Searching for the next crypto killer app: the combination of content publishers and exchanges

Original author: Arnavs Musings

Original translation: TechFlow

The killer use case for cryptocurrency

Imagine you’re scrolling through Instagram and see an influencer you like wearing a hoodie from an emerging brand. You like the design and click on the image to see the price. One more click and you’re reading the product description page. A few seconds later, you decide to buy the hoodie and confirm the transaction with FaceID…

You just made a socially driven purchase in less than a minute, without leaving Instagram.

Welcome to the era of the publisher-exchange, where consumers can exchange value directly through content platforms. This emerging trend removes all friction from the purchasing process, creating a more immersive user experience that brings money and attention together. This is the future of e-commerce.

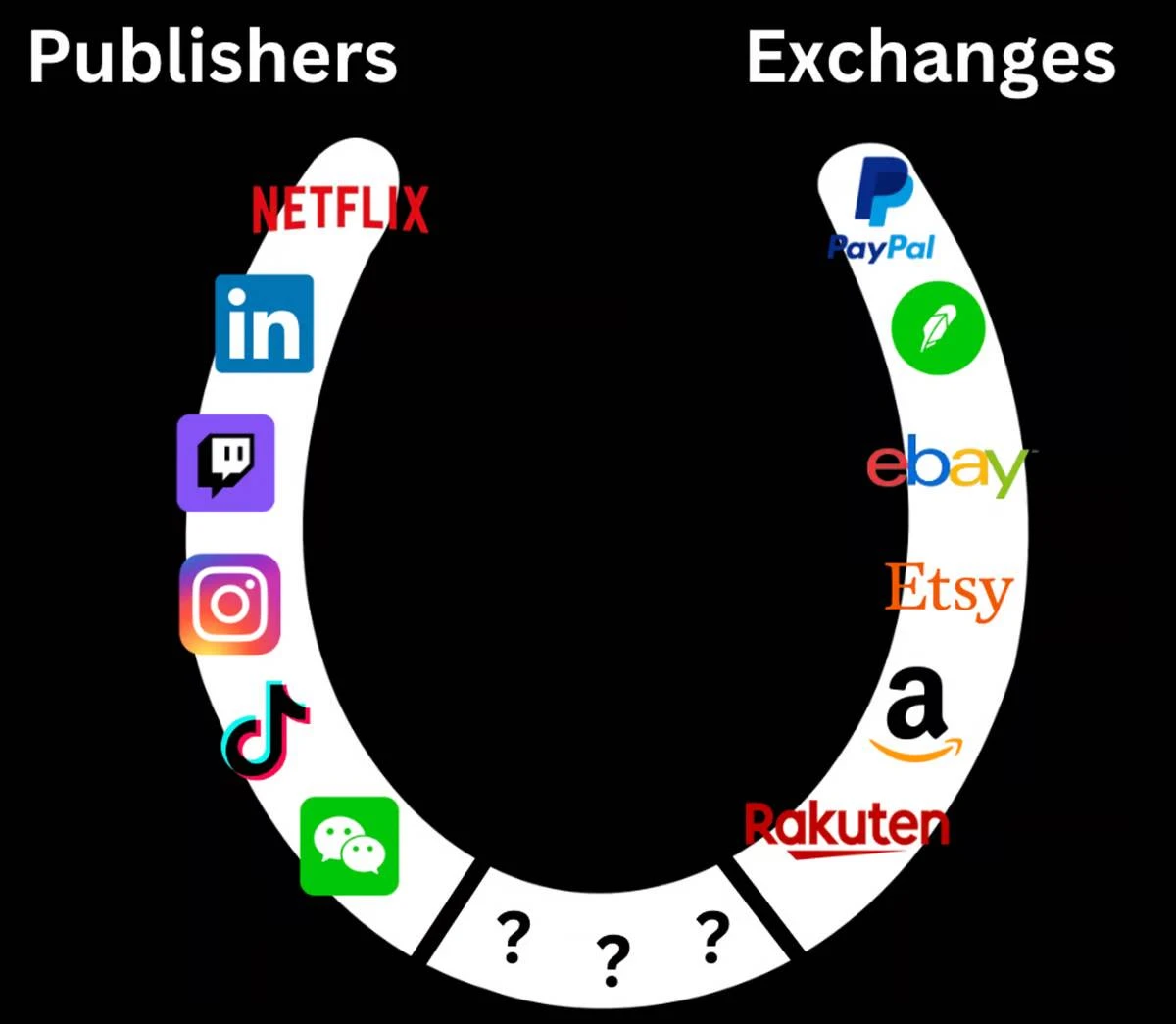

What is a “Publisher-Exchange”?

Publishers = Platforms that thrive by capturing user attention

For example, Instagram, X (formerly Twitter), Spotify, YouTube, Netflix, etc., all of which compete ruthlessly for regretless user time.

Exchange = Platform that controls the flow of funds

For example, PayPal, eBay, Venmo, Robinhood, Coinbase, etc., they are all vying for control of the monetary system.

The fusion of publishers and exchanges is thus called a publisher-exchange, a platform that operates on the interplay of attention and money. Let’s look at a few examples of major publishers moving to a publisher-exchange model:

-

Spotify Merch Bar: Allows artists to sell merchandise and tickets directly through their Spotify profile, merging music streaming with e-commerce.

-

Instagram Live Shopping: Influencers can live stream on Instagram and sell products to their followers in real time. This is based on the fact that influencers can add shopping tags to their posts, and consumers can buy products through these tags.

-

TikTok Shop: A digital storefront that lets creators sell products directly alongside their videos, often offering discounts, subscriptions, and exclusive merchandise. In fact, TikTok lost more than $500 million in U.S. e-commerce last year by subsidizing products, often outright free, to get users familiar with the platform.

-

YouTube Shopping: Through YouTubes partnership with Shopify, companies can sell products on YouTube through live broadcasts, videos, or digital storefronts.

-

Snapchat AR filters: or “catalog-driven shoppable lenses” that allow users to virtually try on eyewear, beauty products, clothes, etc. and subsequently purchase them within the app.

Basically, every publisher is becoming a publisher exchange by allowing frontends to exchange value directly. The data doesn’t lie:

See sources: source 1 , source 2 , source 3

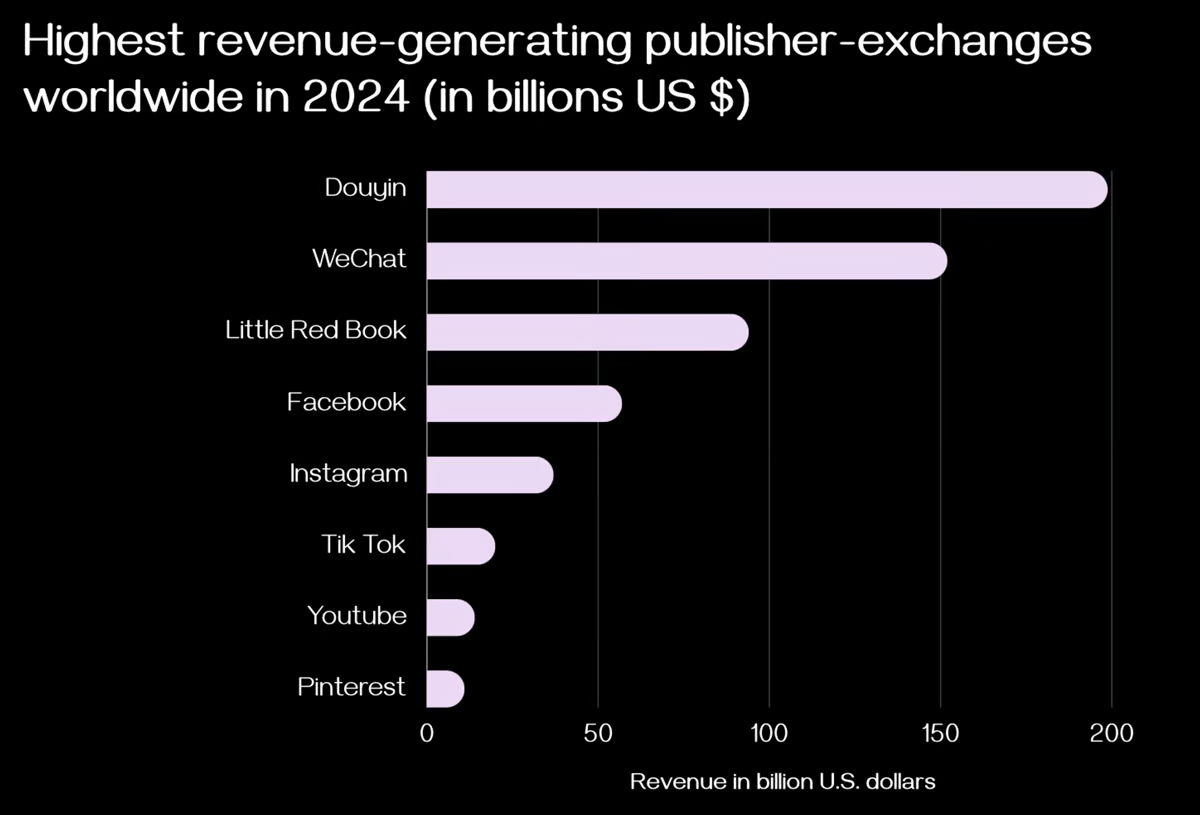

See source: Statista “Digital Shopping Behavior”

According to Statista’s “Digital Shopping Behavior” report, leading publishers-exchanges Douyin (China’s TikTok) and WeChat have a combined annual revenue of over $350 billion!

In addition, each exchange is also becoming a publisher-exchange:

-

Amazon Live: Combines e-commerce with live streaming, allowing influencers to showcase products and viewers to buy them in real time.

-

Alibaba: Entering the media space through Alibaba Pictures, Youku Tudou (video streaming service), and Alibaba Music, integrating e-commerce with content streaming.

-

Every FinTech Company: Every FinTech company is moving into the space of content creation and curation, and providing financial education and business insights (e.g. Robinhood, Square, Stripe, Bloomberg, Coinbase, etc.).

Summary: Every publisher and every exchange is moving towards a hybrid publisher-exchange model as this maximizes user engagement, retention, consumption, and growth.

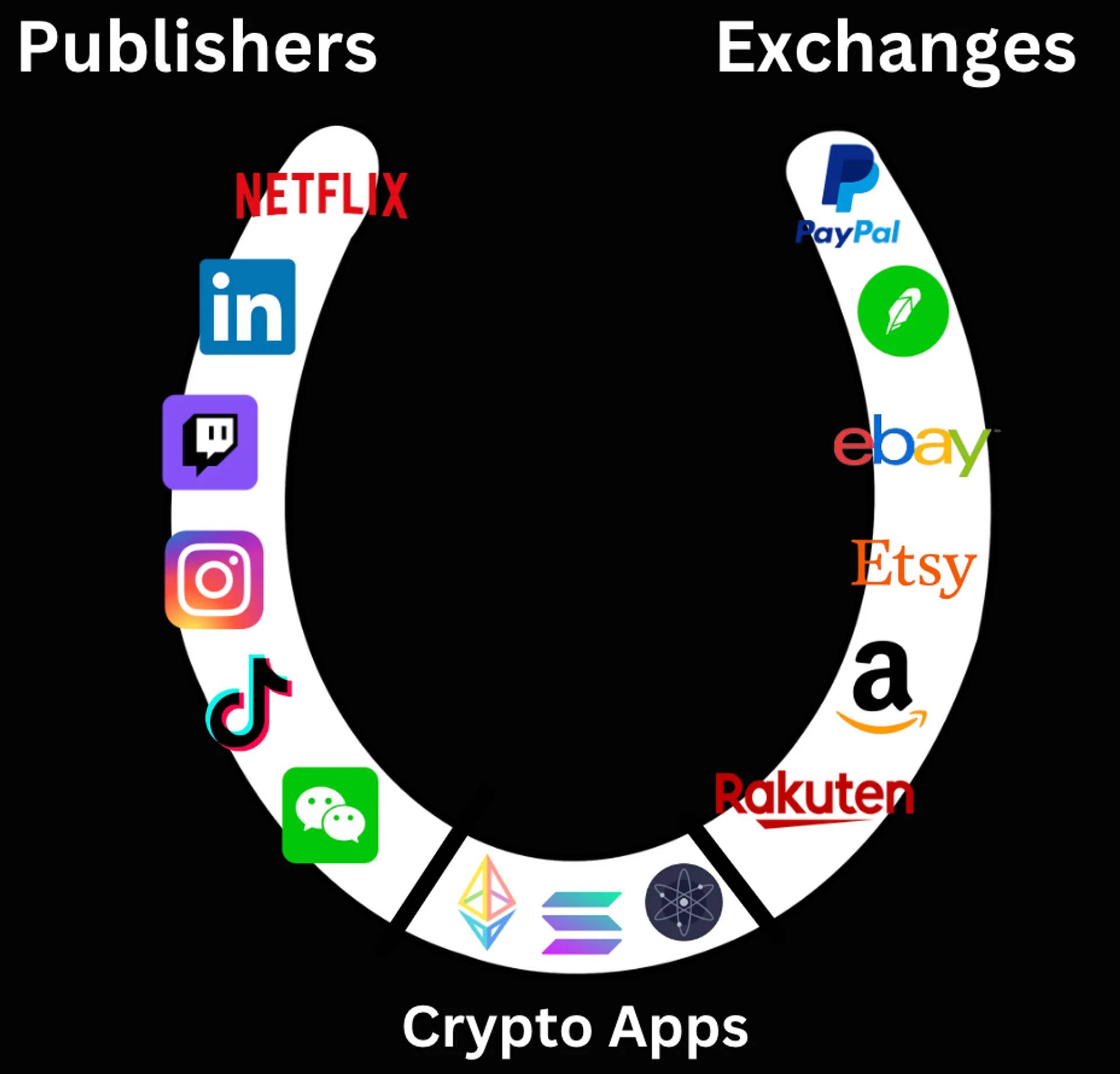

So, what do publisher-exchanges have to do with cryptocurrencies?

-

Web3 publishers and exchanges converge into a unified publisher-exchange, accelerating the creation and adoption of new applications.

-

Web2 publisher-exchange will adopt crypto payments to welcome the next billion users.

Web3 Publishers – Exchanges

We have many publishers in Web3, including blockchain explorers, data providers, analytics tools, etc. We also have many exchanges in Web3, including wallets, decentralized exchanges (DEX), NFT marketplaces, etc. In contrast to the technical debt of Web2, we have the opportunity to inextricably unify publishers and exchanges, creating experiences that were previously impossible in Web2.

In Web2, popular consumer apps like Instagram, TikTok, and Netflix are carefully designed (every detail is carefully crafted) to provide frequent small doses of dopamine that effectively keep users engaged. We have seen with WeChat and Douyin that when you layer financial products on top of sticky consumer apps, they perform very well.

We live in a world where we are exposed to content and information at an exponential rate. Imagine if money could be exchanged as quickly or seamlessly as information. This is the major breakthrough point for cryptocurrency.

Crypto consumer applications can enable any publisher or exchange (crypto-native or not) to offer new forms of user engagement through native trading, speculation, issuing credit, etc. If curated well, these new applications can inspire deeper user commitment than a single publisher could. The ability of consumer applications to seamlessly integrate financial products into their front-ends provides a significant opportunity for newer publisher exchanges to compete with established exchanges in the market.

Here are some examples of consumer cryptocurrency applications:

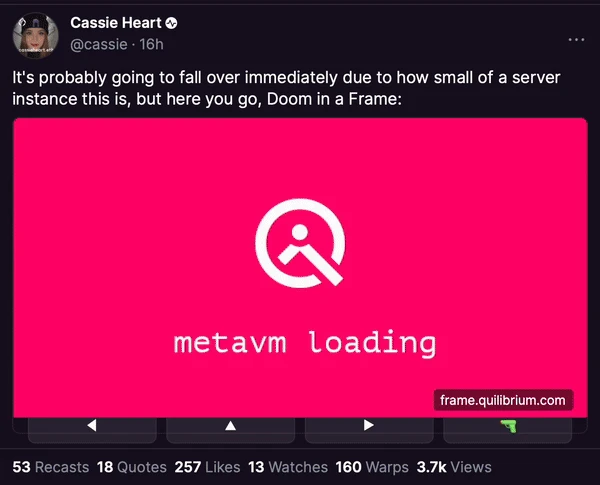

Frames

Frames extends Facebooks OpenGraph standard to turn static embeds into interactive experiences. Its a new cryptographic primitive that provides a standard for developers to run application Y within application X without any coordination between applications X and Y. Here are a few examples of Frames in action:

Someone even built a playable version of Doom within a framework:

If you can build an entire video game within a framework, then anything is possible.

Now imagine the Framework within wallets, blockchain browsers, and other Web3 publishers. When combined with the Smart Publisher Infrastructure, the Framework provides a powerful way for all publishers to become the next generation ad network. For example, a blockchain browser sells ad space to a derivatives platform that can trade in real time within the ad framework by issuing credits. This is a prime example of Web3 publishers becoming publisher-exchanges through native value issuance. Emerging infrastructure providers like Relayer provide publishers with tools for on-chain discovery, management, and rewards.

Furthermore, the framework offers advertisers a whole new realm of marketing that proves to give much better results than the traditional way of acquiring FB or X ad inventory.

Development of the Frames stack is moving full steam ahead, with the team building everything from attribution tools to smart publisher infrastructure to non-hosted social accounts. For a deeper dive into Frames, check out the awesome-frames repository.

Cant we do this in Web2?

The technical debt from the legacy infrastructure, combined with the difficulty in implementing framework-like primitives for multiple teams made it nearly impossible to coordinate. As a result, many people (including Facebook) tried, but none succeeded.

Therefore, interactive advertising via frames – which does not even require a wallet – will become a decisive trend in the coming years.

Wallet Planning Era

The interface of a wallet can determine how we interact with Web3. Similar to how Yahoo curates news or Google curates websites, wallets have the opportunity to be both. While wallets will initially be pure trading platforms, I expect them to move heavily into the publisher space. That is, wallets can:

-

Allows dApps like Uniswap, dYdX, Aave to be accessible within the wallet. Additionally, the wallet can curate leading protocols in every sector (money markets, perpetual contracts, etc.).

-

Curate a new protocol’s “For You Page” (FYP) by leveraging a user’s Web3 profile.

-

Create an “Offers” page that allows users to discover brands and earn rewards, while enabling the wallet to monetize through ad revenue. It’s a bit like the composable credit card rewards we know and love.

This is a prime example of “meeting users where they live”, rather than having them click to other web pages to achieve the same outcome. And we’ve only scratched the surface of what the wallet can do – like become an aggregator of prediction market data, a news provider, and curate crypto events from X and Farcaster, etc.

app

Since we are still in the early stages of the consumer cryptocurrency lifecycle, we are seeing the emergence of “v1 Web3 publisher-exchanges.” These early versions of Web3 publisher-exchanges come in many forms, but they all aim to achieve the same goal of creating a new coupling between information and money that transcends the limitations of Web2.

social contact

-

Farcaster : A new social networking protocol created by the community.

-

Unlonely : A live streaming platform where users can simultaneously mint tokens and play prediction games while live streaming.

-

JokeRace : A contest protocol for programmatically monetizing engagement events.

Prediction Market

-

Polymarket : A decentralized prediction market where users can speculate on anything.

-

Swaye : A prediction market and battle royale game available on Farcaster, players can create markets, bet against friends and earn rewards.

-

Parcl : A real estate prediction market allowing for liquid exposure to the asset class.

game

-

Parallel : A sci-fi trading card game that uses NFTs to enable users to own part of the world they create.

-

Karate Combat : A full-contact striking league that combines motion capture and full-contact karate matches where users can earn tokens when their fighters win.

-

Anichess : A chess game that introduces new mechanics where users can leverage NFTs and tokens.

Of course, we’ve already validated this theme with early examples of Telegram bots like Banana Gun, Maestro, and BonkBot, which have cumulatively processed nearly $15 billion in transaction volume.

TikTok is to media what crypto is to money

Just as TikTok became the most mainstream form of media by shortening the unit of content consumption, cryptocurrency will become the most mainstream form of value by shrinking the unit of money consumption.

The younger generation, in particular, is moving away from TV, Netflix, etc. to short-form video content. I believe cryptocurrencies are just a natural extension of the “TikTok Theory” because we have reduced the unit of consumption of media, why not do the same with money?

The above applications are the first real attempt to do this. As the infrastructure matures and applications advance, I have no doubt that Web3 publisher-exchanges will be the frontrunners in attracting the next generation of Internet users.

So, do Web3 publishers-exchanges offer something that Web2 doesn’t?

There are two notable features that may make Web3 significantly superior to Web2:

1. Credit issued by the agreement

Cryptocurrencies reduce the friction of money, allowing it to flow as quickly and freely as data. As mentioned above, cryptocurrencies enable publishers to seamlessly add financial rails to their applications. There are many use cases, the most important of which is Protocol Issued Credit (PIC).

In the past, marketers measured campaign effectiveness by cost per click (CPC) or cost per thousand impressions (CPM). The future of marketing will include interactive ads that support PIC. For example, a new perp DEX could issue 10 USDC for in-platform trading through the advertising framework, or a game could offer 15 OPs for completing a tutorial, which can then be used later. This would be a structural change in market funding expenditures, directly compensating users for their time – and early framework statistics show that this can actually increase user engagement – which can be a win-win.

But don’t I need to be a crypto native to participate?

Actually, no. There are many cryptocurrency applications today that simplify the complexity of getting started. No initial password is required, so there is no need to get started.

Here are some examples of cryptocurrency apps that don’t require a cryptocurrency wallet:

-

Pudgy Penguins : The founders released a cool demo showing how users can get on board by buying penguins from Target, opening digital mystery boxes, and logging in via email to save their progress.

-

Blackbird : Users can earn status, points, and privileges from Blackbird-eligible restaurants without the need for cryptocurrency or paying for gas.

-

Lolli : Browser extension that allows users to earn Bitcoin on purchases through affiliate marketing strategies, without the need for a wallet or portal.

By leveraging a decentralized identity platform like Privy , developers can seamlessly integrate login functionality without requiring users to have a cryptocurrency wallet.

2. Phasing out Cookies

While the values promoted by companies like Facebook, Snapchat, and Google are fundamentally about getting your attention, you might think these platforms are free, but as the old saying goes, “If it’s free, you are the product,” it couldn’t be more true.

Yes, Im referring to the use of cookies – they have revolutionized the modern digital advertising era and user experience by delivering personalized content and targeted ads based on individual browsing behavior across websites. But… there is a paradigm shift on the way.

The traditional use of third-party cookies in web browsers is finally starting to decline. Major browsers like Safari and Firefox already block third-party cookies by default, and Google Chrome also plans to phase them out by early 2025 .

The phase-out of third-party cookies, particularly driven by privacy concerns and regulatory changes, has several implications:

-

Privacy enhancement: Removing third-party cookies can enhance user privacy and reduce cross-site tracking. Users will have more control over their personal data (which is already the purpose of Web3).

-

Advertising impact: Advertisers will need to find new ways to deliver personalized ads that don’t rely on extensive tracking.

-

Changes in web analytics: Without third-party cookies, businesses will need to adjust their web analytics approaches to use first-party data or aggregate reporting.

-

New technology developments: Technology efforts like Google’s Privacy Sandbox aim to create a more private web while still enabling personalization, but they won’t be anywhere near as effective as third-party cookies.

This presents a golden opportunity for Web3.

Enter on-chain data and digital identity

Content curation and targeted advertising is a trillion-dollar industry built largely on the premise of using cookies to build highly optimized curation algorithms and deliver targeted ads. The end of cookies provides an opportunity for the flip of Web2 to Web3 – Web3 can provide a more powerful solution than Web2s replacement for cookies.

A core belief of Web3 is to incentivize data based on merit. There are a plethora of platforms where users can earn tokens by providing various off-chain data: whether it’s through eye scans on Worldcoin , connecting your Web2 social profiles through Oamo , or providing ZKP-secured demographic data on other platforms. Additionally, platforms like JokeRace allow you to share your projects, memes, tweets, songs, etc., and people can vote to form a value graph. While Web3’s identity stack is fairly fragmented today, I expect the integration of standards will further increase the adoption and utility of these primitives.

The key is that on-chain data is paired with incentivized off-chain data, which means Web3 can build a more complete user profile, leading to better curation and better ad conversion rates.

In response to this, I absolutely expect Web2 companies to start acquiring data through Web3 native platforms to gain advantage.

Bottom line: The combination of protocol issuance credit and the “flip” of Web3 data may provide a viable path to long-term, broader cryptocurrency adoption.

So far, we’ve covered the transformational shift toward publisher-exchanges and how Web3 is the ultimate proving ground for building the next generation of publisher-exchanges. Next, we’ll dive into why Web2 publisher-exchanges are more likely to adopt crypto payment rails than you think.

Welcoming the next billion users

There are many reasons why crypto payments have not been adopted by institutions to date. To name a few: high transaction fees, slow settlement, lack of privacy and compliance, poor user experience and developer experience, brand risk, etc.

Fortunately, the major infrastructure issues are mostly solved. Naively speaking, one could create an AppChain and modify everything, including gas fees, block times, enable FaceID, and pretty much anything else you can think of.

We are at a stage where the infrastructure is good enough that the benefits of adopting crypto payments may outweigh its perceived risks now.

Web2 publishers-exchanges, in particular, face a unique opportunity to become the earliest institutional adopters of cryptocurrency.

Of course, I don’t think publisher-exchanges will integrate crypto payments just because crypto is cool; crypto needs to offer a 10x improvement over existing infrastructure to justify the switching costs and brand risk. So publisher-exchanges won’t adopt crypto all at once, but early adopters will be the following categories:

-

Demographics

-

Integrated reward system

-

Credible Neutrality

Demographics

The number of cryptocurrency users is growing rapidly around the world. By the end of 2023, the number of cryptocurrency users around the world has surged to about 580 million, a year-on-year increase of 34% . This growth trend is expected to continue, and it is estimated that the number of users may reach 850 million to 950 million by the end of 2024. In addition, studies have shown that 72% of cryptocurrency owners are under the age of 34. Basically, the global cryptocurrency adoption rate is rising rapidly, and the younger generation has a strong preference for it.

Similarly, sales on existing publisher-exchanges are driven primarily by people aged 10 to 34. As the younger generation enters the market, two trends are very apparent:

1) They prefer short-form video content and instant gratification

2) Most of their purchases will be made through publisher-exchanges

Given the striking similarities between cryptocurrency and publisher-exchange demographics, and the increasing similarity of their user bases, it is likely that publisher-exchange users will expect or even demand crypto payments over time.

On the other hand, people living in countries with unstable governments and currencies have made it clear that they want to move their funds into stablecoins such as USDC. Many people in less developed countries

1) Either it will be destroyed by inflation,

2) Either don’t trust banks,

3) Or even being unable to open a bank account.

Fortunately, the two-way nature of cryptocurrencies is the most obvious solution, so Visa is exploring paying merchants in USDC . Another notable example is Stripe’s reintroduction of cryptocurrency payments. This decision was not driven by improvements in infrastructure, but rather by increased demand in emerging markets.

Publisher-exchanges are at the forefront of commerce, just as cryptocurrencies are at the forefront of finance. As such, the shared user bases will grow in tandem until they become a unified whole.

Integrated reward system

Traditional payment rails make it very easy to send value, but very difficult to receive value. The nature of sending and receiving value on-chain and the ease of creating accounts makes it 10 times easier to do it over crypto rails. So there are a number of breakthroughs here:

1) You can receive value seamlessly

2) Smaller units of value can be exchanged due to the speed and low cost of settlement.

Here are some incredible use cases:

-

Interest Payments: Gambling platforms or escrow services can incentivize users to hold funds within the platform by offering real-time interest payments.

-

Asset issuance: Special interest communities can create and distribute virtual assets without connecting a bank account or doing KYC. Reddit Rewards or Discord Nitro are signs of early market fit.

-

Protocol Issued Credits (PIC): As mentioned earlier, PICs can fundamentally change user acquisition as we know it today. Crypto payment rails can enable Web2 companies to also offer PICs.

Trusted Neutrality and Privacy

The beauty of smart contracts is that they represent the pinnacle of trusted neutrality. As a result, any publisher-exchange (of which there are many) facing scrutiny or high chargeback rates from traditional payment processors may choose to move payments on-chain. This includes industries such as CBD, gambling, pharmaceuticals, adult entertainment, and more.

Just look at Stripe’s list of prohibited and restricted businesses and you’ll quickly realize there’s a significant demand for alternative payment channels.

Generally speaking, this group of publishers-exchange users also have a higher demand for privacy. We have many technology and infrastructure providers such as Fhenix, Aztec, Penumbra, etc. building tools for private payments. A recent example is the Shiba Inu team adopting an FHE-powered privacy layer to expand its entertainment ecosystem.

Looking ahead

Publisher-Exchanges represent the future of e-commerce. Web3 publisher-Exchanges, in particular, offer an incredible opportunity to inextricably unite publishers and exchanges, creating a closer relationship between money and attention in Web2.

Web2 publishers-exchanges are one of the institutions most likely to adopt crypto payments due to the striking similarity of their demographics and the new capabilities and autonomy that on-chain payments bring. Looking ahead, I expect to see a resurgence of verticalized crypto payment startups, high-performance privacy technology, chain/balance abstraction, seamless non-custodial experience, etc.

As information becomes democratized and accessible, so too will money become democratized and accessible.

This article is sourced from the internet: Searching for the next crypto killer app: the combination of content publishers and exchanges

Related: Dogecoin in the Danger Zone: How Bearish Reversal Could Slash Prices by 40%

In Brief Dogecoin price is currently stuck in a rising wedge pattern, according to which a 40% correction is likely. The MVRV ratio is inching close to the danger zone, which is usually followed by profit-taking and corrections. The coming days will push 95% of the circulating DOGE supply into profits, marking a market top. Dogecoin’s price is currently trapped in a bearish reversal pattern, potentially leading the meme coin to revisit its previous lows. Sometimes, bearish market trends are altered by investors. However, this time, investors’ behavior does not appear very bullish either. Dogecoin Will See Some Drawdown Dogecoin price is exhibiting signs of an increase on the 8-hour chart, but when the extended candlesticks are taken into consideration, a bearish pattern forms. To make it worse, investors may…