and splits SY into two parts: PT (principal token) and YT (yield token).

PT represents the principal portion of the interest-bearing token before its maturity date, while the right to earn income during this period is represented by YT and sold to other buyers. Since the monetary value of YT is separated, the principal portion (ie PT) can be sold at a lower price.

There are three main ways to participate in Pendle:

-

Buy PT: PT allows holders to redeem the underlying asset after maturity and can be sold at any time. For example, 1 PT-weETH purchased at 0.9 ETH at the beginning of the period can be redeemed for weETH equivalent to 1 ETH after the maturity date. The 11% appreciation between 0.9 ETH → 1.0 ETH is Pendles fixed yield strategy. And this is the strategy adopted by Sun Ge.

-

Buy YT: allows the holder to obtain all the income and airdrop points generated by the underlying asset before the expiration date, and can also be sold at any time. For example, holding 1 YT-weETH means having the right to receive all the income and points generated by 1 weETH until the expiration date.

-

As a liquidity provider (LP): LPs income includes: PT income + SY income + ($PENDLE emission + pool transaction fee).

Ways to avoid price risk: borrowing and short selling

With such an impressive rate of return, the risks of using Pendle are mainly smart contract risks, human risks in operations, and price risks (in terms of U standard. If viewed in terms of currency standard, the strategy of purchasing PT is a sure win).

To further avoid price risk, that is, the loss caused by price falling, you can try to open a short contract on the exchange as a response, but this requires considering the risk of liquidation and funding rate. If everything goes well, you can get a fixed income. For example:

If you buy 1 ETH at $3,800, you can exchange it for 1.01 PT eETH on the Ether.fi market that expires on June 27, which means you can get a net profit of about 0.01 ETH after expiration.

But in order to avoid the decline in ETH prices, a short order worth 1 ETH was opened on the exchange. After the expiration, the short order and 1 ETH were closed and sold at the same time. In this way, in addition to recovering the cost of US$3,800, a stable income of 0.01 ETH was also obtained.

Another method is to quote Alvins capital preservation strategy (this strategy was recently forwarded by Pendle official), and try to borrow money to buy PT. Taking the same example, the method is as follows:

1. Borrow 1 ETH on CEX/DEX

2. Use the borrowed ETH to buy 1.01 PT eETH

3. Redeem eETH worth 1.01 ETH upon maturity and repay 1 ETH

4. The remaining ETH is the stable income, estimated to be about 0.01 ETH. As explained above, this depends on the market conditions of eETH and ETH.

This strategy needs to consider whether the stable income can exceed the borrowing cost, otherwise there may still be losses.

This article is sourced from the internet: Detailed explanation of Sun Ges arbitrage method: 33,000 ETH to buy PT tokens and enjoy a return rate of nearly 20%

Related: What do you think of Starknet announcement to enter the Bitcoin Layer2 field?

Original author: Haotian In short: 1) The prerequisite for Starknet to expand Bitcoin is that the OP_CAT proposal is passed first, which is uncertain; 2) Starknets entry into BTC layer 2 may break the embarrassing situation that BTCs ecosystem is bright in the east and not in the west; 3) The trend of layer 2 tending to layer 1 is strengthening. Will high performance become the differentiated advantage of Starknet? Next, let me talk about my opinion: 1) OP_CAT can realize the combined link processing of multiple UTXO unlocking Script byte strings, thereby greatly improving the programmability of the BTC main network. OP_CAT allows script fragments to be combined, and STARK proof is a very simple and efficient way of computational verification. With the foundation of OP_CAT, Starknet naturally has…