以太坊(ETH)目前试图保持在$3,000的关键技术和心理支撑位之上。

只有当 ETH 持有者选择停止出售和 HODL 时,这才有可能,而事实确实如此。

以太坊投资者转向 HODL

以太坊的价格交易价为 $3,177,徘徊在 $3,000 支撑位上方,ETH 持有者现在表现出比以前更多的看涨情绪。这种韧性的迹象在供应转移和行为变化中可见一斑。

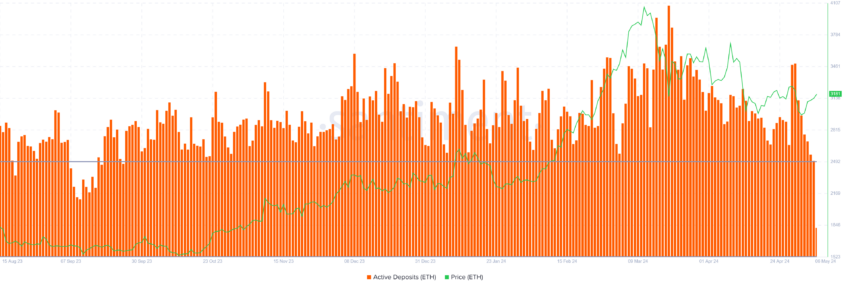

过去一周,链上观察到的存款减少了 27%,这是一个积极的信号。

活跃存款突出显示了将资金从钱包转移到交易所的独特地址。这一下降使潜在卖出量降至八个月来的最低水平,上一次出现如此低的水平是在 2023 年 9 月。

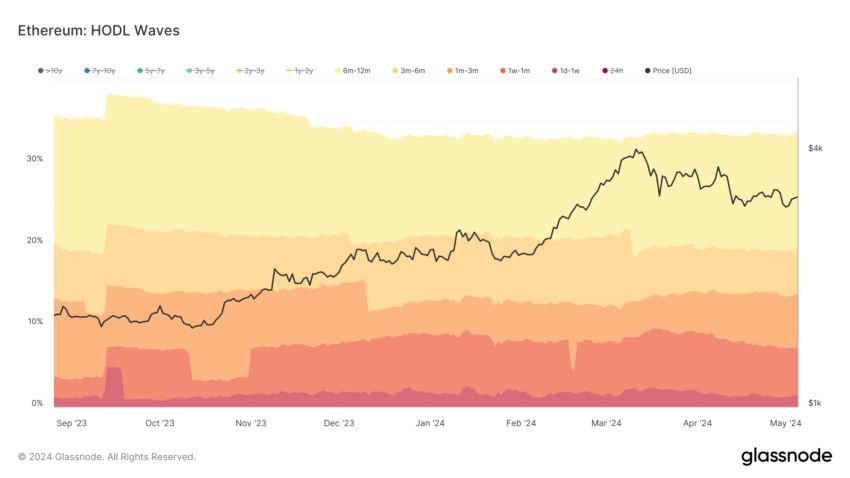

此外,ETH 的 HODLing 也在增长,供应量从短期持有者转向中期持有者。HODL 浪潮显示,持有 ETH 一个月至一年的钱包在过去一个月内供应量增加了 2.3%。

此外,持有 ETH 一周至一个月的地址已见证了 2.2% 的流通 ETH 供应流出。这证明 ETH 已从潜在卖家转移到 HODLers,后者倾向于避免立即抛售。

短期持有者占比的下降证明投资者的信心正在大幅增强。

了解更多:以太坊 ETF 解释:它是什么以及如何运作

ETH 价格预测:$3,000 持有

以太坊的价格徘徊在关键支撑位 $3,000 上方,与 23.6% 斐波那契回撤位相吻合。23.6% 斐波那契回撤位是关键支撑位,失去该水平将削弱复苏的可能性。因此,保持在 $3,000 上方对 ETH 至关重要,鉴于投资者的支持,这是可能的结果。

如果看涨势头持续,以太坊的价格可能会突破 38.2% 斐波那契水平。确保这一支撑将使 ETH 能够尝试突破 $3,582 和 $3,829 之间的阻力区。

阅读更多:以太坊 (ETH) 价格预测 2024 / 2025 / 2030

然而,如果失去 $3,000 的支撑,ETH 很可能会回调至 2,539。这种下跌将使看涨论点失效,并扩大投资者的损失。