原文作者:1912212.eth,远见新闻

The markets big correction in early October made some investors doubtful, worrying that October, which has historically maintained an upward trend, might be different this time. As a result, history always seems to prove that this time is the same.

After BTC jumped to the peak of $66,000 at the end of September, it did not stop there, but experienced a thrilling retracement, reaching the valley of $59,000. But it was the ups and downs that gave birth to a more violent rebound storm! Since October 11, the market situation has changed suddenly, with a sharp increase of 3.67% in a single day, announcing the return of the rising market. The price returned to the high ground of $63,000 like a broken bamboo, and then it rushed to $66,500.

At the same time, Ethereum also broke free from its shackles, rushing from $2,300 to $2,650, with a single-day increase of more than 6.52%, marking the largest single-day increase since August.

In the market ignited by passion and hope, the public chain sector SUI, SEI, APT, the stable currency sector ENA, the AI sector ARKM, WLD, memes and other sector targets have seen a sharp rise.

In terms of contract data, short positions suffered heavy losses. In 24 hours, the entire network was liquidated at $246 million, and short positions were liquidated at $210 million. BTC open interest data also soared to above $37 billion.

The market is full of altcoins, has the second half of the bull market really begun?

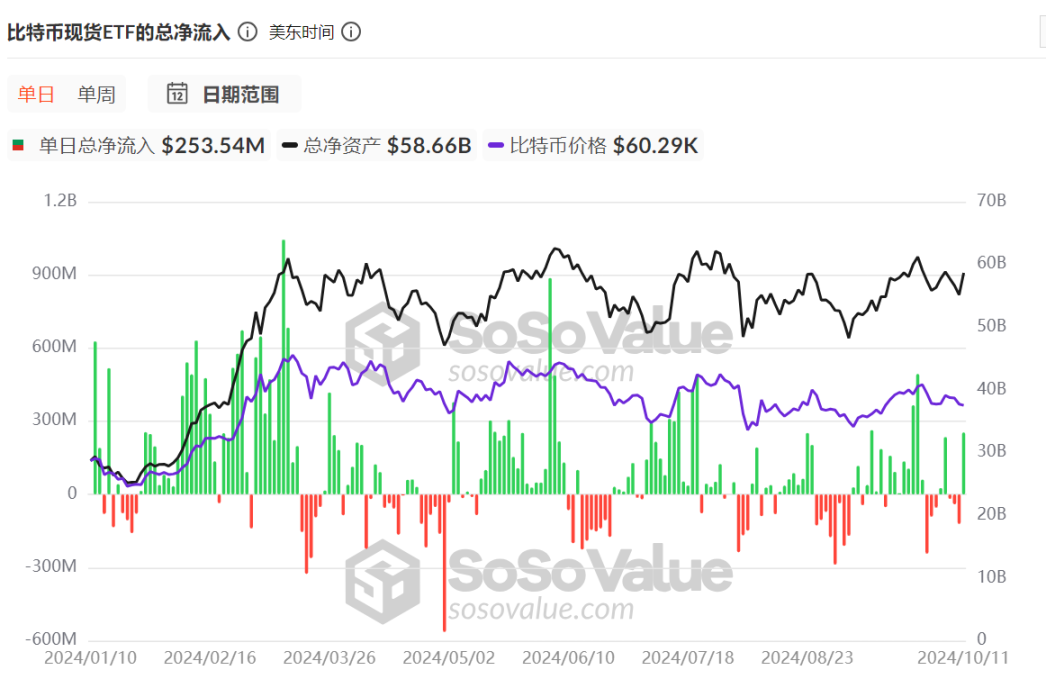

BTC spot ETF saw a large net inflow in a single day

Since the beginning of October, although there has been some net outflow of funds, it has roughly balanced the net inflow. Starting from October 8, there has been a three-day continuous net outflow, with a total net outflow of nearly 180 million.

On October 11, the data showed a big reversal, with the Bitcoin spot ETF’s net inflow reaching $253.54 million in a single day, setting a new record for single-day net inflow since October. After the large inflow of OTC funds, the BTC price also rose sharply on the same day.

The confidence of off-market funds remains relatively firm.

The Fed will continue to cut interest rates, and market expectations are stable

This week, the United States released two major inflation data for September, CPI and PPI. The year-on-year and month-on-month increases of the overall CPI and core CPI exceeded expectations, but the year-on-year increase of CPI of 2.4% was still the lowest since February 2021. PPI was flat month-on-month, indicating that inflation has further cooled.

Goldman Sachs economists pointed out that although the CPI and PPI inflation data in September were mixed, the final readings were still close to expectations, indicating that US inflation is moving towards the Feds 2% target and the Fed is approaching its inflation target.

After two major inflation data releases this week, traders are betting almost certainly that the Federal Reserve will cut interest rates by a quarter percentage point at its November and December meetings.

US presidential election

Historically, the crypto market tends to rise around the time of the U.S. presidential election results. The results of the U.S. presidential election will be announced on November 5, and there are only 20 days left.

In addition, Bloomberg reported that even US presidential candidate Harris, who has not had much close connection with the crypto market, is working hard for votes.

Harris proposed a new plan on Monday to provide loans to black entrepreneurs and others who face barriers to financing. According to Harris campaign outline for black male voters, the plan will provide 1 million loans with up to $20,000 forgiven. Harris also pledged to support a cryptocurrency regulatory framework to provide more investment certainty for the 20% of black Americans who own or have owned digital assets.

The Trump familys DeFi lending project World Liberty Financial has also been making moves in recent days. In addition to introducing a number of experienced executives, it will also publicly sell WLFI tokens.

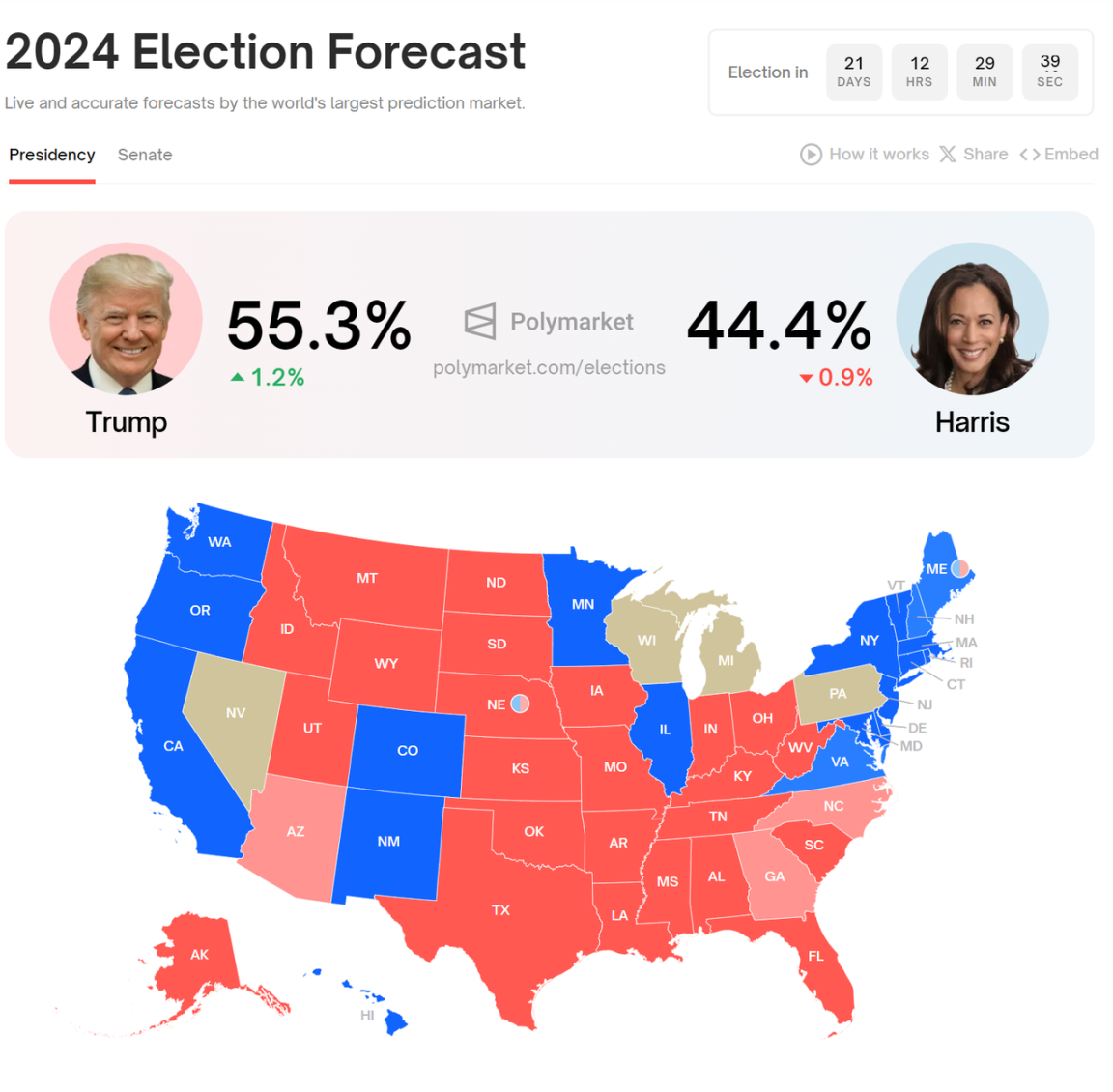

Data from Polymarket shows that as of now, Trumps chances of winning are significantly ahead of Harris.

Currently, the market is more inclined to believe that Trumps election as president will be good for the crypto market. However, given that all US presidential candidates have released crypto-friendly remarks and opinions, no matter who comes to power, the negative impact will be minimal.

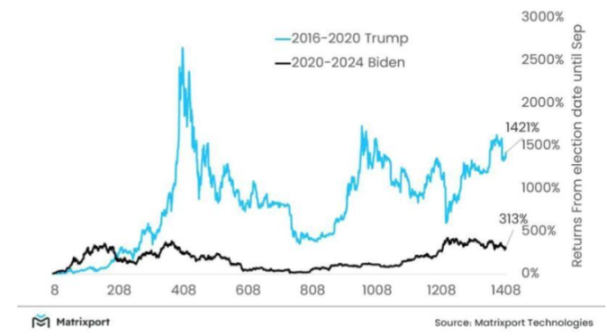

The bull market from 2016 to mid-2020 was under the administration of Republican Trump, and from 2020 to 2024, Democratic Biden was in power. The BTC-dominated crypto market has experienced strong bull markets during their respective administrations.

Judging from the market’s historical performance in the past two cycles, whether the Republican or Democratic presidential candidate came to power, it did not affect the upward trend of the crypto market.

After the election results are officially released, some funds that choose to wait and see may change their hesitant style and choose to boldly bet on the crypto market.

Future market trends

Coinbase analyst: Macro factors affecting cryptocurrency performance are shifting from monetary policy to US election results

Coinbase analysts David Duong and David Han said that despite Bitcoins sluggish price action this week, market sentiment has remained largely unchanged, as evidenced by the stability of perpetual contract funding rates and the number of open contracts over the past week. Coinbase analysts pointed out that the macro factors affecting the performance of cryptocurrencies are shifting from monetary policy to the results of the US election. Despite the recent rise in CPI and core PPI, market expectations for rate cuts remain roughly stable.

He also mentioned that China’s fiscal policy briefing this Saturday could indirectly affect the cryptocurrency market, especially during a time when many markets will be closed. The cryptocurrency market could be used to express a proxy view on the size and strength of any fiscal policy announcement.

Bitfinex: BTC short-term holders’ actual price becomes key resistance

The latest Bitfinex Alpha analysis highlights that the actual price for short-term holders (around $63,000) has become a key resistance level. A break above this level could spark further gains, while a failure could lead to a retest of the $59,000 or even $55,000 support levels.

Bitfinex Alpha believes that the market is still in a passive state, and the future trend will depend on whether Bitcoin can break through the actual price of short-term holders. It is recommended that traders be alert to potential pullbacks and be prepared for a possible strong rebound.

This article is sourced from the internet: ETH’s daily increase exceeded 6.52%, and altcoins were “dancing wildly”. Has the second half of the bull market begun?

Original author: 0xLouisT ( L1D Partner) Compiled by Odaily Planet Daily ( @OdailyChine ) Translator 锝淎zuma ( @azuma_eth ) Editors note: The meme token Three Arrowz Capitel ( 3AC), which is based on the concept of the bankrupt fund Three Arrows Capital and has been openly endorsed by two former partners, Su Zhu and Kyle Davies, has unexpectedly become popular in recent days. Dex Screener shows that the token was once quoted at a maximum of US$0.192, corresponding to a market value of up to US$170 million. However, Bubblemaps data shows that 80% of the token鈥檚 supply is controlled by the same cluster. In addition, according to the latest article by L1D partner 0xLouisT , there seems to be more stories behind the launch of the token worth digging into.…