原文作者:BitMEX

Welcome back to our weekly Options Trading Strategy Analysis. In this issue, we will explore an interesting arbitrage opportunity involving BitMEX’s options market and prediction platform Polymarket, using a combination of a buy spread strategy and a prediction market position.

市场 Conditions

Current market conditions present an attractive arbitrage opportunity:

BitMEX options market (Dec 20 expiry):

-

$3,850 Call Option: 1 contract costs $75.9

-

$3,950 Call: 1 contract sold at $32.5

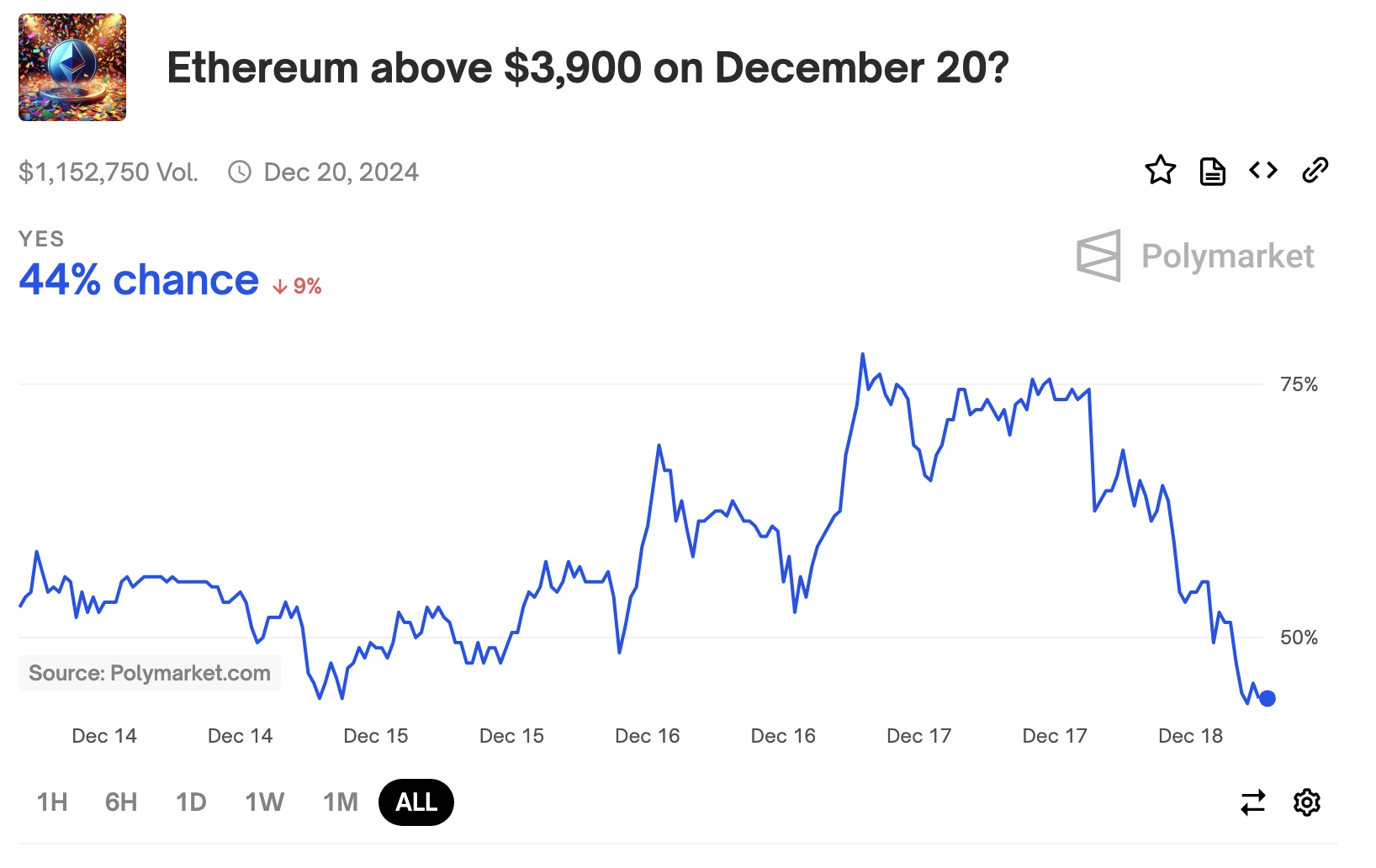

Polymarket (expiring on December 20):

-

The “no” contract on whether ETH will go above $3,900 on December 20th is priced at 57 cents.

-

A $25 position, if successful, would have an estimated profit of $44.98 (a return of 75.4%).

Arbitrage strategies

The strategy combines positions in BitMEX options and Polymarket. Here is a detailed breakdown of the strategy:

BitMEX Spread Options:

-

Buy 1 ETH 20 Dec $3850 Call Option

-

Sell 1 ETH 20 Dec $3950 Call Option

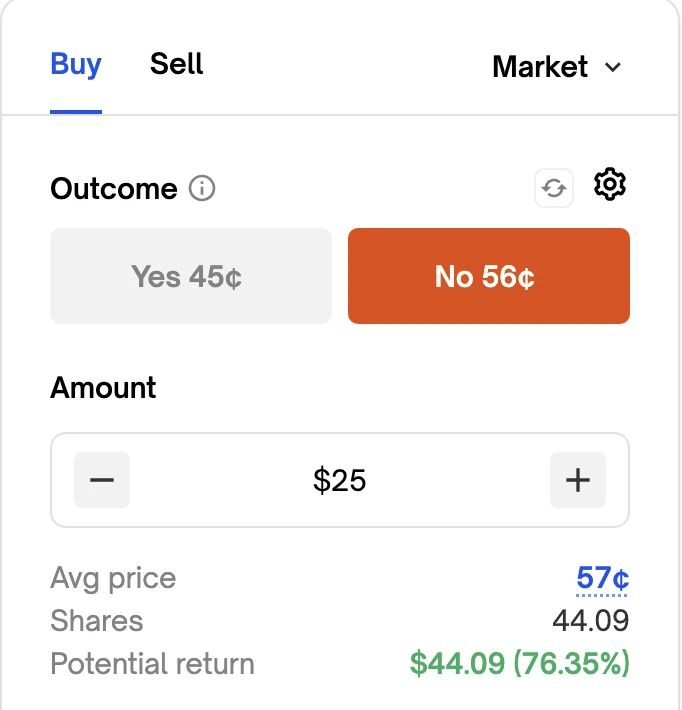

Polymarket Positions:

-

Buy a $25 No contract to buy ETH below $3,900 for 46 cents.

-

Potential Return: If ETH stays below $3,900 on Dec. 20, the projected return is $44.09.

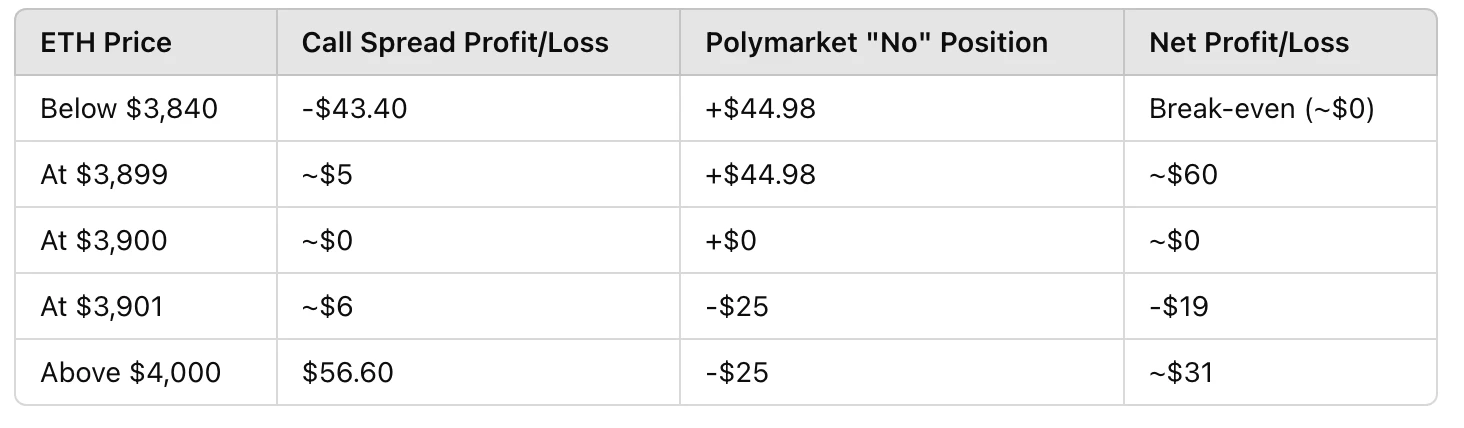

Profit scenario

风险考虑

Calendar risk: The BitMEX options expire at 08:00 UTC on December 20, while the Polymarket position is settled at 12:00 ET (noon) on December 20. Since there is a 4-hour gap between the two, price fluctuations need to be closely monitored as they may affect profitability.

Liquidity risk: Ensure that there is sufficient liquidity in both markets. Pay attention to the bid-ask spread and execution costs, as these factors may affect the final profit calculation.

Market Volatility: High volatility can impact the premium of options. Monitor changes in implied volatility and adjust position sizes based on market conditions.

总结

This strategy provides an interesting arbitrage opportunity, combining positions on BitMEX options and Polymarket. By using option spreads, we have created a strategy with multiple profit scenarios and clear risk parameters.

This arbitrage opportunity looks particularly attractive given current market pricing. However, as always, careful position sizing and risk management are critical. Monitor the dynamics of both markets closely and be prepared to adjust positions as market conditions change to maximize profits.

This article is sourced from the internet: BitMEX Alpha: Arbitrage Opportunities on Polymarket

Original title: No production, only hoarding coins: MSTRs latest financial report released, revealing MicroStrategys capital growth and high premium valuation model Original author: Alvis, MarsBit Historically, whenever a traditional industry reaches its peak, there are often some groundbreaking companies that find unique production methods in the cracks of the market and rely on unique strategies to attract capital. These companies rarely produce actual things, but concentrate their resources on a core asset – like Shell Oil Company in the past maintained its valuation through oil reserves, and gold mining companies relied on gold mining and reserves to dominate prices. In the early hours of this morning, MicroStrategys financial report was released, and people once again saw such a company: it is not known for production, but with its huge investment…