Original article by Sean Tan, Primitive Ventures

原文翻译:TechFlow

As a multi-strategy investment institution that does not stick to a single asset, our investment philosophy is not just about finding opportunities. We value how to build an investment framework that can predict and adapt to future market changes, and constantly seek the best balance between risk and return. What attracts us most are often those opportunities that are misunderstood or ignored by most market participants. Based on the experience in the foreign exchange and cross-border markets over the past decade, we have found that the transfer of liquidity or sudden external shocks are often the best catalysts.

These major events often force market participants to adjust their portfolios quickly under tight time pressure. When large amounts of money scramble to correct course, significant market volatility can occur. As macro investors, one of our key skills is the ability to see the connection between liquidity changes between the East and West markets, onshore and offshore markets, and compliant markets and underground capital flows.

About Investing in China

We had a long and hard time getting to China. We started in late 2023, when China was reopening and the market was not doing as well as we had hoped, and then added more in the first quarter of 2024. The reason for investing in China was obvious: Chinese stocks were trading at a 60-70% discount to their U.S. counterparts. “Seriously oversold” and “uninvestable” were everywhere. But from a purely fundamental perspective, you’d find a basket of blue chips with strong double-digit growth. However, the most critical constraint on the Chinese market at the time was liquidity.

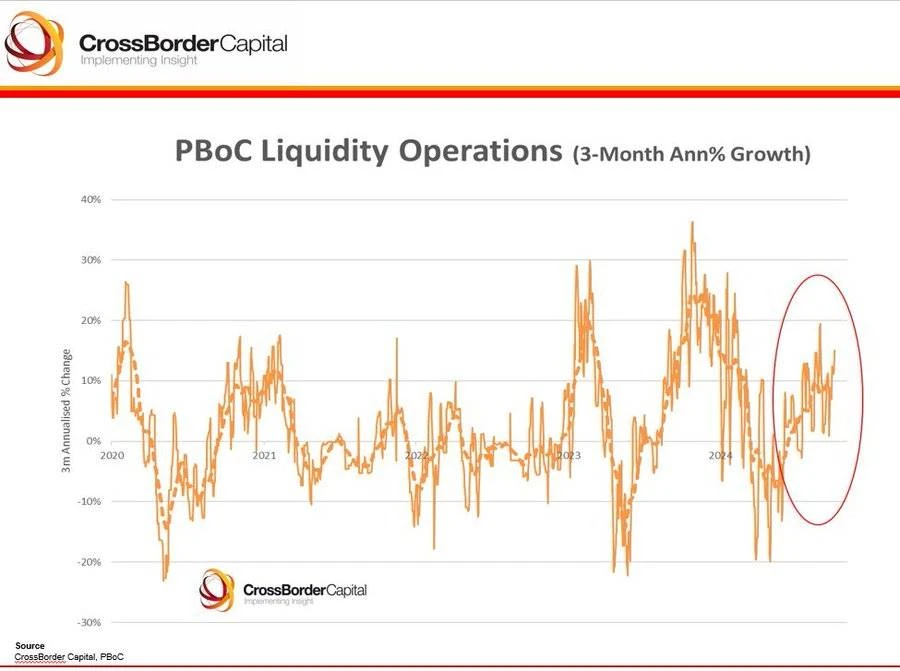

Until last week, the situation changed. The Politburo convened an unscheduled meeting to confront the current economic challenges. Unlike previous incremental approaches, this time a unified strategic action plan was proposed, led by the central bank and presided over by the national leader. This was a clear signal that the government was ready to inject liquidity and intervene in the market on a large scale.

Here are the highlights:

-

The timing of the Politburo meeting is unusual: the Politburo meets monthly, but usually discusses the economic agenda only in April, July and at the end of the year. The September meeting was the first to publicly discuss economic issues without a scheduled agenda, and also coordinated with the central bank for an aggressive monetary policy update.

-

Urgency of Economic Challenges: The meeting content showed that the government has a strong sense of urgency about the current economic environment, urging a clear-eyed view of the economy, acknowledging the difficulties, and emphasizing the responsibility to address these problems.

-

Increase countercyclical fiscal policies: The meeting emphasized the need to increase countercyclical fiscal and monetary measures to ensure necessary fiscal spending, so we are now waiting for the introduction of the next series of fiscal policies.

-

Capital market support: The government recognizes the importance of the capital market and sends a signal of stability through large-scale liquidity injections.

-

A 50 basis point reduction in the reserve requirement ratio will inject 1 trillion yuan of long-term liquidity, and the reserve requirement ratio may be further reduced by 0.25-0.5 basis points in the future.

-

The 7-day reverse repurchase rate was lowered by 20 basis points from 1.7% to 1.5%.

-

The central bank will provide 500 billion yuan to purchase stocks and enhance market stability.

This was clearly a signal of liquidity injection and intervention cycle. Western/global markets quickly received this information and skillfully interpreted it as monetary easing. Then, boom! The catalyst event came and the market moved. The whole world woke up and saw the strong fundamentals of Chinas economy, and we finally reaped the belated return of this counter-trend investment.

While it remains to be seen whether these measures can truly revive the sluggish economy, the upcoming Double Eleven shopping festival (which can be understood as Chinas version of Black Friday) will serve as an early litmus test of consumer demand and retail spending, directly reflecting the health of the domestic consumption recovery.

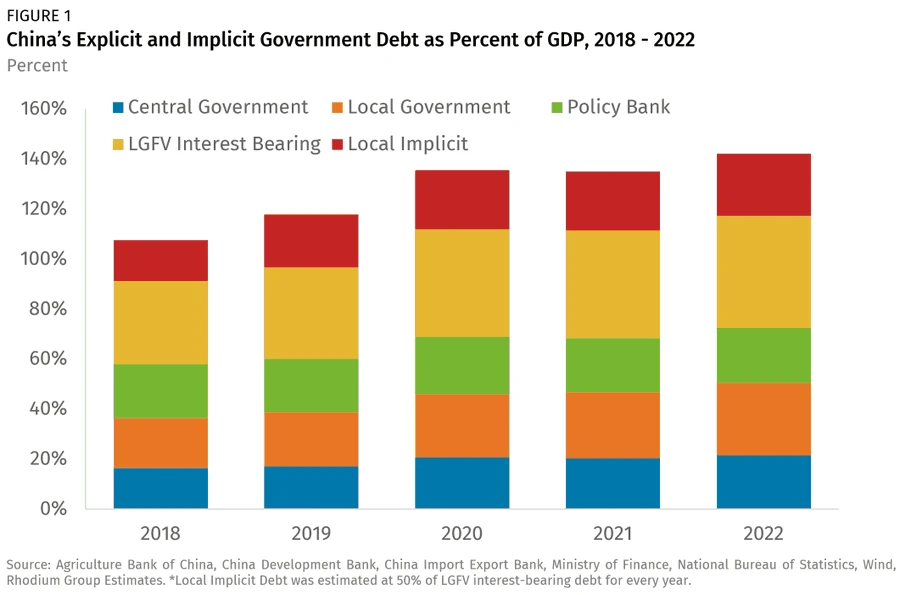

It’s important to note, however, that China’s debt structure is very different from that of the U.S. In China, local governments carry the bulk of the debt and rely primarily on land sales as a source of revenue. This unique situation complicates the issue, making local economic trends a key factor in assessing the broader recovery trajectory.

Impact on Cryptocurrencies

At Primitive, we strive to take the broadest view of the landscape. As crypto enters the mainstream investment cycle and more institutions and portfolios begin to make meaningful and substantial allocations, we are finding that the profiles of the money managers making these decisions are increasingly similar and overlapping.

Unlike before, we did not see large-scale retail investors directly buying crypto assets with fiat currency in this cycle, as in the ICO boom in 2017 or the NFT craze in 2021. At that time, new users would deposit fiat currency directly into exchanges, then convert it into stablecoins or Ethereum, and then participate in various cryptocurrency speculation activities. In 2021, we even saw users withdraw funds from Coinbase and flow directly to OpenSea, and MoonPay rose rapidly because a large number of users needed to buy NFTs with fiat currency.

In this cycle, traditional finance is clearly more attractive than the native crypto ecosystem. CME futures open interest has surpassed Binance, and CME is about to launch spot products. US institutional investors are still not allowed to trade on overseas trading venues, even through prime brokers. At the same time, ETFs are expected to become high-quality, underutilized collateral, while credit within the crypto ecosystem has dried up. In fact, when Bitcoin fell to $53,000 in early September due to a seasonal sell-off, our market positioning was based primarily on the following macroeconomic views:

-

Currently in a loose liquidity environment

-

Cryptocurrency cycles are actually part of a larger macroeconomic cycle

These two points have become the core beliefs that guide our investment decisions.

Early in this cycle, the crypto spot market was doubly beaten by tech/AI stocks, but also by zero-day options. The former has brought a more significant wealth effect to retail investors, while the latter offers thrill-seeking investors a more attractive gambler experience than the current relatively calm crypto market. Less than two years after the Chicago Board Options Exchange (CBOE) launched zero-day options, they already dominate the stock market, accounting for more than 50% of SP 500 index options trading volume.

As both the United States and China enter a monetary easing cycle, global liquidity is rising. Coupled with the upcoming US election and the possible slowdown in the rise of technology stocks, we expect some risk-averse funds to flow into the crypto market. The seasonal factors in the fourth quarter may affect investors decisions to adjust their portfolios for 2025, especially when important figures such as BlackRock CEO Larry Fink publicly stated that Bitcoin is an excellent low-correlation asset in the portfolio, which will undoubtedly attract the attention of more allocators.

未来展望

In the long term, we closely watch Chinas savers, who maintain a world-class high savings rate of 34%. Most of these funds are still in bank deposits, away from the depressed real estate market and the stock market that has underperformed in the past five years. The key question is whether these funds will be reallocated to risky assets and how to activate them.

We are also watching closely whether the 5% GDP growth target can be achieved after this week’s coordinated policy actions, and whether funds will flow back into China’s domestic market, boosting retail consumption and increasing risk appetite for financial assets. These factors will set the stage for economic trends in 2025, and will also affect the outcome of the US election on November 5.

Whether in traditional markets or crypto markets, we find that the distribution of returns is quite concentrated. This means that it is difficult to obtain significant excess returns whether picking niche stocks or alternative coins. Therefore, in Primitives investment practice, we have adopted a different strategy. Our core concept is follow liquidity. Specifically, when we design trading strategies, we mainly focus on how to follow and make good use of liquidity changes in the market.

This article is sourced from the internet: The situation has reversed, is the rising tide of liquidity in the East coming?

Related: Deep Dive into Consumer Crypto Applications: Audience Targeting and 市场 Fit

原文作者:Aryan Agarwal 原文翻译:TechFlow 如何定义消费者应用?在深入任何话题之前,我想先澄清一下我对消费者应用的理解,这将为后面的部分奠定背景。消费者是每天使用你的平台的任何人,或者平台就像是用户的一种习惯。例如,用户应该在早上醒来时打开你的应用,就像他们打开 X(以前称为 Twitter)或阅读报纸一样,或者应用应该成为用户生活的一部分。如果你有 100 个这样的用户,那么你就拥有了一个消费者应用。可以从应用商店排名中引用一些非加密应用的示例。按国家/地区划分的最受欢迎应用加密应用的一些示例包括…