The secret war behind chain abstraction, the super player of the whole chain Axelar emerges?

On May 8, Vitalik Buterin proposed a new proposal EIP-7702 around account abstraction, which aims to solve the historical problems of account abstraction once and for all, in order to completely change the way everyone interacts with Web3.

At the same time, further chain abstraction has been popular since the beginning of the year, and has even become a lifeline for many crypto DApps and project parties seeking to break through homogeneous competition: launching a full-chain version of the super DApp, creating a low-threshold Web3 product environment that is easy to get started and has an experience close to traditional Web2 applications, returning to a user-centric product paradigm, and thus capturing the broadest underlying value.

If account abstraction aims to solve user experience problems, then chain abstraction is undoubtedly the last mile for billions of users outside the circle to seamlessly enter Web3. This is also the core logic of the full-chain narrative behind chain abstraction that may usher in a reassessment of value with the further advancement of Mass Adoption in 2024.

The wind starts from the tip of the green ripples. In this context, how will the top projects in the full chain track perform? Who is likely to benefit from this?

The full-chain battle behind the transition from “account abstraction” to “chain abstraction”

After entering 2024, under the expanding modular narrative, the increasing and fragmented L1L2 have gradually made the full-chain narrative reach a critical point where it can become sexy again.

Especially as modular expansion continues to disperse users and liquidity on more and more (alt-VM) execution layers, it is the biggest positive signal for the full-chain narrative – based on the full-chain service, any project party that originally did on-chain applications such as DEX and lending can build a complete full-chain version of the super application.

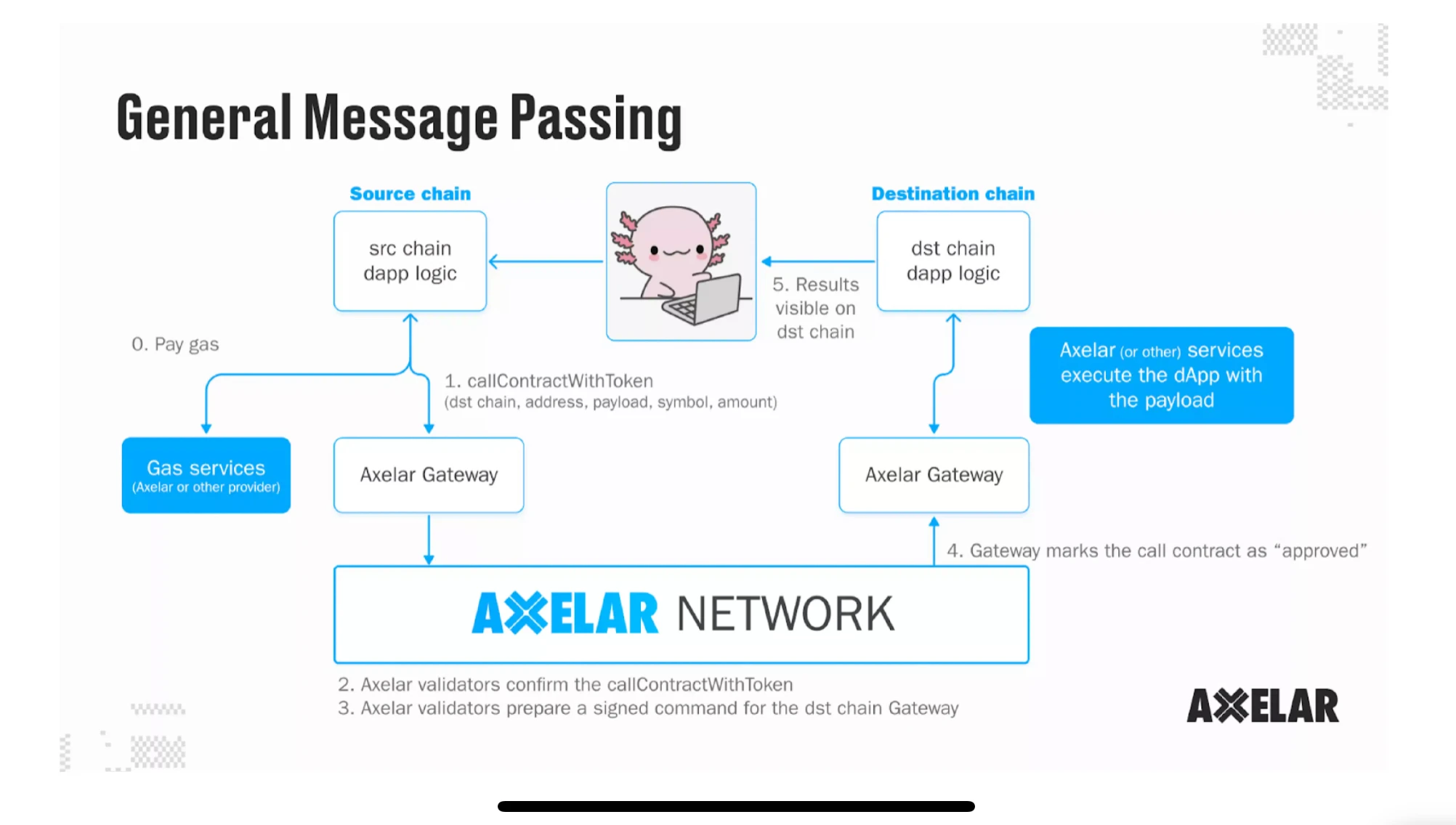

Taking the general messaging technology GMP of Axelar, the leader in the entire chain, as an example, it enables developers to build native cross-chain applications, implement chain abstraction for users, and perform cross-chain function calls and state synchronization: users and liquidity are no longer limited to Ethereum, nor do they need to switch networks. Instead, they can operate in one stop and conduct transactions such as exchange of native assets such as ETH and other on-chain crypto assets, provide liquidity, and so on on any chain.

This means that on-chain applications only need to display the service itself, and do not need to display which chain the token assets or NFTs are on. For example, users can use ETH to complete asset exchanges on the BNB Chain and buy and sell NFTs on Polygon. This also allows creators to focus on creation and project development. Users will no longer be biased by issues such as liquidity, which chain NFTs exist on, or which token to use as the basis for transactions.

From this perspective, chain abstraction, as a further step after account abstraction for large-scale adoption of Web3, has the greatest room for imagination in separating the blockchain from the user, hiding the complex logic such as the back-end principles of the blockchain in the form of a sandbox, so that users only need to enjoy the front-end experience.

After all, from a product perspective, if you want to become mainstream, you must ensure that even if many people understand what Web3 is, they can easily use the various functional services of Web3 with a low threshold.

Most people don’t know about the existence of Web3. As long as we create a low-threshold Web3 product environment that is easy to get started with and provides an experience close to traditional Web2 applications, and remove the barriers for users outside the circle to seamlessly enter the Web3 world, there will be huge incremental imagination space.

The key to achieving such a smooth chain abstraction experience lies in realizing seamless and smooth cross-chain transmission of assets and information on different chains. Compared with the simple cross-chain asset transmission of the bridge, the full chain uses message passing to abstract the chain itself, and users can use DApps on any chain without being aware of the chain.

This also means that the competition in the entire chain is directly competing for who can capture the most widely covered underlying user value in the Web3 world: DApps and project parties are responsible for competition and customer acquisition . For the entire chain infrastructure, no matter which track or which product comes out, they can directly face the end users, capture the value of the end users, and thus share the large-scale adoption dividends of the entire Web3 ecosystem.

Therefore, in the context of modular expansion and the blowout of the multi-chain era in 2024, chain abstraction is destined to gradually become a popular discipline, and ultimately all the struggles will be directed towards the ultimate full chain battle – as the underlying infrastructure, the full chain track is essentially another grander narrative, which is an indispensable key component of chain abstraction.

Looking at the full chain track: Axelar is gaining momentum

Looking at the entire full-chain interoperability competition, Axelar, Wormhole, and LayerZero are undoubtedly the top players with absolute dominance. In addition, except for LayerZero, which has not yet issued a coin, AXL and W have also been listed on Binance and other first-tier exchanges.

As a veteran leader in full-chain narrative, Axelar’s biggest advantage lies in the full-chain deployment of DApp – based on the concept of Interchain, it provides a unified development environment for all Web3 applications, and supports users from multiple chains by accommodating different logics on multiple chains.

On this basis, it further launched the Interchain Token Service (ITS), which specifically addresses the needs of project parties when deploying tokens on multiple chains. Its automated deployment + maintenance service allows any project team to easily manage the token deployment process:

At the same time, it can not only be used to link native tokens to meet diverse blockchain network deployment needs, but also be fully interoperable with native tokens, helping developers and project parties to easily manage the token deployment process and quickly realize the free flow of tokens across chains.

Simply put, DApps developed on Axelar can be deployed on all public chains it supports. In addition, Axelar supports the most public chains among the three (64 chains), which means that DApps using Axelar naturally have the advantages of full-chain deployment in terms of quantity and user experience.

Wormhole consists of on-chain components and off-chain components. The on-chain components mainly include the emitter, Wormhole core contract and transaction log; the off-chain components mainly consist of 19 guardian nodes and a message transmission network.

Since it originated from the cross-chain bridge between Ethereum and Solana, its main advantage lies in the cross-chain between the Solana ecosystem and other public chains. And because the Solana ecosystem is currently developing in full swing, it has certain advantages in data dimensions such as specific cross-chain amounts.

LayerZero is characterized by lightweight cross-chain information transmission. It chooses to use oracles and relay networks to complete data transmission. Its V2 version has four components: immutable endpoints that can achieve censorship resistance, an append-only collection of on-chain verification modules (MessageLib registry), a decentralized verification network (DVN) for cross-chain verification of data without permission, and a permissionless executor (independent of the cross-chain message verification context execution function logic).

From a process perspective, LayerZero is divided into an execution layer and a verification layer. The verification layer securely transmits data between chains, and the execution layer interprets the data to form a secure, censorship-resistant messaging channel. This means that it is not responsible for verifying the information itself, but the security is guaranteed by both parties across the chain, which greatly simplifies the process of cross-chain information interaction and is more efficient.

In short, Axelar is far ahead in terms of coverage and product applicability, Wormhole has an advantage in Solana-Xs cross-chain connectivity, and LayerZero is slightly better in cross-chain efficiency. The above are also the differences and personalized characteristics of the three in terms of technical architecture and product logic.

So if we look at it from a more specific data dimension, how do the data dimensions of Axelar, Wormhole, and LayerZero actually perform?

First of all, Axelar currently covers the largest number of blockchain networks and DApps that have integrated and deployed GMP full-chain services, reaching 64 chains and 666 DApps (GMP contracts) respectively. During the same period, Wormhole has 28 chains and more than 200 DApps, and LayerZero has more than 50 chains.

In terms of on-chain transaction volume, since the beginning of this year, Axelars monthly transaction volume has been above US$250 million, with an average of US$310 million, and has been in a steady growth trend.

During the same period, Wormholes average monthly transaction volume was as high as 1 billion US dollars. However, since the issuance of W, the transaction volume has dropped sharply to about 700 million US dollars in the past 30 days, which should be related to the realization of airdrop expectations and the exit of some funds. As for LayerZero, since the airdrop snapshot has been completed, the transaction volume this month is expected to be less than 600 million US dollars, which is a significant drop compared to last month (2.5 billion US dollars). This also further shows that most of the previous transaction volume and on-chain activity are closely related to the communitys airdrop expectations.

In terms of the number of on-chain users, Axelar has experienced a significant increase in March and April (which should be related to its AVM upgrade and expectations for token economics reform), with the number of active users reaching 66,000, the second highest in history.

In general, Axelar leads by several times in terms of network coverage and applicability, and on-chain data such as transaction volume continues to rise steadily despite the impact of Wormholes coin issuance, indicating that it has begun to occupy a leading cognitive position in the chain abstraction ship that has just set sail, and this first-mover advantage is expected to continue to expand, becoming a key tool for Axelar to lead the narrative of full-chain + chain abstraction integration this year.

More importantly, Axelar’s actual trading volume has already reached nearly half of Wormhole’s. If we look at it from the perspective of market value to trading volume, AXL’s full circulation market value is only equivalent to 20% of W’s, which is undoubtedly in a significantly underestimated range.

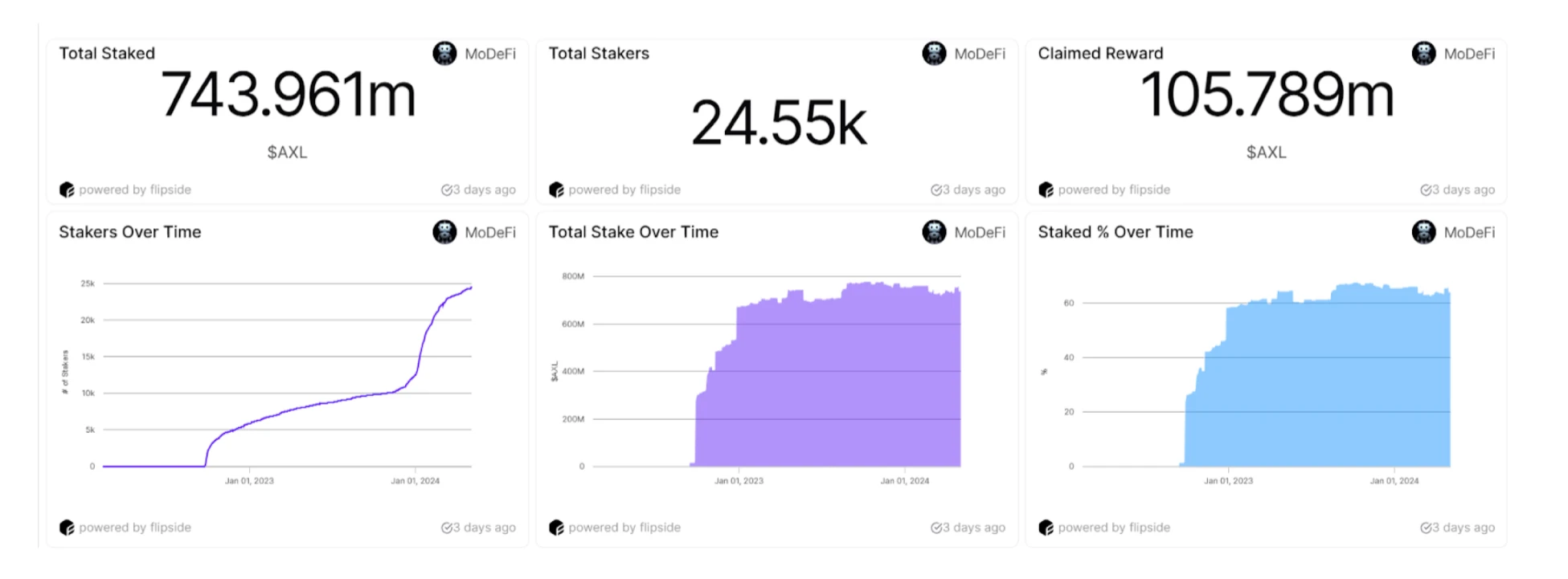

It is worth noting that Axelars performance in terms of data has also clearly rebounded this year. The number of AXL stakes has soared to approximately 750 million, accounting for 66% of the total supply, an increase of nearly 100% this year!

Combined with the upcoming new token economics model that will reduce the final total inflation rate from 11.5% to 6.7%, and the recent plan to change the AXL token from an inflationary token to a deflationary token by implementing Gas burning, the fundamentals of the AXL supply/demand side have completely changed, which is likely to push up AXLs deflationary expectations and have a strong stimulating effect on the secondary market.

This may also be the core factor why AXL has been extremely strong and always one step ahead in recent pullbacks/rebounds.

RWA narrative double buff bonus

In addition, among the three, Axelar has an exclusive advantage that other full-chain projects cannot achieve, which may even become a future growth point that can create another Axelar market value:

The RWA narrative is the key conduit for trillions of dollars of funds from traditional financial institutions to flow into the chain.

On April 26, Grayscale published a research report titled “ Public BlockChains and the Tokenization Revolution ”, which detailed four categories of tracks/currencies that can capture dividends from the upcoming surging tokenization wave:

-

1. Tokenized protocols, such as Ondo Finance (ONDO), Centrifuge (CFG), Goldfinch (GFI), etc.

-

2. Tokenized general-purpose smart contract platforms, such as Ethereum (ETH), Solana (SOL), Avalanche (AVAX), etc.

-

3. Related tokenized infrastructure, such as ChainLink (LINK), Axelar (AXL), Biconomy (BICO), etc.

-

4. Smart contract platforms designed for tokenization, such as Mantra (OM), Polymesh (POLYX), etc.

Compared with the three types of fiercely competitive and either-or upper-level projects, namely tokenized general/special smart contract platforms and tokenized protocols, tokenized infrastructures such as Axelar (AXL) are actually the real winners. After all, as long as the scale of the entire RWA market continues to grow, Axelar and others that provide the most basic cross-chain liquidity support in the form of infrastructure can enter the RWA market of up to hundreds of billions or even trillions of dollars and directly capture the global incremental value.

Behind this, Axelars first-mover advantage is unique in the entire full-chain interoperability track, crushing Wormhole and LayerZero (they have not even publicly entered the RWA field) in terms of smell and action :

-

Centrifuge has already integrated Axelar’s cross-chain solution, using Axelar’s interoperability layer as the underlying infrastructure. Its “Centrifuge Everywhere” multi-chain strategy is powered by Axelar, which can introduce native Centrifuge RWA to Arbitrum, Base, Celo and Ethereum.

-

Last November, Axelar also partnered with Ondo Finance to launch Ondo Bridge, an innovative cross-chain liquidity solution for RWA;

-

Apollo, an alternative asset management company represented by traditional financial giants and Wall Street funds, recently cooperated with JPMorgan Chases digital asset platform Onyx, Axelar and others to deliver Project Guardian as a new generation of POC for its $5.5 trillion portfolio management;

This essentially means that Axelar, as the underlying infrastructure, provides innovative support for traditional financial giants to enter tokenized investment. Axelar will also directly benefit from the hundreds of billions of dollars of untokenized liquidity in the traditional financial system, which will be introduced to the chain in the form of RWA (Real World Assets) through Axelars full-chain architecture, completely releasing its liquidity.

For example, traditional financial giants such as Franklin Templeton and BlackRock can freely deploy tokenized funds on different chains based on Axelar, and allow the tokens of each fund product to be traded across chains on supported chains, thereby arbitrarily transferring liquidity on the chains connected to Axelar.

At the same time, from a long-term perspective, this first-mover advantage will undoubtedly continue to expand. JPMorgan Chases choice of Axelar is objectively equivalent to endorsing it and introducing Axelar to a wider range of off-market funds and traditional resources. At least when other traditional Wall Street financial giants re-enter the market, they will most likely consider Axelar first. This is also the first-mover recognition and ecological advantage that is difficult for other projects to replicate.

So now looking back, in fact, big funds themselves are the most sensitive weather vane: according to Grayscales usual temperament, the new currencies mentioned in the new reports are most likely the targets that have been secretly built up, so it is not ruled out that AXL is the new seed player that Grayscale Trust has not yet disclosed.

summary

In general, the ultimate and biggest beneficiary of the chain abstraction narrative for incremental users may be the projects in the full chain track. Among them, Axelar is in the limelight and is currently at a turning point from being greatly underestimated to gradually gaining momentum.

On this basis, in response to the demand for asset tokenization of up to trillions of dollars, Axelar, which was the first to enter the RWA track, has another piece of reserve cake worth hundreds of billions of dollars, which also provides it with objective conditions for leading the full-chain track and launching a dimensionality reduction attack.

From this perspective, the dual-line positioning of chain abstraction + RWA is undoubtedly extremely challenging and has the most room for imagination. As for what kind of attempts Axelar can make in this direction in the end, it is worth continued attention.

This article is sourced from the internet: The secret war behind chain abstraction, the super player of the whole chain Axelar emerges?

Related: What Crypto Whales Are Buying for Profits in May 2024

In Brief Following the Bitcoin halving, crypto whales accumulation has slowed down as the market is still awaiting a rally. However, crypto whale addresses have switched to buying altcoins as observed in the spikes in large transactions. The likes of Toncoin (TON), Cardano (ADA), and Arbitrum (ARB) have seen massive surges since 2024 began. Bitcoin’s (BTC) price has been making mild moves despite the halving that occurred towards the end of April. Thus, institutional investors have moved to accumulate altcoins in the meanwhile to capitalize on the potential bull run that the crypto market could witness once BTC rises. BeInCrypto has analyzed three tokens that have been noted to be of the most interest to these large wallet holders. Cardano (ADA) Whales Add More ADA to Their Holdings Cardano has been noting increasing accumulation…