Key indicators: (November 4, 4pm -> November 11, 4pm Hong Kong time)

-

BTC/USD price increased by +18.4% ($68,000->$81,200), ETH/USD price increased by +27.6% ($2,460->$3,140)

-

BTC/USD ATM volatility at the end of the year (December) fell by -6.2 points (58.0->51.8), December 25 d skewness increased by +0.1 points (3.1->3.2)

-

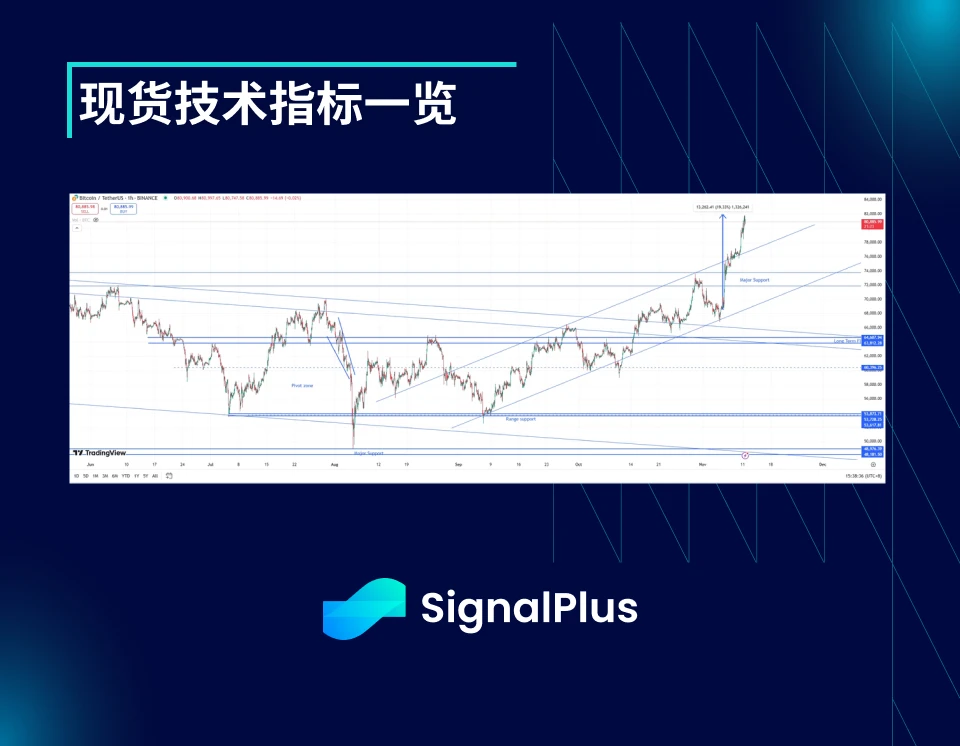

After the confirmation of Trumps succession as the next president, the price broke through the resistance level of $74k. Between 4pm (Hong Kong time) on Tuesday, November 5 and 4pm on November 8, the price rose by 11% to our bullish target range for the election ($76k-$78k). Since then, the upward momentum has continued to increase. We continue to be bullish on BTC after the election and set a long-term price target of more than $100k. In the short term, we may see some price fluctuations or recessions, but the core technicals still support bullishness.

-

We believe that the current major support level of $74k-$72k will continue to hold, considering the possibility of aggressive profit-taking and a correction in the market in the short term.

市场 Theme

-

The margin of victory between the two presidential candidates narrowed before the election, causing a short-term spot market liquidation and a drop to $67k. Despite this, Trump ultimately retained his position as the next president, and the Republicans successfully won a majority in the House and Senate. This finally proved to be the fresh catalyst that the 加密货币currency market had been waiting for. After rising to the $75k-76k range in the early days after the election, the price of the coin continued to rise, breaking through the key psychological point of $80k over the weekend. At the same time, with ETH returning to above $3k, the prices of other small coins also rose sharply.

-

The Federal Reserve announced a dovish rate cut on Thursday night after the election, and the loose macro backdrop still supports the good performance of risk assets before the end of the year. Chinas stimulus policy released on Friday failed to attract market attention, as the market generally believes that there is no strong reason to reduce risk assets in the short term. This will also continue to boost the price of cryptocurrencies.

-

While USD strengthened against other fiat currencies in response to Trump鈥檚 election (partly driven by rising USD yields), the price of the currency has not responded to the new narrative supporting cryptocurrency regulation and potential strategic reserves. This situation is likely to remain dominant in the coming months until further confirmation is obtained to support more capital inflows.

ATM 隐含波动率

BTC ATM Implied Volatility (November 4 – November 11, 4pm Hong Kong Time)

-

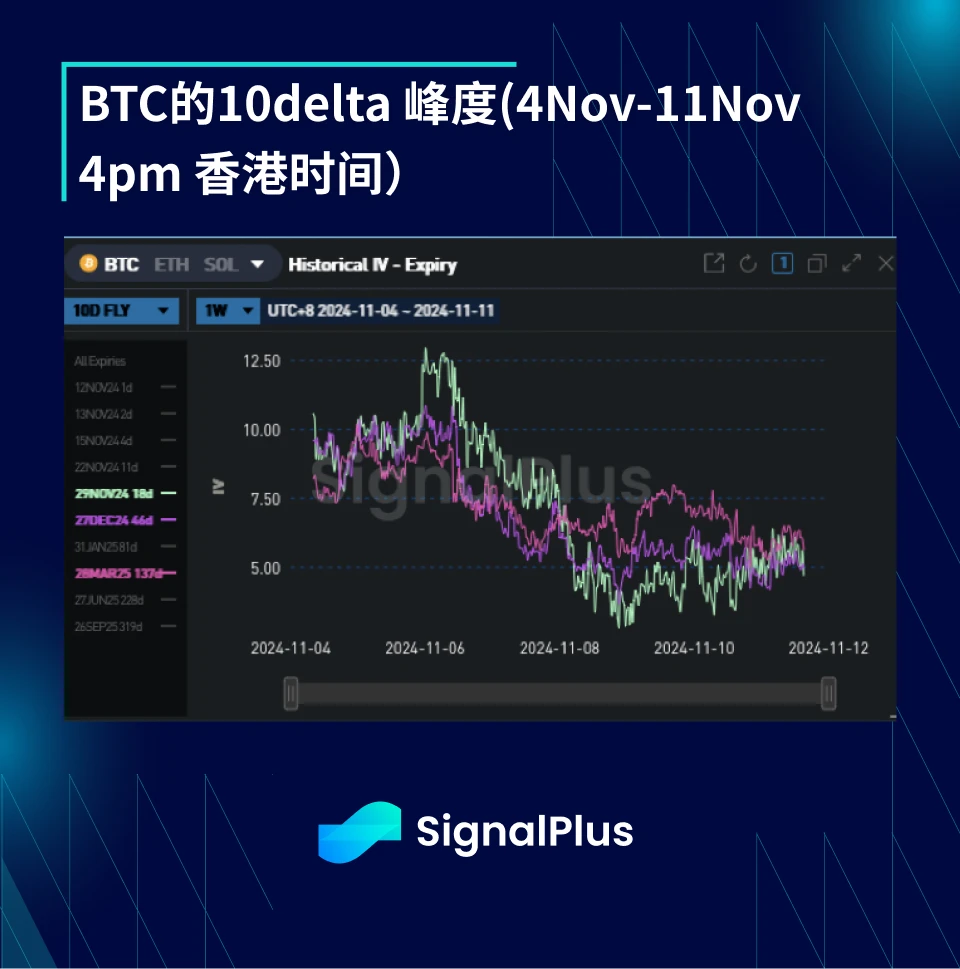

The volatility of the election event ended up being priced in at a low level. The market gradually lowered the time price movement to 5.5% in the two days before the event, but the actual daily movement on the day of the election was close to 8.5%. The result on election day also caught the entire market off guard. Because many people expected the election to be more intense and raised the premium from the mid-term to the forward in November, hoping to see the election results delayed. In the end, these premiums were aggressively cleared after the election.

-

Implied volatility levels have been trending downward since the election, as the market has seen both calls (using traditional call spreads) and selling pressure on higher-priced volatility. At the same time, there has been little interest in directional trading through options as prices move higher, with the exception of some rolling of strikes seen.

-

There is a structural argument that volatility could weaken as a new regime takes office. If Trump succeeds in pushing US institutions to regulate cryptocurrencies, this will unleash a new wave of capital inflows. This inflow of capital will provide a fulcrum for the price of the currency and weaken volatility. In addition, in addition to the election events, the actual volatility of the currency price has also been reduced to the early 40s in the past few months, which further confirms this view. However, we need to point out that there is still a long way to go before Trump can actually pass congressional approval for cryptocurrencies.

Skewness/Kurtosis

-

Despite the bullish sentiment, the skewness has remained largely unchanged this week. It is still a classic upward structure (mainly caused by selling pressure and call option spreads), which has formed a bullish volatility structure for higher prices in the market, and this structure has not yet been offset by new demand. Therefore, when prices rise,

-

The correlation between the coin price and implied volatility is not well represented, which has an impact on the skewness and eliminates the impact of bullish sentiment and supply on the downside.

-

The kurtosis is gradually decreasing, but we think it is oversold at present. Because although the spot will stabilize in a new local range, it may still explode to more than 100k USD or fall below 60k-65k USD in some risk-off events.

祝大家在接下来的一周里好运!

您可以使用 SignalPlus 交易风向标功能 t.signalplus.com 获取更多实时加密资讯,如想第一时间收到我们的更新,请关注我们的推特账号@SignalPlusCN,或加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群、Discord社群,与更多朋友交流互动。

SignalPlus 官方网站: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility – Weekly Review (November 4 – November 11)

相关:一周融资快报 | 19个项目获投资,披露融资总额约100亿美元

据Odaily星球日报不完全统计,9月16日至9月22日期间,国内外共宣布发生19起区块链融资事件,较上周数据(18起)有所增加,披露的融资总额约为$1.8亿美元,较上周数据($1.28亿美元)有所增加。上周,获得投资最多的项目为模块化公链Celestia($1亿美元);紧随其后的是Rollup互操作协议Initia($14亿美元)。以下为具体融资事件(注:1.按公布金额排序;2.不包括募资及MA事件;3.*表示业务涉及区块链的传统公司): Celestia基金会宣布完成$1亿美元融资,由贝恩资本领投 Crypto 9月24日,Celestia基金会,区块链背后的团队…