原创 | Odaily星球日报( @OdailyChina )

作者:Wenser( @wenser 2010 )

在 加密货币 world, there is no myth of eternal profit, but there is a legend of making money.

In October, which just ended, according to 沙丘数据 , pump.funs cumulative revenue exceeded 160 million US dollars, the total number of addresses exceeded 2.4 million, and the total number of deployed tokens exceeded 2.8 million; currently, its cumulative revenue has reached 167.3 million US dollars . In other words, in just about 4 days, pump.fun, as the strongest money-making machine in this cycle, has increased its revenue by about 7.3 million US dollars again, which is terrifying.

Combining the revenue data of various agreements in the past year, Odaily Planet Daily will classify and inventory the top 10 most profitable agreements in this article. In the process of looking through the changes in the industry cycle, it will reveal the trend of the wind direction for readers reference.

A comprehensive review of money-making machines: 42 major projects have generated revenues of over 30 million US dollars in the past year, mainly in three categories

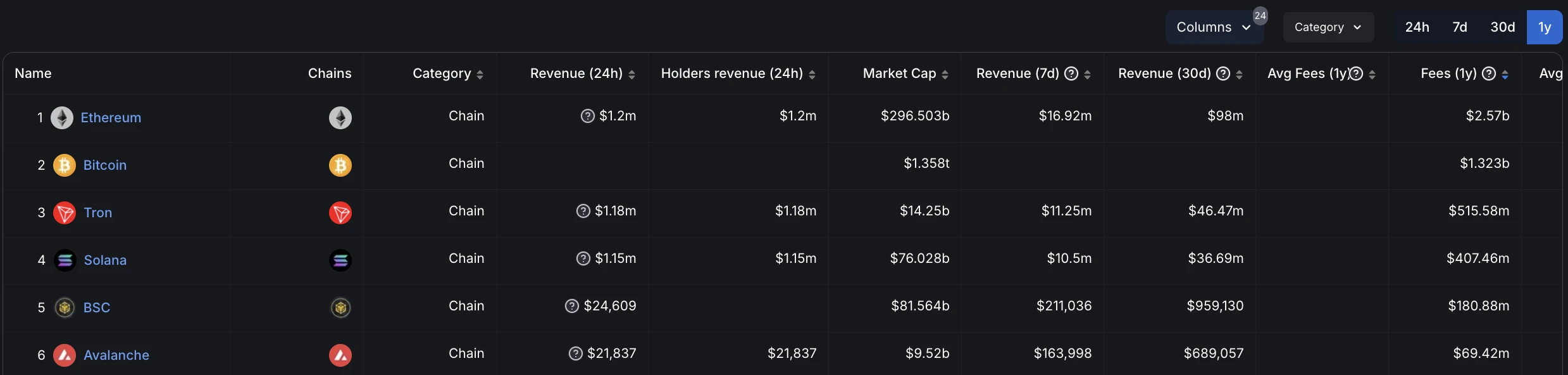

根据 数据来自 DefiLlama 网站 , if the time is narrowed down to less than 1 year, the current 42 major project agreements have revenues exceeding 30 million US dollars, which can be mainly divided into the following categories:

Blockchain Ecosystem: L1 Network is Still the “Mainstream Money-Making Giant”

Looking closely at the list of “players with protocol revenue exceeding 30 million USD”, we can clearly see that in the past ten years of blockchain ecosystem development, L1 public chain network is still the most mainstream “money-making behemoth”, among which:

-

Ethereum took the top spot with revenue of $2.57 billion in the past year;

-

Bitcoin ranked second with revenue of $1.323 billion in the past year;

-

TRON, positioned as a “stablecoin network”, earned $515 million in revenue;

-

Solana has benefited from the meme coin craze that has been in full swing this year, earning $407 million;

-

BSC (i.e. BNB Chain) benefits from the Binance exchange with revenue of up to $180 million;

-

Avalanche experienced a wave of explosive growth at the end of 2023, with monthly contract revenue increasing from US$2.5 million to US$52.25 million.

Overall, although the L1 ecosystem has a very bumpy road to development, it is still the main pillar supporting the crypto world, and Ethereums protocol revenue of $19.367 billion (as of November 3, 2024) is indeed daunting. This also shows from the side that as the largest ecosystem in the crypto world, Ethereum is indeed far from the desperate situation of running out of ammunition and food as many people say.

Some representative ecosystems

Infrastructure projects: Stablecoins and DEX become money-making experts

Another category of projects that rank at the top of the “money-making rankings” are many infrastructure projects including stablecoins, staking protocols, and DEX, among which:

-

Tether, the issuer behind USDT, and Circle, the issuer behind USDC, ranked first with $16.17 billion and $516 million in agreement revenue in the past year respectively;

-

Uniswap, Raydium, PancakeSwap and other DEXs are in the second tier of such projects, with protocol revenues ranging from US$350 million to US$820 million within a year;

In addition, Ethereum ecosystem staking and re-staking protocols such as Lido and Ethena also ranked among them with annual agreement revenues of US$986 million and US$136 million, becoming part of the new infrastructure and gaining high recognition from the market.

Some representative projects

Application projects: Wallets and Meme coin platforms are money-making machines

As for specific application projects, the previous industry hot spots – wallet applications and the theme track of this cycle Meme coin platform have become the money-making machines with the largest proportion. Among them –

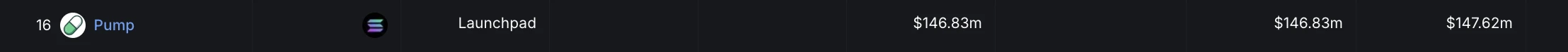

pump.fun (Pump as platform note) ranked 16th with $146 million in contract revenue in the past year;

pump.fun ranked 16th

MetaMask (commonly known as the Little Fox Wallet) ranked 28th with $70.49 million in contract revenue in the past year.

MetaMask ranked 28th

Expansion projects: L2 and service platforms are new money-making platforms

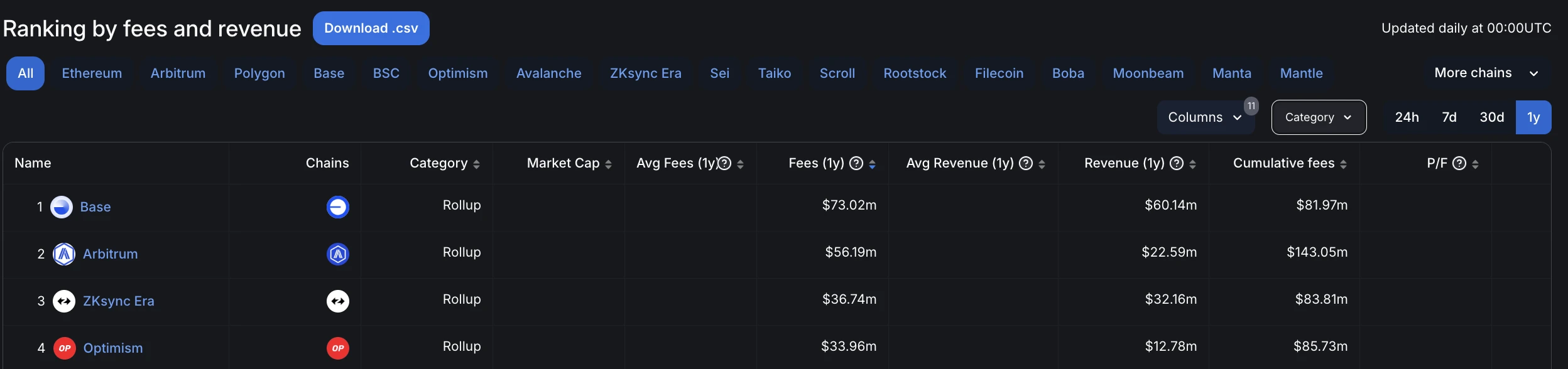

In addition to the above main categories, there are also many expansion projects that have ranked at the top of the protocol revenue in the past year, such as Ethereum L2 networks including Base, Arbitrum, ZKsync Era, and Optimism. Among them,

-

Base ranks 26th with $73.02 million in nearly one-year agreements;

-

Arbitrum ranked 32nd with $56.19 million in contract revenue in the past year;

-

ZKsync Era ranked 38th with $36.74 million in contract revenue in the past year;

-

Optimism ranked 41st with $33.96 million in contract revenue for the past year.

Some representative ecosystems

Service platforms are more diverse, including the former NFT market king OpenSea, as well as aggregated trading platforms such as DEX Screener, and a number of Telegram ecosystem trading bots such as Photon, BONKbot, Trojan, Banana Gun, and Maestro. Of course, as we can see from the figure below, the Solana ecosystem is still the main focus of these projects.

A review of the top 10 most profitable protocols, a look at the most profitable tracks in crypto

Based on the above information and the data from the DefiLlama website , we can filter out the following representative money-making projects based on the total revenue of the protocol:

-

Ethereum, with total protocol revenue reaching $19.369 billion;

-

Uniswap, with total protocol revenue reaching $5.697 billion;

-

BTC, with total protocol revenue reaching $4.144 billion;

-

BSC (BNB Chain), with total protocol revenue reaching $2.857 billion;

-

OpenSea, with total protocol revenue of $2.783 billion;

-

Lido, with total agreement revenue of $1.939 billion;

-

Tether, with total protocol revenue of $1.684 billion;

-

PancakeSwap, with total protocol revenue of $1.614 billion;

-

TRON, with total protocol revenue reaching $1.17 billion;

-

AAVE, with total agreement revenues of $961 million.

Summary: Compared with the version answer, the long-term solution is the best

To be fair, in my opinion, the coming and going of money-sucking agreements also reflects the changes in the crypto industry from the side:

-

Before 2020, the most profitable protocols were undoubtedly the public chains that started with various IC0s. Ethereum also stood out since then, laying the foundation for todays market value of $300 billion.

-

In the period of 2020-2022, the Ethereum ecosystem has become the center of the cryptocurrency industry. Driven by waves of industry trends such as DeFi Summer, GameFi Summer, and NFT Summer, platforms and projects in corresponding tracks such as Uniswap, Axie Infinity, STEPN, and OpenSea have emerged one after another, taking up the banner of attracting money in the industry;

-

In the 2023-2024 stage, that is, this cycle, the SocialFi golden product represented by friend.tech first appeared, and then the Memefit MVP represented by pump.fun emerged. The gold-sucking black hole in the crypto industry has become an asset issuance platform that controls both liquidity and attention.

But if we look closely at the ranking of agreement revenue in the past year or even in a longer period of time, the version answer is at best a new player in the money-making track. As for whether they can survive the early and middle stages of the product life cycle and still ensure that they do not leave the table and stay on the field in the later stages, it is still an unknown at present.

Compared with the countless one-wave protocols and applications, perhaps a long-lasting ecosystem is still the best money-making tool.

This article is sourced from the internet: Taking stock of the top 10 money-making agreements and gaining insights into the 3 major industry cycle trends

Related: Uncovering Binance’s Compliance Spending: Where Did the $200 Million Go?

Original author: Jasmine Original translation: Wen Dao The total amount of illegal activity on the chain has dropped by nearly 20%, this is the conclusion given by the well-known blockchain data company Chainalysis in August this year. The company believes that this shows that legal activities are growing faster than illegal activities. The rapid growth of legal activities is closely related to the increasingly strict global regulatory approach to crypto-asset crimes, which has forced companies engaged in crypto-asset businesses to continuously raise the compliance red line and actively separate themselves from crimes such as fraud, money laundering, and extortion. Especially after Binance, the worlds largest cryptocurrency trading platform, reached a settlement with the U.S. Department of Justice with a high fine in 2023, various cryptocurrency companies have almost reached a…