Cobie: When low-circulation, high-FDV tokens are rampant, the rising profits have already been privately divided

Original author: Cobie

Original translation: TechFlow

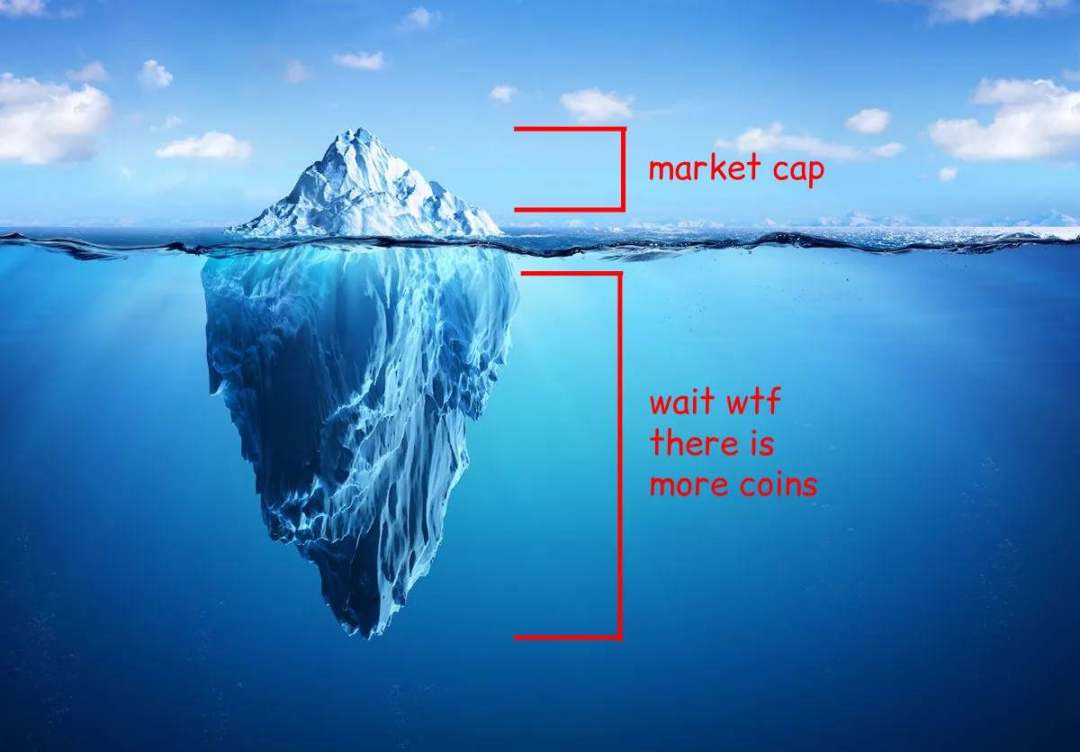

This post will discuss the topic of new token launches, focusing on common questions and misunderstandings about new tokens in the market, which are often referred to as low circulation, high FDV.

Before I begin – if you are confused by what I am saying in this post, I wrote an article in 2021 called Market Cap and the Unlocked Myth that might help you.

As always, please remember: I am not a financial advisor, I am a biased and flawed human being, I have been brainwashed, I am an idiot, I am past my mental prime and into my twilight years, and I stumble through the world trying to make sense of it all, with little success. I am actually a participant in the crypto industry, which means my IQ is probably not even in the double digits. I try not to write about the tokens I own, but I will disclose my holdings in the articles. Did you guys hear that RoaringKitty is back and released fifty super cool Avengers clips? Well, anyway, lets get started.

When I wrote that article three years ago, I thought that would be the last time I discussed the float, FDV, and market cap game. Perhaps I was naive, thinking that market participants would become more savvy about these important dynamics.

However, the reality is that they select these new tokens as the “best long-term holding tokens” because of “locking up for one year” and some other novel reasons, such as the charts of new coins, the concentration of attention on new coins, etc.

To make matters worse, other market participants have become more savvy to these dynamics. Teams, exchanges, market makers, and financiers have adapted to these market mechanisms, often exploiting them to great advantage.

Therefore, in my opinion, most new token launches in the market today are actually uninvestable, and market participants have an extremely immature understanding of these issues, and they mostly spend their time blaming the superficial symptoms of the problem.

In this series of multiple articles, I will explore some of the issues in the current new token launch market and discuss why I generally choose to avoid new token launches altogether – unless you know what you are doing and are willing to do sufficient research and analysis.

The rising profits have already been divided up privately

In modern markets, almost all “price discovery” for assets happens outside of the market, with these pricings carved up privately long before the token actually exists. Due to the dynamics of private markets, a lot of price discovery is actually exaggerated.

Looking back to 2024, people are actually nostalgic for the days of ICOs (Initial Coin Offerings). When you look at the difference in opportunities between then and now, it’s hard to disagree with them: in some ways, the ICO era was much fairer than today’s market dynamics.

Review of ICOs: The drawbacks

Lest I be misunderstood, I must stress that ICOs have their fair share of downsides. It’s easy to look back at the successful ICOs, but there are literally hundreds of projects that raised eight figures and either ran away or slowly collapsed. (Also, ICOs are probably illegal in most major jurisdictions.)

Retail investors wasted hundreds of millions of dollars funding unrealistic, junk projects that were able to raise money thanks to the ICO craze.

Even for those that succeed, their ICOs have left investors with losses. Many of the tokens of supposedly successful companies have ended up being worthless, while the companies made non-diluted money in the process and then gradually ignored the existence of these tokens.

(This even happened with Binance’s ICO — investors raised $15 million to build Binance, but received no equity in Binance. Of course, investors who participated in the Binance ICO certainly aren’t complaining now that the price per BNB is $0.15, making it one of the best performing ICOs in history.)

Benefits of ICOs

Okay, so we know that ICOs have their downsides, but they also have some benefits that are easier to demonstrate.

-

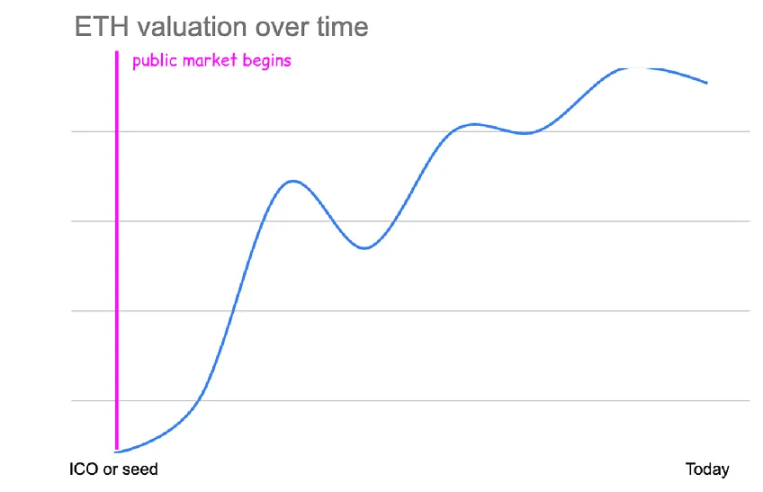

Ethereum raised $16 million in its ICO, selling 83% of the supply at the time (60 million ETH) at $0.31 per ETH.

-

The effective valuation of this public token sale is about $26 million (it’s a little more complicated taking into account mining and staking issuance, but that’s roughly it).

-

Investors who bought into the ETH ICO received a ~10,000x return in USD (~70x return in Bitcoin) at today’s prices.

-

If you missed the ETH ICO, the cheapest ETH purchase price on the market was $0.433 in October 2015, which was only 1.5 times higher than the public sale price. At the time, Ethereum was valued at around $35 million.

While it’s almost impossible to find a similar $26M valuation on Ethereum in crypto investing now, or even for seed rounds of the dumbest ideas, the point is that price discovery and upside were open to all participants.

Price discovery from $26 million to $350 billion was done on the open market, and regular people could participate. There were no KOL rounds, no unlocking and vesting schedules, and buying the cheapest price on the market was very similar to the returns of buying into an ICO.

The shift to private financing

After major global regulators enforced laws against ICOs, crypto token issuers stopped raising funds from the public and turned to private financing from venture capital firms.

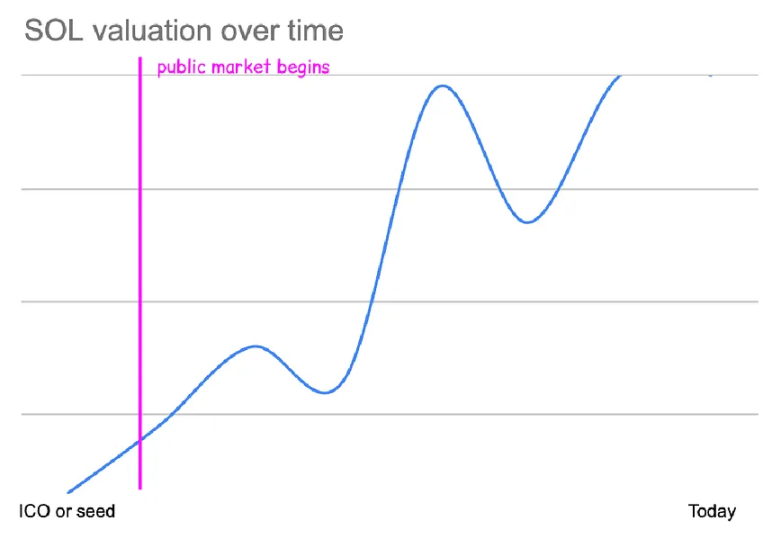

If you compare Solana’s initial funding round to Ethereum’s ICO in 2018, there are some interesting contrasts.

-

Solana raised about $3.2 million in this round, selling about 15% of the supply at a price of $0.04 per SOL at the time. The effective valuation of this round was about $20 million, similar to the valuation of the ETH ICO.

-

Investors who bought into SOL’s seed round received a return of about 4,000x USD at today’s prices. (Their actual return is likely higher, given the annualized staking returns.)

-

If you were unable to participate in the limited funding round, the cheapest SOL purchase price on the market was $0.50 in May 2020, which is about 12 times higher than the seed round.

-

Buying the cheapest price on the market yielded a ~300x return. At the time, Solana was valued at ~$240M with less than 5% in circulation. Solana actually only had ~10 months of low circulation – they unlocked very quickly from very little circulation, with most of the tokens unlocked all at once in January 2021.

The initial few privilege rounds enabled investors to effectively privately capture a 10x increase in Solana’s price ($0.04 → $0.5).

(Solana has also done a few other privileged/private funding rounds at around $0.20 USD. There was also an “auction-style” limited public token sale on CoinList, also at $0.20 USD as I recall.)

The craze of 2021

Solana launched in 2020, almost exactly at the low point of BTC and ETH prices after the COVID crash. Their massive unlocking coincided with a new wave of users entering the crypto space. This pattern has been successful across a variety of tokens, with the “bullish unlocking” phenomenon leading to massive increases in private market valuations.

Both ETH and SOL had initial sales valuations of around $20 million. By 2021, seed rounds were highly competitive, with large VCs often engaging in bidding wars. Seed round prices reached hundreds of millions of dollars.

(I remember the first time I was recommended a $100 million seed round, I turned it down in disgust. Later, the project opened with a FDV of $4 billion, and I missed a 40x return. After learning from the lesson, I bought the next $100 million seed round project. As a result, it failed, the project went to zero, and is no longer active.)

As private market valuations soared, crypto traders on liquid markets claimed that “FDV is a joke” and all charts were practically green.

Axie Infinity reached a valuation of ~$50 billion with only ~20% of tokens in circulation. FileCoin reached an FDV of ~$475 billion but had a market cap of only $12 billion. The supply increase for high FDV tokens was masked by the influx of new entrants.

As fully diluted valuations reach larger numbers, venture capital firms are increasingly willing to pay higher private round prices – If the transaction valuation of this project is $15 billion, then bidding $300 million for this project is okay, and the risk of missing out is greater!

The founders are of course happy to take these offers — they can raise more money while giving away fewer tokens. They previously had to sell 10% of their tokens at a $20 million valuation to raise $2 million. Now, they can sell 1% to raise $2 million and keep the extra token supply for incentives, the community, or (…surprise!) themselves.

If a well-known VC funds a promising project at a $100M valuation, many less respected VCs will try to follow suit. If a projects last round of financing was valued at $100M, these follower VCs without a clear investment thesis will raise a new round as soon as possible at a valuation of $300M-500M. A slightly worse entry price does not matter to them because these projects are already trading at valuations of billions of dollars.

It’s easy for founders to take these deals. Without market forces, their personal wealth “water level” is raised, and new team members are added to help their product succeed. Of course, most of these team members turn out to be net negatives, but the founders don’t know that at the time.

Through this model, more value and price discovery is privately divided over time.

Private division

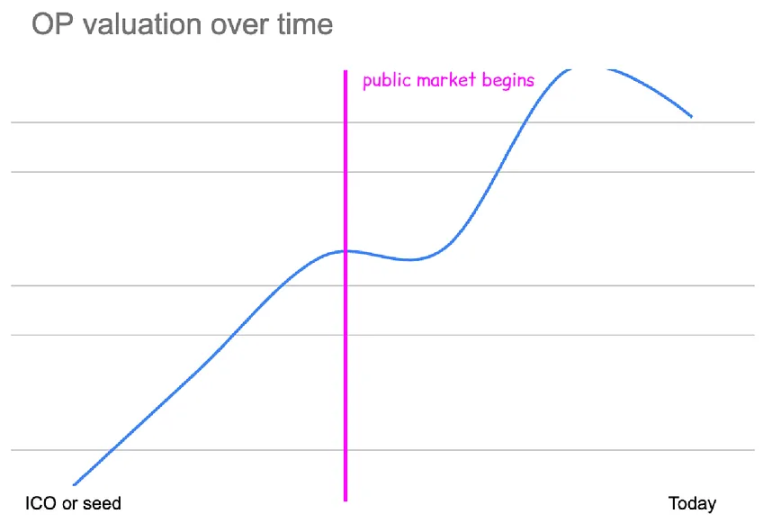

If we compare the examples of Ethereum and Solana mentioned earlier to projects launched in recent years, I would pick two comparable projects: Optimism and Starknet.

Consider the following metrics: initial sale valuation, lowest valuation in the market, percent of float at the time, market vs. private returns.

ETH ICO valuation: $26 million

-

ETH’s lowest market valuation: $35 million FDV

-

Market Low Valuation Date: October 2015

-

Circulating Supply at the Time: 100% of Supply in the Market – Market Cap $35M

-

Public sale return: 10,000x

-

Market Return: 7,500x

SOL Seed Round Valuation: $20 million

-

SOLs minimum market valuation: $240 million FDV

-

Market Lowest Valuation Date: May 2020

-

Circulating Supply at the Time: 2% of Supply in the Market – Market Cap $4M

-

Seed round return: 4000 times

-

Market return: 300 times

OP Seed Round Valuation: $60 million

-

OPs minimum market valuation: $1.7 billion FDV

-

Market Lowest Valuation Date: June 2022

-

Circulating Supply at the Time: 6% of Supply in the Market – Market Cap $95M

-

Seed round return: 183 times

-

Market return: 6 times

STRK Seed Round Valuation: $80 million

-

STRKs market minimum valuation: $11 billion FDV

-

Market Lowest Valuation Date: Today

-

Circulating Supply at the Time: 7.5% of Supply in the Market – Market Cap $800 Million

-

Seed round return: 138 times

-

Market Return: None

If you look at these metrics, a few things are clear. First, seed valuations have increased substantially over time.

-

Ethereum’s ICO valuation was approximately $26 million.

-

Solanas seed round valuation is approximately $20 million FDV.

-

Optimisms seed round valuation is approximately $60 million FDV.

-

StarkNets seed round valuation is approximately $80 million FDV.

-

Currently, the seed round financing amount of similar projects has exceeded 100 million US dollars FDV.

As the seed valuation rises, the team can reap this multiple benefit because they still own the entire supply until the first round of funding. If StarkNet were valued the same as Ethereum, the initial investors would still have a worse financial return because their initial entry price was 4x higher.

Honestly, I think that in itself is pretty acceptable.

I think its reasonable to assume that as cryptocurrencies gain popularity and the financial returns of Bitcoin and Ethereum prove their worth over time, founders will have better fundraising options. The demand for early-stage cryptocurrency investments is so great that prices will naturally adjust.

But the most obvious trend from the data above is the huge difference between financial returns in public markets and those in private markets.

-

Ethereum’s ICO returns were 1.5 times higher than what was available on the market.

-

Solana’s seed round returns were 10x higher than what was available in the market.

-

OPs seed round returns are 30 times higher than what is available in the market.

-

STRKs seed round return is infinitely high because today is the lowest price STRK has ever seen, which means that all public market buyers have lost money, but the seed round return is 138 times.

As you can see, the gains are increasingly being divvied up privately.

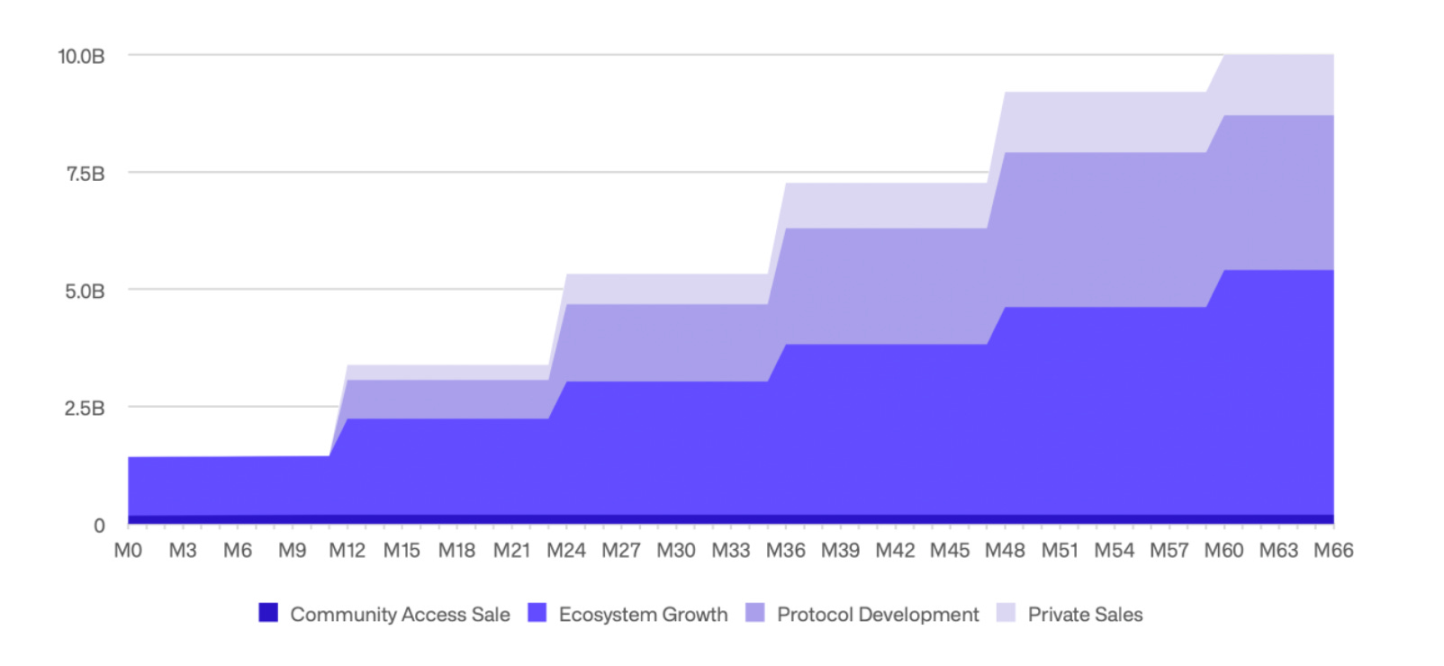

To visualize this, consider the private fundraising round for the token I mentioned earlier:

-

Ethereum had one ICO that sold 80% of tokens and no other funding rounds.

-

Solana’s seed round sold 15% of tokens, along with a few other private rounds that reached ~$80M FDV prior to the TGE.

-

OP had a seed round valuation of about $60 million, followed by private fundraising rounds of about $300 million and about $1.5 billion FDV before the TGE.

-

STRKs seed round was valued at $80 million FDV, and then it also had fundraising rounds of about $240 million FDV, about $1 billion FDV, and about $8 billion FDV before the TGE.

If you imagine a price chart for each asset, and try to visualize the private market prices on the chart at the same time. (Valuations are represented on a logarithmic scale.)

All charts start at roughly the same point ($2-8 billion range), but more and more of the uptrend is being captured by private markets.

OP and STRK currently have similar market caps ($11 billion), yet OP had to grow 6x on the public markets to reach $11 billion, while STRK fell 50% to get here.

To reach $11 billion, SOL would have to achieve a 50x increase on the open market and Ethereum would have to achieve a massive 450x open market return.

Cryptocurrency token investment opportunities like the Ethereum ICO are still very common, but are now almost entirely dominated by private markets.

High FDV is partly due to natural growth in market demand

It is an unrealistic expectation to expect the FDV issued to match the FDV issued 4 years ago.

Capitalization in the space has grown 100x, stablecoin supply has grown 100x, demand for new quality crypto tokens has grown 100x, etc. New tokens will be issued at higher prices because market demand is now higher and comparable projects are valued much higher.

When looking at FDVs, consider whether they are priced in line with the rest of the market.

-

Solana’s issuance FDV is approximately $500 million.

-

At that time, Solana’s valuation placed it in the top 25 cryptocurrencies.

-

Its value was equivalent to 1/4 of BNB’s valuation, which was a top 10 cryptocurrency at the time.

-

It launched when Ethereum was $150 per ETH.

-

It was launched when the ETHBTC ratio was 0.02.

I use the ETHBTC ratio here to show market confidence and demand for Ethereum and the smart contract chain thesis, both of which are at historical lows. There is even greater skepticism about alt L1s that replace Ethereum. There have been a series of ETH killers that failed to succeed.

Since then, ETH has risen 20x, BTC has risen 10x, SOL has risen 138x, the general market has risen sharply, and confidence in smart contract chains as an alternative to Ethereum has reached an all-time high.

today:

-

A top 25 cryptocurrency would have a market cap of over $5 billion, about 10x higher than when Solana launched.

-

1/4 of BNB’s valuation is now around $9 billion market cap, about 20x higher than when Solana launched.

-

ETH is $3,100, about 20x higher than when Solana launched.

-

The ETHBTC ratio is 0.046, more than 2x higher than when Solana launched.

If Solana launched today, using these comparable metrics as proxies for demand, the FDV at launch would likely be around $10B — and this may even be an underestimate, as these proxies don’t take into account the popularity of alt L1s.

Similarly, when Avalanche launched in September 2020:

-

Avalanches issuance FDV is approximately $2.2 billion.

-

At that time, it ranked AVA among the top 15 cryptocurrencies.

-

Its value was equivalent to 1/2 of BNB’s valuation, which was a top 5 cryptocurrency at the time.

-

It was launched when Ethereum was at $350 per ETH.

-

It was launched when the ETHBTC ratio was around 0.03.

Recalculating the issuance FDV, using modern prices, Avalanches issuance would be $15-20 billion.

Post-crisis prices

Another way is to think about Solana’s low valuation at the 2022 trough, which was after the FTX crash and collapse of investor confidence.

Solana is trading at a minimal valuation of around $5 billion in a severely depressed market. This valuation represents one of the best liquid investment opportunities of the past few years and was only achievable through the absolute expulsion of fraud and leverage from the market.

Since then, the market has rebounded significantly. If the Ethereum ICO were held today, it would not only raise $16 million. If Solana’s seed round were held today, there would be billions of dollars in demand.

It’s great that you want to buy things at the prices they were 5-10 years ago, but that’s a bit like saying “I want to buy Ethereum at $150.” Yeah, who wouldn’t want that?

Older rounds and previous issuances FDV are priced relative to the amount of risk taken and the level of confidence in those assets and cryptocurrencies as a whole. The demand for those earlier funding rounds is much lower, so they are priced to meet that demand.

Even in late 2020, projects I was invested in were struggling to fill their $2-3 million rounds. Now, seed rounds for unrealistic projects are getting oversubscribed simply for calling themselves “gamefi.”

Imagine this: if the founders of Solana launched a new blockchain tomorrow, what price would you be willing to pay for it? Would you pay at least a quarter of Solana’s current valuation ($25 billion FDV)? Or maybe even half of Solana’s valuation ($50 billion FDV)?

Of course, even at 10% of Solana’s current valuation, the FDV would be very high because market demand is very high. So yes, the FDV is higher now because the entire market is much more valuable than before and demand is much greater. Of course, a high FDV is not always indicative of market demand for a particular asset. A high FDV is not always justified or deserved.

Especially recently, this has often not been the case. Market participants have found ways to use these levers to keep valuations at artificially high levels.

One of the bigger problems in the market is not that FDV is high on average, but that many new projects have high FDVs that are disconnected from the reality of the asset and are simply trying to fit in with other high FDVs.

It has become the norm for projects to be launched at multi-billion dollar prices, even if this valuation cannot be justified by any real data, and for many market participants, projects that may never justify these valuations are clearly indistinguishable from better projects.

Low liquidity isn’t the only culprit

Low circulation is not a bad thing in and of itself, nor does low circulation in itself lead to an unhealthy market or represent a state of bad behavior – it is just a variable that investors must consider. Many low circulation tokens have had good launches and healthy market dynamics.

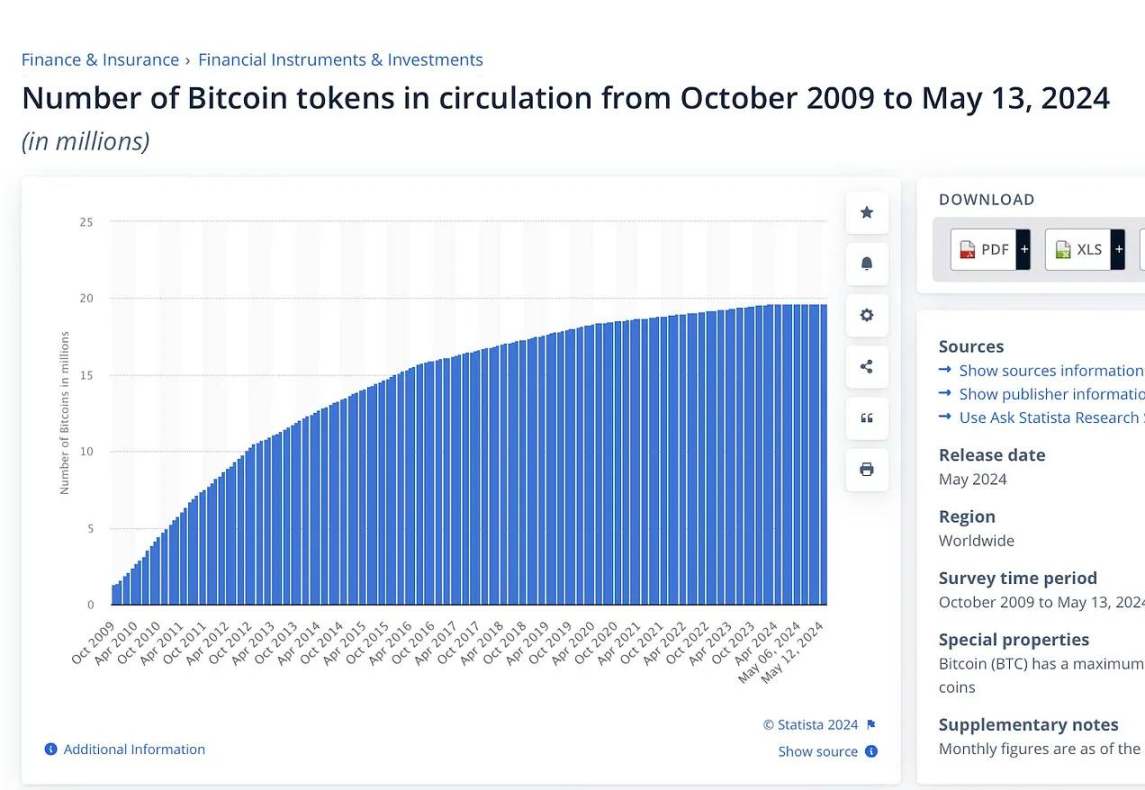

Bitcoins issuance schedule is well known, with a halving every four years, which reduces the supply of new coins on the market every four years. Bitcoins circulating supply was less than 10% a full year after the genesis block.

Solonas first-year float was also very small, and was not unlocked until 10 months later.

To be clear, I am not trying to defend low turnover.

I think higher circulating supply is always healthier for a token, and I respect projects that try to reach 100% circulating supply quickly. (There doesn’t seem to be a good way to introduce more circulating supply into the market right now, and the projects that do succeed in doing so are often not acting in their own best interest in the short term).

I am merely suggesting that low float alone is not a clear problem if you have evaluated other important factors and they are favorable. Likewise, higher float does not immediately signal a green flag and does not mean it will be a better investment.

The dynamics of low float can get tricky indeed when it is combined with other issues: unwarranted and inflated FDV, improper agreements with other market participants, or active manipulation from bad actors.

Low float markets are more susceptible to manipulation and distortion when misused by bad actors — for example, the lower the float, the lower the USD demand required to price a token at a high valuation.

Yes, low float can also lead to a disconnect between valuation and reality when float or FDV is misunderstood or ignored by uninformed token buyers. I think it is highly unlikely that there are buyers independent of valuation. It is more likely that token buyers simply do not review or consider these metrics.

To protect and inform themselves, token buyers need to evaluate the balance between circulating supply, FDV, and demand for tokens being unlocked. They should consider: what is the cost basis for locking up supply, what is the OTC demand for locked tokens in private markets, and how willing existing holders are to sell these locked tokens.

Finally, a reported high turnover may itself be a low turnover.

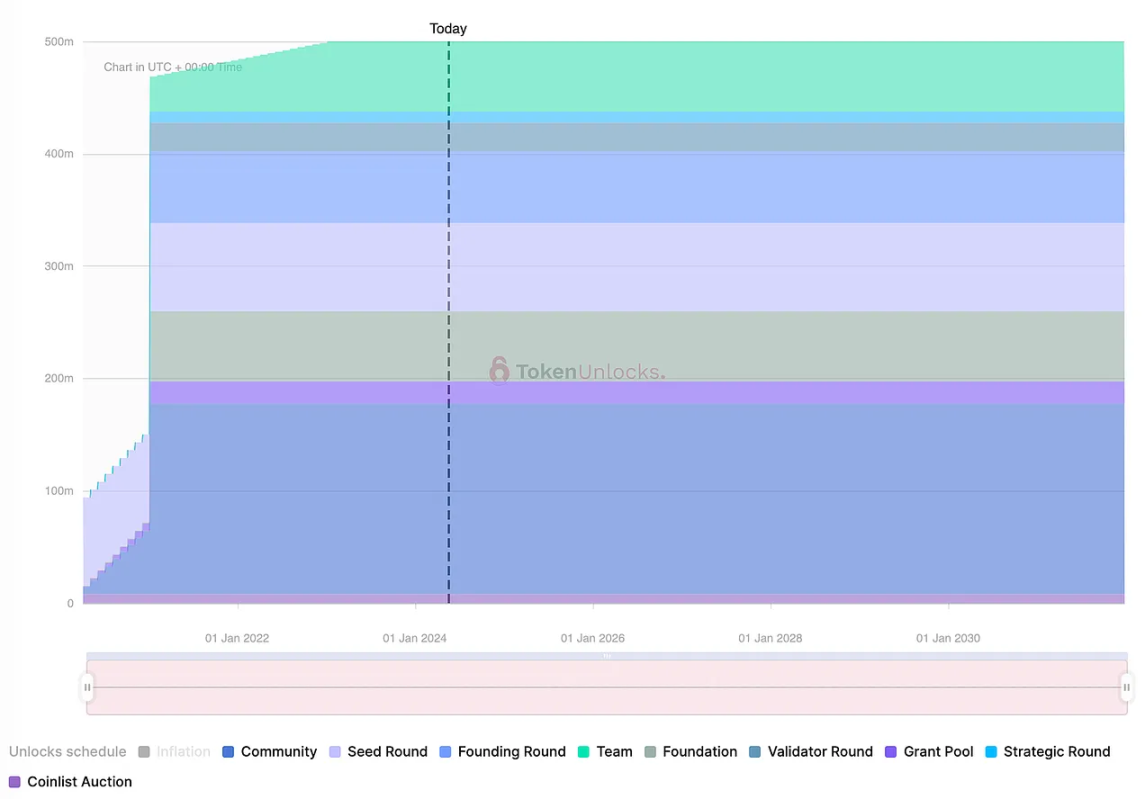

I think an example that illustrates this point might be a recent popular token launch:

As you can see from this chart, approximately 15% of the circulating supply is already unlocked.

Looking closely, you’ll notice that only about 2% is attributed to “Community Sales.” The remaining unlocked circulation is attributed to the “Ecosystem Growth Fund,” a portion of tokens reserved specifically for growth incentives (such as airdrops) and contributors to the project’s ecosystem, including developers, educators, researchers, and strategic contributors.

As outsiders, we have no way of knowing how this portion of the ecosystem tokens will be distributed. We don’t even know if this portion has been distributed. The actual (sellable) circulation of this token is probably only about 2-3%, despite reports that 15% is unlocked. This could mean that the market cap is almost 90% lower than reported due to inactive supply and OTC tokens being included in the circulation.

This suggests that simply assessing the percentage of unlocked supply is not enough. In fact, from the perspective of bad actors, obscuring and exaggerating the size of the actual (trading) supply may be a more effective technique, especially if market participants default to the idea that “low supply = bad”.

Token buyers should research who holds the unlocked supply, how it is being used, and whether they will be able to allocate it.

This “private price discovery” occurs in a rigged market, and the resulting valuations are deceptive

In my opinion, one of the core issues with the low float/high FDV debate lies here. The problem people have with “low float” or “high FDV” is really that price discovery is happening in a private market that is manipulated, delusional, or both.

Let me introduce you to the Ghost Market. (I was going to call it Shadow Realm, but Im trying not to get too obsessed with the Yugioh manga anymore.) Imagine a market where one person, lets call him Kain, controls all the new token supply. In this market, anyone can bid, but only Kain can sell.

Kain sells some tokens to a new investor, Adam, at a $50 million valuation. Adam’s tokens are locked and cannot be transferred. Kain sells more tokens to another new investor, Eve, at a $300 million valuation. Eve’s tokens are also locked and cannot be transferred.

Adam and Eve have a good reputation as investors (perhaps because of the biblical reputation?), so other investors are also interested in Kains tokens. Kyle, Bob and Taylor Swift are all bidding for the next round at a valuation of $1 billion – Kain decides that Bob is the best investor here, and Bob also buys the locked tokens. After being rejected, Kyle is unwilling to give up, and is worried about missing out on this great new token, so he bids at a valuation of $2.5 billion, and Kain sells some locked tokens to him.

At this point, Adam’s investment had gone up 50x. He was desperate to sell. He’d been writing Twitter posts for years and now he had finally gotten a big payout. In fact, he was willing to sell even at the $1 billion valuation of the previous round.

Eves position is up about 10x, and she would be happy to sell at any price above a $1 billion valuation.

But since these holders can’t sell, and the only ones who can sell, Kain, have no reason to sell at a lower price, this is a rigged market that can only go up.

This pre-token “ghost market” is an illusion. Rather than discovering a natural price based on supply and demand dynamics, it simply finds the highest price VC investors are willing to pay. This dynamic drives valuations to prices the market can’t bear, as can be seen in the token graveyards of 2020-2022, which trade at far lower than private market valuations.

The ghost market didn’t stop when Kain’s tokens arrived on Binance or Coinbase, it just evolved a bit. Let’s say Kain’s tokens are now trading at a $5 billion valuation. Even the late panic-buying Kyle has doubled down. Every investor is now willing to sell their tokens — maybe Kain is now accused of doing something nefarious in private, or a new guy has designed a better version of Kain’s product.

These investors are eager to sell but are unable to sell their locked tokens in the market. They can only wait until the unlocking/vesting period arrives. Therefore, these investors try again through the private market and find off-market demand at a 60% discount to the market price.

Right now, the real market price is $5 billion. But in the ghost market, the token is trading at $2 billion. The real problem with this low-circulation token is the disconnect between the circulating token price and the locked token price. If the ghost market price is significantly lower than the real price, unlocking will be extremely painful.

(On the other hand, if the ghost market price is close to the real price, then low circulation and upcoming unlocks may not mean much. I’m told that at some points before the major unlock, locked Solana was trading at just 15% less than unlocked Solana, and nearly all locked SOL tokens were bought up by MultiCoin, Jump, Alameda, or others.)

Open market price discovery creates a healthier market. The reason why some tokens have so much unlocking is because price discovery never really happens, it’s just testing what the highest possible bid is.

Ghost market prices are wildly different from real prices. Most market participants cannot track ghost market prices, which means they have a hard time assessing the expected pain of unlocking any asset.

opt out

Parts 2 and 3 of this series will explore the incentive structures of other market participants and use these to further explain the dynamics of new issuance. Specifically, who is benefiting and why new issuance is able to maintain such high valuations.

These sequels will also discuss ideas and solutions that well-intentioned actors can use to create healthier markets—and why it is in their interest to do so.

However, in the interim, I can recommend a simple suggestion for readers who do not have the power to change structural dynamics at the infrastructure level.

It’s your choice to buy an inflated FDV – you can opt out, and you probably should

Sure, it seems obvious, but the mantra of “invest first, research later” doesn’t seem to apply to many of you. Either that, or maybe you skipped the research part.

Token market cap information and FDV information are always public – unlocks are usually public somewhere too, if the project is halfway decent. Token economics usually show who owns the supply. Its hard to find prices for private rounds, but its possible.

If any of this basic information is missing – that’s a red flag! If any of this basic information seems confusing or obscured – that’s a major red flag.

Even if you think the project is good, you don’t have to buy these tokens.

In fact, opting out and expressing protest by not participating seems to be the right response to recent token launches.

If existing strategies fail or are rejected by the market, projects, founders, exchanges, and other market participants will have to adjust their market strategies.

I have seen some projects adjust their plans for token launches and fundraising due to the popularity of the meme and the rejection of the recent Metaverse launch. Valuations should be researched before buying, and if they don’t like the valuation then they should refuse to participate.

If you think a new project is the greatest idea in the world and you want to gain exposure for it, it is still important to evaluate the valuation and unlocking schedule. Even great projects may have bad token dynamics before full dilution, or the valuation may be too high to invest in at that moment.

There is currently no way to participate “early” in new token issuances, and as we have seen, private sharing of rising profits occurs in an inaccessible way.

Rather than trying to get in early, it is better to be disciplined and patient. It is better to identify projects that interest you and evaluate them within attractive valuation ranges, rather than following the latest CEX-affiliated Twitter influencer to chase the rise of the token 30 minutes after listing.

The good news is that for most of these tokens (good projects but with a lot of unlocking or VC overhang, or perhaps a few years of bad token dynamics), market participants may draw the wrong conclusions about these assets and abandon them entirely during their early volatility — potentially providing you with a better entry opportunity than you expected.

Summarize

Newly issued tokens have become uninvestable, primarily due to the privatization of price discovery and high valuations by the venture capital market that ignore supply and demand. These market dynamics can be exploited by dishonest actors, and increasingly by established market participants.

While the FDV is higher than in past years, the FDV of popular and hyped newly issued tokens is always set at the top of the market’s valuation range. This has been the case for at least the past five years — largely due to the privatization of price discovery.

The “upside” of Avalanche and Solana since launch is:

Part of this is driven by overall market returns.

a. Avalanche has outperformed ~7x since its public market debut, while Ethereum has outperformed ~9x over the same period.

But it was also driven by a repricing of its position in the market.

a. Solana moved from top 25 to top 5, a significant repricing relative to ETH and the rest of the market.

b. Avalanche moved from top 15 to top 10 and then back down, causing a temporary repricing relative to ETH (and the rest of the market) during the bull run that was subsequently erased.

When evaluating the upside of a new token, one should consider the FDV of the new token relative to the rest of the market, but also consider the trajectory of the market as a whole.

If the valuation of the new issuance places it in the top three of all existing tokens, then in order for this investment to perform well, investors need a massive market expansion and for the project to maintain its position in the top three as it does not have much upside relative to the market.

If the new issuance valuation places it in the top 30 and investors consider it a top 10 project, then low circulation and high FDV may not be as important when valuing the token.

While a $1 billion offering price may seem expensive today — if Solana hits $1,000 per coin and is worth $1 trillion in a few years, then $1 billion may look cheap in retrospect and people will complain about new offerings at $80 billion.

Judging new token issuance based on performance in the first few months can also be misleading — Solana fell 50% from its listing price and failed to recover to its initial price in a few months. It will take new capital inflows in a bull market to re-price its position in the market.

Significant early market repricing is unlikely to occur in the absence of a sustained market trend because:

a) Private markets squeeze out upside.

b) In high-demand markets, it is difficult to fight market forces to drive prices down.

c) If circulating supply is very low, projects, exchanges, and market makers can fight market forces and drive prices higher.

Market participants should expect valuations of new projects to remain high when market demand is high. In a model of private returns, it is no longer possible to get in early – investors should focus on finding forgotten or mispriced value in the market. When buying, one should become more proficient in evaluating the valuations and supply and demand dynamics of new tokens, and discerning which high FDVs (fully diluted valuations) are based on supply and demand realities and which are extremely out of touch ghost markets. Choosing not to participate in these markets is voting with capital.

Good founders want to build successful projects and they know that market dynamics will affect the perception of their projects. The overperformance of memes and the underperformance of new token launches have caused future founders to adjust their fundraising and launch plans.

This article is sourced from the internet: Cobie: When low-circulation, high-FDV tokens are rampant, the rising profits have already been privately divided

Original author: Nancy, PANews As the Web3 environment in Hong Kong becomes more open, in addition to a number of Hong Kong investment institutions purchasing US Bitcoin spot ETFs, more and more Hong Kong stocks are also entering the Crypto track. This article lists 8 Hong Kong listed companies that have joined the Web3 wave this year. In addition to investing heavily in crypto assets, these institutions have also combined their own businesses with Web3 technology, and invested in related crypto projects to promote business diversification and even transformation, which has a certain impact on their own stock prices. Certain boosting effect. Boyaa Interactive: Plans to purchase up to $100 million in cryptocurrencies, driving the latest quarterly profit to grow 1130% year-on-year Boyaa Interactive is a Hong Kong-listed company whose…