Coinbase Weekly Report: The market may reach a turning point next week, and Aave’s evolution

Original title: Weekly: Following the Undercurrents

Original author: David Han (Institutional Research Analyst)

Key Takeaways

-

While the dollars momentum has stalled, we believe the upcoming PPI and CPI data on May 14 and 15 could determine the dollars next major direction. We believe the Fed will continue to prioritize fighting inflation over early signs of a cooling labor market.

-

Grayscale Bitcoin Trust (GBTC) saw inflows in the first two days since its transition to an open-end fund, marking an important completion of a structural capital rotation for the asset.

-

Aave recently revealed plans for the fourth iteration (V4) of its protocol as part of its long-term vision for Aave 2030, with V4 bringing many new architectural improvements with a focus on supporting their GHO stablecoin, which is scheduled to launch in Q2 2025.

Market View

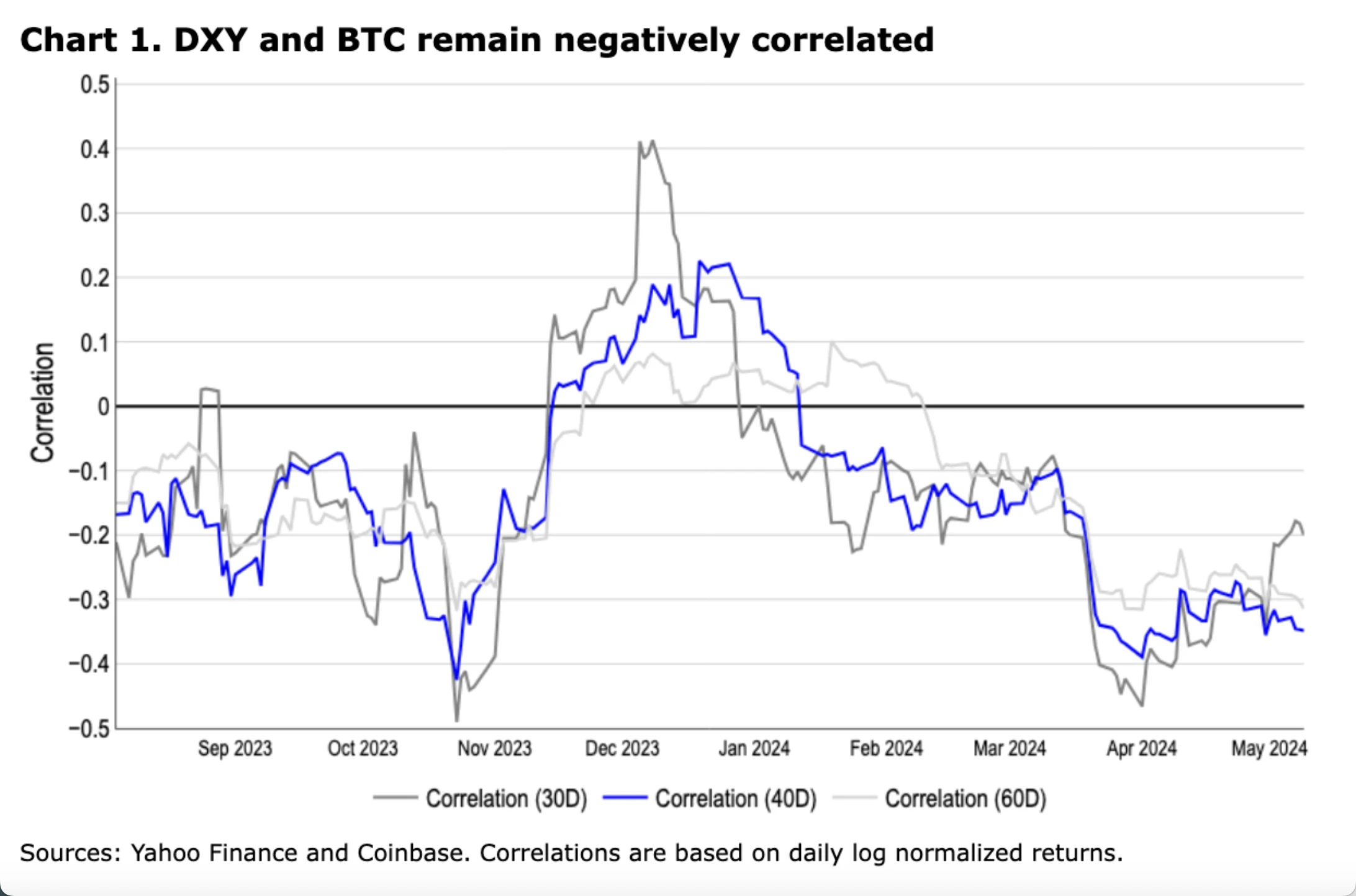

The continued lack of clear macro direction has led to a continued decline in Bitcoin in recent weeks. Altcoins have also been largely in the same boat, with correlations within the crypto asset class still close to their highest levels since the beginning of the year. The current uncertainty in macro factors supports our thesis in our April Outlook that macroeconomic conditions will continue to dominate BTC performance (with altcoins following closely behind), with US spot ETF inflows tapering off and the market beginning to look for catalysts other than the Bitcoin halving. Although the ECB and other central banks have reiterated plans to cut interest rates in the summer, higher-than-expected US inflation data has raised concerns about the Fed delaying rate cuts. Expectations of a longer US rate cut period have led to a stronger US dollar, which in turn has weighed on the broader cryptocurrency market due to its key role as the quote currency on most cryptocurrency exchanges.

However, the dollar’s strength has stalled following a more dovish-than-expected Fed meeting, and after weaker-than-expected nonfarm payrolls on May 3, market expectations for the first rate cut (based on Fed Funds futures) shifted from November to September 2024. Higher-than-expected initial jobless claims on May 9 further added to the drive for faster rate cuts, as the Fed has a dual mandate to not only fight inflation but also keep unemployment low.

Nevertheless, we do not think that changes in the US unemployment rate (currently at 3.9%) will be a focus for the Fed in the near term, as it remains close to historical lows. In fact, we still believe that the US economy will be supported by technological progress and government spending and is not on the verge of entering a contraction period. At the next Federal Open Market Committee (FOMC) meeting, we believe that the Feds attention and rhetoric will remain focused on inflation indicators, which highlights the importance of the upcoming PPI and CPI data on May 14 and 15 as expected macro catalysts, especially if they are higher than expected.

Separately, Grayscale Bitcoin Trust (GBTC) saw inflows in its first two days since transitioning to an open-ended fund. While the source of these inflows is unclear given their higher management fees (1.5%) compared to similar spot products (less than 0.5%), this development signals the completion of a structural capital rotation. We believe a large portion of early GBTC outflows were related to bankruptcy proceedings (e.g., Genesis and FTX), profit realization from GBTC discount trading (40% discount to NAV a year ago), and a shift to low-fee products (

On-chain: Aave’s progress

Meanwhile, Aave recently revealed plans for the fourth iteration (V4) of its protocol as part of the Aave 2030 long-term roadmap. The proposed V4 contains architectural improvements, including a unified liquidity layer (for flexible expansion of borrowing capabilities), fuzzy interest rates (for interest rate curves previously controlled by governance), and liquidity premiums (adjusting borrowing rates based on collateral composition). V4 also focuses on strengthening the use of its GHO stablecoin and incorporates other improvements such as improved risk management and liquidation engines.

While the proposed mainnet launch date is in Q2 2025, we view this announcement (along with other major announcements from existing DeFi protocols like Uniswap and Maker this year) as an early roadmap for DeFi protocols to mature in their core functionality, even as they maintain market dominance and continue to innovate in other areas. This could set a precedent for new protocols in terms of decentralization, long-term token utility, and iterative feature rollouts.

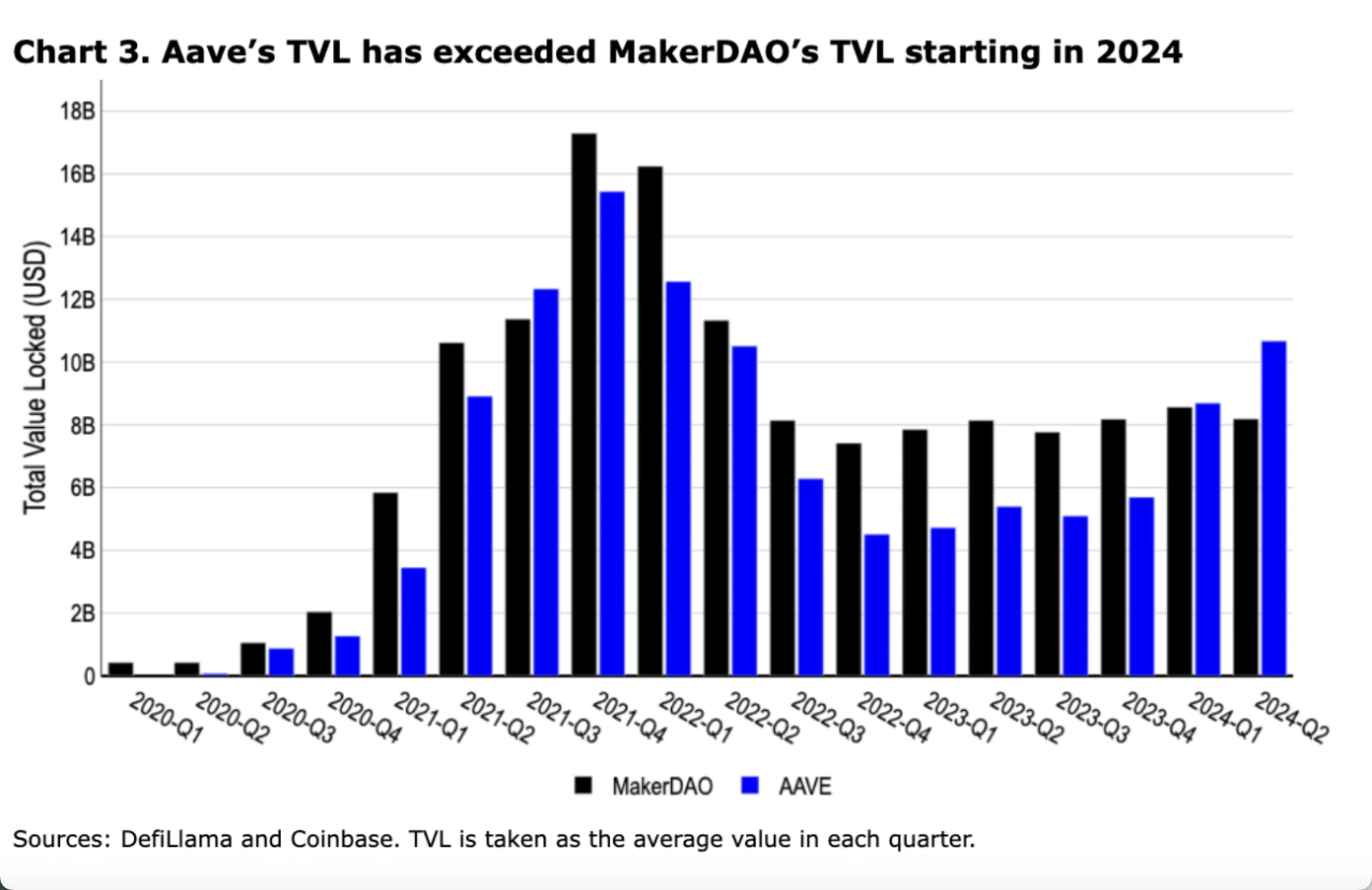

Scaling DeFi protocol functionality is a technical challenge, especially compared to traditional web2 companies whose motto is to “move fast and break things.” Successful DeFi protocols rarely scale their initial architecture in a way that is transparent to end users. Instead, they deploy new versions and incentivize active liquidity migrations. This applies not only to Aave, but also to other leading protocols such as Uniswap, Curve, Pendle, etc. These cross-version liquidity migrations are a difficult task as users need to actively switch. In fact, although Aave V3 was launched as early as 2022, it was not until September 2023 that Aave V3 surpassed Aave V2 in total locked value (TVL). We believe that the adoption cycle of Aave V4 may also go through a similar process.

Despite the large number of functional improvements in the new version, the cautious migration of liquidity highlights the relative importance of the Lindy effect in DeFi markets. That is, the trust gained from market time seems to be more important than new mechanisms that may be attractive to a small group of users. The adversarial environment of decentralized technology means that time is often the most reliable way to determine the security of a protocol, more important than audits and theories. We believe this highlights the characteristics of smart contract immutability and the financialization of web3 products, that is, how to maintain stable security amid rapid innovation. As a result, we believe that the long-term adoption cycle of crypto products may be different from what we see in web2 markets. For end users, the consequences of web3 financial vulnerabilities are far more serious than web2 data vulnerabilities that do not disrupt core application functionality.

Additionally, the Aave 2030 roadmap appears to be in competition with Maker’s Endgame, especially with Aave’s renewed focus on its GHO stablecoin. Many of the elements proposed in Aave 2030, such as Aave’s specific network, GHO’s cross-chain liquidity layer, augmented reality asset (RWA) integration, and updated protocol branding, are reminiscent of Maker’s Endgame vision.

With TVLs of $10.5 billion and $8.2 billion, respectively, both protocols are significant sources of lending in the space. However, while Maker borrowers are limited to DAI, Aave supports lending across a wide range of assets beyond its own GHO stablecoin. Given that DAI’s market cap has only grown from $5.3 billion to $5.4 billion YTD, questions remain around its ability to increase cross-chain adoption and gain market share. That said, it’s interesting to note that Aave appears to be focusing on the decentralized stablecoin space, even though the market for that space has been shrinking relative to centralized stablecoins like USDC. With DAI demand on hold, Aave actually surpasses Maker as the largest lending DeFi protocol by early 2024. However, we’re still in the early days of web3. While Maker’s Endgame plan and Aave’s 2030 roadmap offer a promising vision for the future of these protocols, we believe these developments may be overlooked by the market in the short term as the macro environment remains an anchor for attention in the near term.

Crypto and Traditional Finance

(As of 4 p.m. ET May 9)

Source: Bloomberg

Coinbase Exchange and CES Insights

Crypto traders are looking for the next market catalyst. This upcoming week, the market will see US inflation data and hear a speech from Federal Open Market Committee (FOMC) Chairman Jerome Powell. Barring any major surprises in the data or the Chairman’s tone, we are likely to see volatility continue to compress. In the absence of clear macro or crypto-specific catalysts, the correlation between traditional markets and crypto assets will likely continue to rise, with crypto taking the US stock market as a reference. The 13-F filing deadline is May 15, and many companies will wait until the last minute to submit their applications. It will be interesting to see who takes a seat in the US spot Bitcoin ETF. But unless a very surprising name emerges, it is unlikely to be a market-moving event in our opinion. And regarding ETH, as the May 23 deadline for the VanEck spot Ethereum ETF application approaches, it will likely continue to lag behind. In talking to traders, expectations for approval are mostly low.

Coinbase platform transaction volume (USD)

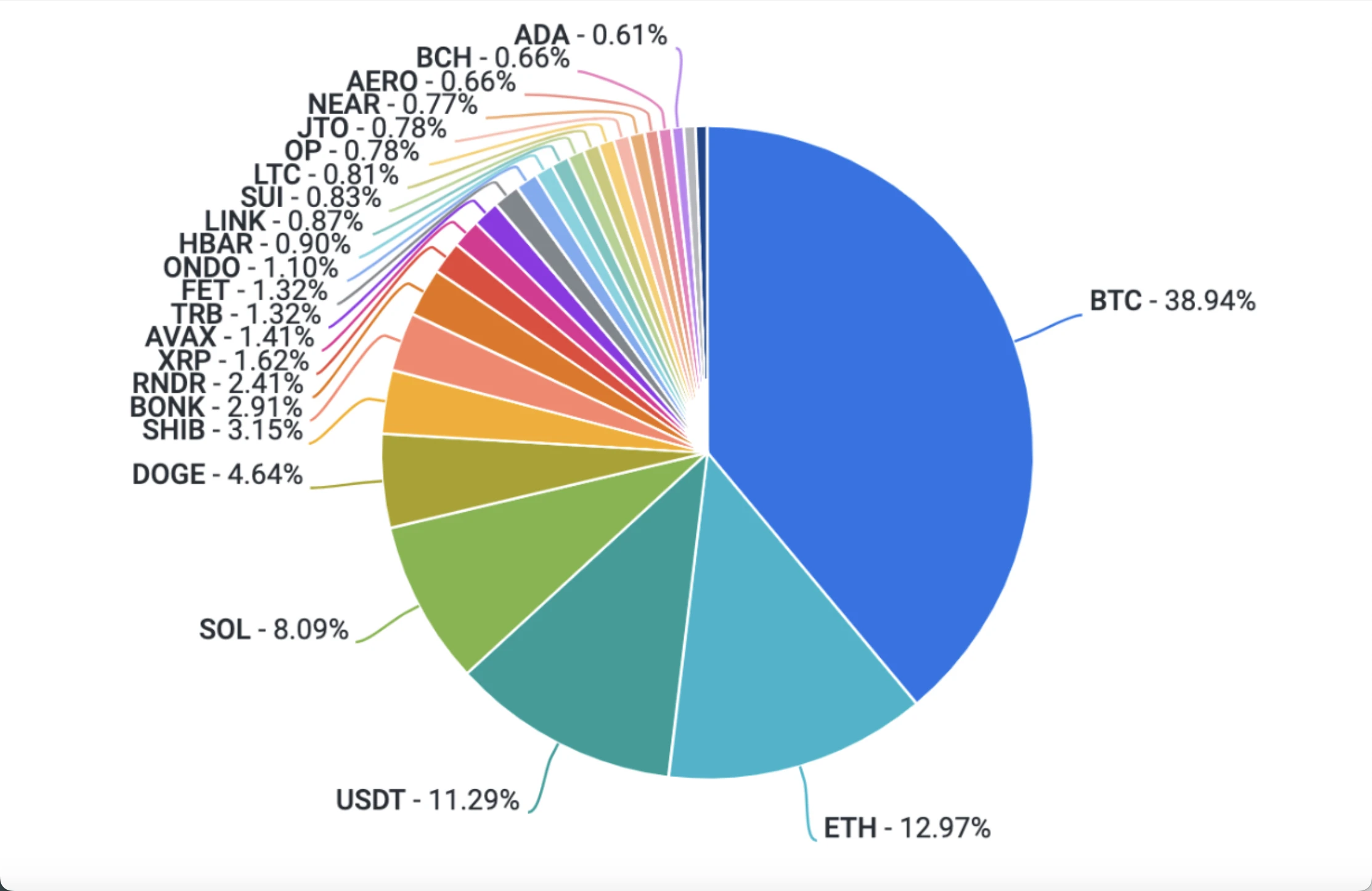

Coinbase platform transaction volume (asset ratio)

Funding Rate

Notable Crypto News

mechanism

-

Global crypto firms turn to Hong Kong for refuge and opportunity (TechCrunch)

-

Mastercard teams up with US banking giant to trial tokenized settlements (Cointelegraph)

Supervision

-

The U.S. Securities and Exchange Commission (SEC) issued a Wells Notice to Robinhood Crypto for alleged securities violations (The Block)

-

QCP receives in-principle approval from Abu Dhabi regulator (Coindesk)

-

SEC files final response in Ripple XRP case (Cointelegraph)

conventional

-

Friend Tech sees a resurgence in activity after V2 launch (The Defiant)

-

Bitcoin Network Surpasses 1 Billion On-Chain Transactions (The Defiant)

-

Vitalik Buterin proposed EIP-7702, which aims to improve account abstraction on Ethereum (The Block)

Coinbase

-

Coinbase benefits from ‘hostile regulatory environment’: Bitwise (The Block)

global vision

Europe

-

UK FCA says 30% of financial criminals will come from crypto companies by 2023 (Crypto News)

-

BNP Paribas, Europes Second-Largest Bank, Buys Shares of BlackRock Spot Bitcoin ETF: SEC Filing (Decrypt)

-

Crypto banking firm BCB Group receives regulatory approval in France as an electronic money institution and digital asset service provider (BCB Group)

-

Vodafone wants to integrate crypto wallets with SIM cards (TradingView)

-

German central bank president calls for rapid CBDC adoption to remain competitive (CryptoSlate)

Asia

-

Hong Kong Spot Bitcoin and Ethereum ETFs See $11M in Trading Volume in First Launch (Watcher Guru)

-

Chinese police arrested a suspect who created numerous fake identities to claim STRK airdrops (Crypto Briefing)

-

PwC China and Xalts establish strategic partnership in blockchain and tokenization (RWA Tokenizer)

-

Australian Tax Office asks cryptocurrency exchanges to hand over transaction details of 1.2 million accounts (CoinDesk)

-

South Korea bans cryptocurrencies in updated donation law (CoinTelegraph)

Big events in the coming week

This article is sourced from the internet: Coinbase Weekly Report: The market may reach a turning point next week, and Aave’s evolution

Related: Can the new token economic model proposed by the EOS Foundation help it return to its peak?

Original | Odaily Planet Daily Author | Asher EOS was once considered one of the most promising blockchains in the Layer 1 sector. At the time of its launch, EOS was one of the top five cryptocurrencies by market capitalization. On the morning of April 25, Yves La Rose, CEO of the EOS Network Foundation (ENF), proposed new token economics on the X platform and said that he would meet with BPs later today to discuss this topic. As soon as the news came out, according to OKX market data, EOS briefly broke through $0.95, with an increase of more than 12% in one hour, and has now fallen back to around $0.88. Next, Odaily Planet Daily will take you through a detailed interpretation of the new token economic model…