Arthur Hayes: The best investment under Trumps policies is to hold Bitcoin

原作者:Arthur Hayes

原文翻译:TechFlow

All opinions expressed in this article are the author’s personal opinions and are for reference only. They do not constitute investment advice or a recommendation for any trading behavior.

More content

Four steps from the wall, a wooden board is attached vertically to a movable bracket. My yoga teacher has me align the heels of my hands with the point where the board meets the bracket, then bend over like a cat, making sure the back of my head is pressed against the board. If I’m in the right position, I can move my feet up the wall so that my body forms an L shape, with the back of my head, back, and sacrum pressed against the board. To keep my ribs from flaring out, I have to tighten my abdominal muscles and draw my tailbone in. Oops—I’m already sweating just holding this position. But the real challenge is yet to come: I have to kick one leg up to a completely vertical position while maintaining alignment.

The board was like a “mirror of truth” that would immediately expose problems with my body’s posture. If your posture is not right, you will immediately feel some part of your back or hips lifting off the board. As I lifted my left foot, with my right foot still against the wall, my musculoskeletal problems were immediately apparent: my left lat was flaring out, my left shoulder was rolling in, and my whole body looked like a twisted ball of hair. I knew these problems because my athletic trainer and chiropractor had noticed that my left back muscles were weaker than the right, causing my left shoulder to be higher and tilted forward. Practicing handstands on the board only made my imbalances more apparent. There is no quick fix for these problems, only a slow, sometimes painful series of exercises that can help you adjust and improve them.

If this board is the “mirror of truth” that my body is aligned with, then the President-elect of the United States, Donald Trump, is the “catalyst of truth” for various geopolitical and economic issues in the world today. The global elite hates Trump precisely because he reveals certain truths. When I say “Trump truth” here, I don’t mean that he will tell you personal information about himself, such as his height, net worth or golf scores. I mean that Trump reveals the true relationship between countries and what ordinary Americans really think when they are away from the pressure of political correctness.

As a macroeconomic analyst, I try to make predictions based on public data and current events to 指导 my portfolio. I appreciate Trump Truth because it is a catalyst that forces leaders to confront problems and take action. These actions will ultimately shape the future world order, and I hope to profit from them. Even before Trump officially took office, countries had begun to act in the way I predicted, which further strengthened my judgment on the future monetary policy and financial repression. This year-end article will analyze the major changes taking place inside and outside the four major economies: the United States, the European Union, China, and Japan. In particular, I need to assess whether monetary policy will continue to be loose or even accelerate further after Trump officially takes office on January 20, 2025. This judgment is crucial to my short-term investment strategy.

However, I think the current 加密货币currency market has too high expectations that Trump can quickly change the status quo. In fact, there are few politically feasible quick solutions from Trump. The market may wake up around January 20, 2025 and realize that Trump has only a year at most to push through any policy changes. This reality shock could trigger a sharp sell-off in cryptocurrencies and other Trump 2.0 related assets.

Trump only has one year to act, as most US lawmakers will begin campaigning at the end of 2025 for the midterm elections in November 2026. At that time, all seats in the House of Representatives and a large number of Senate seats will be up for re-election. The Republicans currently have a very thin majority in Congress, and they are likely to lose control after November 2026. The anger of the American people is understandable, but it will take even the most capable politicians more than a decade, not just a year, to solve those deep-seated domestic and foreign problems. Therefore, many investors may face serious buyers regret. Nonetheless, can the policy of printing money and financial repression measures against savers drive the crypto market to continue to prosper until 2025 and beyond? I believe the answer is yes, but this article is also a way for me to try to convince myself of this possibility.

Currency Phase Changes

I will borrow Russell Napiers ideas and simplify the timeline of monetary structure after World War II.

-

1944 – 1971: Bretton Woods

Countries fixed their currencies to the dollar, which in turn was pegged to gold at $35 per ounce.

-

1971 – 1994: The Petrodollar System

With President Nixon’s announcement of abandoning the gold standard, the dollar began to float freely against other currencies. This shift was due to the US’ inability to simultaneously maintain the gold peg, expand the welfare state, and finance the Vietnam War. Nixon made a deal with the Persian Gulf oil producers, including Saudi Arabia, that required these countries to price their oil in dollars, pump as much oil as required, and recycle their trade surpluses into US financial assets. If you believe some reports , the US manipulated certain Gulf countries into raising oil prices in order to support this new monetary structure.

-

1994 – 2024: The Petro-Yuan System

China devalued its currency sharply in 1994 to combat inflation, a banking crisis, and a slump in its export sector. At the same time, China and other Asian economies adopted mercantilist policies, accumulating dollar reserves through cheap exports to pay for energy and high-end manufacturing imports. This policy not only promoted globalization, but also introduced a billion low-wage workers to the international market, suppressed inflation in developed countries, and enabled Western central banks to maintain low interest rates for a long time.

The white line represents the USD/CNY exchange rate (USDCNY), and the yellow line represents Chinas GDP in constant USD.

2024 – till now?

I have not yet named the system that is emerging. However, Trump’s election is a catalyst for changes to the global monetary system. To be clear, Trump is not the root cause of this realignment; rather, he is outspoken about the imbalances that need to change and is willing to adopt highly disruptive policies to quickly push through changes that he believes are best for Americans. These changes will end the petroyuan system. As I have argued in this article, these changes will lead to an increase in the supply of fiat money worldwide and an increase in financial repression. Both of these must happen because leaders, whether in the United States, the European Union, China, or Japan, are unwilling to deleverage to achieve a new sustainable equilibrium. Instead, they will choose to print money and destroy the real purchasing power of long-term government bonds and bank savings deposits to ensure the elite’s control in the new system.

Next, I will begin with an overview of Trump’s goals and then assess the responses of various economies or countries.

The truth about Trump

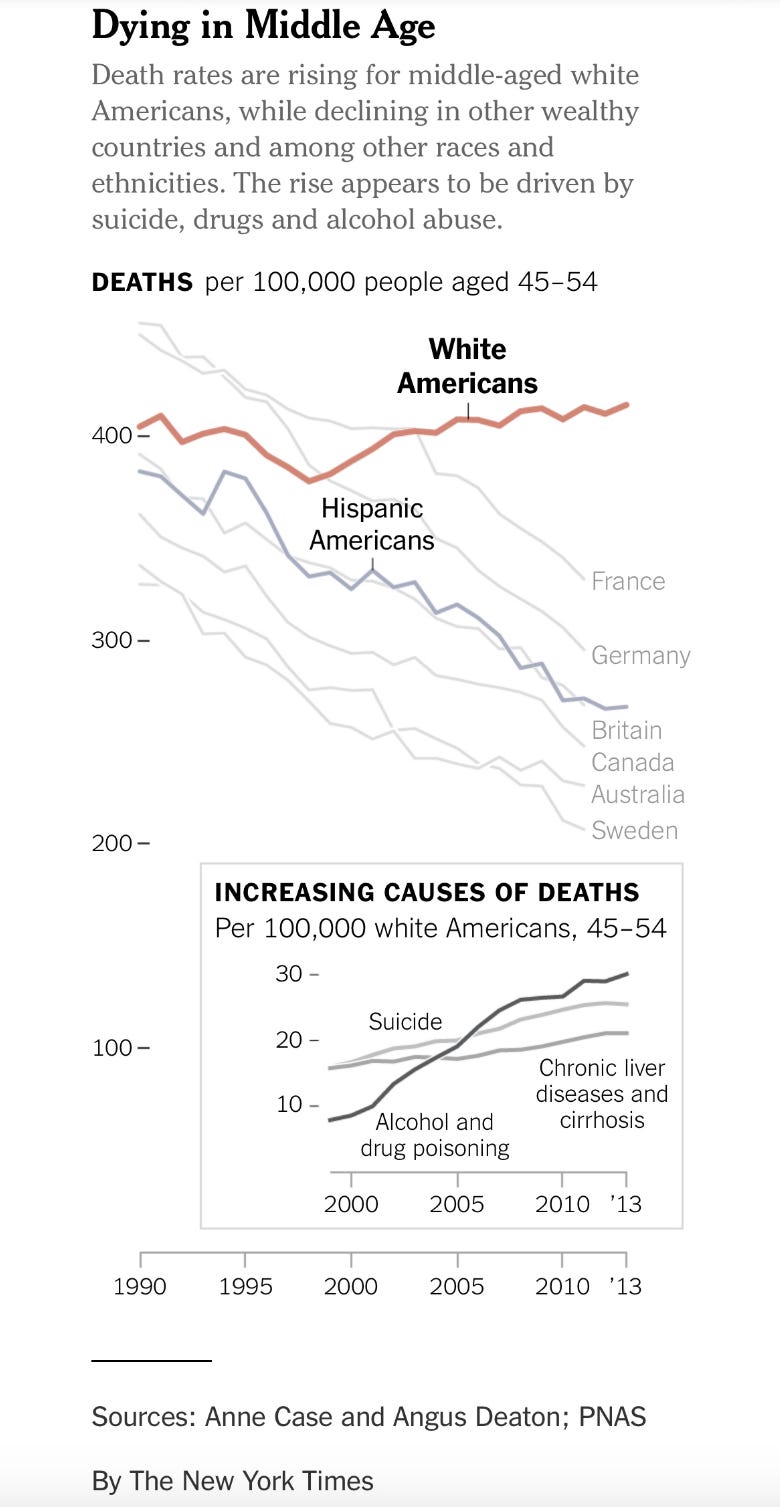

To maintain the petro-yuan system, the US must run current and trade account 定义cits. This has led to the deindustrialization and financialization of the US economy. If you want to understand the mechanisms, I recommend reading all of Michael Pettis’s work. I’m not saying this is why the world should change its economic system, but the average white American male who served the so-called Pax Americana has clearly lost a lot since the 1970s. The key here is the word “average”; I’m not talking about the top guys like Jamie Dimon, CEO of JP Morgan, and David Solomon, CEO of Goldman Sachs, or the average white-collar worker who works for them. I’m talking about the average person who once had a job at Bethlehem Steel, a house of their own, and a partner, and now the only woman they come into contact with may be a nurse at a methadone clinic. This is obvious because this group is slowly killing themselves with alcohol and prescription drugs. Compared to the high living standards and job satisfaction they once enjoyed after World War II, things are clearly terrible now. As we all know, this is Trump’s base, and he speaks to them in a way that other politicians dare not. Trump promised to bring industry back to America and inject meaning back into their miserable lives.

For bloodthirsty Americans who love “video game wars” (a very powerful political group), the current state of the U.S. military is a disgrace. The myth of the superiority of the U.S. military over any near or real adversary (currently only Russia and China qualify as such) originates from the fact that the U.S. military “liberated” the world from Hitler’s aggression in World War II. But that was not the case; it took tens of millions of Soviet lives to defeat the Germans, and the U.S. was only the finishing touch. Stalin despaired at the U.S. delay in launching a major offensive against Hitler in the Western European theater. U.S. President Roosevelt bled the Soviet Union to reduce the casualties of American soldiers. In the Pacific theater, although the U.S. defeated Japan, they never faced a full-scale attack by the Japanese Army because Japan committed most of its forces to the Chinese mainland. Instead of mythologizing the Normandy Landings in movies, Hollywood should depict the Battle of Stalingrad and the heroism of General Zhukov and the millions of Russian soldiers who died.

After World War II, the U.S. military fought a tie with North Korea in the Korean War, lost to North Vietnam in the Vietnam War, underwent a chaotic withdrawal from Afghanistan in 2021, and is now losing to Russia in Ukraine. The only thing the U.S. military can be proud of is using highly complex and overly expensive weapons against third world countries such as Iraq in the two Persian Gulf Wars.

Success in war is a reflection of industrial economic strength. If you care about war, the US economy is actually false prosperity. Yes, Americans can make unparalleled leveraged buyouts, but their weapons systems are a patchwork of imported Chinese parts, sold at high prices, but forced to be sold to captive customers like Saudi Arabia, who must buy these systems under geopolitical agreements. And Russia, whose economy is only one-tenth the size of the United States, can produce unstoppable hypersonic missiles at a cost far lower than that of American conventional weapons.

Trump is not a “peace first” hippie; he fully believes in American military superiority and exceptionalism, and is happy to use that military might to slaughter his enemies. Remember during his first term, he assassinated Iranian General Qasem Soleimani on Iraqi soil, an act that delighted many Americans. Trump unilaterally decided to assassinate another country’s general without caring about violating Iraqi airspace or the fact that the United States was not officially at war with Iran. Therefore, he wants to rearm the empire so that its military capabilities match the propaganda.

Trump advocates reinvigorating the U.S. economy through reindustrialization, which will not only help those who want good manufacturing jobs, but also support those who want a strong military. To do this, the imbalances that have developed under the petro-yuan system need to be reversed. This will be done by weakening the dollar, providing tax subsidies and production grants, and relaxing regulations. All of these measures will make it economically viable for companies to move production back to the United States, because China is still the best place to produce, thanks to three decades of pro-growth policies.

In my article Black or White , I talked about how quantitative easing (QE) for the poor could help finance the reindustrialization of the United States. I believe that incoming US Treasury Secretary Bessant will pursue such an industrial policy. However, this will take time, and Trump needs to show immediate results that will appeal to voters as progress in his first year in office. Therefore, I believe Trump and Bessant must immediately devalue the dollar. I want to discuss how this is possible and why it must happen in the first half of 2025.

Bitcoin Strategic Reserve

“Gold is money, everything else is just credit.” – JP Morgan

Trump and Bessant have repeatedly stressed the need to weaken the dollar in order to achieve U.S. economic goals. So, what should the dollar be devalued against, and when?

Among the worlds major exporters, in addition to the United States, there are China (RMB), the European Union (Euro), the United Kingdom (British Pound) and Japan (Japanese Yen). If you want to attract more companies to move production back to the United States, the US dollar must depreciate against these currencies. Companies do not necessarily need to be registered in the United States; Trump also accepts Chinese manufacturers setting up factories in the United States and selling goods locally. But the key is that American consumers must buy Made in the USA products.

The old way of adjusting exchange rates through international coordination is outdated. Today, the United States is not as powerful as it was in the 1980s, both economically and militarily, relative to other countries. Therefore, Bessent cannot unilaterally ask other countries to adjust their currencies against the dollar. Of course, he can use tariffs or other means to put pressure on them, but this requires a lot of time and diplomatic effort. In fact, there is a more direct way.

The United States currently has the largest gold reserves in the world, about 8,133.46 tons, which provides a unique advantage for achieving the devaluation of the US dollar. As we all know, gold is the real currency of global trade. Although the United States has been off the gold standard for 50 years, historically, the gold standard has always been the mainstream, while the current fiat currency system is the exception. Therefore, the easiest path is to devalue the US dollar relative to gold.

Currently, the U.S. Treasury prices gold on its balance sheet at $42.22 per ounce. If Bessant can convince Congress to raise the legal price of gold, the depreciation of the dollar relative to gold will directly increase the credit line of the Treasurys account at the Federal Reserve. These additional funds can be directly used for economic spending. Every increase in the gold price of $3,824 per ounce can bring an additional $1 trillion to the Treasury. For example, adjusting the gold price to the current spot price can increase the Treasurys reserves by about $695 billion.

In this way, the U.S. government can create dollars out of thin air by adjusting the price of gold and use them to purchase goods and services. This operation is essentially a devaluation of fiat currencies. Since the value of other fiat currencies is also implicitly linked to gold, these currencies will automatically appreciate relative to the dollar. The United States can quickly achieve a significant devaluation of the dollar against the currencies of its major trading partners without consulting other countries.

One might ask, will other exporting countries restore competitiveness by devaluing their currencies more against gold? In theory, yes, but due to the dollars global reserve currency status, these countries cannot follow the US gold devaluation strategy, otherwise they will face the risk of hyperinflation. Especially because these countries cannot achieve self-sufficiency in energy and food like the United States, such inflation will lead to severe social unrest, thus threatening the position of the ruling party.

How much of a devaluation of the dollar would be needed to reindustrialize the U.S. economy? The answer is a new gold price. If I were Bessent, I would take a bold move, such as revaluing gold to $10,000 to $20,000 an ounce. According to Luke Gromens calculations, if we return to the ratio of gold to Fed liabilities in the 1980s, the price of gold may need to rise 14 times to about $40,000 an ounce. This is not my prediction, but it illustrates how overvalued the dollar is relative to gold.

As a gold supporter, I own physical gold bars and invest in gold mining ETFs because the easiest way for the dollar to depreciate is relative to gold. This action will also have a profound impact on the cryptocurrency market.

The concept of the Bitcoin Strategic Reserve (BSR) is based on this logic. U.S. Senator Lummis has proposed legislation that would require the Treasury to purchase 200,000 Bitcoins per year for five years and finance these purchases by increasing the price of gold on the governments balance sheet. The core of this proposal is that Bitcoin, as the hardest currency, can help the United States maintain its financial dominance in both the digital and physical economies.

If the governments economic policies are closely tied to the price of Bitcoin, then it will be more inclined to support the expansion of the Bitcoin and cryptocurrency ecosystem. This logic is similar to the way the government supports domestic gold mining and the gold trading market. For example, China encourages domestic gold holdings through the Shanghai Gold Futures 交换, which is a policy practice to increase the countrys gold reserves.

If the US government creates more dollars by devaluing gold and uses some of these funds to buy Bitcoin, then the fiat price of Bitcoin will rise accordingly. This rise will further trigger competitive sovereign purchases from other countries as they need to catch up with the United States. In this case, the price of Bitcoin may increase exponentially. After all, who would be willing to sell Bitcoin in exchange for devalued fiat currency in the context of the governments active devaluation of fiat currency? Of course, long-term holders will eventually sell Bitcoin at a certain price point, but this price will definitely not be $100,000. Despite this clear and reasonable logic, I still dont think the Bitcoin Strategic Reserve (BSR) will actually be implemented. I think politicians are more inclined to use the newly created dollars for livelihood projects to ensure their victory in the upcoming election. However, even if the BSR does not happen, the mere possibility is enough to generate buying pressure in the market.

Although I dont think the US government will buy Bitcoin, this does not affect my optimistic expectations for Bitcoin prices. The depreciation of gold will create a large number of new US dollars, which will eventually flow into real goods, services and financial assets. According to historical experience, the price of Bitcoin has increased much faster than the growth rate of the global US dollar supply, because the total amount of Bitcoin is limited and the circulation is gradually decreasing.

The white line in the figure is the Federal Reserves balance sheet, and the yellow line is the Bitcoin price, both of which are based on the index value of 100 on January 1, 2011. The Federal Reserves balance sheet has increased by 2.83 times, while the Bitcoin price has increased by 317,500 times.

In summary, rapidly and significantly weakening the dollar is the first step for Trump and Bessent to achieve their economic goals. This measure can be accomplished quickly without consulting domestic lawmakers or foreign finance ministries. Given that Trump needs to show results within a year to help the Republicans maintain control of the House and Senate, I expect the devaluation of the dollar/gold to take place in the first half of 2025.

Next, let’s focus on China and explore how they will respond to Trump’s core policies.

China’s response

China is currently facing two major challenges: one is employment and the other is real estate. Trumps policies have undoubtedly increased these challenges, because the United States also needs to create higher-paying jobs for ordinary people and increase investment in production capacity. Trump and his teams main weapons are a weak dollar and tariffs, so what are Chinas countermeasures?

I think China has made it clear that it must ideologically accept quantitative easing (QE) and further allow the RMB to float freely. So far, China has done little fiscal stimulus through central bank money printing, mainly to avoid exacerbating imbalances in the domestic economy. In addition, China has been in a wait-and-see mode, waiting for the policy direction of the new US administration. However, signs in recent weeks suggest that China will conduct large-scale economic stimulus through traditional QE channels and allow the RMB to trade freely as the market demands.

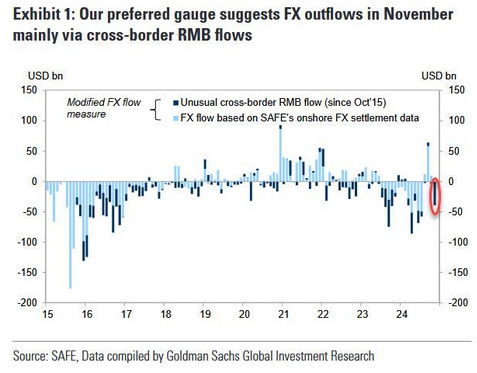

As for why QE will lead to the depreciation of the RMB, we can understand it from the following logic: QE will increase the supply of RMB. If the growth rate of RMB supply exceeds that of other currencies, then the RMB will naturally depreciate relative to these currencies. In addition, RMB holders may act in advance to convert RMB into assets with fixed supply such as Bitcoin, gold or US stocks to protect their purchasing power. This behavior will also further exacerbate the depreciation of the RMB.

The picture shows the trend of investors starting to withdraw funds from China.

As I mentioned before, due to China’s dependence on food and energy, they cannot counter the US by devaluing the RMB against gold. This would lead to hyperinflation and ultimately threaten the Communist Party’s rule. However, China can alleviate the real estate crisis and avoid deflation by significantly increasing the supply of RMB. Recent news suggests that the People’s Bank of China (PBOC) is ready to allow the RMB to depreciate in response to Trump’s tariff threats, which is a sign that China may fully launch a QE policy.

“China’s top leaders and policymakers are considering allowing the yuan to depreciate further in 2025 in response to higher U.S. trade tariffs as Trump returns to the White House.” – Reuters, December 11, 2024

The PBOC has not made clear the real reason why it allows the RMB to float freely, which may be to avoid further exacerbating capital outflows. If the wealthy were told directly that the PBOCs policy would focus on printing money and buying government bonds, it might cause panic among investors and lead to a rapid capital flight. Funds might first flow into Hong Kong and then move to other parts of the world. Therefore, the PBOC prefers to guide investors to invest their funds in domestic stock and real estate markets rather than moving them overseas by hinting at them.

As I predicted in my 让我们去比特币 article, the Peoples Bank of China (PBOC) will use large-scale quantitative easing (QE) and monetary stimulus policies to curb deflation. We can judge the effectiveness of these policies by observing whether the yields on Chinese government bonds (CGBs) rise. Currently, the yields on CGBs are at historical lows, as investors prefer to choose government bonds with principal protection rather than risk investing in volatile stock and real estate markets. This choice reflects the markets pessimism about the medium-term prospects of the Chinese economy. It is not complicated to reverse this sentiment: just print money on a large scale and buy back government bonds from investors through the central banks open market operations. This is the definition of quantitative easing. For a detailed description of this process, please refer to my chart analysis in the Black and White article.

At the macro level, the main problem with money printing is the external value of the renminbi. While a strong renminbi has some benefits, such as making imported goods cheaper for Chinese consumers, increasing the likelihood that trading partners will use renminbi for settlement, and helping companies borrow renminbi at lower interest rates, these benefits are negligible under Trumps policy pressure. The United States can print money more boldly than China without causing hyperinflation, as Trump and Bessant have shown. Therefore, the renminbis exchange rate against the dollar is likely to float, which in the short term means that the renminbi will depreciate.

Before Bessant pushes for a sharp devaluation of the dollar against gold, a weaker yuan will help Chinese manufacturers export more goods. This short-term advantage will help China negotiate more favorable terms with the Trump team, such as easier access to the U.S. market for Chinese companies.

The important question for cryptocurrency investors is: How will Chinese investors react to signals of growing RMB supply? Will legal capital outflow channels such as Macau gaming and Hong Kong businesses be allowed to continue operating, or will they be closed to limit capital flight? Given that the United States is restricting certain funds (such as Texas public university endowment funds ) from investing in Chinese assets, China may also take similar measures to prevent newly printed RMB from flowing to the United States through Hong Kong. These RMB must be channeled into Chinas own stock and real estate markets. Therefore, capital outflows from RMB to the US dollar may accelerate before the policy window closes.

For the cryptocurrency market, in the short term, Chinese capital may flow to the US dollar through Hong Kong and buy Bitcoin and other cryptocurrencies. In the medium term, once the Chinese government prohibits the transfer of capital overseas through obvious channels, the question will become whether Hong Kongs cryptocurrency ETFs will be allowed to accept funds from mainland China. If controlling cryptocurrencies through Hong Kongs state-owned asset management companies can enhance Chinas competitiveness, or at least put China on an equal footing with the United States in the crypto field, then Hong Kongs cryptocurrency ETFs will quickly attract a large amount of funds. This will bring new impetus to the cryptocurrency market, as these ETFs will need to buy spot cryptocurrencies in the global market.

Japan: The Choice of the Setting Sun Empire

Although Japan’s political elites are proud of their culture and history, they still rely heavily on U.S. support. After World War II, Japan quickly rebuilt itself with the help of dollar loans and tariff-free access to the U.S. market, and by the early 1990s, it had become the world’s second-largest economy. At the same time, Japan also built the most ski resorts in the world, which is essential to my lifestyle.

However, just as in the 1980s, trade and financial imbalances between Japan and the United States are once again in the spotlight. The currency agreement at the time led to a weaker dollar and a stronger yen, which eventually triggered the collapse of the bubble in Japans stock and real estate markets in 1989. In order to strengthen the yen, the Bank of Japan had to tighten monetary policy, which directly led to the collapse of the bubble. It also shows that loose monetary policy often inflates asset bubbles, and once the policy is tightened, the bubble will burst. Today, Japanese politicians may once again take similar financial hara-kiri actions to cater to the needs of the United States.

Japan is currently the largest holder of US Treasuries and has implemented aggressive quantitative easing, which then evolved into yield curve control (YCC), which has led to extreme USD/JPY weakness. I explored the significance of the USD/JPY exchange rate in detail in my articles Shikata Ga Nai 和 Spirited Away .

Trump’s economic strategy clearly states that the dollar needs to appreciate relative to the yen. Trump and Bessant make it clear that this adjustment is inevitable. Unlike China, Japan’s currency adjustment is not adversarial, but Bessant directly determines the dollar-yen exchange rate and Japan will be forced to comply.

However, the key problem for the yen to appreciate is that the Bank of Japan (BOJ) must raise interest rates. Without government intervention, the following may happen:

-

As interest rates rise, Japanese government bonds (JGBs) become more attractive, and Japanese companies, households, and pension funds are likely to sell foreign assets (mainly U.S. Treasuries and stocks), convert the proceeds into yen, and buy JGBs instead.

-

The rise in JGB yields means a fall in its price, which will have a severe impact on the Bank of Japans balance sheet. In addition, the Bank of Japan holds a large amount of US Treasury bonds and stocks, and their prices may also fall as Japanese investors sell these assets to repatriate funds. At the same time, the Bank of Japan will also need to pay higher interest on yen bank reserves. These changes may eventually put the Bank of Japans solvency under great pressure.

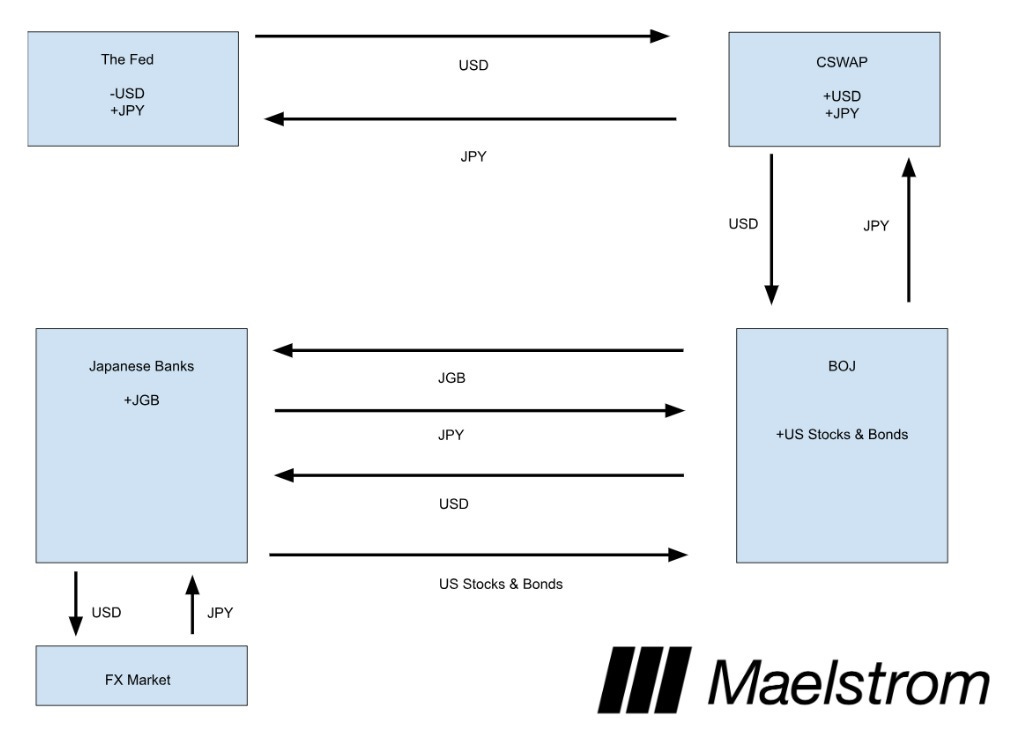

Trump obviously does not want Japans financial system to collapse. The United States naval bases in Japan are crucial to curbing Chinas maritime expansion, and key products such as semiconductors produced in Japan also ensure that the United States can obtain a stable supply. Therefore, Trump may instruct Bessant to take all necessary measures to ensure Japans financial stability. For example, Bessant may use the power of the US Treasury to conduct a currency swap (CSWAP) between the US dollar and the yen with the Bank of Japan in order to absorb the US Treasury bonds and stocks sold by Japan off-market. The specific process of this mechanism can be referred to my description in the article Spirited Away :

-

The Fed increases the supply of dollars in exchange for the yen that was previously generated by the growth of the carry trade.

-

In the currency swap, the Fed provides dollars to the Bank of Japan, while the Bank of Japan provides yen to the Fed.

-

The Bank of Japan therefore holds more U.S. stocks and bonds, and the prices of these assets will rise as the supply of dollars increases.

-

The Bank of Japan holds more Japanese Government Bonds (JGB).

This mechanism is critical to the cryptocurrency market because the supply of U.S. dollars will increase significantly in order to solve the unwinding of the yen-dollar carry trade. Although this process will unfold slowly, trillions of dollars may be printed to maintain the stability of Japans financial system.

Resolving the trade and financial imbalances between Japan and the United States is not complicated, because Japan has little say in the matter. Japan’s political position is extremely fragile at present, and the ruling Liberal Democratic Party (LDP) has lost its parliamentary majority, causing the country’s governance to fall into turmoil. Although Japan’s elites are full of disgust at the boorish behavior of the United States, they do not have enough political power to oppose Trump’s economic tactics.

EU: The last will always be the last

Although many Europeans (at least those who don’t have names like Muhammad) still have some Christian tradition, the biblical phrase “the last shall be first” clearly does not apply to the EU economically. The last shall always be last. For some reason, Europe’s elite politicians always seem willing to accept ruthless oppression from the United States.

In fact, Europe should have done its best to strengthen cooperation with Russia and China. Russia can provide cheap energy through pipelines and provide Europe with abundant food supplies. China can provide high-quality, low-cost manufactured goods and is willing to buy European luxury goods in astonishing quantities. However, the European continent has been constrained by two island countries, Britain and the United States, and has failed to integrate into a large and unstoppable Eurasian common prosperity circle.

Germany and France are struggling economically because Europe is unwilling to buy cheap Russian gas, abandon its false promises of green energy transition, or engage in mutually beneficial trade with China. The decline of Germany and France, the two engines of the European economy, has also made the entire European continent look weaker, almost becoming a holiday destination for Arabs, Russians (although perhaps less now), and Americans. All this is ironic because European elites often have deep prejudices against the people of these regions.

This year, two key speeches were delivered by Super Mario Draghi ( The Future of European Competitiveness, September 2024) and Emmanuel Macron ( Europe, April 2024 ). For Europeans, these speeches were frustrating because, while both politicians accurately identified the core problems facing Europe – high energy costs and insufficient domestic investment – their solutions boiled down to “financing the green energy transition by printing more money and more financial repression”.

In fact, a more effective solution would be to abandon blind support for US policies, reach an accommodation with Russia to obtain cheap natural gas, develop nuclear energy, strengthen trade with China, and thoroughly deregulate financial markets. However, it is disappointing that although many European voters have realized that the current policy mix is not in their interests and voted for parties that want to promote these changes, the elites in power still weaken the will of the majority through various undemocratic means. The current political turmoil continues, and both France and Germany are actually in a state of no stable ruling government.

Trump’s strategic intent is clear: the United States needs Europe to continue to distance itself from Russia, restrict trade with China, and buy American-made weapons to defend against Russia and China, thereby preventing the formation of a strong, integrated Eurasian economy. However, the negative impact of these policies on the European economy has forced the EU to rely on financial repression and massive money printing to stay afloat. I will quote some of Macron’s remarks to illustrate Europe’s future financial policies and explain why you should be worried if you hold capital in Europe. You need to be wary of the possibility that you may lose the freedom to move capital out of Europe in the future, and your retirement accounts or bank deposits may only be invested in poorly performing long-term EU government bonds.

Before quoting Macron, let’s take a look at a statement by Enrico Letta, former Italian Prime Minister and current president of the Jacques Delors Institute: “The EU has 33 trillion euros in private savings, of which 34.1% is held in current accounts. However, these funds are not fully utilized to meet the EU’s strategic needs. What is worrying is that a large amount of European capital flows to the US economy and US asset management companies every year. This phenomenon reflects the EU’s inefficiency in the use of savings. If these resources can be effectively reallocated within the EU’s internal economy, it will be able to significantly promote the realization of its strategic goals.” – Excerpted from More Than a Market

Letta’s point is crystal clear: European capital should not be used by American companies, but should serve Europe’s own development. EU authorities have a variety of means to force investors to put their money into underperforming European assets. For example, for funds invested through pension or retirement accounts, EU regulators can stipulate a “suitable investment range” so that investment managers can only legally invest in EU stocks and bonds. For funds in bank accounts, regulators can prohibit banks from offering investment options in non-EU assets on the grounds that these options are “unsuitable” for depositors. Any money that is parked in an EU-regulated financial institution may be subject to the control of policymakers like Christine Lagarde. As president of the European Central Bank (ECB), her first responsibility is to ensure the survival of the EU financial system, not to make your savings outperform inflation.

And if you thought only the elites of the World Economic Forum in Davos support such policies, here’s another quote from Marine Le Pen : “Europe must wake up… because the United States will defend its own interests more vigorously.”

Trumps policies have sparked strong reactions on both the left and right sides of the political spectrum in Europe.

Coming back to the point about EU politicians refusing to take simpler, less economically destructive approaches to their problems, here is Macron speaking directly to ordinary people: “Yes, the days of Europe relying on Russian energy and fertilizers, outsourcing production to China, and relying on the United States for security are over.”

Macron stressed that EU capital should not flow to the best performing financial products, but should serve more the development of the European economy. He said: The third problem is that every year, about 300 billion euros of our savings are used to finance the United States, whether it is buying U.S. Treasury bonds or participating in venture capital. This is extremely absurd.

In addition, Macron proposed suspending the Basel III banking regulatory rules. This move would allow banks to buy expensive, low-yielding EU government bonds with unlimited leverage, and investors holding euro assets would ultimately suffer because it would mean an unlimited increase in the supply of euros. He further pointed out: Secondly, we need to review the way Basel and Solvency are applied. We cannot be the only economy in the world that strictly abides by these rules. The United States, the source of the 2008-2010 financial crisis, chose not to abide by these rules.

Macron believes that since the United States does not follow these global banking rules, Europe does not need to fully comply. But such a policy may trigger the collapse of the fiat currency system and accelerate the rise of Bitcoin and gold.

Draghi also mentioned in a recent report that in order to maintain a huge welfare system (for example, Frances government spending accounts for 57% of GDP, ranking first among developed countries), the EU needs to invest an additional 800 billion euros each year. The source of this money will be the European Central Banks money printing operations, while forcing savers to buy long-term EU government bonds through financial repression.

I am not making this up. This is straight from the left and right of the EU political spectrum. They claim to know best how to invest EU savings. They tell you that banks should be allowed to use unlimited leverage to buy EU member state bonds, which will eventually be issued by the ECB after the launch of pan-Eurobonds. The rationale behind this is the so-called Trump strategic intention. If the US under Trump weakens the dollar, suspends bank supervision, and forces Europe to cut ties with Russia and China, then EU savers will have to accept low returns and financial repression. EU compliers will need to sacrifice their capital and living standards to keep the EU project going.

I’m sure you’ve noticed the obvious irony in this statement. But if you’re willing to lower your standard of living for the sake of “Europe™”, I don’t blame you. I bet many of you may be flying the EU flag in public, but in private you’re rushing to your computer, trying to find a way out of this mess as quickly as possible. You know, the way out is to buy Bitcoin before it’s banned and keep it yourself. But it’s up to you, EU readers.

From a global perspective, as the circulation of the euro continues to increase and the EUs control over local capital becomes increasingly tight, the price of Bitcoin will continue to soar. This trend is actually an inevitable result of current policies. However, I believe that this will be a say one thing, do another situation. Those in power may quietly transfer assets to Switzerland or Liechtenstein and buy cryptocurrencies frantically. At the same time, ordinary people will suffer losses under the state-sponsored inflation policy if they do not take action to protect their savings. This is the helpless reality of Europe today.

Encrypted Truth Terminal

Our Truth Terminal is a crypto free market that operates 24/7. Bitcoins rise after Trumps victory in early November has become a leading indicator of the acceleration of the growth of the fiat money supply. Faced with the impact of Trump policies, every major economy or country must respond quickly, and the usual response is currency devaluation and increased financial repression.

Bitcoin (yellow line) is driving growth in U.S. bank credit (white line).

Does this mean that Bitcoin will go all the way to $1 million without any major pullback? Of course not.

I dont think the market realizes that Trump actually has a very limited time to get things done. The market currently has too high expectations for Trump and his team to quickly pull off economic and political miracles. However, the problems that have made Trump popular have been accumulating for decades and cannot be solved in a short period of time. No matter how Elon Musk promotes on the X platform, there is no instant solution. Therefore, it is almost impossible for Trump to fully meet the expectations of his supporters and prevent the Democrats from regaining control of the Senate and the House in 2026. Peoples impatience stems from their desperation, and Trump, as a shrewd politician, knows this. In my opinion, this means that he must take big actions early in his term, which is why I bet that he will promote a significant depreciation of the US dollar against gold in his first 100 days in office. This is a simple way to quickly improve the competitiveness of US production costs. Through this policy, US production capacity will be quickly repatriated, resulting in immediate job growth, rather than waiting for the effect in five years.

Before this crypto bull market enters the market bubble burst boom phase, I expect the market to experience a sharp decline around Trumps inauguration on January 20, 2025. The Maelstrom team plans to reduce some positions in advance and hopes to buy back into some core assets at lower prices in the first half of 2025. Of course, every trader will say this and believe that they can accurately grasp the market timing. But in most cases, they tend to sell too early and then lack the confidence to re-enter the market at a higher price, thus missing out on the main gains of the bull market. With this in mind, we promise that if the bull market continues to be strong after January 20, we will quickly adjust our strategy, accept short-term losses, and re-enter the market.

Trump policies have made me see the structural flaws of the global economic order, and also made me understand that the best way to maximize investment returns in the current environment is to hold Bitcoin and cryptocurrencies. Therefore, I will continue to buy on dips and rebounds in the market to seize the opportunity of this bull market.

The future is here, the choice is yours.

This article is sourced from the internet: Arthur Hayes: The best investment under Trumps policies is to hold Bitcoin

Related: Bitcoin never gives up: $100,000 per coin, from zero to $2 trillion in 16 years

On December 5, 2024, a single Bitcoin was worth $100,000, a record high, with a market value of $2.1 trillion. It has officially entered the six-digit range. The $100,000 that was once out of reach and even seemed unrealistic is now history. Any asset that has grown from zero to a trillion-dollar market value must have a magnificent story behind it, and Bitcoin is no exception. For those of us who are in the game, we feel that the journey of Bitcoin over the past decade can only be described as magical. The Bitcoin network was officially launched on January 3, 2009, and the initial trading price of Bitcoin was $0.0008. At a price of 100,000, Bitcoin has increased by more than 125 million times. Let us return to the…