Original author: Joyce, Sky

Three months ago, in the first phase of io.nets points incentive activity that started on March 1, io.net founder and CEO Ahmad Shadid said in a press release interview that the token is expected to be launched on April 28. Even though io.nets GPU supply surged in the following month, io.net CMO Garrison said in an interview in early April that io.net is still releasing tokens as planned, coinciding with Nvidias financial report release, which will be an appropriate time.

But on April 25, the io.net team announced in the telegram group that the trading platform required the TGE of io.net tokens to be postponed to after April 28. Now a month has passed since the original time, and the time for io.net to issue tokens has not yet been determined. But after the snapshot, the community seems to no longer care about io.net.

Since the start of the mining incentive plan, io.net has undergone tremendous changes in the past three months. First, it became popular and was regarded as a star project in this round of bull market. Then, the project data was repeatedly questioned for fraud, and the founder was exposed for his black history. A large number of users set up rights protection groups to denounce io.net. Although the token has not yet been launched, many users believe that the high return expectations have been dashed, but generally speaking, io.net is a good project.

After all, everyone knows that outside of io.net, the market has shifted. Ten days ago, amid the communitys dissatisfaction with high FDV projects, Binance announced a revision of its listing rules, saying it would start supporting small and medium-sized crypto projects, aiming to provide opportunities for more small and medium-sized projects with good fundamentals, organic community foundations, sustainable business models and industry responsibility, so as to promote the development of the blockchain ecosystem. And just today, one month after postponing the coin issuance, io.net announced that the third mining activity will start on June 1.

Overwhelming traffic

Looking back, the explosion of io.net two months ago was inevitable. Since February, AI has become the recognized wealth code in the crypto community. Nvidias stock continues to hit new highs, OpenAI launches revolutionary new products, and WLD has increased several times in a few days. The growth of a number of AI tokens has outperformed most track tokens.

Retail investors who are fully equipped and queuing to enter the market

According to the development of previous stories, some new AI projects should be launched in this round, and the lucky early community users will benefit a hundredfold. Adhering to the concept of buy new, not old, among all AI projects, io.net is the one that looks the most reliable.

Generally speaking, the community generally divides the combination path of AI and Web3 into three sub-directions: computing power, algorithms, and data. Two months ago, many new AI projects emerged, among which GPU leasing was the most popular positioning among all projects. The reason is that, at the popular science level, most retail investors find it difficult to understand the positioning and development space of similar projects in terms of the combination of AI models, applications and encryption technology. The continuous rise of Nvidia has made everyone realize the necessity of computing power, and the direction chosen by io.net has a natural advantage in user perception compared to other projects.

In essence, all the decentralized computing power projects that have emerged now belong to the category of Depin, and the Depin project on Solana has experienced a hot market last year. The combination of AI, Solana, and Depin has made io.net a chosen project. In addition to the good track selection, io.net also had in-depth cooperation with Render Network in the early days. At that time, RNDR was in an upward cycle, rising from less than $4 to $13 in two months.

In February and March, there were hardly any KOLs promoting io.net on social media. However, since io.net launched the two-month Ignitio.net points reward program on March 1 and directly announced the token launch date – April 28, a large number of users have flocked to io.net. An early user of io.net told BlockBeats about his observation that the number of discord community members has increased tenfold in a week.

On March 5, io.net announced that it had completed a $30 million Series A financing led by Hack VC, with other investors including Multicoin Capital, 6th Man Ventures, Solana Ventures, OKX Ventures, Aptos Labs, Delphi Digital, The Sandbox, etc. Among them, Multicoin Capital had a brilliant record in the Depin field and participated in the early financing of Helium Mobile (MOBILE). In addition, individual investors include Solana co-founder and CEO Anatoly Yakovenko, Sandbox co-founder and COO Sebastien Borget, and Animoca co-founder and executive chairman Yat Siu.

With the support of powerful VC, in the io.net project, how to overcome the technical difficulties in the process of realizing decentralized computing power and whether there is a suitable and sufficient demand side to pay users and platforms are not within the scope of consideration of the participants. From the users perspective, I am not afraid of whether you can land or not, I just look at how well you tell the story.

The technical participation threshold of io.net is not low. BlockBeats observed that at the beginning of the activity, there were bug feedbacks everywhere in discord, and the project team specially opened a channel support ticket to receive and handle user-submitted questions. An early user who participated in io.net once told BlockBeats that the high participation threshold was also one of the reasons why he was optimistic about io.net, which meant that no risk would result in more chips. But what the community did not expect was that various io.net mining tutorials later became popular all over the Internet.

io.net user Zhu Rui (pseudonym) described his experience in detail to BlockBeats. During his first attempt, Zhu Rui gave up after finding that his device did not meet the requirements listed on the official website. But then he found that more and more people around him were digging io.net, and many people showed off multiple Mac minis. I have a friend… He has a lot of Mac minis… I dont know what to use…

Perhaps out of precaution against LuMao Studio, io.net did not publish the points details, only stating that the points will be related to multiple factors such as machine online time, bandwidth score, GPU performance and equipment rental time. In addition to contributing your own equipment, participation in galactic missions and Discord activity will also bring varying points, but more users choose to buy more equipment on their own and enter the game fully armed.

Not wanting to miss out, Zhu Rui began to consider entering the market. He studied the configuration plans circulating in the community in detail, and first considered buying a Mac mini directly. This strategy is suitable for players with a small number of graphics cards, because it is very troublesome to configure more than 100 graphics cards, and special people are needed to maintain them in special venues. Just like a mining factory, it is a heavy asset. But there are also advantages. After use, you can sell it second-hand at half the price, or switch to mining other projects. When researching, he speculated that perhaps there was a trend of volume in this direction. Earlier, the price of buying a Mac mini on Pinduoduo was 2,100 (RMB), and two weeks later it was 2,800.

In addition to purchasing Mac Mini, some users choose to rent cloud servers. There are domestic and foreign ones. Domestic ones are generally in some computing centers, the cost is cheap, and there are channels. A single 3080 Ti card is about 150 U-200 U. The cost overseas is higher. The price of a single card in Google Cloud is about 1400 U per month, and it requires an annual lease, requiring more than 50 cards; Tencent Cloud is often out of stock and has no inventory; the price of a single card in AWS is about 2400 U per month, requiring more than 8 cards.

Zhu Rui finally chose the premium account route. He bought more than 200 T4 single cards from a small foreign cloud service provider, renting each card for 400 U per month. In addition, he also equipped 15 a1008 cards, renting each card for 1200 U per month. In one month, Zhu Rui had to pay about $98,000 for equipment alone.

In addition to the equipment costs, Zhu Rui also made sufficient preparations for anti-witch detection. He purchased hundreds of IP addresses, manually modified the 100 Google email passwords he bought, and spent a week running all the equipment.

Zhu Rui is one of the larger io.net users. For small and medium-sized retail investors, after successfully entering the market with their equipment, they will still face many challenges.

An io.net user recalled to BlockBeats that after going through the complicated configuration process, users still need to deal with a series of problems. Devices connected to io.net often disconnect, and it is difficult for users to tell whether their devices are online. It is possible that your front-end shows that the device is online, but the back-end is actually offline. We have no choice but to write a script that automatically restarts the disconnection every day to deal with this problem.

In addition to spending a lot of money, io.net users also need to constantly check the operation of their devices. For those who are not able to write scripts, they can only reconfigure manually. In a configuration tutorial on Youtube with more than 10,000 views, the airdrop blogger was also at a loss for this problem. If you cant see the device operation status on the official page after completing these configurations, I suggest you go through the whole process again.

The high maintenance cost is actually in the io.net settings. The official explanation is that the purpose of repeatedly asking users to reconfigure is to filter out witch accounts. In the later stages of the activity, this frequency has been greatly reduced. This was also interpreted as a positive signal by some users at the time. After all, the bigger the storm, the more expensive the fish. For battle-hardened Web3 players, as long as the rewards in the later stages are sufficient, the early physical and mental investment is worth it.

Cloud service providers are all digging into io.net

The popularity of io.net has not diminished despite users’ complaints about high maintenance costs. The title of a video posted by YouTube blogger “Alex’s Crypto Diary” two months ago may be the most appropriate explanation of the situation at the time: “[io.net] The most reliable combination of computing power and encryption in the AI X Crypto track. Two weeks ago, we planned to use 600 machines to mine io.net, but our dream of a computer room was shattered two weeks later! But this is undoubtedly the best project in the same field before the release of Gensyn.”

In the video, blogger Alex explained the reason for the broken computer room dream. The original plan was to deploy 800 devices, and the estimated capacity could account for about 1%-2% of the entire network. After finding a computer room overseas, io.net became popular during the price negotiation. All overseas cloud service providers that had been contacted before asked them to confirm whether they were digging for io.net. The computer rooms that had originally agreed on pricing also doubled their quotes.

io.net has gone viral, and domestic and foreign cloud service providers who are raising their prices may be the biggest winners in this wave of popularity.

At present, there is no channel to calculate the specific profit figures of cloud service providers in this wave of fortune brought by io.net. Alex once said in a tweet that Amazon Cloud, a leading foreign cloud service provider, has generated a total of 40 million US dollars in revenue from providing io.net mining services. Although there are more doubts about this number in the comment area, if calculated according to the number of hundreds of thousands of GPUs displayed on the io.net front end at that time, this number may not be exaggerated.

Not only overseas cloud service providers benefited, many users interviewed by BlockBeats expressed the same understanding: All domestic cloud service providers are digging into io.net.

Xiaoju (pseudonym), a cloud server manufacturer with computer room resources and not accepting retail investors, revealed to BlockBeats, Looking back now, renting machines from io.net is the easiest business I have ever done. When asked about the specific rental scale, Xiaoju said, As long as you have enough machine resources, it is easy to rent out machines worth millions a month, tens of millions is not difficult, and hundreds of millions can be rented with some effort. All the machines in various domestic and overseas clouds are sold out, and almost all the computer rooms in China have been rented out. At that time, all the machine vendors in the market raised the price. It was up to you to rent or not. Anyway, if you didnt rent, someone else would rent it soon.

In addition, since the devices supported by io.net also include Apples Mac mini, those who took advantage of the airdrops bought all the Mac minis worth tens of billions on Pinduoduo and increased the price by several hundred yuan, and the Mac minis on Xianyu also increased their prices by several hundred yuan.

Even in April, when the first phase of io.nets incentive campaign was already halfway through, users continued to try to buy more equipment. Xiaoju recalled, I stopped renting machines after April, but many people still came to me to rent. I always told them that renting for a month was not cost-effective, and that they would basically get their money back if they rented. Dont do it, its too tempting.

Misaligned expectations

Judging from the past stories in the crypto industry, users who invested in io.net have all used the right formula. If faced with the risk of being repaid, it is inevitable that there will be many emotions. However, for a Web3 project, the io.net project itself has not done too much evil, constantly improving the interactive experience, and responding to disputes in a relatively fast time. But various problems have indeed occurred, and in the past three months, io.net has often faced embarrassing situations.

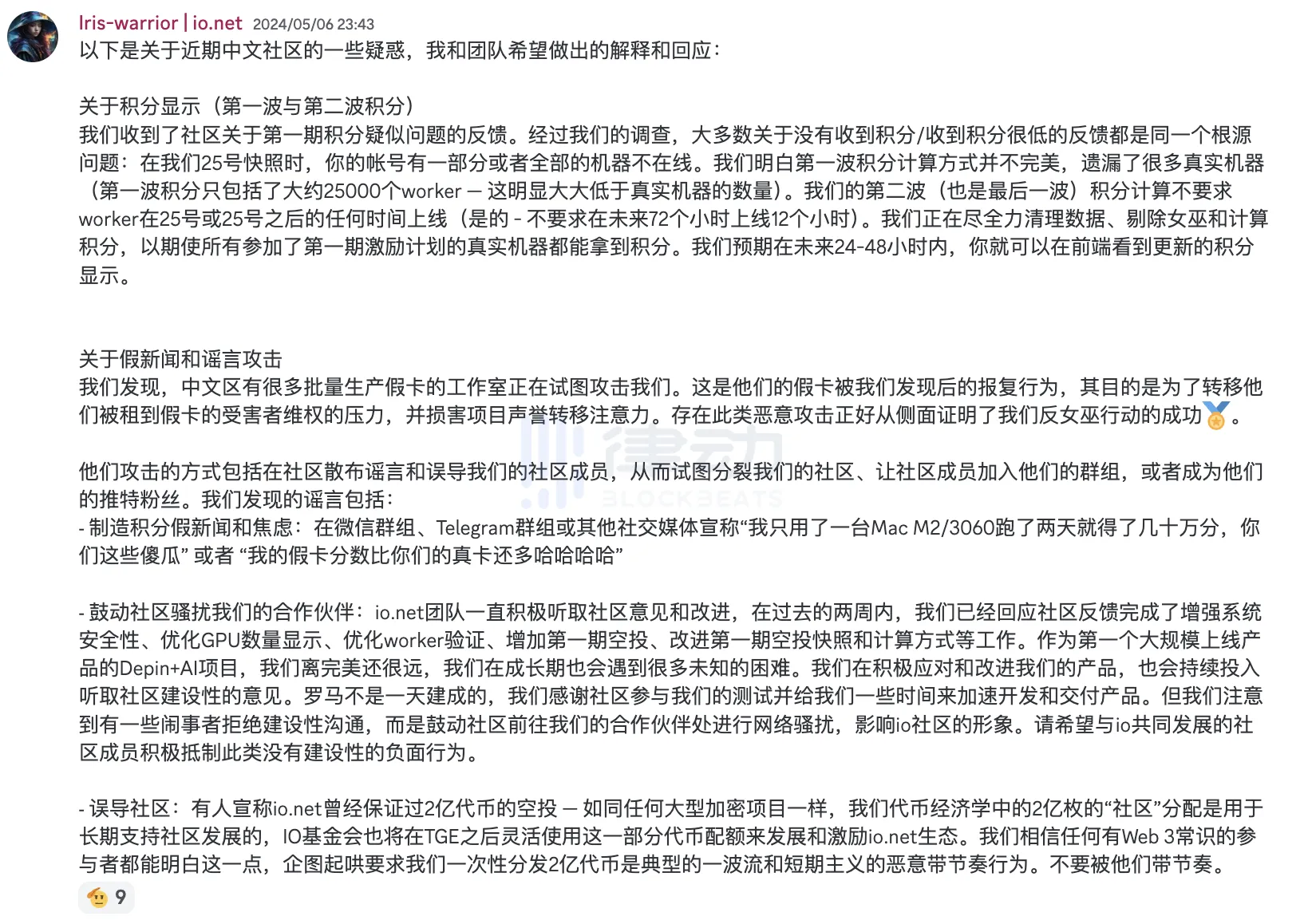

After the first round of points were announced, many users received very low points because their machines were not online during the snapshot period. Some rights protection actions against the io.net project began to appear in the community. Zhu Rui recalled that on May 3, someone on Twitter launched a space called io.net Criticism Conference. More than 1,000 users participated without any preheating, and the WeChat group was full of rights protection information.

Unable to calculate the points

Unlike other projects with open points, io.net did not seem to have any intention to release a points panel from the beginning. BlockBeats asked a user close to the io.net project team in early March about the problem of displaying statistical points on the front end. He speculated that it may be due to lack of manpower. If there is a chance, I will propose it to them.

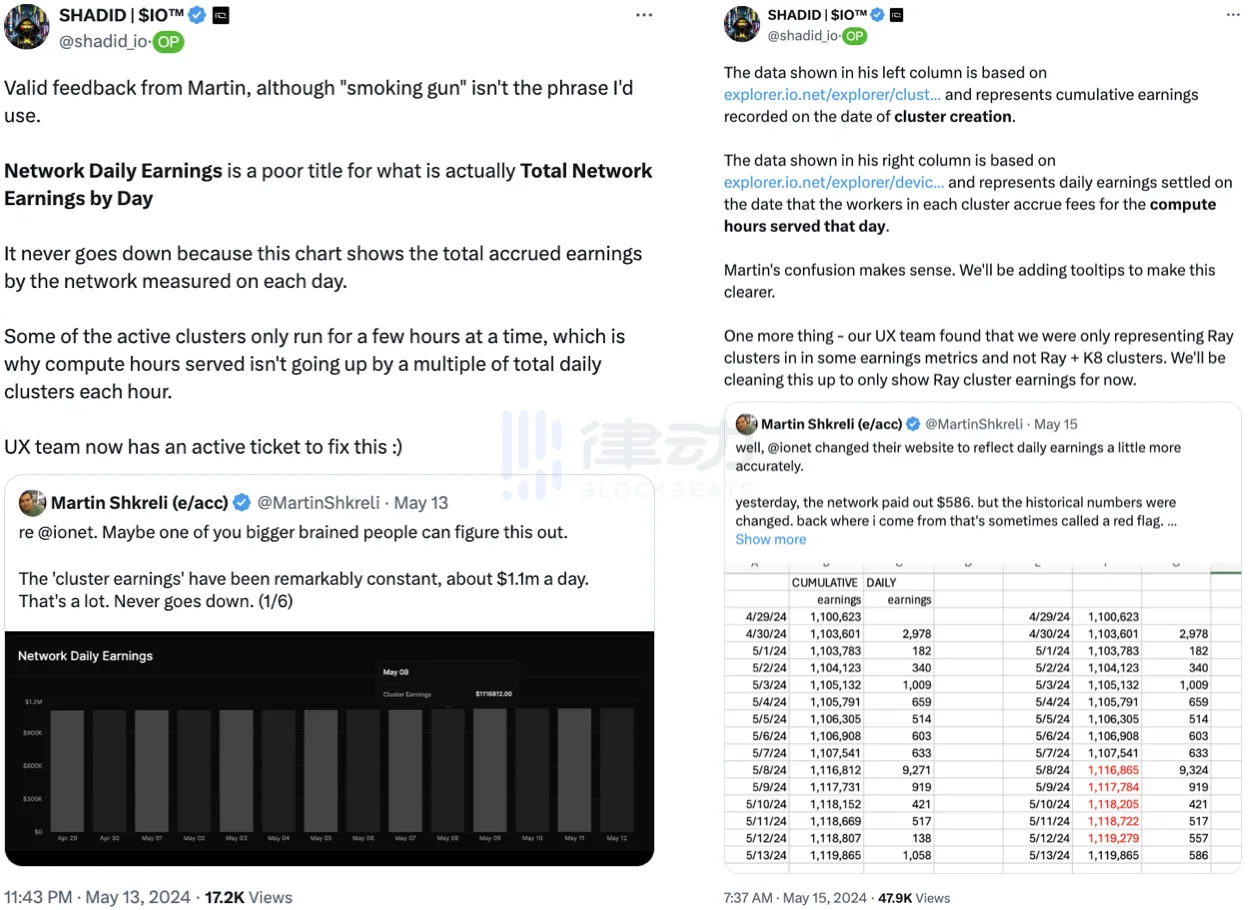

In the two months since the launch of the io.net points program, there have been constant voices questioning the number of GPUs displayed on the io.net platform. The most notable one was the question raised by community member Martin Shkreli on May 13, who posted several tweets on the accuracy of the data displayed on the io.net front end and received a personal response from io.net founder Shadid.

In his tweet, he believed that the revenue displayed by the platform did not match the actual situation. For example, he found that the daily revenue of the platform was 1.1 million US dollars, the number of online clusters was very small, and the total computing time on the platform was always displayed as 88 hours. After getting Shadids explanation, Martin Shkreli released his calculation of the specific daily revenue indicators. Shadids response mainly revolved around the errors in the statistical indicators, such as the difference between the average daily revenue and the cumulative revenue, and the fact that the revenue did not calculate the clusters of other specifications.

Pima, founder of ContinueCapital, pointed out two months ago that several decentralized AI projects currently call each others ports and share computing power. An early anonymous user of io.net also explained to BlockBeats that the equipment provided by users on io.net may be rented on Render Network, and vice versa. In early April, the io.net front-end showed that the number of available GPUs online was 200,000, while the number of available GPUs on Render Network was around 3,700.

In this case, calculating the points clearly may be a test of technical ability. Investment institution Mint Ventures once mentioned in its analysis of io.net that there are problems that need to be solved to achieve decentralized computing power, including engineering verification problems, parallelization problems and privacy protection problems. Among them, the parallelization problem involves more technical obstacles, including considering the decomposition of AI tasks, data transmission and communication costs between devices.

Objectively speaking, some users were indeed deceived by witches because they bought fake card sharding machines. Xiaoju told BlockBeats, At that time, the rental market was very chaotic. In theory, the market was in short supply of machine resources, but there were many machine dealers who would give you as many as you wanted. This was actually selling virtual machines to you as real machines. For example, they could use a 4090 to virtualize unlimited cards, and the merchants could make money at zero cost. This kind of machine was easily identified and was not sharded by witches.

In response to the network-wide crusade, the io.net team issued a long article in discord. They said they would conduct a second round of point calculations to eliminate witches and retain real users. In addition to the point dispute, the team also said that the community is facing fake news and rumor attacks and pointed out that the fake card studio is behind it.

Regarding the data pollution caused by fake cards, different io.net users responded to BlockBeats and said that it has been there for a long time. Two months before io.net announced the points, I knew that a group of people were making a lot of fake cards. I went to DC to report it, but no one paid attention to me. I also often saw other people reporting this problem, but it didnt attract the attention of the officials. It wasnt until they started calculating the points that they said they would start identifying fake machines, but it was too late, Xiaoju told BlockBeats.

ImbaTrader also recalled, In the early days, there were only a few thousand people in Discord. At that time, someone who claimed to be a student from a certain university in the United States questioned whether the number of GPU devices displayed on the io.net front end was fake, but no one responded to this matter.

On the other hand, the vague points do leave enough room for the io.net project team to adjust the chip allocation according to the situation. When too much became the keyword for topics related to io.net, community members generally reflected the situation of large accounts receiving low security in the final points amount. Small accounts (one or two machines) have more points than my large accounts with more than a dozen high-end graphics cards. From observation, small accounts of the io.net project generally have higher points, while large accounts with more equipment have lower points. It seems like they are killing large accounts and supporting retail accounts. After the second points update, some users found that their points had tripled.

However, no matter how the points are distributed, the total amount of tokens distributed to miners remains unchanged at 32 million tokens. Among these mining equipment, the io.net project seems to have accounted for a large part.

A user told BlockBeats in early March, I think many of the A 100s in there may be the projects machines. However, considering that the device records are not on the chain, the community also questioned the possibility that io.net has falsified front-end data.

In a video released in April, YouTube blogger Alex Encrypted Diary said that the number of GPU devices on the io.net front end was between 60,000 and 80,000, but suddenly increased to 140,000 to 150,000 one night. He found that the number of GPU devices displayed on the front end would increase by thousands every half an hour, and the number of 4070s that had not been there before suddenly increased by more than 20,000. Considering that the online status of devices from real users is not stable, it is hard not to suspect that the linear growth figures are from the project side.

A few days ago, Asa, the head of io.net in Asia, attended a space. In response to the inconsistency of front-end and back-end data and the centralization of device data records raised by community users, Asa said, The decentralized technology stack is an improvement that will be implemented in the future. The workload of our technical team in the past month is the same as that of the past three months.

The three features of strict anti-witch measures, delayed launch of fake card identification, and opaque points have invisibly raised the participation cost of real users who want to interact properly. In addition to economic costs such as traffic and electricity, it not only PUAs you to hang on for a long time, but also does not tell you the actual points, so everyone has to pay a lot of energy, and the backlash will be so big afterwards. Faced with the rights protection action initiated by the io.net community before the coin was issued, user Liu analyzed to BlockBeats.

A tough bargaining chip

User Xiaoju feels deeply touched. For me personally, losing money on io.net is a small matter. io.net is the most torturous project I have ever worked on. At that time, it was offline several times a day. After all the machines were offline, the maintenance took several hours. After the maintenance was completed, it was offline again. In short, io.net was the most torturous project I have ever worked on. The shadow of blockchain.

From the perspective of the project, the high maintenance threshold that has been complained about is actually due to the management of low-quality nodes. In a podcast interview, Garrison Yang, COO of io.net, specifically introduced the management of low-quality nodes when mentioning the airdrop session, We introduced time score and reputation score. Each node on io.net has a reputation score, and customers see the time a node remains available, the time it is online, and other performance indicators to help make decisions. We will constantly ping each node, and if a node does not respond, it is considered unavailable. If it is unavailable, it will not receive a reward.

In the teams vision, the crypto-economic incentives are straightforward: if a node is available, it provides better service to the demand side and is hired more frequently, earning more rewards. As long as the node maintains availability and performance when hired, the demand side will get the required computing power, a win-win situation. Although this setting later contributed to one of the controversies faced by io.net.

According to the valuation, token share, total points and OTC price estimates, except for early users, most users feel that they will not make much profit on io.net. One month before the announcement of the airdrop points for this project, I roughly knew that I would reverse my investment because the airdrop is limited, but the machine is unlimited. Based on the ratio of the OTC price and my estimate, in the worst case scenario, I will lose about half, and in the best case, I will at most break even.

However, despite this, Xiaoju believes that the problem of the project lies in the technical loopholes that have appeared, rather than intentional evil. The machines are all rented, and io.net has never charged retail investors a penny. Not only Xiaoju, but also early users and large participants interviewed by BlockBeats have expressed their continued optimism about io.net to varying degrees. Alex said in the video, Although I dont recommend participating again, I still think io.net is a good project worth paying attention to.

Although we were also counter-paid, my money was not paid to io.net. First of all, everyone needs to understand this issue. Alex explained in an interview with BlockBeats, Generally speaking, when you interact with a project, the money you invested is taken away by the project party, and the project party will then decide how to distribute the chips in their hands. But the problem with io.net is that in the process it set up, there are only retail investors and project parties, but in fact, there are cloud service providers, retail investors and project parties. Retail investors paid the money to cloud service providers, and cloud service providers did not pay the money to io.net, so io.net paid salary costs, operating costs and everyones constantly rising expectations from beginning to end.

A VC member who participated in the investment process of io.net told BlockBeats that they were looking for AI projects at the time, and the Partner Fund introduced the io.net project. It took about one and a half months from contacting io.net to deciding to invest. Its early performance was relatively strong, including various technical documents and cooperation with Render. Among the targets that were looked at at the time, io.net was a relatively good target. But at the time, io.nets valuation was relatively expensive, with a price of 300 million US dollars, so it was not decided immediately until the valuation of the secondary market rose later, and this valuation became a suitable valuation.

The investor told BlockBeats that the psychological expectation of io.nets return ratio was far from the actual situation. It was originally expected that after listing, the overall environment would be better, and FDV could reach 5 billion US dollars, and it was expected that there would be more than 10 times the profit margin. In addition, people familiar with the matter told BlockBeats that some investors had already connected their own computing power equipment to io.net in the early days, participating in mining at a lower cost.

Regarding the various situations that occurred later, There is actually no way to control this aspect, and we can only observe the development in the later stage. The investor said. Technical shortcomings and investor scandals will not constitute reasons for withdrawal.

Where is PMF?

The time for io.net to issue the coin has not yet been determined. Although they no longer expect a high rate of return, Zhu Rui and most users still believe that io.net itself is a good project. In the crypto industry, product logic is not very important. If we follow the idea of fud io.net to fud other crypto products, how many products can be thoroughly investigated? Zhu Rui told BlockBeats, io.net also sorted out its product structure after being fud this time. I think it is a good thing. Now that the market is recovering, it is better to postpone the coin issuance than to issue it in the bear market a month ago.

The concept of decentralization and asset ownership, which has only been around for more than a decade, meets the evolving AI revolution. Under the understanding that AI represents productivity and Web3 represents production relations, no one can deny the huge imagination space created by the collision of the two. From VCs to retail investors, everyone has high expectations for the development of the AI concept.

But objectively speaking, as the hot narrative of this round of bull market, the source of Web3 xAIs charm comes from the explosive innovation of AI productivity outside the crypto community. Compared with previous years DeFi, Gamefi and other project categories with strong crypto characteristics and traceable valuation models, the AI track is completely different. In the research and analysis of major investment research institutions, this direction seems to still remain at the stage of elaborating imagination space and classifying existing projects.

ImbaTrader, an early user of io, told BlockBeats, “I think the reason why the narrative expectations for io.net are so high is probably not because the io.net project itself is so good, but because the web3 market is too eager for this narrative.

All Web3 projects will encounter doubts about their technical level and product logic. The real problem that io.net needs to solve is that in the communitys reputation, io seems to have changed from a top narrative this year project to a VC-based high FDV project.

However, the AI narrative still has undoubted vitality. In an environment where computing power is becoming increasingly tight, as io.net continues to polish its products, it still has obvious scale and funding advantages in decentralized computing power. For AI projects, there is already a huge demand for funding scale, and it is somewhat one-sided to deny the development of the project simply because of high FDV.

In the Web3 world, how to control the hot trend is a question that every project needs to think about. Whether it is embracing the bubble or looking for the sword on the boat, only time can give the answer.

This article is sourced from the internet: io.net has gone viral. Who is paying for AI narrative?

Related: ArkStream Capital: 2024 Q1 Investments and Updates

Investment Project Summary ArkStream Capital has invested in a total of 6 projects in the first quarter of 2024. We will publish project details and explain why we invested in these projects. Project Introduction XION is the first modular universal abstraction layer, purpose-built to enable a seamless user experience for the average user to promote consumer adoption. XIONs universal abstraction layer includes multiple protocol-level abstractions such as accounts, signatures, gas, interoperability, pricing, devices, payments, etc. By abstracting all cryptographic complexities, XION removes the main barrier to entry for new users while circumventing the challenges of fragmentation for developers. Its signature-agnostic infrastructure supports a wide range of existing crypto curves and can be easily adapted to future developments, which not only expands its market coverage but also ensures its long-term viability…