Stacks is the leading Bitcoin L2, unlocking BTC capital with new use cases, leveraging Bitcoin security with 100% Bitcoin finality, and benefiting from fast transactions. Activate the Bitcoin economy with Stacks.

What is sBTC?

Bitcoin is a 1:1 Bitcoin-backed asset on Stacks Bitcoin L2, which will allow developers to create efficient use cases for BTC, opening the door to Bitcoin DeFi, NFTs, and more.

Unlocking BTC liquidity is a key factor, especially considering that Ethereum’s DeFi ecosystem has a significantly higher TVL despite accounting for only 25% of Bitcoin’s market cap.

sBTC aims to unlock over $ 2T worth of BTC liquidity for DeFi and dApps through Stacks, paving the way for a prosperous Bitcoin economy.

sBTC is operated by a large number of signers, including institutional giants such as BitGo, Asymmetry, Ankr, etc., which makes it one of the most decentralized versions of BTC on L2. More importantly, transactions on L2 are protected by 100% of Bitcoins security budget, making BTC transactions on L2 as irreversible as L1.

How does sBTC work?

The user journey begins with a Bitcoin mainnet transaction, where BTC is deposited into a multi-signature protocol monitored by the decentralized group of Stacks signers.

Once BTC is deposited, sBTC is minted on Stacks, enabling users to interact with DeFi dApps.

Due to this design, users can access Bitcoin DeFi without even knowing it is on Stacks. For example, Zest Protocol will support mainnet BTC deposits, which will be automatically converted to sBTC. Since sBTC is likely to become a gas token for charging on Stacks in the future, the user experience will be further improved.

Is there a cap on sBTC?

A 1,000 BTC deposit cap will be implemented during this phase to allow for controlled testing while ongoing security work continues to strengthen the protocol as it scales.

In the early stage, only deposits are supported and withdrawals are temporarily not possible.

Will sBTC have a yield?

Imagine earning Bitcoin yield just by holding BTC. No staking, no points, no complexity — just Bitcoin rewards in your wallet. Early adopters of sBTC will earn 5% APY when they connect their wallet to https://bitcoinismore.org/ (live Dec 17 at 11am ET).

This is now possible through the sBTC rewards program. Early users can receive BTC rewards (distributed in the form of sBTC) simply by holding sBTC.

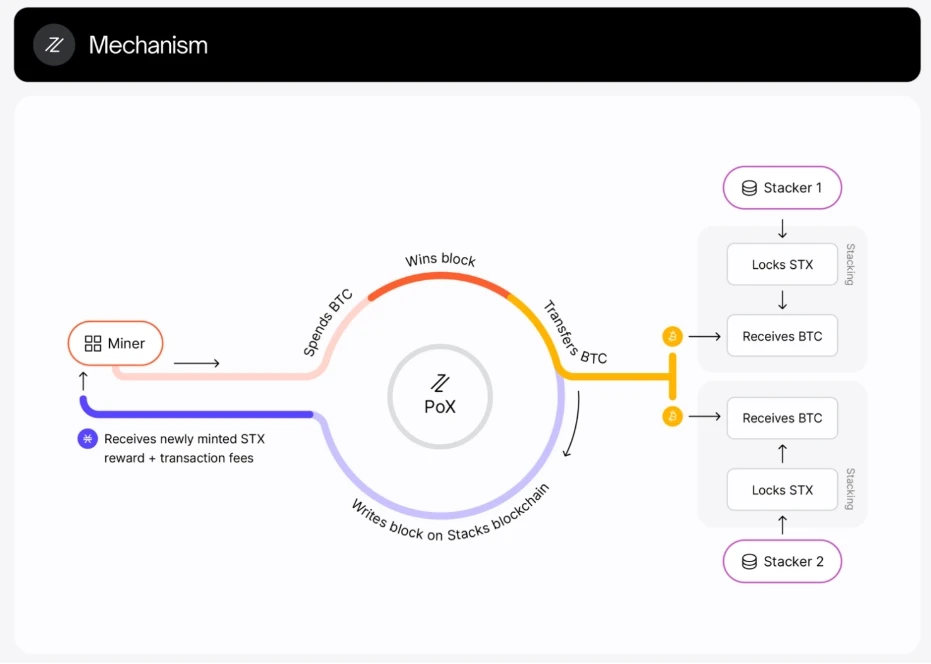

The sBTC rewards program is powered by a group of stackers “Stacking” STX.

When stacking STX, Stackers receive BTC through Stacks consensus mechanism. To enable the sBTC reward program, these stackers contribute the corresponding proof-of-transfer BTC rewards to the sBTC reward pool.

The BTC in the reward pool is deposited directly into a smart contract, which deposits BTC into sBTC and distributes the rewards proportionally to sBTC holders. The protocol takes a snapshot of users’ sBTC holdings every day and distributes rewards every two weeks (the length of the PoX cycle).

The current estimated annual Bitcoin reward is 5%, distributed every two weeks.

What are the main features of sBTC?

DeFi Use Cases: Additional Income

Where can sBTC be used?

Multiple DeFi protocols will support sBTC, allowing users to earn an additional 5% above the target simply by holding sBTC:

1) BitTorrent decentralized exchange:

-

Liquidity Pool: Users can deposit sBTC into Bitflow’s liquidity pool to facilitate transactions and earn a certain percentage of transaction fees.

-

Liquidity Mining: Liquidity providers can stake their LP (liquidity provider) tokens in the liquidity mining program to receive additional rewards, which usually come from trading activities or platform incentives.

-

Early predictions suggest that deploying sBTC will increase annual returns by 10-30%.

-

Bitflow Rune AMM

-

Bitflow introduced Stacks L2 Runes AMM, you can bring Runes to L2 for a better user experience.

2) Zest – Lending 市场地方

-

sBTC will be listed on the Zest Protocol lending market on day one.

-

Zest Protocol will launch a yield-raising campaign on the Zest Protocol lending market from day one, with up to 10% BTC yield on sBTC supply

Zest will also unlock more DeFi strategies involving sBTC, such as:

-

Deposit sBTC to earn up to 10% annualized return on BTC

-

Borrow USDh stablecoin with BTC (or other stablecoins and convert them to USDh)

-

Stake USDh on Hermetica and earn up to 25% APY in stablecoins

https://x.com/HermeticaFi (The annual yield of stablecoin USDh on Stacks is 25%).

Reminder: Hermeticas DeFi protocol offers USDh, the first stablecoin backed by Bitcoin with yield. Yield is generated sustainably through perpetual funding rate payments on centralized exchanges and is paid daily.

stSTXbtc is a new liquidity staking token that users can deploy on Stacks DeFi. By holding this token, users will receive stacking rewards of up to 10% API, paid directly to your wallet in sBTC.

3) Xingmai Decentralized 交换

-

Liquidity Provision: Users can provide sBTC to Velar’s liquidity pool, facilitate transactions and earn a portion of the transaction fees generated by the platform.

-

Liquidity Mining: By participating in the liquidity mining program, users can stake liquidity provider (LP) tokens earned by providing sBTC liquidity to receive additional rewards in the form of Velar native tokens or other incentives.

-

Staking: If Velar introduces an sBTC staking option, users can lock their sBTC in a staking contract to receive rewards, such as additional tokens or percentage returns, to support network operations.

-

Velar will have its own incentive program that allows you to earn Velar’s native token VELAR by deploying sBTC on one of its DEX pools.

4) Arkadiko – USDA Stablecoin

Arkadiko will allow sBTC to be used as collateral within its protocol via a governance vote, enabling users to borrow USDA or other assets against their Bitcoin holdings.

5) Alex Dex

Users can deposit sBTC into a liquidity pool on ALEX and pair it with another asset, such as STX or a stablecoin. By doing so, they facilitate transactions on the platform and earn a portion of the transaction fees generated by the pool.

-

ALEX will receive bonus income in the form of native ALEX tokens through the Surge event. This means that in addition to the 5% APY of the sBTC reward program, you can also earn income by pooling sBTC, as well as additional ALEX token rewards.

6) Granite (not yet launched) – lending protocol

Borrowers can obtain stablecoin loans by pledging Bitcoin, while liquidity providers earn returns by providing stablecoins to the protocol.

-

Lending: Users can deposit sBTC as collateral to borrow stablecoins, and then deploy the stablecoins into various DeFi strategies to earn returns.

-

Participate in liquidation: Users can act as liquidators and repay part of the undercollateralized loans in exchange for collateral and rewards, thereby gaining benefits through the liquidation process

Granite currently has a waitlist that allows those who sign up early to get in. Eventually, a points system will provide additional benefits, with early access registrants receiving a significant advantage.

https://www.granite.world/waitlist

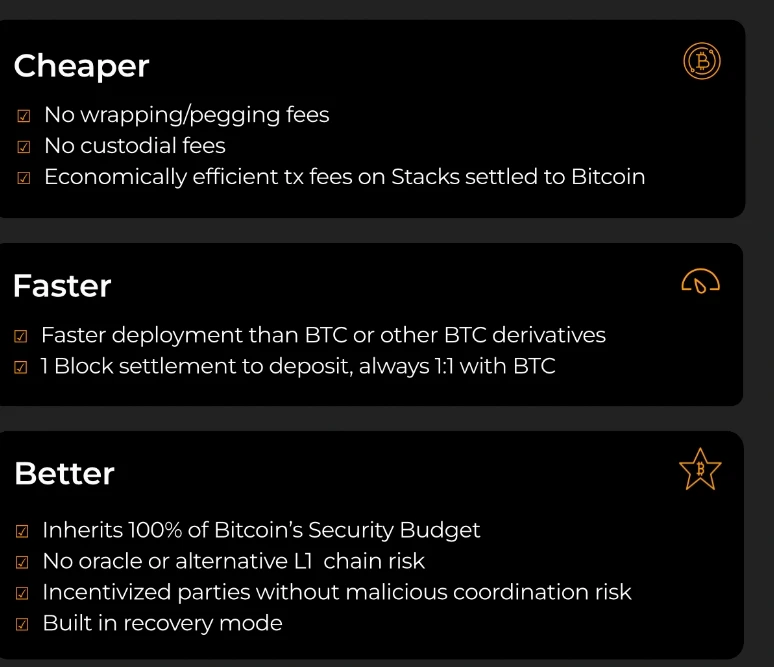

How is sBTC different from other Bitcoin assets such as wBTC, cbBTC, ecc, etc.?

These BTC assets typically require sending BTC to an intermediary or relying on a trusted consortium of signers/small multi-signers.

sBTC will initially rely on a group of 15 signers, including enterprise-level institutions such as BlockDaemon, Figment, Luganodes, and Kiln, to handle hooks and pegs. Over time, this responsibility will be transferred to all Stacks signers, allowing anyone to participate in the security and decentralization of the network. BitGo, Aptos Foundation, and others are also expected to join this work.

Additionally, thanks to the design of Stacks, sBTC will benefit from 100% Bitcoin finality, meaning that transactions on the Stacks layer will be irreversible like Bitcoin.

Reminder: Signers are responsible for verifying and approving each block produced; anyone can become a signer, provided that there are enough STX accumulated to become a single signer – similar to the concept of a validator

额外的

1) sBTC Additional Materials

-sBTC website: https://www.stacks.co/sbtc

-sBTC documentation: https://docs.stacks.co/concepts/sbtc

-sBTC deck: https://www.stacks.co/sbtc-deck

2) Nakamoto upgrade information

-Satoshi Nakamoto website: https://www.nakamoto.run/

– Documentation: https://docs.stacks.co/nakamoto-upgrade/nakamoto-upgrade-start-here

Satoshi’s upgrade is critical because it provides:

-

Fast block generation (shortened from the current 10 minutes to less than 1 minute, optimization is in progress)

-

100% Bitcoin Finality

Fast Blocks: Fast blocks bring a Solana-like experience to transactions and Bitcoin DeFi interactions, greatly improving the overall user experience of interacting with Stacks L2.

The Stacks DeFi ecosystem has grown a lot this year, and applying DeFi strategies now takes seconds, facilitating onboarding and retention.

Prior to the Satoshi hard fork, Stacks blocks were in sync with Bitcoin blocks (on average 10 minutes), making the chain slow and inadequate for DeFi activities. This limitation no longer exists. Instead, Stacks blocks now take just a few seconds, with performance improving regularly. Once a Bitcoin block is settled, it is still possible to take advantage of Bitcoin’s security.

100% Bitcoin Finality: With the Satoshi upgrade, transactions occurring on Stacks L2 will utilize 100% of the Bitcoin security budget, meaning that once consecutive Bitcoin blocks are settled, Stacks transactions become irreversible like Bitcoin.

Bitcoin blocks are no longer tied to a single Bitcoin block, but to a miner’s term, during which they mine several Stacks blocks that are settled within a few seconds.

There are already 50 signatories, including enterprise-level institutions such as BitGo, Aptos, Luganodes, Kiln, etc., responsible for verifying and approving each block produced during the miners tenure.

The fast block times of Bitcoin finality make Stacks the most secure Bitcoin L2 to scale, running alongside a decentralized network of signers, which will allow BTC to move decentralization to L2 in the future through the upcoming sBTC upgrade.

3) Stack Analysis Platform

-Signal 21: https://signal21.io/

-DefiLlama: https://defillama.com/chain/Stacks

– Stack Explorer: https://explorer.hiro.so/

This article is sourced from the internet: KOL Pager on sBTC

Original author: TechFlow After the ETH mainnet鈥檚 meme market was suppressed by Solana for several weeks, a target finally emerged today. Around 8 am on October 30, the AI Meme token $TEE was launched on the ETH mainnet. This time, it started to pull up the market without warning and the smart money alarm sounded. The market value was close to 50 million US dollars within 6 hours of opening, which was even more outrageous than yesterdays $LUSE. Shenchao has sorted out some information about the token to help readers understand the differences between the main technical concepts of $TEE and other AI coins, as well as the reasons for the popularity of $TEE. An AI agent with full autonomy? At about 6:00 a.m. on October 30, a Twitter account…