SignalPlus Volatility Column (20240520): ETF Resolutions This Week

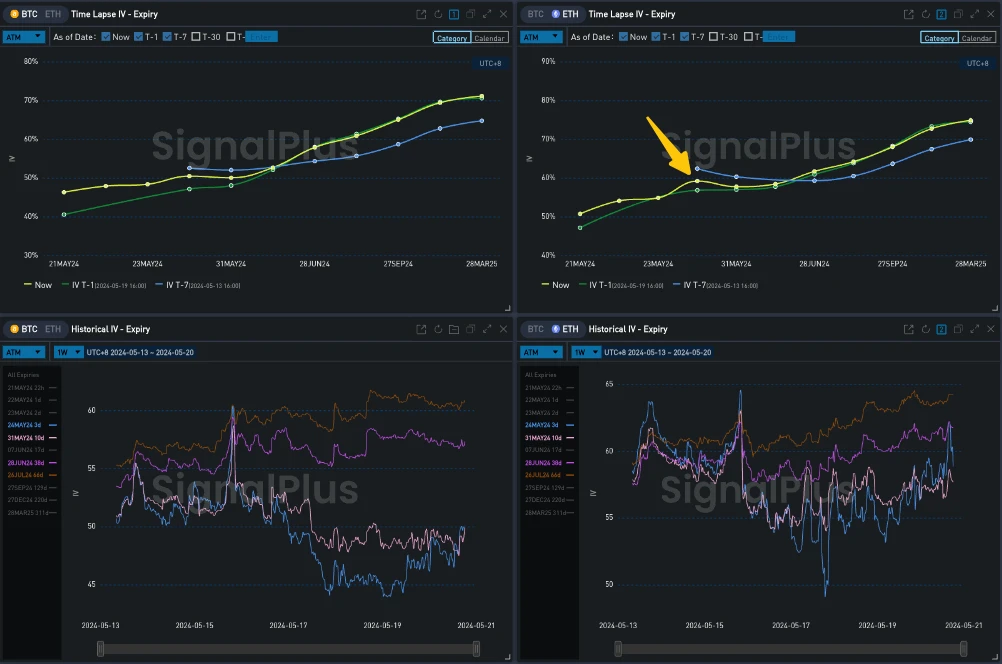

In terms of digital currency, this week the U.S. SEC is expected to announce the final decision on VanEcks ETH Spot ETF on May 23rd local time, which has attracted great attention from the market. From the volatility pricing of the options market, it can be seen that the ATM Vol of ETH 24 MAY has continued to rise in the past few days and formed a local high point. The overall level is also 5-10% higher than BTC Vol. The slope of the term is also flatter due to the higher Vol Premium at the front end. This will undoubtedly be an important moment for the cryptocurrency community. Although the market is relatively optimistic about the approval of the ETH ETF, the recent weak trend of ETH seems to suggest that the market has digested the rejection of Ethereum this time. Analysts believe that the approval of the ETH ETF is expected to be achieved next year, which will provide investors with more investment opportunities and promote the development of the entire crypto industry.

Source: SignalPlus, BTC ETH ATM Vol

Source: Deribit (as of 20 MAY 16: 00 UTC+ 8)

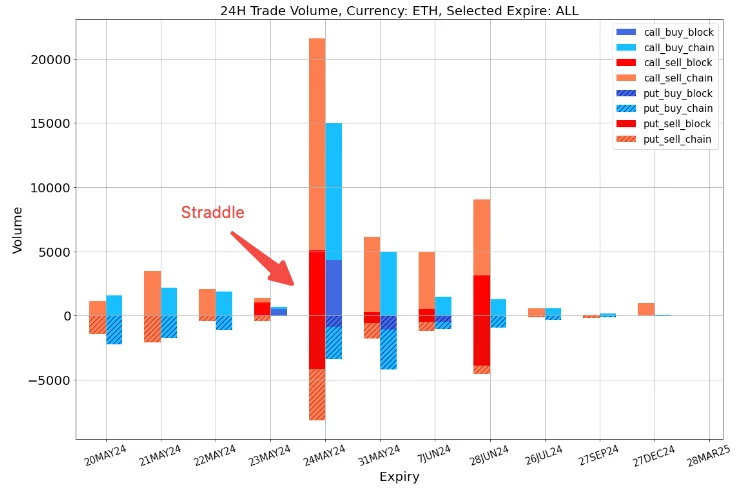

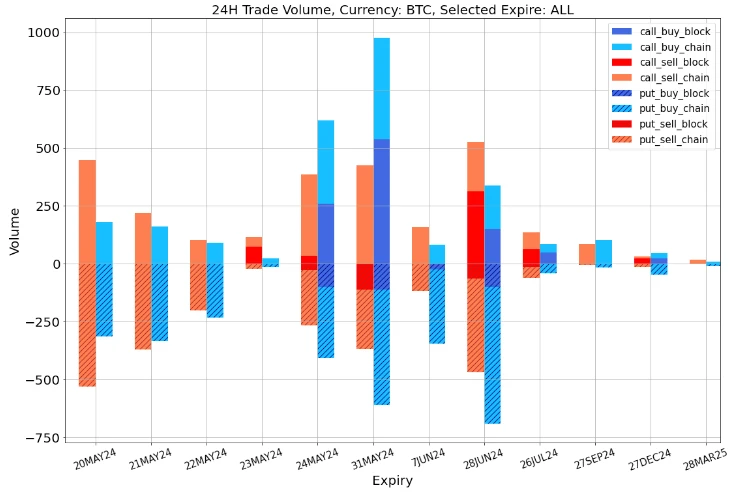

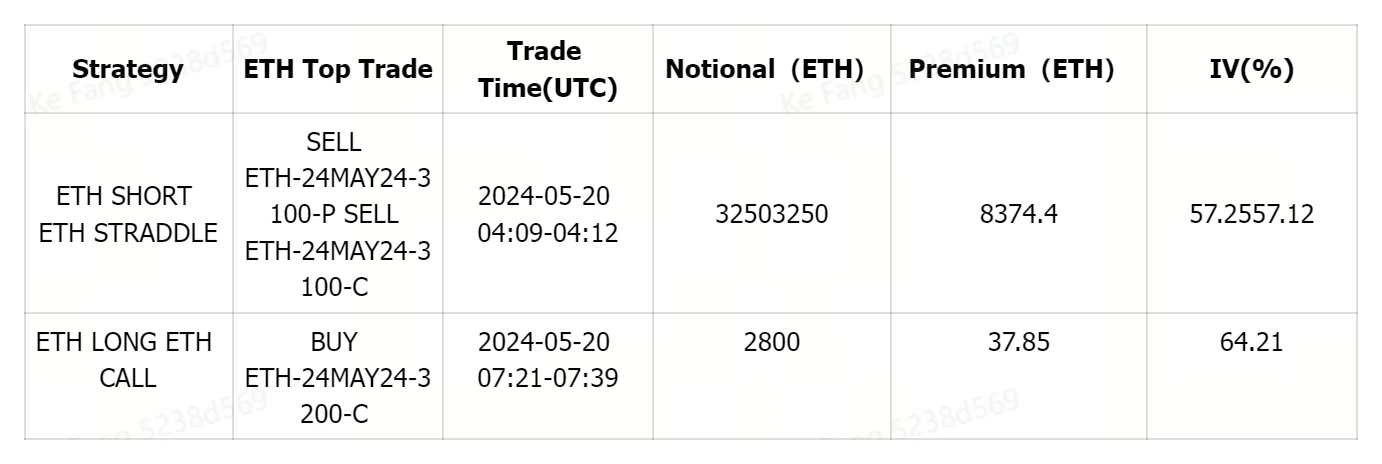

In terms of trading, ETH 24 MAY attracted a group of Sell Straddle transactions of 3250 ETH per leg in bulk due to the formation of a local IV high, betting on the Premium of IV-RV. In terms of BTC, a large number of long put option transactions emerged in May and June in the past day, driving the decline of Vol Skew in this range.

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

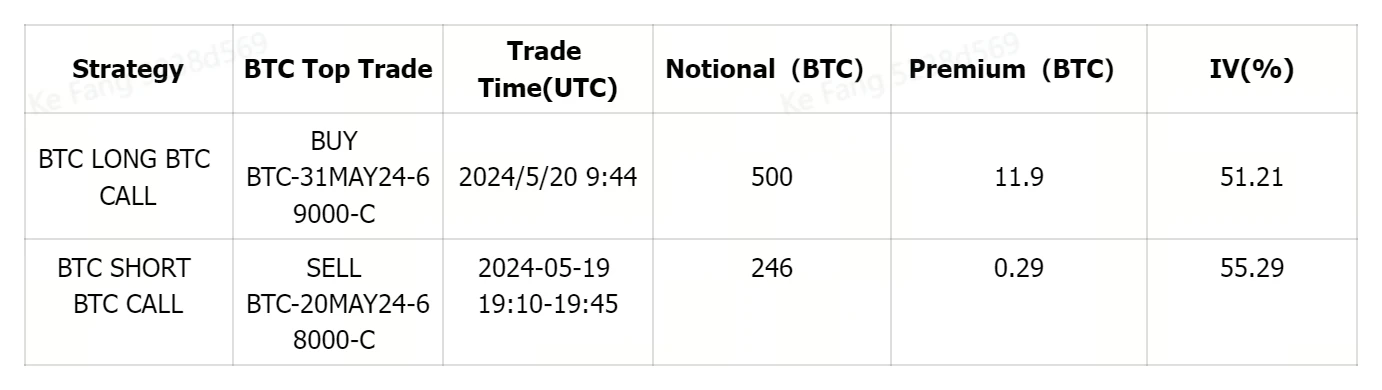

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240520): ETF Resolutions This Week

Related: Tron (TRX) Analysis: Here’s When a Recovery Rally May Occur

In Brief Tron price has been attempting to close above $0.121 for a while now, and broader market cues could trigger a rally. MACD and ADX are both currently exhibiting potential incoming bullishness. The Funding Rate noted an uptick in the past 24 hours, suggesting a surge in optimism. Tron’s (TRX) price will likely note a boost in the coming days from the broader market cues and investors’ bullishness. The question is whether TRX will manage to see the rally through or if it will halt halfway. Tron Investors See Potential Tron’s price trading at $0.118 observes several bullish cues, primarily from investors. This is evident in the Funding rate of the asset. The funding rate in crypto refers to a fee paid between traders to balance the market. Positive…