Or taking charge of the US SEC, will Teresa become the crypto-friendly swordsman?

On November 21, a piece of news was frozen on the official website of the US SEC, and the 加密货币 world cheered.

Gary Gensler may not have thought that encryption would make him successful or unsuccessful. Even though it was normal for him to leave in 26 years, he still decided to leave on the day Biden resigned and Trump took office.

Gary Genslers merits and demerits during his tenure will be judged by future generations. However, in addition to the pressure from congressmen and institutions, the reason for his early resignation cannot be underestimated. The crypto president Trump once threatened to dismiss Gensler after taking office and appoint crypto-friendly blockchain legal expert Teresa Goody Guill茅n as the chairman of the US SEC.

So who is this Teresa Goody Guill茅n? Why did she win Trumps favor? If she takes charge of the US SEC, what different variables might she bring to the crypto industry?

图片来源: SEC official website

The U.S. SEC鈥檚 Crypto Regulation Changes in the Trump Era

Since April 17, 2021, the U.S. SEC under the leadership of Gary Gensler has become synonymous with the big stick in the Crypto industry, running through almost all major crypto enforcement actions in recent years:

Whether it is the large-scale lawsuits filed against crypto exchanges Binance and Coinbase, or the tough stance of classifying most crypto assets as securities, in just three and a half years, the US SEC has completed more than 2,700 enforcement actions and collected more than $21 billion in fines in the crypto industry.

As a former MIT professor who once taught a course on blockchain technology, Gary Genslers iron-fisted regulatory policies have stirred up storm after storm in the crypto market, and have also made the crypto industrys high hopes for him in the early days of his tenure vanish. Evaluations have quickly polarized, making him one of the most controversial figures in the crypto industry.

In the 2024 US presidential election, Trump became the hope of the crypto industry. Trump has repeatedly criticized Gary Genslers crypto regulatory policies, and even said in a public speech that if he is successfully elected president, he will remove Gary Gensler from his position on the first day of his inauguration.

In Trumps reform plan, finding an SEC chairman who understands both traditional finance and the crypto industry is a top priority. For this reason, Teresa Goody Guill茅n has gradually become a potential hot candidate for the new SEC chairman due to her unique cross-border resume and industry support: this senior securities law expert not only has extensive experience in traditional finance, but also maintains close cooperative relations with blockchain companies and has an in-depth understanding of the operating logic of the crypto industry.

Potential successor to the US SEC, who is Teresa?

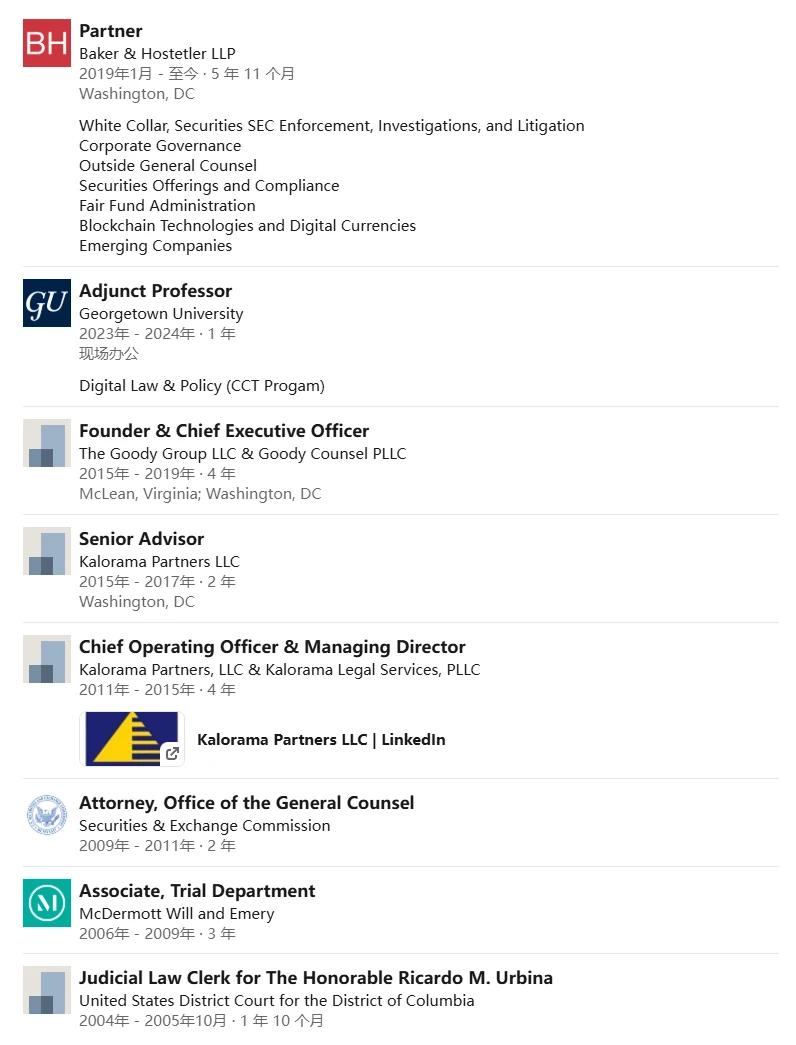

According to public information, Teresa Goody Guill茅n is currently a partner and co-head of the blockchain team at BakerHostetler law firm. She joined in January 2019 and led the team to handle legal affairs involving blockchain technology and digital assets. She has accumulated rich practical experience in blockchain technology, digital assets (including NFT), DAO, DeFi and other fields.

图片来源: BakerHostetler official website

In addition, Teresa Goody Guill茅n has served as a litigation attorney in the Office of General Counsel of the U.S. SEC and held senior positions at Kalorama Partners, which focuses on corporate compliance, risk management and legal strategy consulting, The Goody Group LLC, which provides legal and consulting services, and Goody Counsel PLLC.

-

From 2009 to 2011, he worked as a litigation attorney in the Office of General Counsel at the U.S. Securities and 交换 Commission (SEC), handling complex securities litigation and enforcement-related matters;

-

From 2011 to 2015, he joined Kalorama Partners, founded by former SEC Chairman Harvey Pitt, as Chief Operating Officer and Managing Director, and worked with Harvey Pitt to provide clients with consulting services on SEC enforcement cases.

-

From 2015 to 2019, he participated in the establishment of The Goody Group LLC Goody Counsel PLLC and served as CEO;

This also demonstrates Teresas unique cross-professional background: her experience at the SEC has given her a solid foundation in traditional securities law. At the same time, her in-depth involvement in the blockchain field has made her a rare professional at the intersection of law and technology. Her teaching experience in the academic field has further enhanced her authority in the intersection of law and technology.

It is worth noting that BakerHostetler has taken over several important blockchain-related cases in recent years and provided legal consulting services to a number of Web3 projects. The team led by Teresa is particularly good at helping start-ups cope with complex regulatory challenges, such as developing compliance strategies, responding to regulatory investigations, and defending clients in litigation.

It is worth noting that BakerHostetler has taken over several important blockchain-related cases in recent years and provided legal consulting services to a number of Web3 projects. The team led by Teresa is particularly good at helping start-ups cope with complex regulatory challenges, such as developing compliance strategies, responding to regulatory investigations, and defending clients in litigation.

It is understood that the team led by Teresa has cooperated with well-known blockchain projects such as the decentralized AI Data Chain Masa to help promote the application of Web3 innovative technologies within the legal framework.

Teresas public attitude towards the crypto industry has always been seen as a synonym for friendliness. She has pointed out on many occasions that the United States should adopt a more open attitude in formulating crypto regulations and provide a supportive framework for technological innovation rather than adopting a tough strategy of litigation instead of law. This view has also won her widespread support from the Web3 community.

Will the US SEC enter the era of embracing encryption at full speed?

Judging from the current signs, Teresa has become a popular candidate for the chairman of the US SEC. Not only does her personal resume best meet the comprehensive requirements of the chairman of the US SEC in the Trump era, but it also reflects the markets strong expectations for a policy turnaround in crypto regulation:

In the industrys view, she is an ideal candidate who has a deep understanding of traditional financial rules and can provide support for Web3 innovation. If she eventually succeeds Gary Gensler, she may lead the US SEC on a completely different path and inject new vitality into the US crypto industry.

You should know that one of the biggest obstacles facing the U.S. crypto industry is regulatory uncertainty. The 21st Century Financial Innovation and Technology Act (FIT21 Act) was passed by the House of Representatives on May 22 with an overwhelming majority of 279 votes to 136. The key point is to divide regulatory powers and clearly 定义ne that there are two institutions that regulate crypto assets: one is the U.S. Commodity Futures Trading Commission (CFTC) and the other is the U.S. SEC.

Teresa has publicly stated many times that she hopes to establish a new digital asset classification system so that crypto assets are no longer completely subject to the traditional Howey test, and believes that the Howey test should not determine the future of the industry or technology. Once this idea is implemented, it will undoubtedly provide the industry with a set of executable and clear rules, greatly reduce uncertainty, attract more institutional capital to the Crypto field, and promote the institutionalization of crypto assets.

Masa co-founder Brendan Playford commented: Teresa is the change agent that the US SEC urgently needs. She focuses on light-touch regulation and believes that the Howey test should not determine the future of the industry or technology. She will end the status quo of replacing regulation with law enforcement and unite all key players from Wall Street and the crypto industry to jointly develop a clear market structure so that the crypto industry can flourish in the United States. As a lawyer in Washington, DC who challenges current SEC policies and defends the rights of crypto innovators, her qualifications far exceed what is needed – Make the SEC Goody again!

概括

Once Teresa Goody Guill茅n is appointed, it will undoubtedly mark an unprecedented policy shift for the SEC, which is expected to allow the SEC to escape from its current dilemma of replacing law with litigation and reshape the competitiveness of the U.S. crypto industry through light-touch supervision and clear market rules.

In particular, as a legal expert who is well versed in traditional financial rules and blockchain technology, her good cooperation experience with blockchain projects such as Masa also means that the crypto industry will be able to establish a more direct and pragmatic communication channel with the US SEC through her in the future. As a bridge between technology and regulation, Teresa can more keenly capture industry needs and design a regulatory framework for the crypto market that takes into account both innovation and standardization.

However, there are also challenges under the expectations – can Teresa balance the interests of traditional financial institutions and the emerging crypto industry? How to protect the interests of investors and maintain market stability in the transformation?

The answers to these questions may be revealed after she takes office.

This article is sourced from the internet: Or taking charge of the US SEC, will Teresa become the crypto-friendly swordsman?

In early November, Matrixport announced the worlds first structured product Installment Purchase, which attracted more than 5 million US dollars in one week after its launch and was well received by the market and investors. According to official information, through the Installment Purchase product, investors can use small amounts of funds to purchase and lock in all future returns of the investment target (BTC or ETH). Investors can enjoy the leverage effect without adding margin . They only need to decide whether to pay the balance in exchange for the investment target based on the actual price of the target after maturity. In this regard, we can derive the following keywords for installment purchase: enjoy the leverage effect, no need to add margin, determine whether to exercise after the product…