VC perspective: What is the real reason for the decline of high FDV, low circulation tokens?

Original article by: Haseeb Qureshi, Managing Partner, Dragonfly

Compiled by: Odaily Planet Daily Azuma

Editors note: This article is a personal analysis by Haseeb Qureshi, managing partner of Dragonfly, on the phenomenon of the general decline of high FDV, low float tokens, which is currently hotly discussed in the community. In the article, Haseeb refuted the three reasons for the decline that were generally speculated by the community, such as VC and KOL dumping the market, retail investors dont buy it, only love memes, and low circulation rate leads to imperfect value discovery, based on data analysis, and analyzed the solutions widely discussed in multiple markets, such as return to IC0, one-time full unlocking, increasing the airdrop ratio, and embracing fair launch.

It is worth mentioning that Haseeb mentioned that this article is his personal opinion and does not represent Dragonfly. In fact, because Haseebs views are too radical, many people in Dragonfly disagree with his views.

The following is the original content of Haseeb, translated by Odaily Planet Daily.

Is the market structure broken? Are venture capitalists too greedy? Is this a market manipulation game targeting retail investors?

Regarding the above questions, I have seen many theories recently, but unfortunately, almost every theory seems to be wrong. I will use data to illustrate everything.

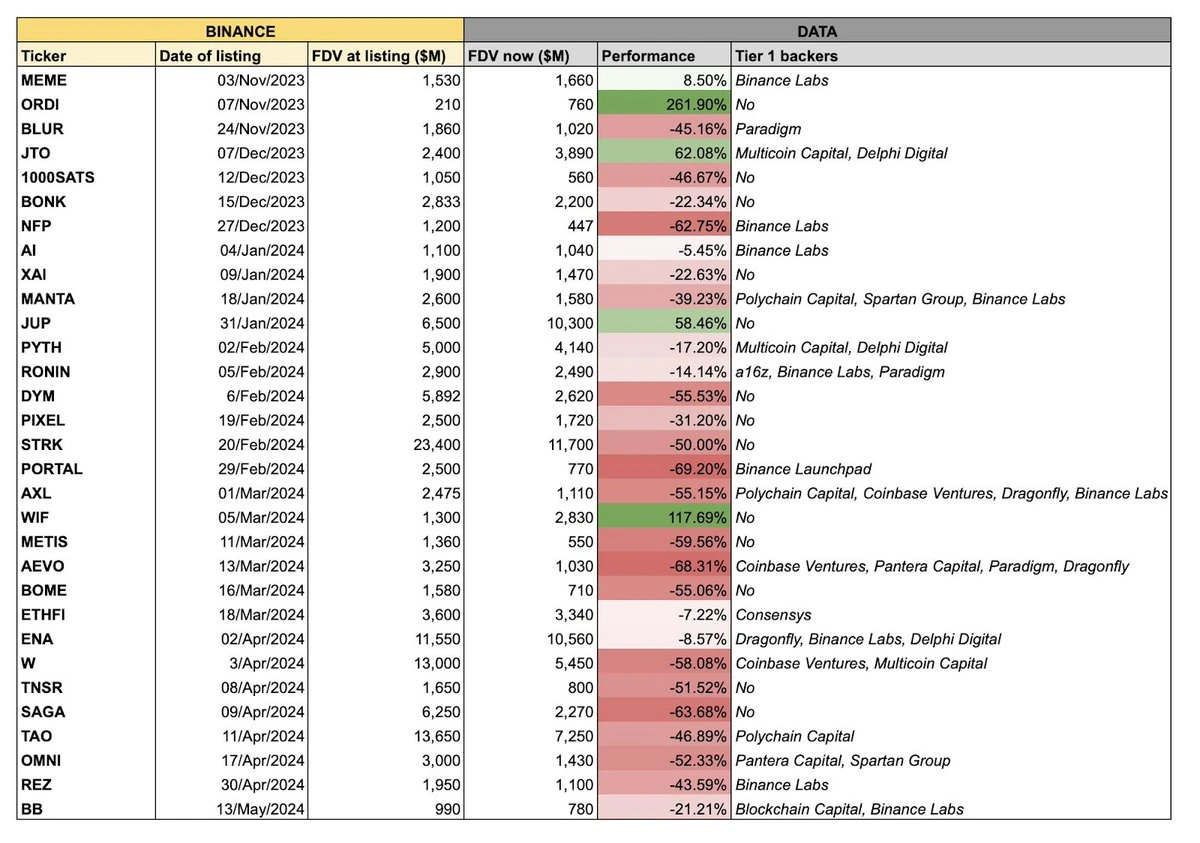

The above chart has been widely circulated in the market recently. The theme of the chart is that a batch of tokens recently listed on Binance generally performed poorly, and this batch of representatives often have the common characteristics of large supply, small circulation – this means that their full circulation valuations are high, but the circulating supply at the beginning of the opening is relatively low.

I sorted the data of all these tokens and excluded some of the “noise factors”, such as meme tokens and those that existed before Binance was listed (RON, AXL, etc.), and finally got the dynamic chart below.

As shown in the figure, these large supply, small circulation tokens almost all fell after listing on Binance. How can this be explained? For this question, everyone has their own preferred explanation. The three most popular explanations on the market are:

-

VCs and KOLs are dumping stocks;

-

Retail investors have no interest in these tokens and are instead investing in meme tokens;

-

The circulation rate is too low, and price discovery fails;

These speculations all seem reasonable. Next, lets see if they are true. There is a premise here that there is no deeper market structure problem for all tokens.

Guess 1: VCs and KOLs are dumping stocks

If this is the real situation, what should the market look like? We may see that those tokens with shorter lock-up periods will fall faster, while those with longer lock-up periods or projects without KOL participation should perform well.

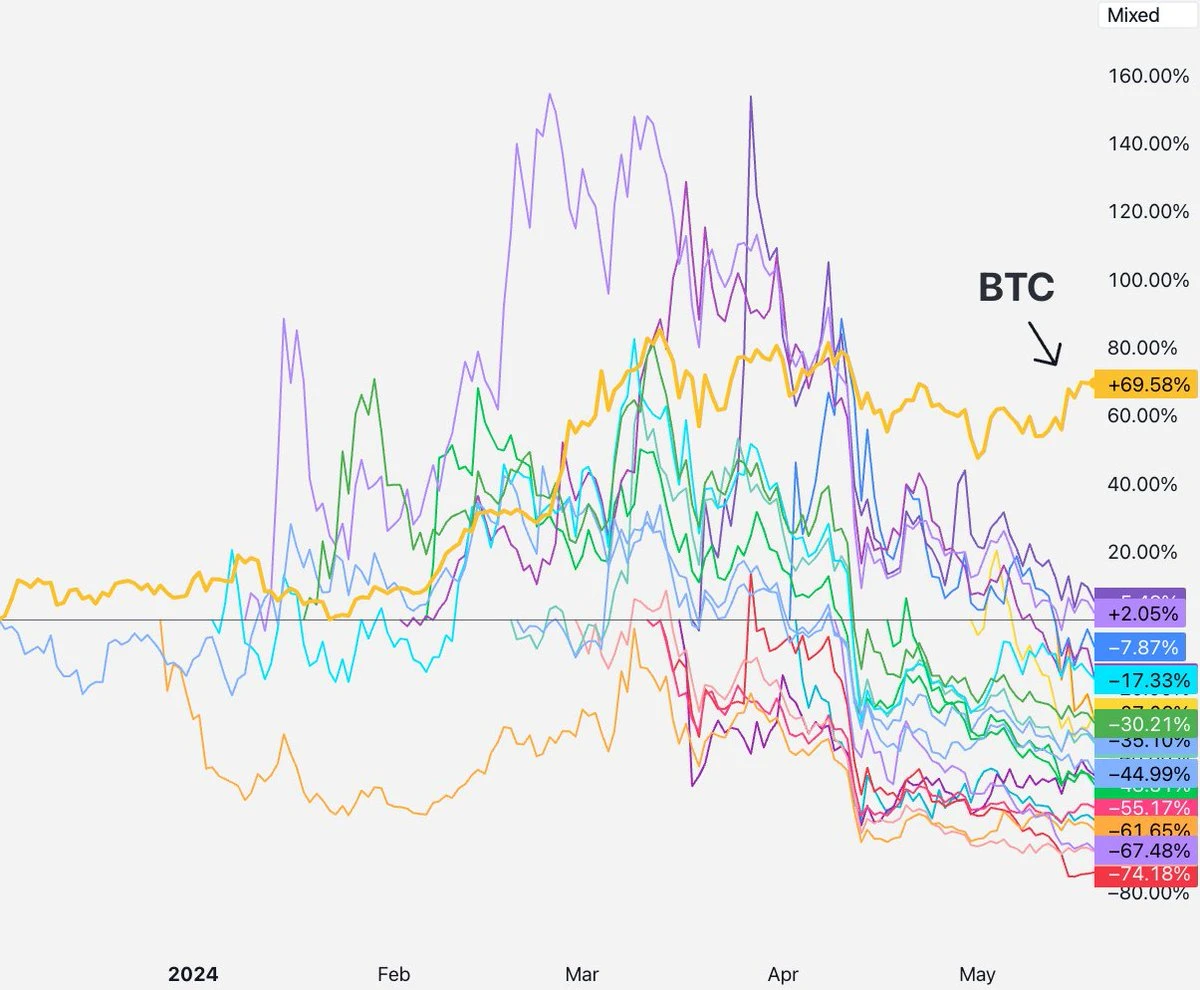

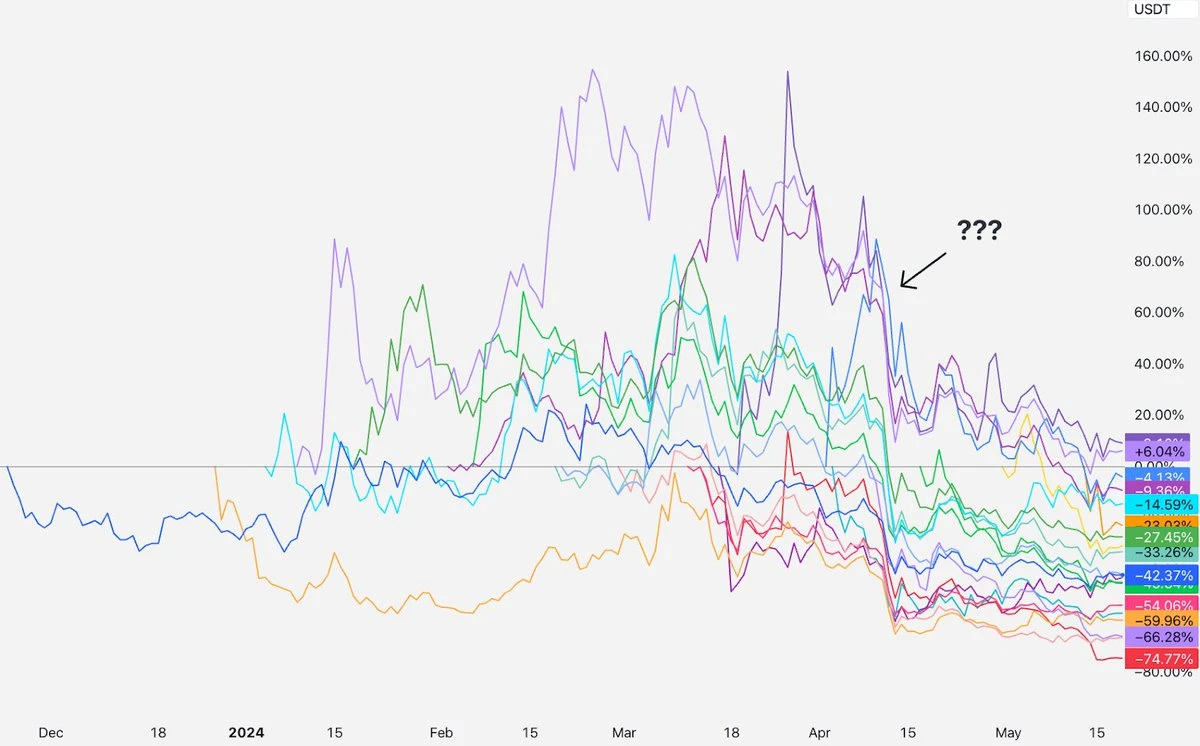

But what is the actual market situation like? From the time the tokens were launched until the beginning of April, the performance of all tokens was basically good. Before that, it seemed that no VC or KOL was dumping the market.

Then in mid-April, all projects started to fall together. The TGE time of these projects is different, and the background of investors is also different. Did they all usher in the unlocking wave in mid-April and then continue to be sold?

I need to confess that I am also a VC investor, and VCs do sometimes sell to retail investors – some VCs have no lock-up restrictions, some need to do so for hedging purposes, and some even sell in default. But generally speaking, only second-tier VCs are so unrefined, and the projects they invest in are often difficult to land on top exchanges.

The fact is that every top VC you can think of is subject to a lock-up period of at least one year and a multi-year release period before receiving tokens. Based on the SECs 144a rule, a lock-up period of at least one year is mandatory for every institution regulated by the SEC.

For this reason, the speculation that VC or KOL are dumping the market will be difficult to stand up to , because the above-mentioned tokens are less than a year away from TGE, which means that VCs are generally still in the lock-up restriction period and cannot sell at all. Maybe some secondary VCs investing in small projects will have coins to sell in the early stage of the projects TGE, but the current situation is that all tokens are falling, including those invested by top VCs and have lock-up restrictions.

In other words, although some tokens are indeed under selling pressure from VCs or KOLs, if all tokens are falling at the same time, the above speculation cannot explain this phenomenon.

Lets look at the next one.

Guess 2: Retail investors no longer buy into the idea, they only love memes

If this is true, what kind of market trend should we expect? New tokens will fall immediately after listing, and retail investors’ funds will flow into the meme token sector.

But what is the actual situation? I compared the trading volume changes of SHIB and this batch of tokens and found that the time does not match up – the craze of meme tokens broke out as early as March, but these tokens did not start to fall sharply until April, a month and a half apart.

Let’s take a look at the changes in trading volume on Solana DEX, and the conclusion is the same – the trading volume of meme tokens began to surge in early March, much earlier than mid-April.

Therefore, these data do not fit the second hypothesis. After the value of the above tokens fell, funds did not flow widely into the meme token sector. People are trading meme tokens, but they are also trading these new tokens, and the trading volume does not show any clear trend signals.

Some might argue that the problem is not the volume, but the price of the asset. Many are trying to convey the idea that retail investors are disillusioned with “real projects” and are instead interested in meme tokens.

I looked at the top 50 tokens on Binance on Coingecko, and about 14.3% of the volume on Binance comes from meme token pairs, which are still a small part of the cryptocurrency market. Financial nihilism does exist, and it is more pronounced in the cryptocurrency field, but most people still buy tokens with the idea of believing in a certain technical narrative, whether this belief is right or wrong.

So, the real situation may not be that retail investors are really shifting from VC tokens to meme tokens.

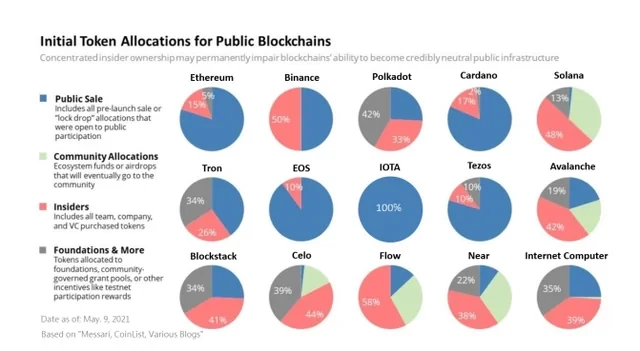

There is also a related saying that the reason why retail investors are angry is that they suddenly realize that these tokens are all scams by VCs, because the team plus VC often hold 30%-50% of the token supply. This story sounds vivid, but unfortunately I have worked in the VC field for a long time and I am familiar with the stories that have happened. Here is an overview of the distribution of mainstream tokens from 2017 to 2020. The red part means the share of insiders (team + investors), SOL 48%, AVAX 42%, BNB 50%, STX 41%, NEAR 38%…

The situation is similar today. Therefore, if you want to say that previous tokens are not VC tokens, it is obviously not true. Capital-intensive projects will face selling pressure from teams and investors from the beginning of issuance, no matter in which cycle, but these early VC tokens have achieved success one after another even after they are fully unlocked.

Generally speaking, if what you are pointing out happened in the last cycle, it does not explain the unique phenomenon happening now. So the story of retail investors no longer buy into the meme does sound attractive, but it is not supported by the data.

Move on, next one.

Guess 3: The circulation rate is too low and price discovery fails

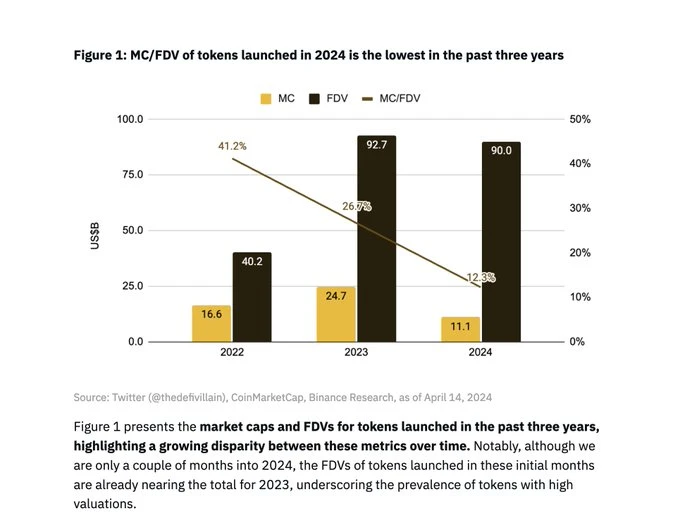

This is the most common view I have seen. It sounds right because it seems objective and not too sensational. Binance Research even published a report to illustrate this issue.

From the chart above provided by Binance Research, we can see that the average initial circulation rate of newly issued tokens in this cycle is about 13% , but is this figure really much lower than in the previous cycle?

Doug Colkitt, founder of Ambient, sorted out the data. In the last cycle, the average initial circulation rate of those mainstream tokens during TGE was also 13%.

It is worth noting that there is also a widely circulated chart in the Binance Research report, which shows that the average initial circulation rate of tokens in 2022 is 41%.

This is ridiculous! I am well aware of the market conditions in 2022, and projects at that time did not launch with an initial circulation rate of 41%.

I checked Binances list of coins to be listed in 2022: OSMO, MAGIC, APT, GMX, STG, OP, LDO, MOB, NEXO, GAL, BSW, APE, KDA, GMT, ASTR, ALPINE, WOO, ANC, ACA, API 3, LOKA, GLMR, ACH, IMX.

After a simple spot check, you will find that some tokens such as IMX, OP, APE, etc. have similar initial circulation rates to the tokens of this cycle. The circulation rate of IMX on the first day was 10%, the circulation rate of APE on the first day was 27% (but 10% of them belonged to the treasury, so the actual circulation rate was 17%), and the circulation rate of OP on the first day was 5%.

In addition, LDO (55%) and OSMO (46%) both had higher circulation rates when they were listed on Binance, but these tokens have been in circulation for more than a year, so you can’t compare the first day of listing with the first day of TGE. This may be the root cause of Binance Research’s 41% figure, but it does not represent the true trend of TGE, but only the trend of Binance’s listing selection.

Some might argue that even if a 13% initial float is similar to past cycles, it is too small to allow for efficient price discovery. The best counter to this argument is the current state of the stock market, where the average float for IPOs in 2023 was 12.8%.

The extremely low initial circulation rate is certainly a problem. WLD is a very serious case, with only 2% of its circulation supply. FIL and ICP also had extremely low circulation rates at the beginning of their launch, which led to their very ugly performance. However, this is not the case with the batch of new tokens recently launched by Binance. Their initial circulation rates are all within a normal range.

Also, if the “low circulation, broken price discovery” hypothesis is true, you should see coins with lower circulation do worse and coins with higher circulation do better, but we don’t see a strong correlation. In fact, they are all falling.

So although this guess sounds the most plausible, after analyzing the data, I cannot agree with it.

What is the solution? What do my peers say? What do I say?

Everyone is complaining about the decline of “large supply, small circulation” coins, but there are also a few people trying to come up with practical solutions.

Many people suggest reintroducing Initial Coin Offerings (ICOs). I disagree. Don’t you remember the historical lesson that ICO tokens fell sharply in price after listing, causing retail investors to suffer heavy losses? Were they seriously affected? In addition, ICOs are illegal almost everywhere, so I don’t think this is a serious suggestion.

Kyle Samani, founder of Multicoin Capital, believes that investors and teams should unlock 100% of their shares immediately at the token TGE , but because of the existence of Rule 144a , this is impossible for US investors.

VC firm Arca believes that token issuance should be equipped with underwriter roles like traditional IPOs. I would say this is possible, but token issuance is more like a direct listing, which only involves listing on an exchange and obtaining support from some service providers. I personally prefer a simpler listing structure and fewer intermediary roles.

Lattice co-founder Regan Bozman suggested that projects should issue tokens at a lower price to allow retail investors to buy in earlier and get some upside. I understand the idea, but I don’t think it will work. Artificially setting the price below the market’s expected price means that anyone can capture this price difference within the first minute of the token being listed on Binance, but this will only benefit the few traders who quickly fill their orders within the first 10 minutes. We have seen this happen many times in the minting of NFTs and IDOs.

Some people suggest that we return to the fair launch model. Although fair launch sounds ideal, it is not smooth in practice because teams will quit. Believe me, many projects have tried so much in DeFi Summer, but apart from Yearn, have you seen other successful cases of non-meme tokens in recent years?

Many people have suggested that the team increase the airdrop ratio. I think this initiative is reasonable. We usually encourage teams to maximize the circulation rate on the first day to achieve better decentralization and price discovery, but I think it is not wise to make an exaggerated large airdrop just to increase the circulation rate. After TGE, the project still has a lot to do. Just to increase the circulation rate, releasing too much airdrop at one time will put the project party under greater financial pressure on future donations and funding plans.

So what do we want to see as a VC? Believe it or not, we want the price of our tokens to reflect real value within the first year after launch. VCs don’t make money from “markups” but from ROI, which means we need to liquidate our tokens eventually. We don’t take any paper gains, and we don’t value our unlocked tokens at market prices (anyone who does this is crazy). It ’s actually a bad image for a VC to have valuations soar and then collapse, which makes LPs think that there is something wrong with the asset class you are investing in. We don’t want that. We prefer that the price of the asset rise gradually and steadily, which is what most people want.

So, will the phenomenon of large supply, small circulation continue? I dont know. Compared with the prices of tokens such as ETH, SOL, NEAR, AVAX, etc. when they were listed in the early years, the current price figures of these tokens are obviously amazing, but at the same time, the scale of the cryptocurrency market has become much larger now, and the market potential of successful projects is significantly greater than in the past.

Doug Colkitt, founder of Ambient , made a great point – if you compare the FDV of new tokens in this cycle with the FDV of old tokens in the previous cycle, denominated in ETH, you will find that the numbers will be very close. Well-known KOL Cobie also mentioned this in his recent post. We will never go back to the days when Layer 1 was valued at $40 million FDV, because everyone has seen how big the current market size is.

In summary, cryptocurrencies have risen significantly over the past five years, and the valuation pricing of emerging projects often requires comparison with existing projects, so the numbers you end up with will be very large.

Some people may notice that I have been bashing other peoples ideas, so what should the real solution be?

The answer is that there is no solution.

The free market will sort out these issues. If the price of these tokens drops; other tokens will also drop in price; exchanges will push teams to list at lower FDVs; damaged traders will simply buy at lower prices, VCs will communicate this to project founders – Series B pricing will drop due to lower public market expectations, Series A investors will start to be alert, and eventually seed investors will be affected. Price signals will always be transmitted.

When there is a true market failure, you may need some clever intervention, but when it is just a pricing error, the free market can solve it by itself – just change the price. Those who lost money, both institutional and retail, have internalized this lesson and are willing to pay lower prices for these tokens. This is why all these tokens are trading at lower FDVs, which will also drive pricing changes for future tokens.

This has happened many times before, just give the market some more time.

Revealing moment

Now it’s time to do a reveal. What happened in April and why did all the currencies fall?

I think the culprit lies in the situation in the Middle East.

For the first few months, these “large supply, small circulation” tokens were trading roughly flat in the early days of the listing, until mid-April, when the situation suddenly changed. Tensions between Iran and Israel intensified, raising the possibility of war. The market crashed, and while Bitcoin gradually recovered, these tokens did not.

Why are these tokens still in a downturn? My explanation is that these new tokens are psychologically classified as high-risk new coins. The events in April caused the markets interest in high-risk new coins to decline, and it has not recovered yet, so the market decided that they would not buy back these new coins for the time being.

Markets can be volatile at times, but would you be talking about the structure of the token market being broken if these tokens had gone up 50% during this time period instead of going down 50%? That would also be mispricing, just in the opposite direction.

A mispricing is a mispricing and the market will eventually correct itself.

What can be done now?

When people lose money, they want to know who to blame. The founder? The VC? The KOL? The exchange? The market maker? The trader?

I think the best answer is that no one is responsible (I accept that everyone is responsible), but different roles can do better in a completely new market environment.

For VCs, what we need to do is listen more to the voice of the market and slow down the pace; we also need to show better price discipline and tell founders to be more realistic in valuation; in addition, never price locked tokens at market prices (almost all top VCs I know will price locked tokens at a significant discount); if you find yourself thinking I cant lose money on this deal, then you are likely to regret the deal.

For exchanges, you need to list tokens at a lower price and consider pricing based on public auctions on the first day rather than based on the last round of venture capital valuations; please do not list tokens without determining the token lock-up period; show retail investors the unlocking and FDV status of newly listed tokens through clearer data.

For project owners, you need to issue more tokens on the first day of TGE. A circulation rate below 10% is too low. Design a comprehensive and healthy airdrop plan. Don’t be afraid of a low FDV on the first day of listing. The best price trend for building an ideal community is always a gradual increase. If your token is falling, don’t feel alone. Remember that AVAX fell by about 24% in two months after listing; SOL fell by about 35% in two months after listing; NEAR fell by about 47% in two months after listing… As long as you focus on building something that you can be proud of, the market will eventually discover your value.

As for the millions of ordinary people, I hope you will be wary of all assertions and outrageous statements. Markets are complex, declines are normal, you should be suspicious of all those who confidently claim to know the reasons, do your own research, and do not invest more money than you can afford.

This article is sourced from the internet: VC perspective: What is the real reason for the decline of high FDV, low circulation tokens?

Original author: Haotian Vitaliks article on FHE (Fully Homomorphic Encryption) has once again inspired everyones exploration and imagination of new encryption technologies. In my opinion, FHE is indeed a step higher than ZKP technology in terms of imagination, and can help AI+Crypto to be implemented in more application scenarios. How should we understand this? 1) Definition: FHE fully homomorphic encryption can realize the operation of encrypted data in a specific form without worrying about exposing data and privacy. In contrast, ZKP can only solve the problem of consistent transmission of data in an encrypted state. The data receiving party can only verify that the data submitted by the data party is authentic. It is a point-to-point encryption transmission scheme; while fully homomorphic encryption does not limit the scope of the…