原文来自 Pink Brains

编译自Odaily星球日报Golem( @web3_golem )

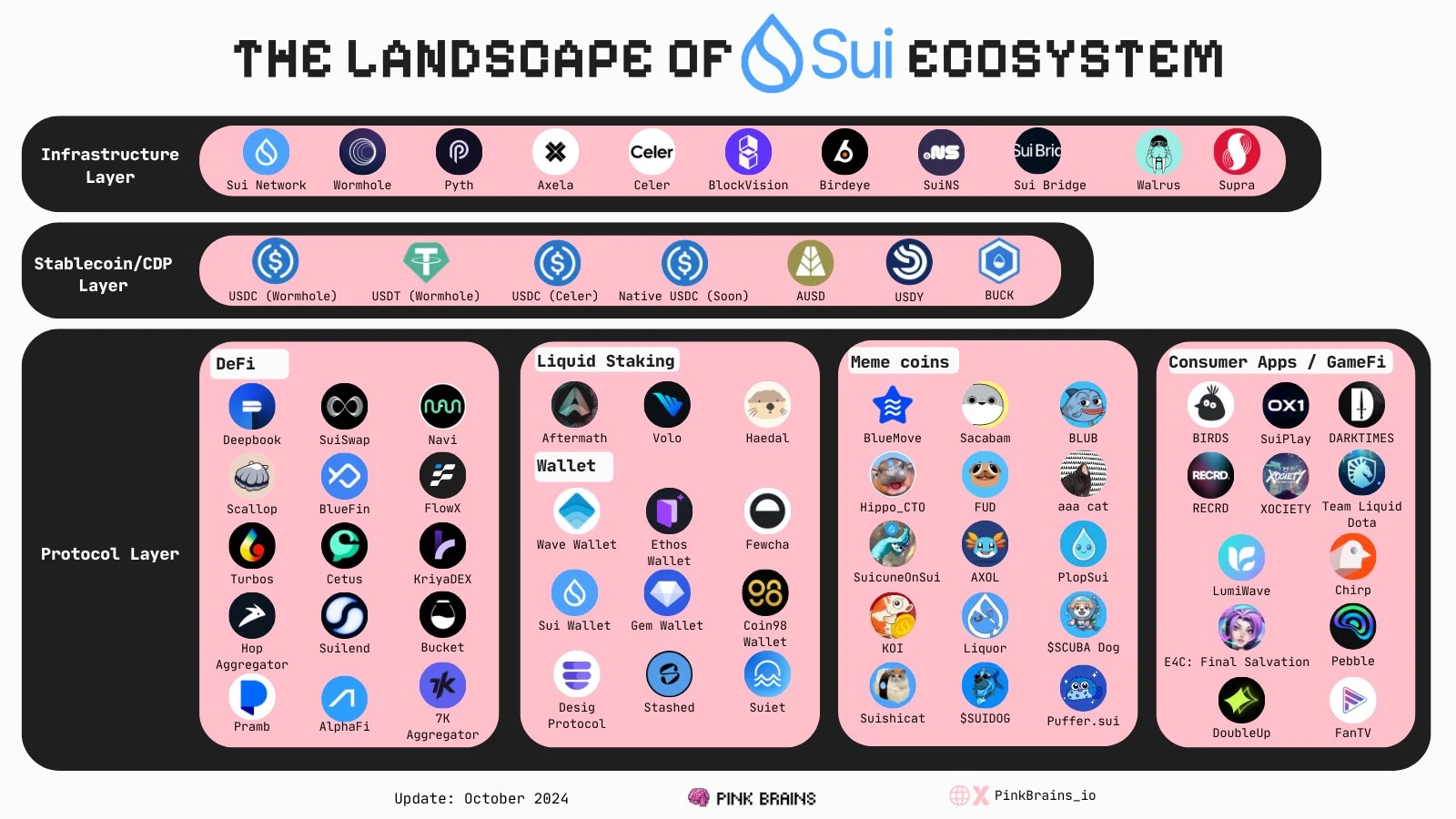

Editors note: After the Sui ecosystem meme attracted peoples attention, the token SUI also rose by more than 10% in the past week, breaking through $2 again after more than 6 months; at the same time, the daily activity of the Sui blockchain soared by 300% in less than a month, TVL hit a record high, and the ecosystem is also booming. Will Sui really become a Solana killer?

This article delves into the Sui ecosystem and introduces the development of the Sui ecosystem from the fields of infrastructure, stablecoins, DeFi, Meme, and consumer applications. Finally, it recommends KOLs worth paying attention to in the Sui ecosystem. I hope it will help readers understand the Sui ecosystem.

Suis Advantages

Sui uses an object-centric approach and parallel execution to solve problems such as blockchain latency, transaction costs, and network congestion. Built with Rust and Sui Move, it simplifies scalable smart contract development while greatly enhancing the user experience with 297,000 TPS, 390 millisecond final confirmation time, and consistently low gas fees (despite the exponential growth of txns in SUI).

Recently, Sui launched a new blockchain consensus protocol, Mysticeti, which further reduces latency on the Sui blockchain. Mysticeti is tailored for Sui, unifying the fast path and consensus process, achieving 390 milliseconds of consensus latency and 640 milliseconds of settlement finality. This means that swapping on Sui is as fast as a blink of an eye.

Sui excels in micropayments, games, and real-world transactions with its fast speed and offline capabilities. Whether using an account abstraction wallet like Stashed or Sui Wallet, or a Telegram-based wallet like Wave Wallet, users can easily send funds using Web 2.0 accounts (such as Google, Twitch, TG), simplifying the entry of novices.

Sui鈥檚 ecosystem is developing rapidly, and currently there are 28 major dApps in the ecosystem, covering the following areas:

-

DeFi: AMM, lending, payment, liquidity staking, Meme coin platform;

-

Web 3.0: DePIN, privacy-focused browsers, and open-architecture games;

-

Consumer Applications: NFT minting, 市场 and community tools, GameFi.

Next, we will introduce the projects of Sui ecosystem in detail.

基础设施

Cross-chain bridge

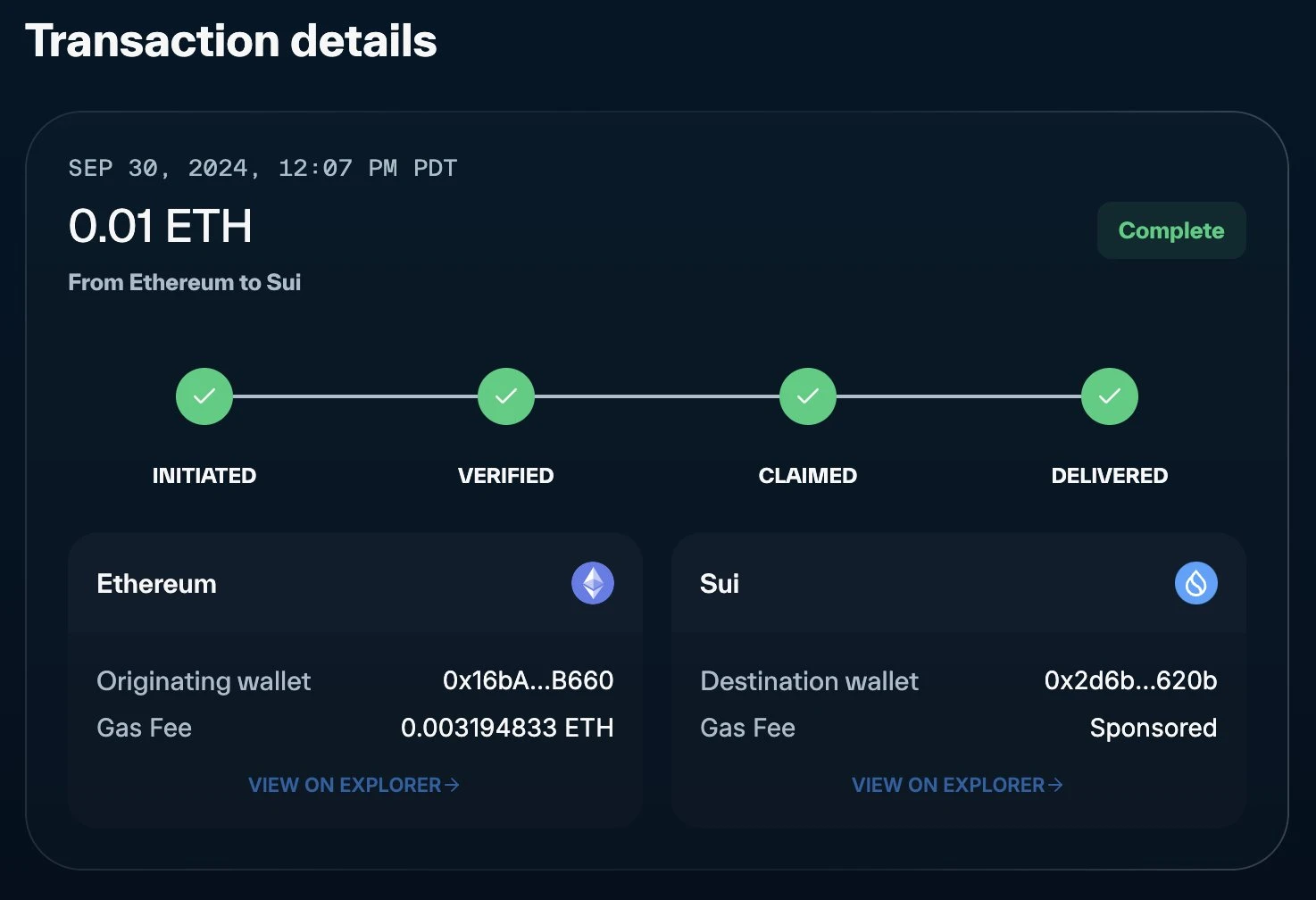

Interoperability solutions like 虫洞 are crucial to Sui鈥檚 DeFi ecosystem. $55 million was transferred to Sui blockchain via Portal Bridge, making Sui the third most-funded blockchain in the past 7 days.

At the same time, Sui Bridge also provides a native way to bridge assets between Sui and Ethereum, protected by Suis network validators. Sui Bridge currently only supports ETH and WETH.

甲骨文

Pyth Network is the largest oracle on Sui, with a total guaranteed value of $939 million. The top ten protocols NAVI protocol, Scallop, Suilend, etc. are all within the service scope of Pyth.

稳定币

USDC/USDT

USDC and USDT bridged from Ethereum are the most liquid stablecoins on the Sui network, but wrapped stablecoins from other different chains have significantly lower liquidity, which can be a challenge for new users trying to join the Sui ecosystem.

At the same time, USDC will soon be natively supported on the Sui network through Circles cross-chain transfer protocol. This will make Sui the first Move-based blockchain to support native USDC. CCTP will connect Sui with blockchains such as Arbitrum, Base, Ethereum, and Solana, ensuring secure and efficient USDC transactions without locking up liquidity.

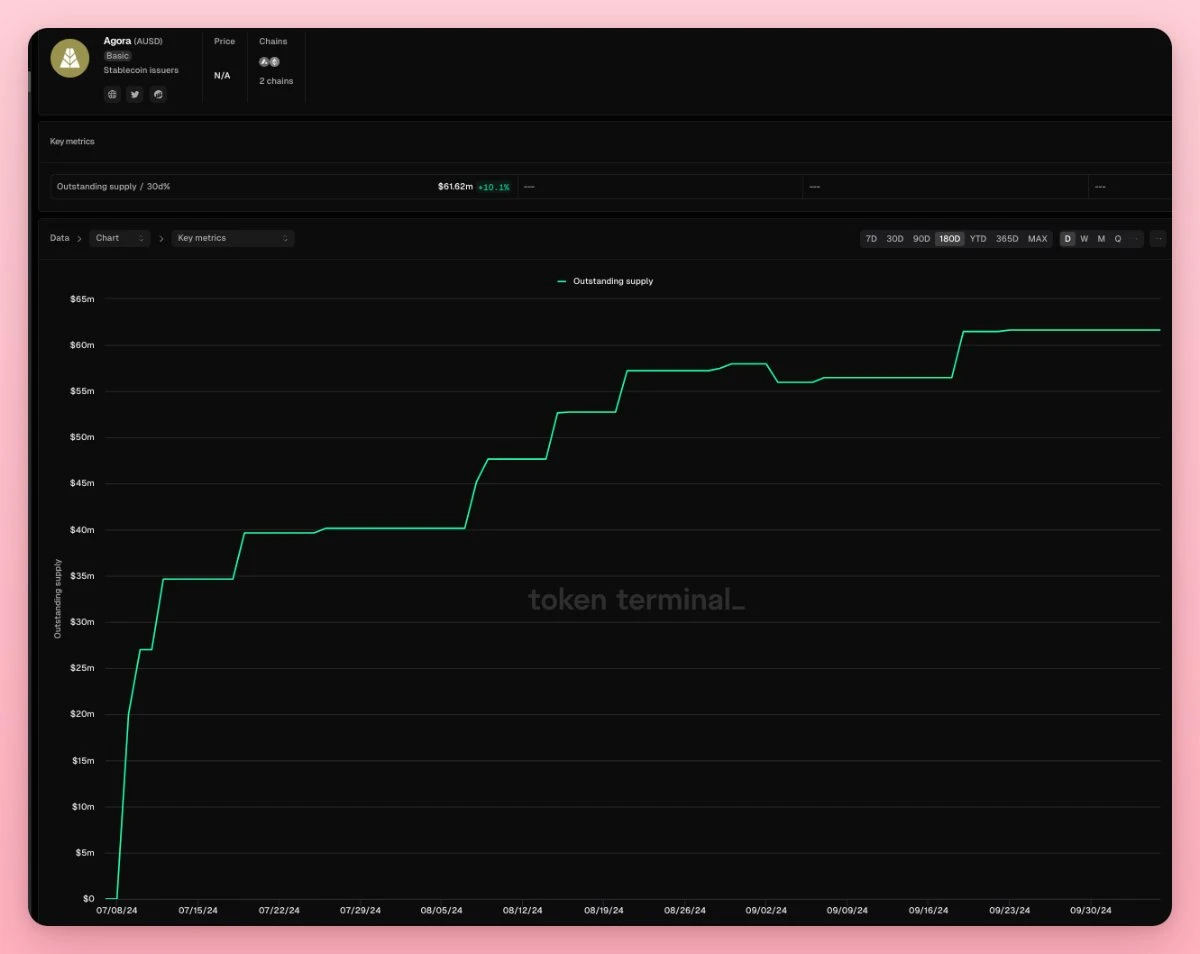

AUSD

AUSD, issued by Agora , is the first RWA-backed stablecoin launched on Sui, backed by large fund management company VanEck. AUSD enriches Suis growing list of native assets. AUSD is also a fast-growing stablecoin on Ethereum and Avax, with a supply of more than $61 million.

美元指数

USDY, issued by Ondo Finance , is the first dollar-denominated token on Sui, including stablecoins and interest-bearing alternatives backed by short-term U.S. Treasuries. Compared with other blockchains, Suis USDY market cap is relatively small at over $8 million, and there is room for growth compared to Aptos and Solana.

去中心化金融

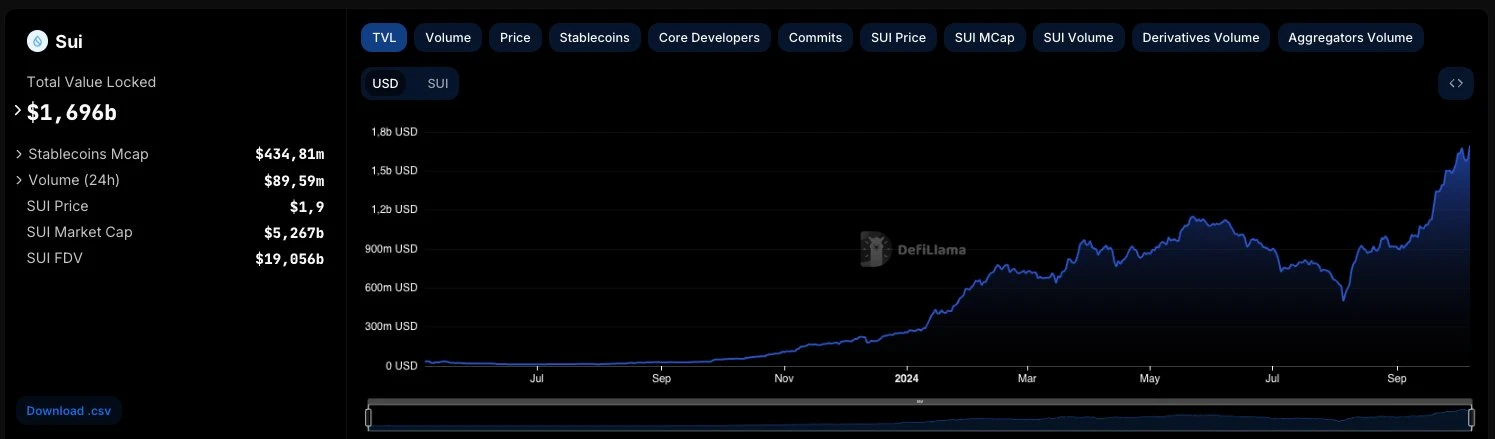

Since late September, Sui鈥檚 popularity and on-chain metrics have increased significantly, posing a threat to Solana. Driven by the surge in the price of the SUI token and the recent hype around its DeFi, its TVL exceeded $1.69 billion for the first time.

The mainstream DeFi protocols of the Sui platform are as follows:

-

NAVI Protocol : The largest lending platform on Sui, with a TVL of $400 million in September, a supply of $10 billion, and a loan amount of over $35.

-

Cetus : The leading DEX on Sui, with daily trading volume of US$118 million and TVL of US$214 million. It is a top DEX aggregator by market share and has low swap slippage.

-

Turbos : Sui provides DEX with centralized liquidity market maker (CLMM) model and automated market maker (AMM) model, with a TVL of 22.12 million US dollars. Among several mainstream DEXs, Turbos is strategically positioned as a Meme hub, and has official cooperation with many Sui ecological Meme tokens, with excellent trading volume and liquidity performance. For example, the top Meme token BLUB ranks first in trading volume on Turbos.

-

扇贝 : The second largest lending protocol on Sui, with a TVL of $250 million. The protocol offers veSCA token rewards every week, with a total trading volume of over $100 billion.

-

Suilend : The third-ranked lending protocol on Sui, with a TVL of $180 million and a swap volume of $25 million. Users who deposit or lend SUI, USDC, USDT, ETH, SOL or AUSD on the platform can receive a certain amount of SUI rewards.

-

Aftermath : Aftermath is the DeFi hub on Sui with a TVL of $104 million. Aftermath Aggregator provides users with the best swap route by scanning DEXs. It is the first DEX to support sETH of Sui Bridge and has afSUI/sETH pool and dynamic Gas.

-

DeepBook : DeepBook is a key liquidity layer for efficient DeFi on Sui. It is currently used by more than 736,000 wallets, with a total transaction volume of more than 100 million transactions and a total transaction volume of more than $5 billion. The DeepBook v3 testnet has 112,000 unique addresses and 1.3 million transactions. DEEP tokens are expected to enter TGE soon.

In addition to the mainstream protocols introduced above, there are also DeFi protocols such as Kriya , FlowX Finance , 和 Suiswap on Sui.

模因币

The surge in DeFi trading volume on Sui is mainly caused by the craze for meme coins, with trading volume tripling since late September. Although most of the meme coins on Sui are low-cap and immature, there are still some noteworthy tokens, which are ranked below according to market capitalization:

市场 value: $50 million to $100 million

-

HIPPO-Community Account: @hippo_cto

-

BLUB-Community Account: @blubsui

-

FUD-Community Account: @fudthepug

Market value: $10 million to $50 million

-

aaa-Community account: @aaaCatSui

Market capitalization less than $10 million

-

HSUI-Community Account: @HsuiOnSui

-

SCB-Community Account: @sacabamfun

-

LIQ-Community Account: @Beliquoronsui

-

PUFF-Community Account: @PufferSui

Meme Coin Platform

-

MovePump is the first Meme launch platform launched by BlueMove on Sui and Aptos. More than 50 Meme projects have been created recently and the number is still increasing.

-

hopdotfun was launched by Hop, the worlds leading DEX aggregator, and will also be launched on October 12.

Consumer applications (GameFi, SocialFi, DePIN)

With a highly scalable blockchain design and low transaction fees, Sui is also a hub for consumer applications including Web3 games, social/DeSo applications, and DePIN.

GameFi

-

SuiPlay : will be launched in the first half of 2025 as the first Sui-based Web3 native handheld gaming device, powered by PLAYTR 0 N. Two major gaming partners are expected to appear on SuiPlay 0X 1, one is the popular AAA shooter 西奥蒂 with RPG progression, and the other is the free and Nordic-style medieval royal fighting game DARKTIMES .

-

BIRDS : BIRDS is a Meme coin and Telegram mini-game app built on Sui. The app has 3 million users, over 450,000 daily active users, and over $1.3 million in on-chain transactions.

-

E 4 C: Final Salvation launched in beta on Sui. The app reached 100,000 users a few days after its release. As a MOBA game, it also has Rangers NFT in-game avatars and utilities.

社交网络

While SocialFi on Sui has yet to gain significant traction, there are a few projects currently under construction:

DePIN

Chirp is Suis well-known DePIN project, which simplifies the Internet of Things by allowing devices from different manufacturers to easily communicate with each other and with the blockchain. Its ecosystem provides tools to reduce costs and accelerate the entry of Web3/Web2 projects into RWA, giving Sui an advantage in the DePIN and RWA fields.

Ecosystem builders worth paying attention to

-

evan.sui : Co-founder and CEO of Mysten Labs;

-

Jameel.sui : Head of Ecosystem Development, Sui Foundation;

-

BL : Chief Technology Officer of STUDIO MIRAI;

-

c | Sui : Retail Marketing Director, Sui Foundation;

-

Sam Blackshear : Creator of Move, Co-founder and CTO of Mysten_Labs;

-

Adeniyi.sui : Co-founder and Chief Product Officer of Mysten_Labs ;

-

MrBreadSmith.sui : Official ambassador of Sui, Cosmocadia and Scallop;

-

Matteo.sui : Sui official ambassador;

-

Drippy.sui : Sui ecosystem software engineer;

-

JoshuaOrhue.sui : Official ambassador of Sui and DoubleUp;

-

David Ticzon : Member of Sui Ecosystem Team;

-

Cleanwater.Sui : Official ambassador of Sui and Liquor ;

-

TREVINvsNFT.SUI : Sui and Cosmocadia brand ambassador;

-

0x julian.sui : Co-founder of FlowX Finance and Suipiens community, and core contributor of NOV螞GEN .

This article is sourced from the internet: In addition to Meme, what other projects in Sui Ecosystem are worth paying attention to? (Attached with recommendations from high-quality KOLs in the ecosystem)

Related: HashKey Capitals internal half-year review of Web3

As one of the most active crypto VCs, HashKey Capital regularly analyzes each Web3 space internally. In the first half of 2024, we “open-sourced” our internal space analysis and insights as our contribution to the industry. The authors of this article are (in alphabetical order): Arnav Pagidyala, Harper Li, Jack Ratkovich, Jeffrey Hu, Junbo Yang, Jin Ming Neo, Stanley Wu, Sunny He, Xiao Xiao, Yerui Zhang, Zeqing Guo. Ethereum Zero Knowledge ZKVM ZKEVM In the first half of 2024, we observed that more and more ZKEVM projects began to turn to the ZKVM architecture, represented by the PSE team under the Ethereum Foundation. Taiko is already working with Risc 0s ZKVM, and Scroll is also preparing in this area. The catalyst for this shift was Plonky 3, which outperformed Halo…