Narrative Trading Guide: From Trend Spotting to Profitable Strategies

Original title: A narrative trading guide

Original author: The DeFi Investor

Original translation: Ismay

Editors note: Crypto researcher The DeFi Investor introduces the strategies and techniques of narrative trading in this article, from discovering new trends to profit-making strategies, and gradually explores how to trade effectively in the cryptocurrency market. He emphasizes the important role of psychology in market fluctuations, as well as the time and patience required to establish successful transactions. He also recommends that beginners start trading with small amounts of money and summarize lessons learned by constantly tracking investment performance.

I have been doing narrative trading for almost 3 years now. There is no doubt that narrative trading can be very profitable if you can bet on emerging trends before most people. But at the same time, it can also be a disaster if you jump on the bandwagon too late. I lost a ton of money because of this when I first started trading. There is a reason why 90% of traders lose money. It takes a lot of time, commitment, and patience to be profitable. In this episode, I want to share my crypto narrative trading strategy and some tips to maximize your profits.

Narrative Trading Strategy Handbook

At first, the general strategy for narrative trading is fairly simple:

Look for big upcoming crypto catalysts

Identify cryptocurrencies that are relevant and benefit from this

Invest in them

Sell when everyone starts talking about them

An example of a catalyst that had a huge positive impact on the price of AI tokens was NVIDIA’s AI conference in March this year.

AI tokens performed extremely well ahead of the event as there was speculation that some major AI news would be announced during the conference. In addition, teams from several cryptocurrency projects, such as Near Protocol, also participated in the event.

If you had bought NEAR or another hot AI token a few weeks before the conference, you would have made a ton of money.

Platforms like Coinmarketcal (Crypto Calendar) can help you find upcoming catalysts that could positively impact the price of certain tokens.

In addition to upcoming catalysts, significant unexpected news could also lead to the formation of a new narrative.

For example, earlier this year, Blackstone announced the launch of its tokenized fund on Ethereum. This news created a lot of hype in the RWA space, and many RWA tokens doubled or even quadrupled in price in the following days.

Trading narratives seems easy in hindsight. But the problem is that it’s hard to tell if you’re an early participant in a trend.

And in the world of crypto, timing is everything.

Later in this issue, I’ll describe some ways to increase your chances of getting in on the action early in an emerging trend.

Three waves of hype

Most major narratives go through three stages:

First, some smart money starts buying tokens associated with a potential upcoming narrative. Then, a few X accounts with fewer followers start sharing bullish arguments for that narrative on X. Eventually, everyone starts talking about that narrative on X, and the price of the token associated with it shoots up. This is a great time to start taking profits.

So how can you use this information to your advantage? Your goal should always be to catch new trends before everyone starts discussing the bullish situation on social media platforms.

Here are a few ways to increase your chances of early involvement in future narratives:

Using on-chain data to gain advantage

On-chain analytics platforms like DeFillama (completely free) can help you easily spot emerging trends in DeFi.

For example, here’s how you can use DeFillama to your advantage:

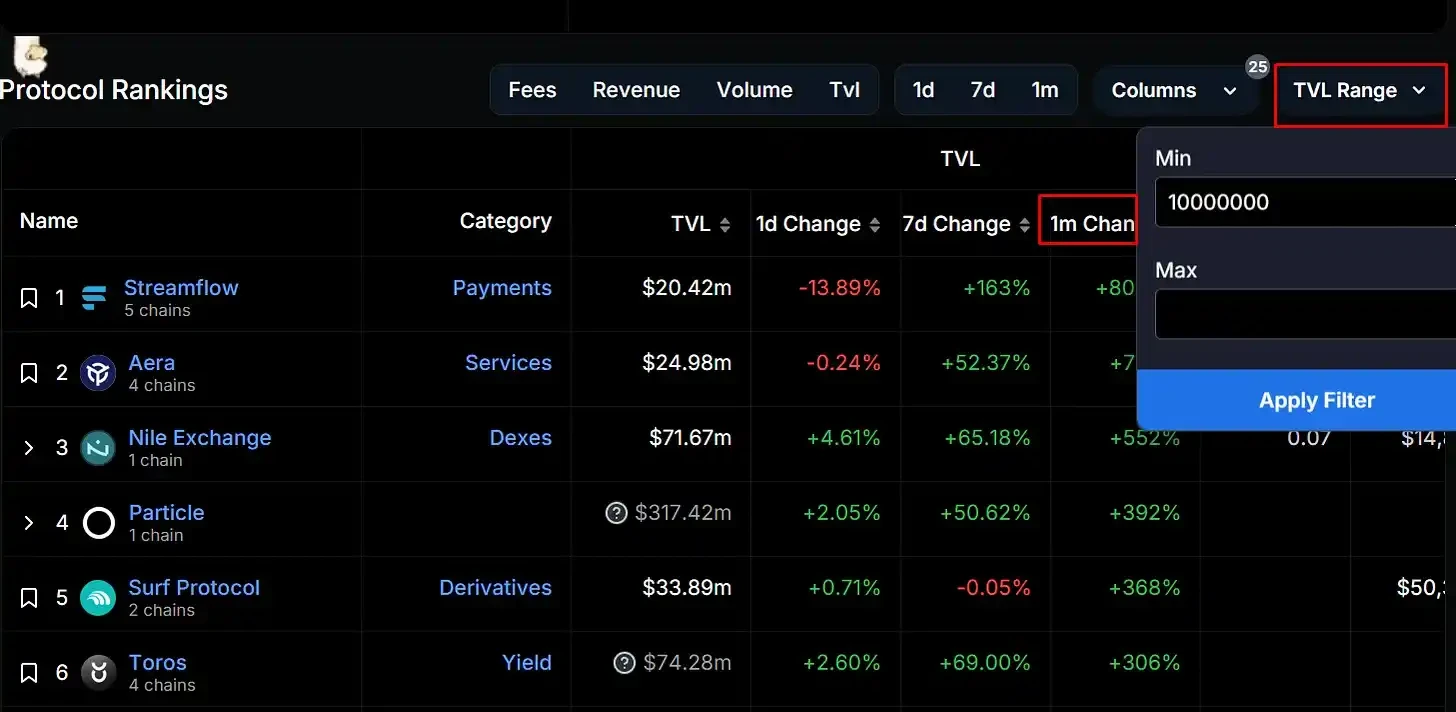

Go to DeFillama

Click DeFi → Overview

Click on 1m Change to sort protocols by recent TVL growth

After that, click on the TVL range, select the minimum $5M-$10M, and then select Apply Filters.

DeFillama will then display the fastest growing DeFi projects in the past 30 days.

If you see that multiple top protocols in a crypto space (like RWA) are growing at a very fast pace, this could be a sign that a narrative is forming in the space and it’s time to pay attention to it.

Build your network

“Your network is your worth” is more than just a meme.

An underrated tip is to try to connect with other narrative traders on social media platforms and build strong relationships with them.

You can use X’s advanced search feature to find people who talked about a narrative or token before it rose.

Once you find some people who seem to know what they are doing, try sending them a message to try to make a connection.

If you do that, and perhaps provide them with value in some way, they may reciprocate and start sharing their trading ideas with you.

Dont try to do this alone. Its like trading on hard mode.

Monitoring Smart Money Wallets

The easiest way to monitor the most profitable on-chain traders and investor wallets is to use a tool like Nansen.

However, Nansen is not free and requires a paid subscription. But even without Nansen, you can use free tools like Arkham to track smart money wallets. Arkham has an advanced filtering system for screening on-chain transactions.

Profit Strategy

Most narratives come down to a few reasons:

1. Major unexpected news (the real-world asset narrative was triggered by Blackstone’s announcement of a tokenized fund)

2. Upcoming Catalysts (The crypto AI narrative in early 2024 is caused by high expectations for the upcoming Nvidia AI conference)

3. Secondary market hype (GameFi is one of the narratives that retail investors love)

Depending on the type of narrative you are trading, your exit strategy should be different.

It is often difficult to estimate when narratives driven by major unexpected news will end. But most of these narratives only last a few weeks. When trading these narratives, I believe the best approach is to take profits gradually as they rise, rather than closing the entire position all at once.

Next, for the narrative of the upcoming catalyst, I think it is easier to trade.

In most cases, the prices of tokens associated with these narratives reached local highs a few days before the catalyst date.

As I mentioned before, Nvidia’s AI conference significantly contributed to the emergence of a new narrative around AI tokens in the first quarter of 2024. Many AI tokens reached their highest price levels in 2024 on the day of the conference or a few days before. After that, they started to fall. So the conference ended up being a “sell the good news” event.

In fact, 90% of catalysts end up being good sell events. Given this, I recommend taking large profits a few days before the catalyst, and possibly even closing the entire position.

As for narratives that emerge due to secondary market speculation, in most cases they will last until the end of the bull market.

Of course, they all go through cycles of ups and downs, but AI, for example, may maintain a high-performing narrative throughout a bull market because it is easy to understand and popular with retail investors.

Summarize

Psychology plays a big role in when and why crypto markets move, and game theory and market psychology take some time to understand.

If you want to start making money from narrative trading, I also recommend that you start trading narratives with a little bit of money.

Track your portfolio performance over time to see where you made mistakes and how you can become more profitable. Do more of what works and less of what doesnt.

Only consider increasing your bet size after you have been making money consistently over a long period of time.

Trading can help you build wealth, but its not something you can learn overnight.

This article is sourced from the internet: Narrative Trading Guide: From Trend Spotting to Profitable Strategies

Related: Polygon (MATIC) Price on the Rise: Investors Fuel Swift Comeback

In Brief MATIC price is making its way back after bouncing off the support at $0.65 to reach $0.81. Investors are putting aside profit-taking and focusing on making their supply profitable instead. The funding rate is recovering as well, suggesting traders are making bullish bets against MATIC. Polygon (MATIC) is among the few altcoins observing quick recovery supported by its investors. The altcoin could soon be on the path to reclaiming the profits lost during the early April correction. Polygon Investors Are Optimistic MATIC price is climbing on the daily chart, and Polygon investors note the potential for this recovery. They are acting accordingly, with the network noting minimal selling in the last few days. This sentiment is being extended at the time of writing as well. Upon categorizing active…