Happy New Year! Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

因此,每周六,我们的编辑部都会从过去7天发布的内容中,精选出一些值得花时间阅读和收藏的优质文章,在以后的学习中给你带来新的启发。 加密货币 从数据分析、行业研判、观点输出等角度洞察世界。

现在,就和我们一起来阅读吧:

投资创业

2024 Crypto Investment and Financing Changes: Primary and Secondary 市场s Decoupled, VC Projects Lose Dominance

The AI sector is showing its potential, with a surge in financing in Q4 2024.

On-chain data interpretation: When will the new round of copycat season start?

-

Shanzhai Season Condition 1: Evaluation of capital overflow conditions (representing the possibility of capital overflow);

-

Condition 2 of the altcoin season: capital inflows of mainstream assets (representing overall sentiment and risk appetite);

-

Alt Season Condition 3: Discrete positive momentum in altcoin market capitalization (representing liquidity tilt).

When all the conditions are met at the same time, there is a high probability that a copycat phone is coming.

Currently, condition 2 is met, but 1 and 3 are not; then we can conclude that there is a basis for launching the altcoin season, but liquidity is still concentrated in mainstream assets (especially BTC), and there is not much on-site funds overflowing into altcoins.

Delphi CEO: My 20 favorite crypto projects for 2024

HyperLiquid, Polymarket, Farcaster, Ethena, Gunzilla, Lighthouse.One, Pump.Fun, Truth Terminal and GOAT, VIRTUAL, MetaDAO and MetaLeX, Sandwich, 9dcc, DeBridge, Echo and Legion, Kaito, Grass, Ostium, Moonwalk Fitness.

Sabiges trading strategy has distinct characteristics: it does not focus on narrative valuation, but focuses on on-chain monitoring and strict stop-profit and stop-loss rules. He emphasized that by setting a clear stop-profit and stop-loss strategy, trading can be free from the interference of subjective emotions. At the same time, he also pointed out that trading logic needs to be continuously optimized. At first, he focused on the trading behavior of smart money on the chain, and then expanded his focus to team trading behavior (conspiracy groups), and then to the key main address behavior of a single token. Through in-depth analysis of these on-chain activities, he continuously improves the accuracy of trading decisions.

To summarize its successful experience: data-driven and continuous optimization, patience and discipline, and establishing cognitive and cash flow pillars.

另外建议: redphone: 25 25-year predictions and 23 most promising coins , Top 10 crypto venture capital outlook for 2025: stablecoins are generally optimistic , Dragonfly Partners: Six predictions for the crypto industry in 2025 .

空投 机会与互动指南

Treasure List: 15 airdrop opportunities in 2025

Jupiter, Optimism, Ethena, Blast, Starknet, Grass, Arkham 交换, Saga, Sei, zksync, EigenLayer, Magic Eden, Puffer Finance, Hyperliquid, Aptos.

Treasure List: Inventory of potential large-cap airdrop opportunities in Q1 2025

Pump.fun, Linea, Monad, Berachain, Story Protocol, Babylon, Polymarket, Particle Network, Lombard, DuckChain.

模因

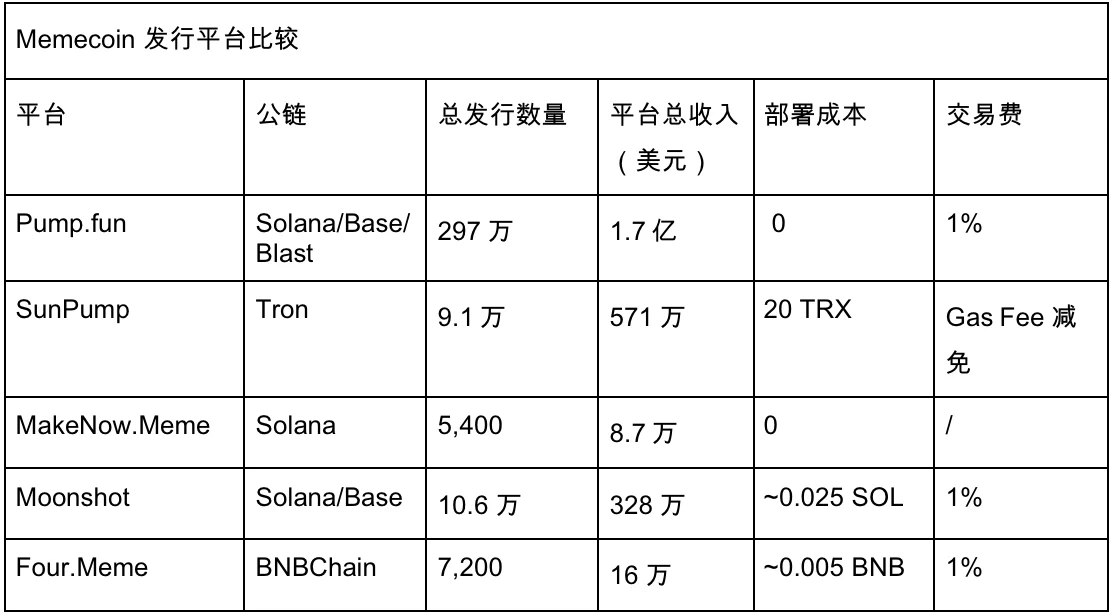

Ecological competition and evolution of Memecoin issuance platform

另外建议: Continue to pay attention to ai16z series and DRUGS this week, and add new attention to METAV and fxn Counting Meme 2024 Person of the Year: Scammers, big traders, and the king of goods…

以太坊

Ethereums five major upgrades in 2025, in which directions will they be optimized?

The article introduces EIP-3074, EIP-7251, EIP-7002, ERC-7683 and ERC-7841.

多元生态

From developer ecology to supply chain, Solana’s “AI ecology conspiracy”

From choosing Solanas infrastructure for high throughput and response speed, various DePin projects provide computing power and data sets, AI Agent basic tools Solana Agent Kit, Zerepy, ElizaOS, arc, etc., to all-in-one tools griffain, etc., everything has been prepared. AI Agent developers only need to use all their imagination to find possible usage scenarios for users. Infrastructure, supply side, usage scenario channels, a complete supply chain closed loop is completed. This is Solanas conspiracy and will be the most efficient way to produce Crypto AI.

Inventory of the most popular projects in Sui Ecosystem in 2024

The most popular projects by community attention are Walrus, Sui Name Service, DeepBook, Cetus, Suilend, NAVI, Aftermath Finance, Scallop, Turbos, and Tradeport. The most popular projects by data indicators are Wave Wallet, BIRDS, FanTV, Aylab, Fomo, Walrus, SuiLink, NAVI, Scallop, and Cetus.

CeFi DeFi

2024 Derivatives Exchange Report: Reshaping the Track Pattern and Analysis of Key Differences

-

Binance leads the market with an average daily mainstream contract trading volume of US$40 billion, consolidating its industry leadership with its strong liquidity and broad user base.

-

OKX ranks second with an average daily mainstream contract trading volume of US$19 billion, and has laid a solid foundation for the sustainable development of the platform through its leading asset reserve proof mechanism.

-

With an average daily mainstream spot trading volume of US$2.3 billion, Bybit ranks second in the global exchange spot market, and will have an inflow of over US$8 billion in 2024.

-

Crypto.com has found a breakthrough in a specific field and won market share through innovative features and user experience.

-

Deribit dominates the options track, accounting for 82.2% of the Bitcoin options market share, establishing its leadership in the professional derivatives field.

-

As the leading on-chain exchange, Hyperliqud uses decentralized perpetual contracts and margin trading to drive the industry towards transparency and efficiency.

PayFi’s new narrative: the wind and the obstacles

PayFi has many advantages such as improving capital efficiency, and serves as a central hub to closely connect traditional financial institutions, merchant networks, DeFi and RWA.

PayFi brings the most significant marginal improvements to cross-border payments and subscription billing, and is therefore most likely to be the first-mover area.

DeFi taxation? Insight into everything about Gringotts on the chain

Regulations believe that there are great similarities between DeFi transactions and securities trading processes (DeFi brokers are determined to provide services to facilitate transactions and have the ability to obtain customer information). DeFi brokers need to submit information reports to the IRS, help customers accurately declare taxes, and ensure compliance (KYC, anti-money laundering, etc.).

Choose to accept broker identification or decentralize the project. The higher the degree of decentralization, the lower the possibility of being identified as a broker. The perfect exit for DeFi in the future is: decentralized front-end, non-upgradeable contracts, on-chain autonomy, and token functionalization to build your own network.

另外建议: CoinW Research Institute: Hyperliquid User Guide , Quick Overview of Hyperliquid: Product Status, Economic Model and Valuation , Tell you why I am bullish on HYPE in the long term based on trading volume, fees and revenue .

Web3 人工智能

Comparison of the four major AI frameworks: adoption, strengths, weaknesses, and growth potential

Eliza (~60% market share, ~$900 million at the time of writing, ~$1.4 billion at the time of writing) will continue to dominate the market. Eliza’s value lies in its first-mover advantage and accelerated adoption by developers, as evidenced by 193 contributors, 1,800 forks, and more than 6,000 stars on Github, making it one of the most popular repositories on Github.

GAME (market share of about 20%, market value of about $300 million at the time of writing, market value of about $257 million as of the time of writing) has been developing very smoothly so far and is also experiencing rapid adoption. As announced earlier by Virtuals Protocol, there are more than 200 projects built on GAME, with more than 150,000 daily requests and a weekly growth rate of more than 200%. GAME will continue to benefit from the outbreak of VIRTUAL and has the potential to become one of the biggest winners in the ecosystem.

Rig (market share of about 15%, market value of about US$160 million at the time of writing, market value of about US$279 million as of writing) has a very attractive and easy-to-use modular design, and is expected to dominate the Solana ecosystem (RUST).

Zerepy (market share of about 5%, market value of about $300 million at the time of writing, market value of about $424 million as of writing) is a more niche application, specific to an avid ZEREBRO community, and its recent collaboration with the ai16z community may produce certain synergies.

Be the first to lay out future narratives: What should the AI Agent track focus on in 2025?

Don’t limit yourself to a single ecosystem. Be flexible and look for real value instead of getting caught up in factional struggles. A successful agent needs to have two core elements: uniqueness and usefulness. At the same time, it will be an extra bonus if the team can master the “art of attracting attention”: create a fascinating background story or brand image around the agent; launch new features quickly and continuously to maintain innovation; actively listen to and meet the needs and expectations of the community.

The most popular intelligent narratives and functions in the current market include: obtaining and providing Alpha information, investing in DAOs, on-chain transactions, tools for developers, and TEEs.

Emerging narratives worth paying attention to in 2025 include: DeFi agents, NSFW agents, robots, data-driven agents, gamification of agents, swarm/collective intelligence, and infrastructure construction.

An article reviewing popular AI Agent Launchpad platforms

VVAIFU, HAT, ALCH, MAX, VIRTUAL, CLANKER.

Market value reaches $5 billion, analysis of the popular narrative of the VIRTUAL ecosystem

The number of projects with strong backgrounds has increased significantly, AI + other fields has become a new hotspot, and AI development tools and frameworks are not the mainstream narrative.

A list of popular memes driven by AI Agent and DeSci

AI Agent focuses on the trend outlook of blockchain + AI value investment, which is in line with the markets expectations for technological development and has a stronger potential to go viral; while DeSci has benefited from the joint discussions of CZ and Vitalik, Binance Labs investment in BIO Protocol, and the DeSci project AmionChain led by a16z. In the context of insufficient market innovation, although AI and DeSci are not concepts that have only appeared in 24 years, after a year of development, AI Agent and DeSci will still be the main hype points in this bull market.

The emerging narrative, a glimpse into the present and future of DePIN

DePIN creates a bilateral market of resource sharing + economic incentives by linking hardware and blockchain. A complete DePIN network consists of u project parties, off-chain physical devices, suppliers and demanders. The basic operation mode is divided into five steps: off-chain hardware equipment, certification, identity verification, reward issuance, and demand matching.

The current DePIN project is divided into two directions, one is focusing on the middle layer of DePIN; the other is focusing on the expansion of the DePIN demand side.

The development trends of DePIN include: integration with Web2 application scenarios, lowering of hardware thresholds, financialization, and mutual support between DePIN and AI.

When examining potential projects, you should pay attention to the following factors: hardware and token economic design.

另外建议: A Review of Popular AI Agent Projects in 2024: The Transformation from Meme to Infrastructure Tokens , Comparative Analysis of Griffain and Neur: Who is the Best Solana AI Assistant? , Virtuals Official Annual Summary: From Ecosystem Construction to Building a Digital Nation of AI Intelligent Bodies , Dialogue with Virtuals Co-founder: Professional Applications and Agent Economic Infrastructure Are the Two Major Directions for Producing Unicorns in the Future , ai16z Ecosystem Explodes, and Related Concept Projects Are Sorted Out in One Article , Solana AI Hackathon Becomes a Golden Dog Manufacturing Machine, List of Issued Coins Worthy of Attention .

本周热点话题

过去一周, in terms of policy and macro markets, the U.S. Treasury Department and the Internal Revenue Service finalized tax reporting requirements for certain cryptocurrency brokers ; the central bank released the China Financial Stability Report (2024), which mentioned the progress of cryptocurrency compliance in Hong Kong ; Do Kwon pleaded not guilty to U.S. fraud charges at a hearing in the Manhattan Federal Court ;

In terms of opinions and voices, Bill Hughes: The US tax reporting requirements for specific cryptocurrency brokers may face challenges in court and Congress; 特朗普的第二个儿子 met with Michael Saylor at Mar-a-Lago and mentioned Bitcoin; Alex Thorn: DeFi applications without front-end, non-upgradeable contracts or no fees are three potential options for dealing with the US IRS broker rules; Hong Kong Legislative Council member Wu Jiezhuang: Bitcoin can be included in the Hong Kong Exchange Fund assets on a trial basis; Fed Daly: Cryptocurrency should not be confused with gold and is still far from becoming a currency; Globalt Investments executives: Will consider increasing Bitcoin holdings, but the proportion of the portfolio may not exceed 5%; Trader Peter Brandt: Bitcoin may be turning to the Hump Slump Bump Dump Pump mode; Axel Adler: The ratio of net inflows to reserves of Bitcoin exchanges shows that the market is in the accumulation stage ; CoinShares: Bitcoin prices may reach $150,000 or $80,000 in 2025; Galaxy Digital: Bitcoin may reach 20% of the gold market value in 2025; Standard Chartered Bank: MicroStrategy next year BTC purchases should exceed those in 2024; Co-founder of Satoshi Action Fund: At least 13 states are drafting Strategic Bitcoin Reserve bills; Dragonfly partner: I hate Multicoin co-founder Kyle Samani, but judging by his record, he is the best investor in the industry ; Animoca Brands: Decentralized e-sports will be one of the trends in blockchain games in 2025; Musk released a statement on the controversial issue of tax payment for encrypted transactions , mentioning that the project rose by more than 100% in a short period of time; ai16z founder: AI Pool is autonomously operated , and ai16z has no control over it; DWF Labs partner: The development of AI proxy transactions is being improved and has been integrated into the DWF trading system; Multicoin co-founder: The total revenue of Helium, Hivemapper, and io.net is expected to exceed US$100 million next year;

In terms of institutions, large companies and leading projects, ai16z: Eliza V2 is in the early development stage, focusing on improving architecture, scalability and plugin management; the Frax community approved the proposal of support for frxUSD stablecoin by BlackRocks BUIDL ; AI architecture protocol arc released official documents ;

In terms of data, VanEck Research Director: VanEck holds 9% of its Bitcoin ETFs outstanding shares ; in December, the US Ethereum spot ETF had a net inflow of US$2.1 billion , making it its best performing month … Well, its the week of bidding farewell to the old and welcoming the new.

随附的 是一个门户 进入“每周编辑精选”系列。

下次再见~

This article is sourced from the internet: Weekly Editors Picks (1228-0103)

Zoth, a leading real-world asset ecosystem, is collaborating with Olea, a digital infrastructure platform for supply chain assets incubated by SC Venutures, to expand its on-chain fixed income pools. This collaboration aims to bring fixed income pools to the chain, marking an important milestone in the digital transformation of the fixed income market, all made possible by Plumes RWAfi L1 blockchain infrastructure. Through these on-chain funding pools, Zoth will finance Oleas trade receivables, providing faster, more diverse and efficient financing solutions for global supply chain participants while leveraging a global distribution network. Revolutionizing Fixed Income and Trade Finance with Blockchain Technology Zoth, Plume and Olea have joined forces to create the next generation of financial solutions by combining fixed income investments with supply chain financing, providing critical liquidity to enterprises…