Original author: 太太和浩

Original translation: TechFlow

L1 premium、货币性、xREV/TEV……这些概念真的存在吗?

特别感谢 @smyyguy 和 @purplepil l3 m 审阅并提供有关此帖子的反馈。

如果你不熟悉 REV,你可以阅读 本文 by @乔恩·查布 .

以下倍数基于 2024 年 10 月 30 日中午 12:00(东部时间)的估值数据。

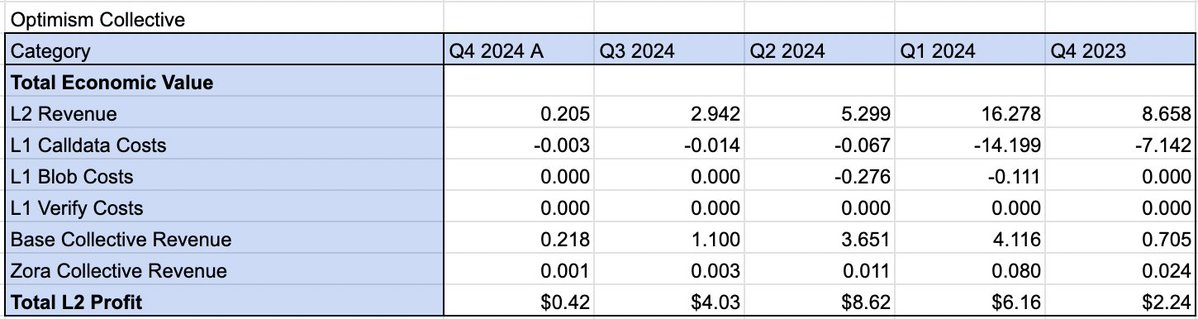

L2 的利润是其收入(包括基础费用和优先费用)减去链上运营成本(例如 L1 数据调用、blob 和验证成本)。Arbitrum、Optimism、Zksync 和 Scroll 拥有过去 12 个月的数据,而 Blast 仅拥有四分之三的数据(与其他项目相比,这使得其倍数被夸大了)。ETH 和 Solana 也有过去 12 个月的数据。

几点说明:

-

REV 和 L2 收入是可比较的指标。L2 收入是扣除运营商成本(测序仪成本)之前的收入,与 REV 类似。

-

L2 的 DAO 在 Token 生成事件 (TGE)。L2 的完全稀释估值 (FDV) 的一部分可归因于 L1 代币中不存在的治理价值。因此,我们在心理上向上调整了 L2 的倍数,但在讨论我们的观察结果时不会进行这种调整。

一些直接的观察:

-

从完全稀释估值(FDV)来看,没有明显的L1溢价,但大多数L2尚未完全流通。不过,在市值比较中,确实存在L1溢价。(Arbitrum和OP的FDV/L2收益约为100-250,而以太坊和Solana的FDV/REV约为118-140)。

-

Optimism 的交易倍数明显高于其他同类项目。投资者似乎对其整体扩张持乐观态度。

-

通过集体利润分享(即 15% 的分类器收入和 2% 的利润),DAO 在第四季度迄今为止的净收入超过了 OP 的 L2 收入。从累积到金库的总价值来看,集体策略是成功的。考虑到仅 Base 就为集体金库贡献了约 $9 百万,未来大规模的收入分享赠款是一个不错的选择。

-

限制区块空间与增加收入无关。Arbitrum 在清算高峰期的中位费用约为 $10,但其 L2 利润低于 Base。

-

代币购买者没有将 Scroll 的增长考虑在内(市值是 L2 收入的 3 倍)。

-

ZKP 的 L1 验证成本暂时降低了 Zk Rollup 的盈利能力。目前,我们尚未看到状态分歧带来的成本节省转嫁给用户。

这让我想到了几个问题:

-

货币溢价真的存在吗?或者,当链上活动相同时,L2 是否会具有相同的估值?

-

与 Solana 相比,ETH 真的具有主权溢价(SOV)吗?(以太坊的 REV 主要集中在 2024 年第一季度和第二季度,如果仅比较最近几个季度,这种溢价是否明显?)

本文来源:公链估值新思考:L1溢价存疑、ETH主权受质疑

相关:Shuffle.com 推出 SHFL 抽奖功能,为代币持有者提供赚钱的新机会

Shuffle.com 是增长最快的加密和体育彩票平台,最近宣布了一项由其原生代币 SHFL 提供支持的新功能 - SHFL 彩票。SHFL 彩票功能为代币持有者提供了一种参与平台的新方式,并提供每周中奖的机会。SHFL 抽奖功能如何运作?SHFL 抽奖计划允许 SHFL 持有者在 Shuffle.com 上质押他们的代币以参与其抽奖活动。如何参与:质押 SHFL 代币:用户每质押 50 个 SHFL 代币即可获得一张奖券;选择或自动生成号码:彩票号码可以由用户随机生成或选择,确认后将从用户余额中扣除相应的 SHFL 代币;取消抽奖:每次抽奖前……