Original|Odaily Planet Daily

Author: Wenser

On May 13, Web3 social infrastructure project UXLINK officially announced a new round of financing , led by SevenX Ventures, INCE Capital and HashKey Capital, with a financing amount of over 5 million US dollars. It is worth mentioning that this round of financing is less than 3 months away from UXLINKs previous round of financing. So far, the project has raised a total of over 15 million US dollars, covering many first-line institutions and well-known angel investors from Europe, America, Asia and the Middle East.

At a time when mainstream applications in the Web3 social track are targeting assets with strong financial attributes and influence speculation, UXLINK is doing the opposite, striving to open up a completely different Web3 social path from acquaintance social network. Today, Odaily Planet Daily will share with you the high-quality potential project UXLINK in the social track.

New social approach: UXLINK’s Web3 social network for acquaintances

As time enters 2024, Mass Adoption is still an unsolvable problem in the Web3 world. The SocialFi track, which is highly anticipated by the market, mainly relies on products such as Friend.tech, which hypes influential assets, the community forum-based social protocol Farcaster (and applications such as Warpcast), and Debox, which is positioned as the Web3 version of WeChat.

Without exception, these products focus on the link of establishing social relationships and hope to attract more people to join through topics such as interest, investment, and ecology. However, they all have the following problems:

1. The entry threshold is high. Whether it is the wallet login method, the interactive gas cost, or the product payment function, it is a high threshold for many people;

2. Poor social stickiness. This problem is a common problem of SocialFi products and GameFi products. Excluding the impact of asset speculation or profit expectations, user stickiness is extremely poor;

3. Low degree of openness. The value of social networks lies in freedom, openness, contact and connection, but the product ecosystem of many social tracks is extremely closed, and the corresponding assets also have poor liquidity.

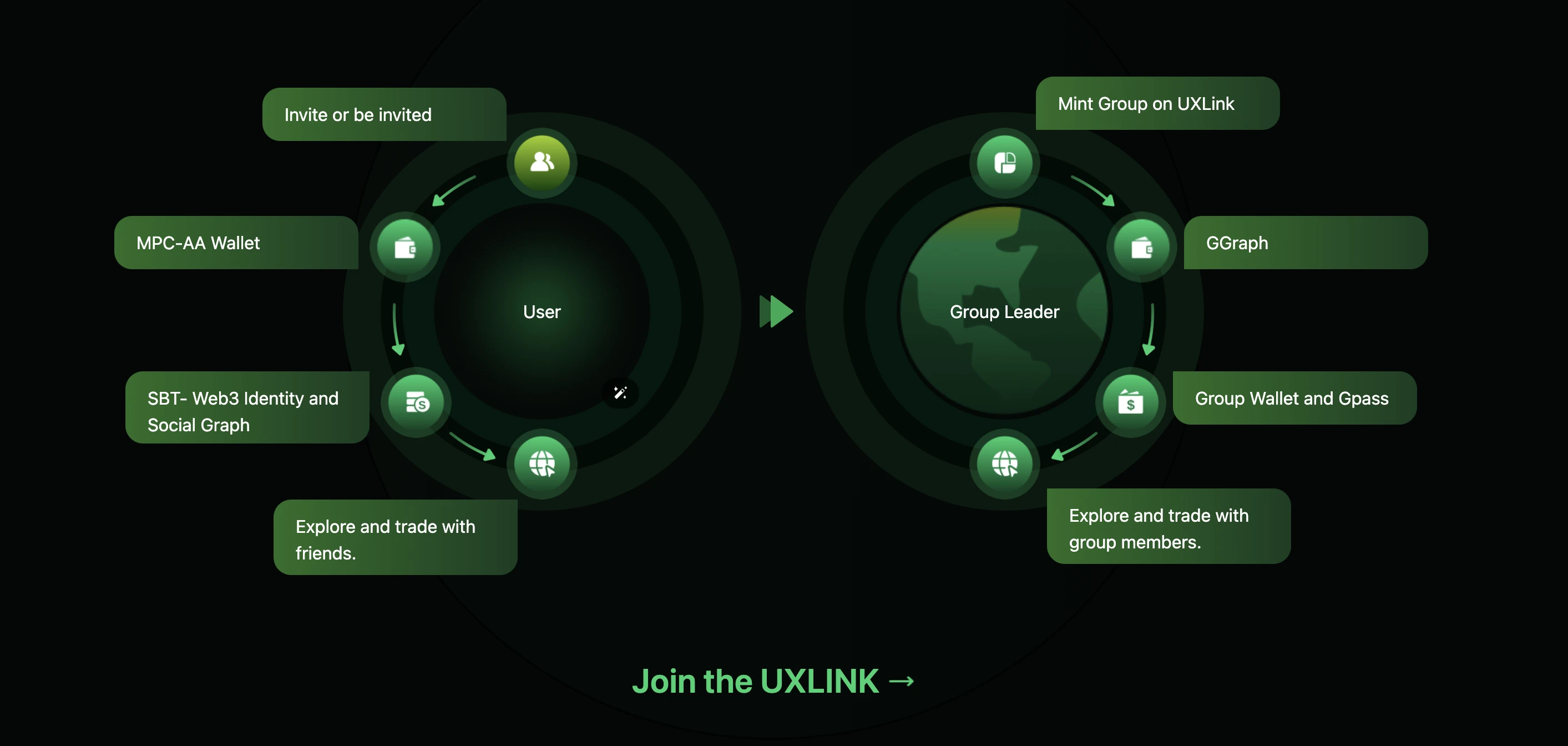

In response to the existing problems in the Web3 social track, UXLINK gave a different answer – acquaintance social network is the direction that is more worthy of effort. Specifically, compared with previous Web3 social networks, the Web3 acquaintance social network opened by UXLINK has the following characteristics:

-

RWS (Real World Social Connections): Focuses on real two-way connections in the real world, leveraging the trust growth potential of the Link To Earn mechanism to tap into the diverse value of acquaintance social networks.

-

Connecting the Web2 Web3 worlds: Seamlessly integrate social applications such as Telegram, and connect numerous users in the Web3 space and the Web2 world through Web3 groups.

-

Social economic equality: Different from previous centralized social networks, UXLINK leverages the advantages of decentralized social networks and builds a relatively equal social economic network based on acquaintance social networks through a series of combined punches such as MPC-AA wallet, UX SBT, UX Graph, GGraph, Gpass, etc.

It has to be said that there are many existing problems in the Web3 social track, but UXLINK has provided new solutions and reference answers for SocialFi and the social track through the construction of different products and ecosystems.

New social data: UXLINKs social data map

According to the data on UXLINKs official website , the number of UXLINK users has exceeded 6.78 million, the number of groups has exceeded 102,200, and the group coverage has exceeded 8.45 million people. In the Odyssey user event previously initiated by UXLINK, 950,000 new certified users were added within 30 days. The Link to Earn mechanism ultimately led to a terrifying growth of 17 new users invited per person on average. At the same time, UX SBT and UX Graph also provide a good tool foundation for users to accumulate social graphs and complete the successful transfer of Web2 SNS social relationships to Web3 social assets.

UXLINK official website interface

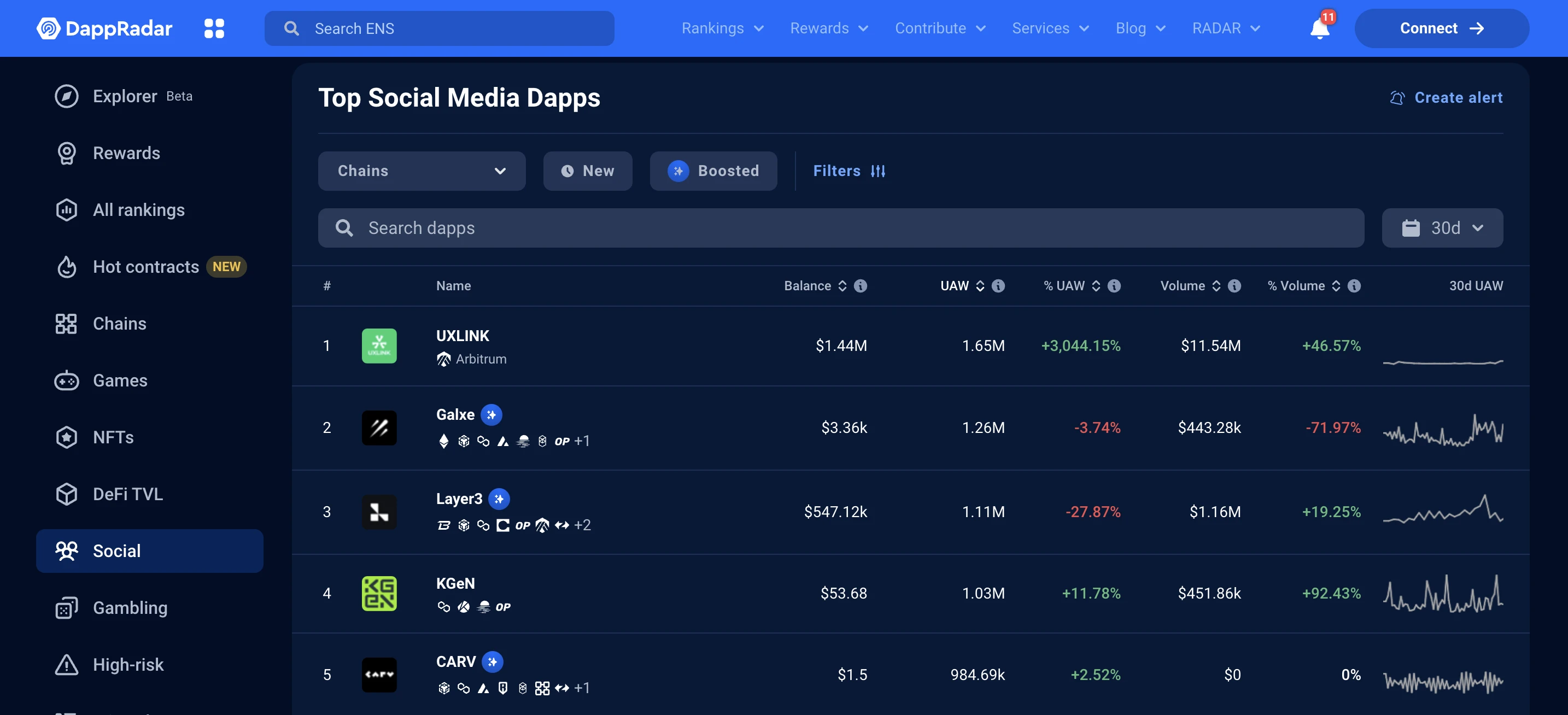

According to information from the DappRadar website , UXLINK has had over 730,000 independent active wallet addresses in the past 24 hours, and over 1.65 million independent active wallet addresses in 30 days, ranking first in the Social sector. The total assets of smart contracts exceed US$1.44 million, and the total assets flowing into smart contracts in 30 days reached US$11.54 million.

DappRadar website interface

In addition, UXLINK is actively expanding its ecological cooperation territory. Recently announced official cooperation projects include decentralized content creation protocol Atem Network , artificial intelligence integrated social network CharacterX , hyper-realistic virtual city project LightCycle , Web3 social application Halo and other social track applications of various types. This is also the most important reason why traditional US dollar funds and cryptocurrency investment institutions including OKX Ventures, Web3Port Foundation, Manifold, UOB Venture, Comma 3 Ventures, Cypher Capital, Kucoin Ventures, Gate Labs, Forgame, ECV, Signum Capital, 7 UPDAO, HongShan, Matrixport Ventures, ZhenFund, etc. chose to bet on this project.

UXLINK official website interface

New social assets: UXLINK’s “users first, assets later” development path

UXLINK is able to achieve the current product data because it has two major differentiated advantages :

The first is to target traditional social tool applications with a huge number of users in the early stage, achieving a certain degree of vampire attack; the second is to encourage the growth of Link to Earn first, and then activate the issuance and trading of assets within the ecosystem. The UXUY and UXLINK dual token model can achieve more sustainable product development and project operations.

By comparing the relevant data of Friend.tech, perhaps we can further see the wisdom of UXLINKs strategy.

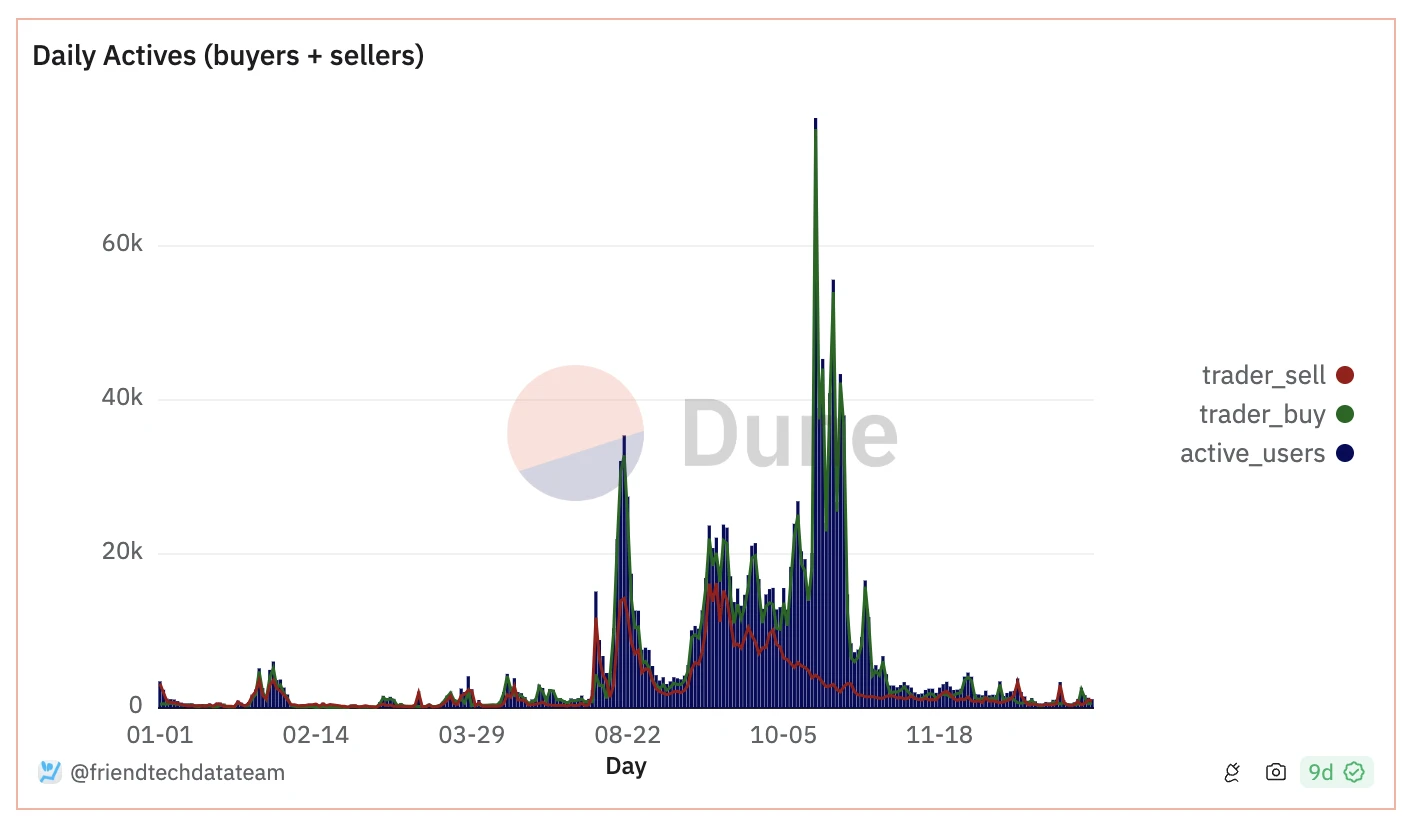

Comparing the number of active users , Friend.techs peak daily active users is about 76,000, while UXLINKs peak daily active users is about 743,000, which is about 10 times the former.

Friend.tech Active Users Panel

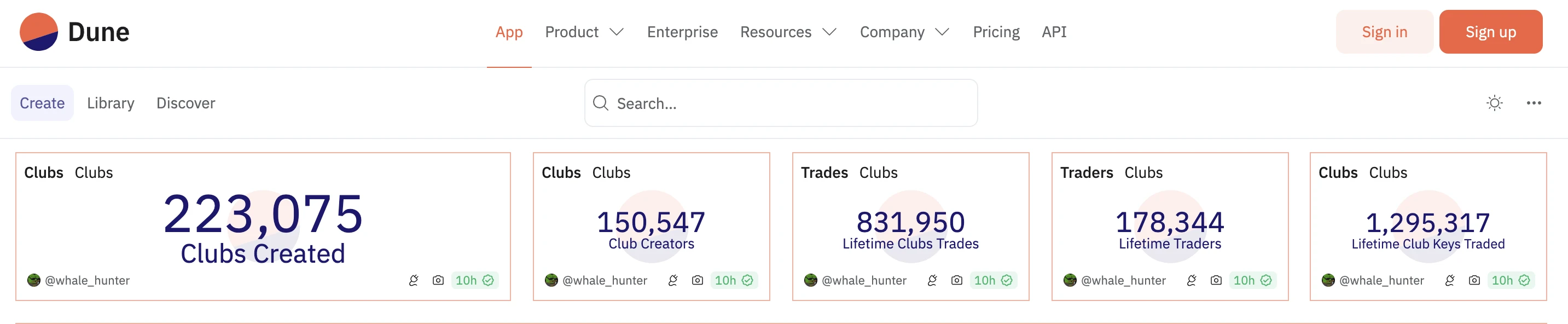

In terms of the number of groups, since the launch of Friend.tech V2, the number of clubs has exceeded 223,000; in this regard, the number of UXLINK groups is about 102,000. This may be because UXLINK pays more attention to the expansion of acquaintance social networks, and the threshold for group creation is relatively high, so the number of groups is showing a steady growth trend.

Friend.tech Dune Data Dashboard

UXLINK Group User Demonstration

Based on the above information, we can see that the acquaintance social network based on UXLINK has a wider radiation range and closer social connections. Users do not need to build their own social networks from scratch, but can conduct a series of interactive operations such as two-way relationship establishment, value exchange, asset conversion, and social currency transactions based on existing social networks. Users come first, and then assets. Avoid the hasty social relationship assetization in the early stage, and take the path of social interaction monetization. Through UXUY points, social relationships are further enhanced and social assets are efficiently circulated. This is naturally inseparable from the UXUY-UXLINK dual token economic model created by UXLINK.

New social valuation: UXLINKs governance value and market valuation speculation

According to the official white paper , UXLINK adopts a dual-token model, including the protocols native utility token (or points) UXUY (as POW records, points) and the governance token UXLINK. Among them, UXUY is a reward system for the development of the UXLINK community and ecosystem, based on a transparent Proof Of Link mechanism, without pre-minting; users can earn UXUY by inviting others or contributing to the ecosystem.

UXUY can be used to pay for on-chain gas fees throughout the ecosystem, covering transactions, transfers, and social network interactions. It is worth noting that 3% to 15% of the fees within the UXLINK ecosystem will be used for token destruction unilaterally determined by UXLINK.

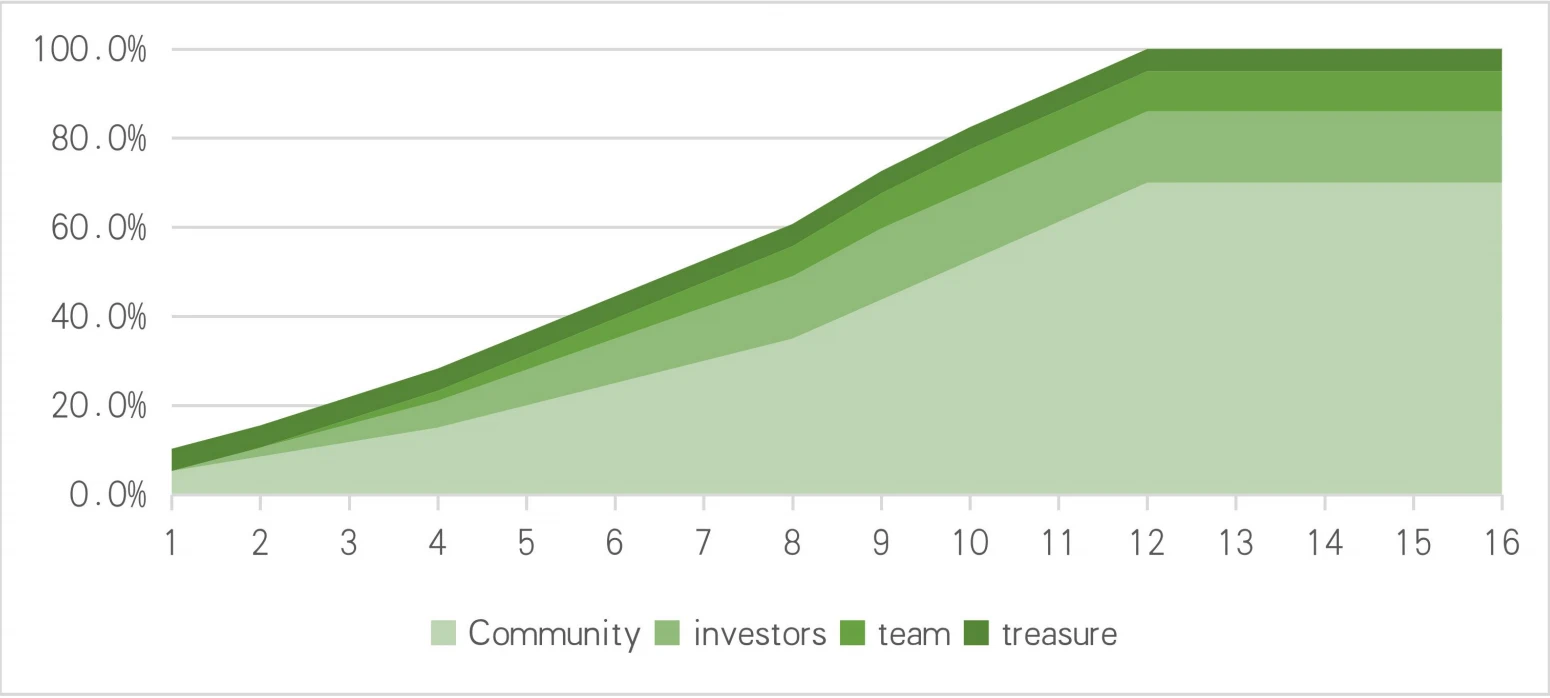

UXLINK belongs to the category of project governance tokens. Its purpose is to achieve project governance and obtain revenue from UXLINK projects and products. The current total amount is tentatively set at 1 billion, of which 65% is allocated to the community; 21.25% is allocated to private placements; 8.75% is allocated to the project team; and 5% is allocated to the treasury.

Official White Paper Token Economic Model

Regarding the distribution time of UXLINK tokens, the official document shows the following information:

Community: UXLINK tokens will be airdropped monthly to active users, project builders, and partners. It is worth noting that once airdropped, there is no lock-up period and they can be released immediately.

Private equity partners: Initially locked for 3 months, followed by a linear quarterly release over the next 2 years, requiring a gradual release of 12.5% every quarter for 8 consecutive quarters.

Project Team: The team’s UXLINK tokens have a 6-month lock-up period and will be released linearly quarterly for 2 years, with 12.5% released each quarter for 8 consecutive quarters, in line with the long-term development of the project.

Project treasury: flexible allocation.

The following is the estimated maximum circulation of UXLINK tokens within 16 quarters (4 years) since the launch (not the official issuance time of TGE tokens):

UXLINK Token Release Schedule

have to be aware of is:

1. Assuming that the token allocation in the treasury (5%) is released when the token goes online, the circulation volume will be about 10% of the total token volume; otherwise, the circulation volume will be about 5% of the total token volume.

2. By the end of Q12 (i.e. the end of Year 3), if the project reaches 30 million users, the total supply will be at its maximum.

Based on the above information, the initial circulation of UXLIKN tokens is mainly for community token allocation and treasury token allocation.

Similarly, comparing with Friend.tech, the current price of its FRIEND token is US$1.46, the circulation is close to the maximum supply, about 93.5 million, and the total market value is US$136 million.

Considering that the initial circulation of UXLINK is about 5% to 10%, or about 50 million to 100 million, and compared with the same market value of FRIEND, the price of a single UXLINK token is about 1.36 to 2.72 US dollars.

Considering that UXLINKs daily active users are 10 times that of Friend.tech, if the price of UXLINK tokens remains the same as FRIEND, at $1.5 to $3, the initial market value of UXLINK tokens will be around $75 million to $300 million, and the total market value will be as high as $1.5 billion to $3 billion.

Of course, the above is only a subjective speculation based on the existing information. The specific performance of the UXLINK token price and market value still needs to be observed based on the subsequent development of the UXLINK project.

New social trends: either become a portal or an asset

As Web3 social networking has developed to the present, the track has gradually entered the deep water zone, and the development trends of many social projects and products are polarized: one type of project, such as Friend.tech and Debox, has become an asset-based social project, that is, it mainly carries out product design, ecological operation and development planning around asset speculation; another type of project, such as UXLINK, has chosen a more challenging path – that is, to become an entry-type social project, more like the starting point of social networks, which is not only reflected in the choice of the field of acquaintance social networks which naturally has fission properties and relationship interactions, but also in the role played by UXLINK as an infrastructure and social protocol and the corresponding source of profit.

In the UXLINK official white paper, the project mentions that “users (not UXLINK) own the network and related data, and thus users own the revenue generated on UXLINK. The UXLINK model includes the following main sources of income :

(1) Gas fee: Involving data owners and demanders. UXLINK will charge a certain percentage of fees for data exchange and transfer, namely gas fees. In addition, if Dapp generates revenue within the UXLINK ecological network, UXLINK will also charge a certain percentage of fees.

(2) Commission fees: UXLINK charges a certain percentage of commission fees for social interaction Dapps related to Web3 financial topics.

(3) Service Fees: If a partner (such as a Dapp creator within the ecosystem) needs the community’s help in attracting new users, a certain service fee may be charged.

(4) Product sales: Communities or projects may launch some tools or items with unique value, such as NFTs.

In addition, all proceeds received by the protocol, including UXLINK tokens and other cryptocurrencies, will be allocated to community development and token management.

It is worth mentioning that in the first season of the IN UXLINK WE TRUST airdrop event launched by UXLINK in early May, minting the airdrop voucher UXLINK NFT can guarantee the airdrop of its native token UXLINK, and the token will be 100% unlocked after TGE. After community discussion, in addition to using UXUY points to redeem this series of NFTs, the community will officially conduct limited sales of 3 airdrop voucher NFTs in the NFT market, namely MOON, TRUST and FRENS NFTs. Each NFT can obtain 25,000, 750, and 50 UXLINK tokens, and enjoy other equal rights of UXLINK NFT. This event is expected to cover 550,000 community contributors, and more than 50% has been completed. It also shows the strong hematopoietic ability of UXLINK as a social infrastructure and social protocol.

UXLINK, which holds the starting point of Web3 social networking, is expected to become a decentralized social network entrance based on the social network of acquaintances. By utilizing the multi-level data traffic of individual-group-application, on the basis of establishing an internal circulation asset ecology and an external link exchange ecology, it will gradually achieve the small goal of 100 million+ users, opening a new door for the Mass Adoption of Web3 social networking.

This article is sourced from the internet: UXLINK: The “elephant in the room” in the social track?

In the past 24 hours, many new popular currencies and topics have appeared in the market, and they may be the next opportunity to make money. The sectors with strong wealth-creating effects are: MEME sector and RWA sector; The most searched tokens and topics by users are: Renzo, Karrat, LayerZero; Potential airdrop opportunities include: Owlto Finance, ZKLINK; Data statistics time: April 24, 2024 4: 00 (UTC + 0) 1. Market environment Yesterday, Bitcoin continued to climb from $65,911 to the pressure level of $67,000, reaching a high of $67,132 in the early morning. Bitcoin has soared by more than 5% since last Wednesday, and the altcoin market has also had a strong rebound, especially MEME coins, which generally rose by more than 20%. Recently, this sector has had a certain…