SignalPlus Volatility Column (20240522): Tomorrows Resolution ETF

Yesterday (21 May), according to Jinshi, Fed Governor Waller said that weak inflation data in the next three to five months will allow the Fed to consider cutting interest rates at the end of the year, and there is no need to raise interest rates at the moment. Fed Vice Chairman Barr also reiterated that high interest rates need to be maintained for a longer period of time. The 10-year US Treasury yield fell for the first time in five days, once dropping to 4.40%, but has recovered most of its losses today, now reporting 4.437%. The three major US stock indexes closed higher, with the SP and Nasdaq rising 0.26%/0.2% respectively, reaching new historical highs again.

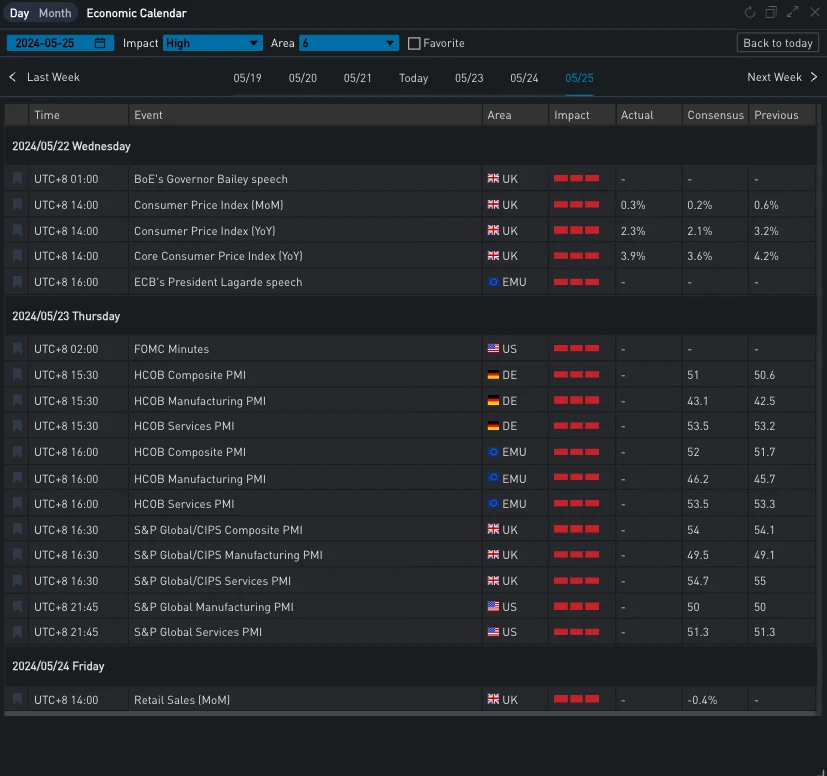

Source: SignalPlus, Economic Calendar

Source: Investing

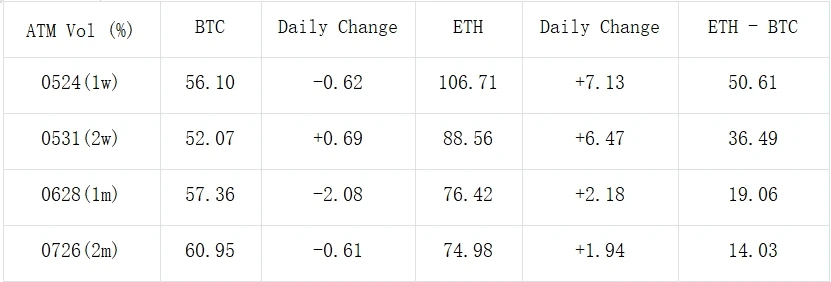

In terms of digital currencies, as the Ethereum spot ETF decision date approaches, ETHs overall IV level has risen again, and the price has successfully broken through the 3,700 mark. Bitcoin prices are slightly weak, and the currency price has adjusted back to around US$70,000.

Source: Deribit (as of 22 MAY 16: 00 UTC+ 8)

Source: SignalPlus

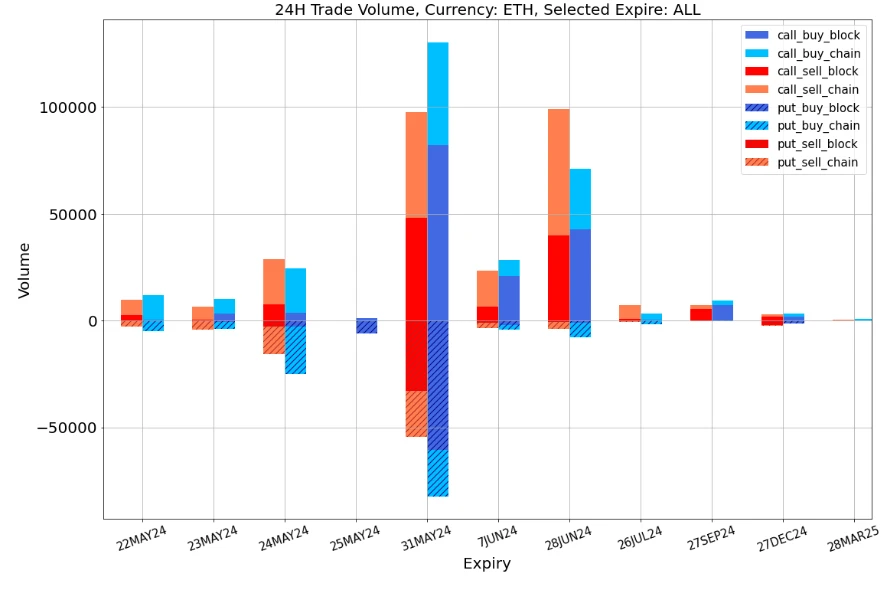

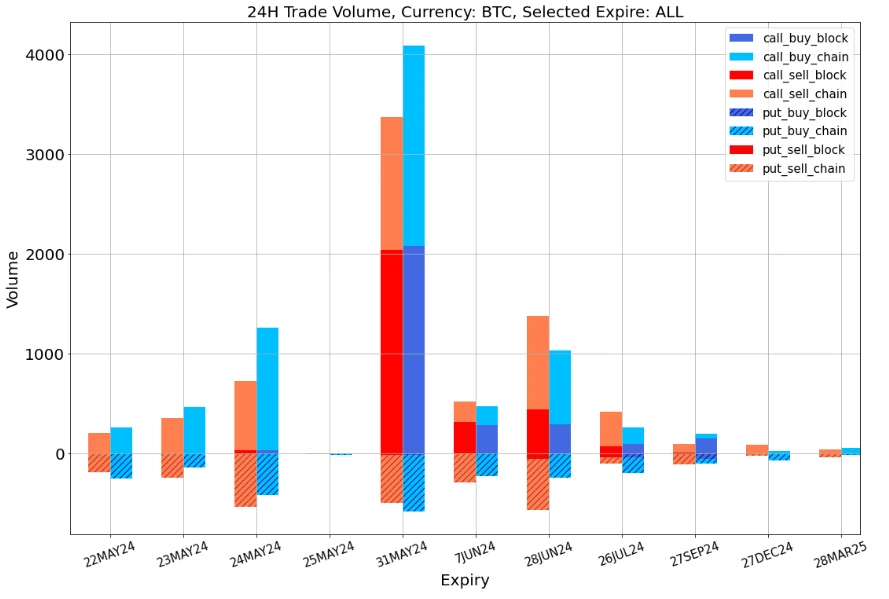

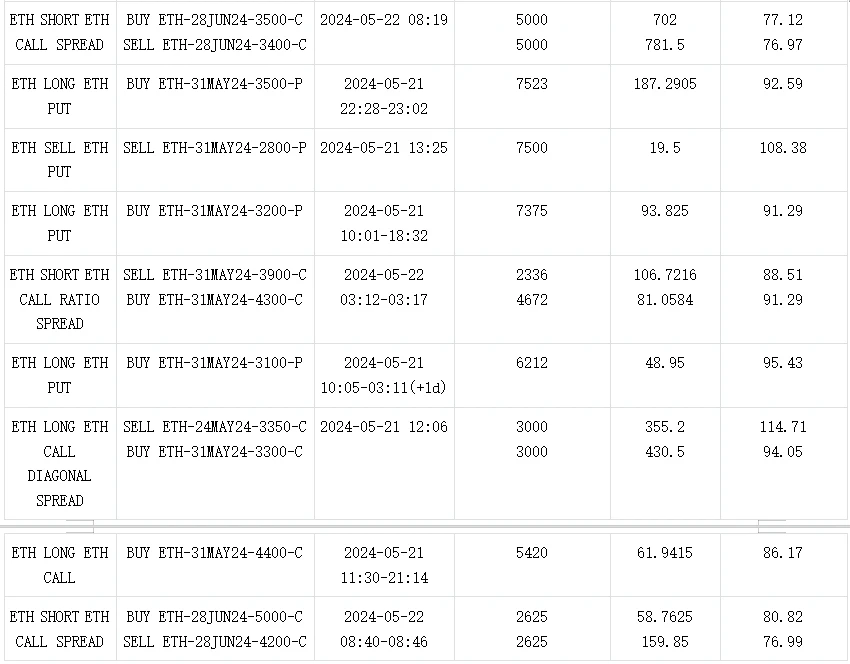

In terms of trading, BTC mainly adopts bullish strategies, among which the single-leg transaction volume of 31 MAY 77000 vs 81000 Call Spread is close to 1400 BTC, becoming the focus yesterday. In terms of ETH, the sharp rise in the price of the currency has caused a large number of stop-loss and take-profit orders, among which the 31 MAY 3000-C buy-back stop-loss is about 19500 ETH, and the 28 JUN 24 3600-C sell-profit is about 18000 ETH, which is the most significant position reduction point yesterday; the bulk platform has hot transactions, mainly including the June bullish Call Spread, the end of May Long 3400 Put, the selling of call options and the buying of put options on Wing explain the overall significant decline of ETHs Vol Skew in the upward market yesterday.

Source: SignalPlus

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240522): Tomorrows Resolution ETF

Related: Polygon (MATIC) Price Stuck in Consolidation, But Bull Rally Could Be Near

In Brief Polygon price is currently stuck in consolidation, heading towards the resistance level at $0.746. MATIC holders are exhibiting signs of potential accumulation, which has historically resulted in rallies. Only 33% of the Polygon native token’s supply is in profits, making it eligible for considerable gains. Polygon (MATIC) price awaits strong bullish cues that could propel the altcoin out of the consolidation it is currently stuck in. Given that the altcoin is among the lowest profit-bearing assets, it is likely that investors will push for a price rise to book profits. Polygon Investors Hint at Accumulation MATIC price could see a breakout above the $0.74 barrier if only investors act accordingly. As long as these MATIC holders refrain from selling, consolidation could continue, and accumulation could enable an upswing. This is the likely outcome for MATIC’s…