Original author: Layergg

Original translation: TechFlow

Meme is becoming an alternative to VC, CEX and high FDV in this crypto cycle. Community-driven + fair release has captured the hearts of retail investors and has begun to exert influence in the actual bidding stage.

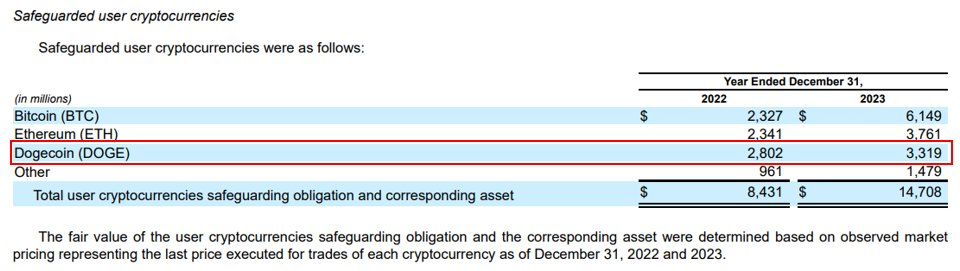

Large-cap memes have been among the top performers this year, maintaining strong returns even during market corrections. Memes are now a mainstream asset class, as evident by the holdings of Robinhood users.

One thing to consider is that global asset managers are only just beginning to enter the cryptocurrency space.

I think it’s unlikely that Wall Street veterans will be the exit liquidity for crypto VCs, they’re more likely to disrupt the status quo, and memes are expected to be one of the tools they use to do that.

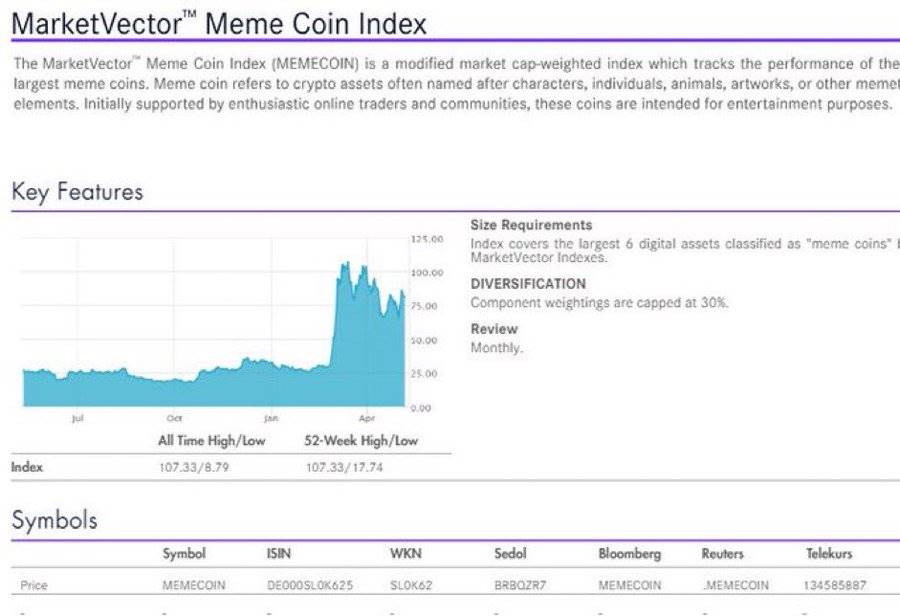

Two prominent examples are Franklin Templeton and VanEck.

a) VanEcks MarketVector recently launched the Meme Index.

b) Franklin Templeton continues to publish articles about Meme. An interesting case is Franklin Templeton’s promotion of $WIF .

Surprisingly, traditional crypto VCs are still slow to embrace memes. Major memes like $WIF and $PEPE are nowhere to be found in the portfolios of top VCs. If they finally give in and decide to invest in memes, this could mark the beginning of the second wave of the meme cycle.

Perhaps the upcoming US presidential election will force VCs to make a painful choice soon (whether to add memes to their portfolios).

While it is still uncertain whether Trump or Biden will win, every related event seems to be conducive to boosting the popularity of the meme.

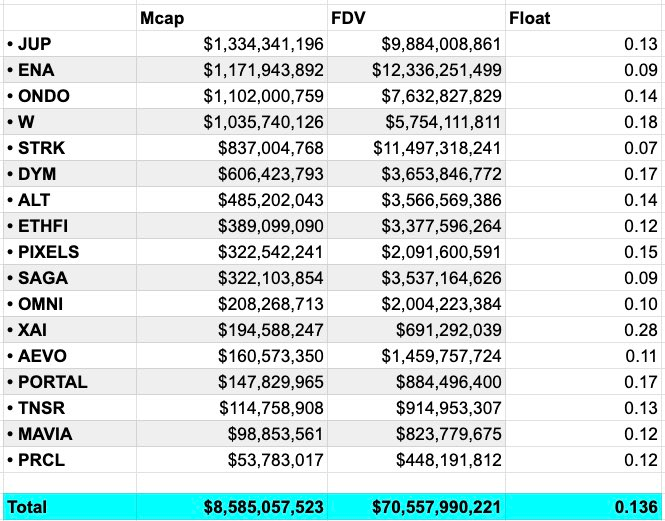

On top of that, retail investors are disappointed with low float, high market cap projects. VCs advocate seriousness/fundamentals!, but the market response remains lukewarm. In this situation, hedge funds and market makers are under pressure to generate returns within a specified time.

“Is the meme over?”

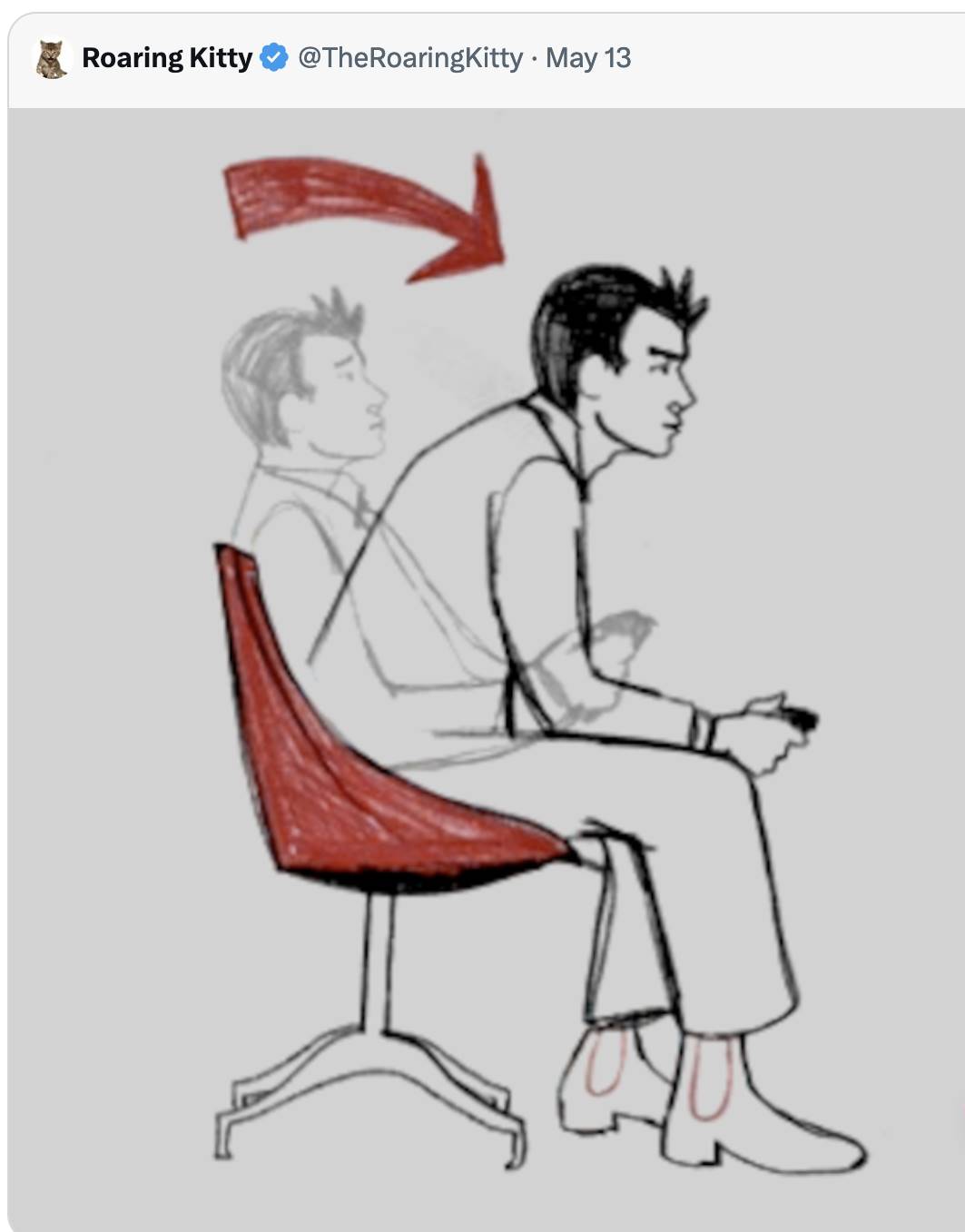

Today, Roaring Kitty of $GME fame posted for the first time in three years. His return may well herald the beginning of the second wave of the meme cycle.

Dont underestimate his influence.

From a technical analysis perspective, most major memes are still in the retest phase. Some important memes (such as $PEPE $WIF ) are expected to enter the top 20 soon.

This article is sourced from the internet: Old money favors Meme, is the next cycle starting?

Related: Bullish Signal For Chainlink (LINK) Price: Indicator Analysis Indicates Upside

In Brief LINK 4-hour price chart recently formed a golden cross, a bullish signal that could drive price up. The MVRV ratio suggests that LINK is currently in a good zone for accumulation. Most of the active Chainlink addresses are currently in profit or at least not at a loss, providing support for consolidation. The LINK price on the 4-hour chart has recently showcased a golden cross, indicating a bullish turn that could propel its value higher. This development aligns with the MVRV ratio, pointing out that LINK is in an advantageous position for accumulation. Furthermore, a significant portion of active Chainlink (LINK) addresses are held by investors who are either profiting or, at the very least, breaking even. This factor is crucial as it underpins the ongoing consolidation, suggesting…