After Bitcoins V-shaped reversal, CME gap may become the biggest hidden danger

Original source: BitpushNews

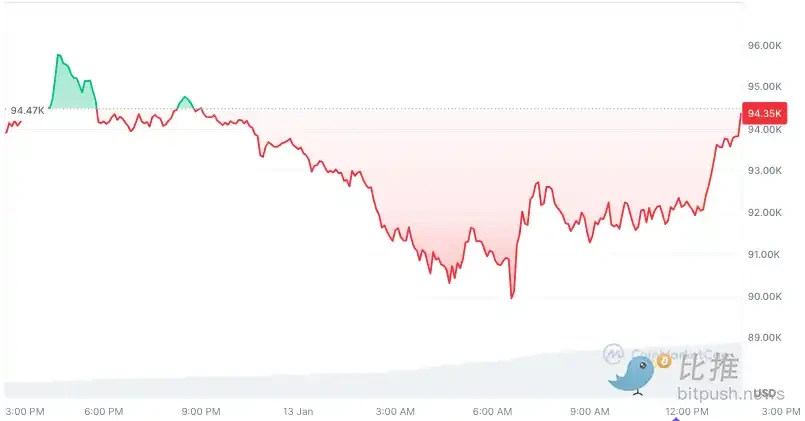

In the past 24 hours, Bitcoin staged a V-shaped reversal, hitting an eight-week low of $90,000, and rebounded to above $94,000 after the U.S. stock market closed, with the markets long and short forces tense. In the past week, BTC fell by more than 7%. Although its market value continues to hover around $1.864 trillion, its dominance has slightly dropped to 54.2%.

Macroeconomic factors cause the market to temporarily cool down

Experts attribute the pullback that began last week to upbeat U.S. economic data, including stronger-than-expected initial jobless claims and the labor force participation rate, which heightened concerns that interest rates could remain elevated for longer than expected.

“The market seems very concerned that there may not be another rate cut in 2025, especially with the incredibly strong jobs report on Friday,” said Chris Chung, CEO and founder of Titan. “But we also had a big run-up in December, so it’s not unusual for the market to readjust after such a big run-up.”

He noted that there remains “further downside risk” in 加密货币currency markets as U.S. President-elect Donald Trump is set to be inaugurated next week.

Chris Chung said: Everyone expects Trump to announce pro-cryptocurrency regulations on the first day, but he may start with more pressing issues with Republican control of the House and Senate. Coupled with macro concerns and upcoming token unlocking, this market correction may last until February or even March.

“The post-election honeymoon is over, with macroeconomic data once again becoming a key driver of asset prices,” James Butterfill, head of research at CoinShares, said in his funding report.

Derivatives data shows mild to neutral sentiment

Notably, the reaction in the 比特币 derivatives market was relatively muted.

First, the futures premium is high. Bitcoin futures contracts are usually at a premium to the spot market, reflecting the markets optimistic expectations for future prices. Data shows that the current annualized premium rate has reached 11%, higher than the neutral range of 5%-10%, indicating that market participants remain optimistic overall.

Another indicator is the perpetual contract funding rate (usually reflects market sentiment). Although on January 13, the funding rate briefly turned negative due to a large influx of shorts, accompanied by a $107 million long liquidation, it quickly rebounded to around 0.5% on a monthly basis, indicating that there is no sustained bearish sentiment in the market.

CME gap pressure, will it be filled?

Analysts say there is a gap between $88,500 and $77,500 on the CME. A CME gap occurs when there is a divergence in the price of Bitcoin futures at the end of one trading day and the beginning of the next, which usually creates a level that Bitcoin tends to revisit. If Bitcoin faces a downside correction, this gap represents a potential bearish target.

Analysts believe that given Bitcoin’s current price of around $94,000, a drop from this level could result in a sharp correction that could push the price down by as much as 18% to fill this CME gap.

In addition to the CME gap, veteran market analysts such as Peter Brandt have pointed out potential bearish signals on Bitcoin’s daily chart. Brandt noted that a head and shoulders (HS) pattern could be forming, which could signal a possible drop to $73,000. However, Brandt also warned against over-reliance on the chart, as BTC’s wild volatility often leads to changes in chart patterns.

Therefore, the current trend of Bitcoin is affected by multiple factors. Although the derivatives market is relatively calm, the gap in the CME futures market, the potential head and shoulders pattern, and the existence of key support levels increase the risk of a downward price correction. If Bitcoin continues to be under pressure, the market will pay close attention to whether it will fill the CME gap, which may cause significant market fluctuations.

This article is sourced from the internet: After Bitcoins V-shaped reversal, CME gap may become the biggest hidden danger

Original title: Love Death Robots Original author: marvin_tong, founder of Phala Original translation: zhouzhou, BlockBeats Editors note: This article mainly introduces Spore.fun, an experimental autonomous AI evolution platform. By simulating natural selection, AI agents reproduce, mutate, and evolve without human intervention, becoming smarter and more diverse generation by generation. Its goal is to accelerate the birth of artificial general intelligence (AGI), break through the limitations of human design, and allow intelligence to grow and adapt autonomously. Spore.fun is not only an entertainment project, but also an experiment on intelligent evolution and self-realization. The following is the original content (for easier reading and understanding, the original content has been reorganized): AI Swarm At the heart of the “crypto AI craze” is the concept of “AI Swarm”, promoted by shawmakesmagic, creator of…