Original author: @tradetheflow_; twitter

Original translation: Zhouzhou, Ismay, BlockBeats

Editors note : The current prospects for the revival of DeFi are optimistic. The current environment has many similarities with the last Summer of DeFi. A new generation of more mature DeFi protocols are also emerging, and relevant data indicators continue to improve. At the same time, more and more institutional investors are participating, which has promoted the expansion of the DeFi ecosystem. In addition, the Federal Reserves loose monetary policy has injected sufficient liquidity into the market, attracting more investors to seek high-yield opportunities. This series of factors together constitutes favorable conditions for DeFi to flourish again and is a driving force for further growth.

The summer of 2020, known as the “Summer of DeFi,” was an extraordinary moment for the crypto industry. For the first time, DeFi was no longer just a theoretical concept, but demonstrated its feasibility in real-world applications. During this time, we witnessed the explosive growth of multiple DeFi infrastructure protocols—such as @Uniswap ’s decentralized exchange (DEX), @aave ’s lending protocol, @SkyEcosystem ’s algorithmic stablecoin, and more.

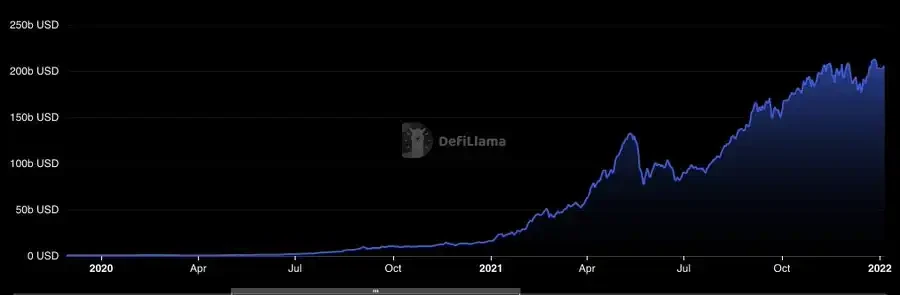

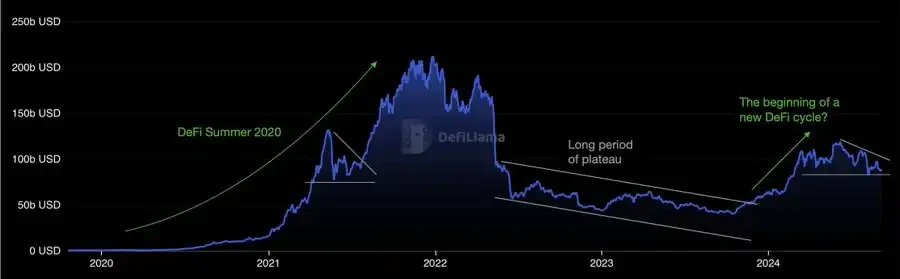

Soon after, the total locked value (TVL) of DeFi applications also soared rapidly. Starting from about $600 million at the beginning of 2020, TVL exceeded $16 billion at the end of the year and hit a record high of more than $210 billion in December 2021. This wave of growth was accompanied by a strong bull market in the DeFi field, making DeFi the core focus of the crypto world.

TVL of the crypto industry from 2020 to the end of 2021. Source: DeFi Llama

It can be said that the two key catalysts driving the Summer of DeFi are:

1. The breakthrough progress of the DeFi protocol has enabled it to scale and provided users with clear application scenarios.

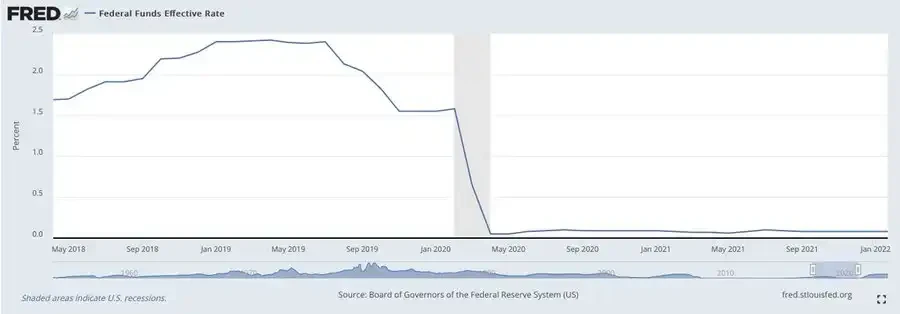

2. The Federal Reserve launched an easy monetary policy, during which interest rates were significantly lowered to stimulate the economy. This injected ample liquidity into the market, prompting investors to look for more attractive yield opportunities because traditional risk-free interest rates are extremely low. This is undoubtedly an excellent environment for the rapid rise of DeFi.

Chart of the Federal Funds Rate from May 2018 to January 2022 Source: Fred St Louis

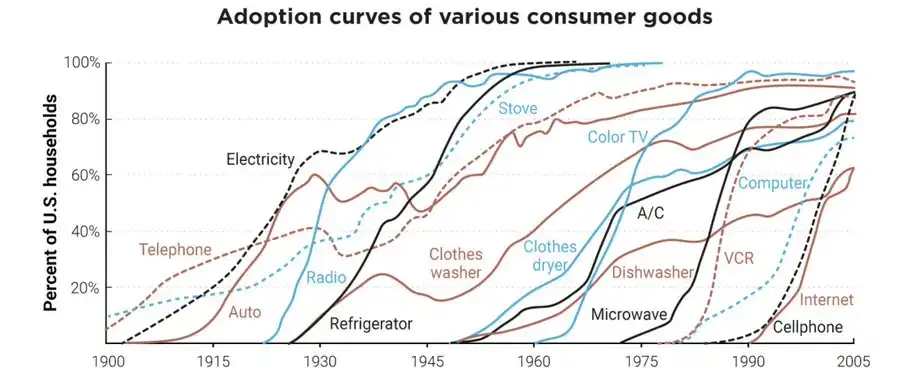

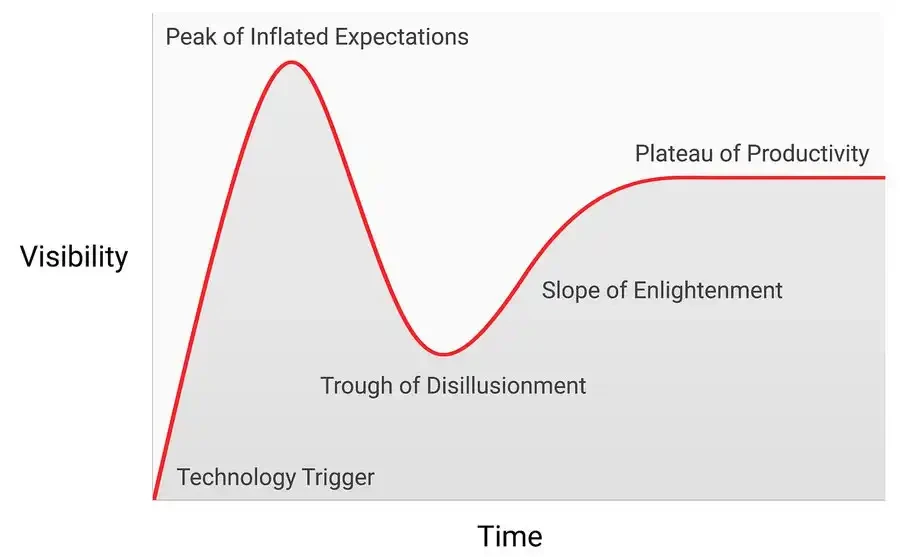

But like many disruptive new technologies, DeFi adoption has followed a familiar S-curve path, often referred to as the Gartner Hype Cycle.

Chart showing adoption of various consumer products over time Source: Bullish Case for Bitcoin

From a macro perspective, this process goes like this: In the early days of the Summer of DeFi, early investors were confident in the technological revolution they were investing in. For DeFi, the core idea is that it can completely subvert the existing financial system. However, as more and more people poured into the market, enthusiasm quickly reached a peak, and investment behavior gradually became driven by speculation, with investors paying more attention to short-term profits rather than underlying technology. When this wave of enthusiasm reached its peak, prices fell, public interest in DeFi waned, and we entered a bear market, followed by a long period of stability.

Gartner Hype Cycle Chart Source: Speculative Adoption Theory

There is every reason to believe that this boring period of stability is not the end of DeFi, but the real starting point for its popularization. During this period, developers continue to promote innovation, and the number of firm believers is gradually increasing. This has laid a solid foundation for the next round of Gartner hype cycle, and it is expected to attract more large-scale users in the future.

DeFi renaissance

So far, the prospects for the DeFi revival look quite optimistic. Similar to the catalysts of the last DeFi summer, we now have: a new generation of more mature DeFi protocols being built; healthy and growing DeFi data indicators; the participation of institutional investors; and the current loose policy cycle of the Federal Reserve. All of this together constitutes an ideal environment for DeFi to flourish again.

Towards DeFi 2.0

Over the years, DeFi protocols and applications have evolved significantly from the first wave of enthusiasm in 2020. The problems and limitations faced by many first-generation protocols have been largely resolved, forming a more mature ecosystem, which is the rise of what we now call the DeFi 2.0 movement.

Some of the key improvements include:

Better user experience

跨链互操作性

Improved financial architecture

Improved scalability

Enhanced on-chain governance

Improved security

Proper risk management

In addition, many new application scenarios have emerged in DeFi. It is not limited to early trading and lending. New trends such as double pledge, liquid pledge, native yield, new stablecoin solutions, and tokenization of real-world assets (RWA) make the ecosystem more vibrant. Whats more exciting is that new infrastructure is being built continuously. What currently catches my attention is the on-chain credit default swaps (CDS) and fixed-rate/term loans built on the existing lending infrastructure.

Healthy and growing DeFi metrics

Since the end of 2023, we have witnessed a resurgence in DeFi activity as a new wave of DeFi protocols emerged. First, looking at the total value locked (TVL) in the crypto ecosystem, we notice that momentum is starting to pick up after a long period of plateauing. From $41 billion in October 2023, TVL has almost tripled, reaching a local high of $118 billion in June 2024, before falling back to current levels of around $85 billion. While this is still below the all-time high (ATH), it is undoubtedly a significant upward trend, which may be the first wave of a long-term upward trend in TVL.

Chart showing the evolution of TVL in the crypto industry Source: DeFi Llama

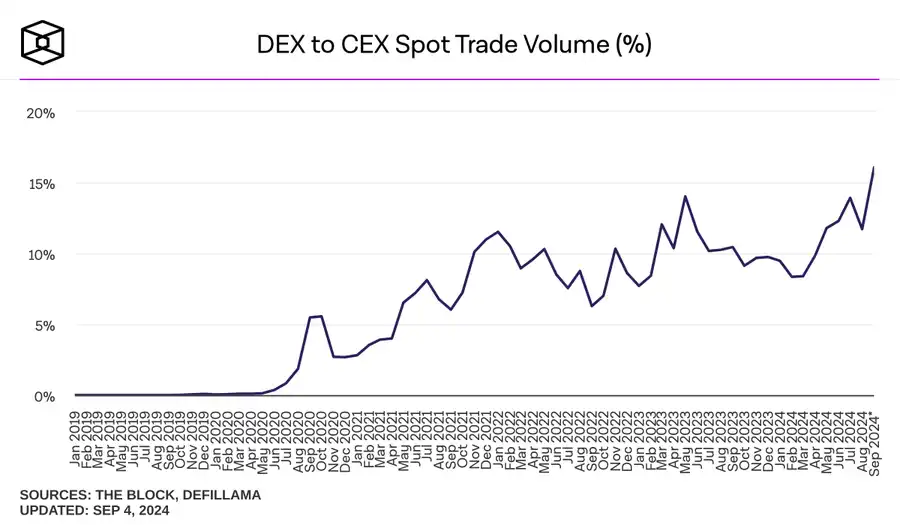

Another interesting metric is the DEX to CEX spot volume ratio, which measures the relative trading activity between centralized exchanges (CEX) and decentralized exchanges (DEX). Once again, we notice a positive long-term trend, indicating that more and more trading volume is moving on-chain.

Chart showing the ratio of DEX to CEX spot trading volume Source: The Block

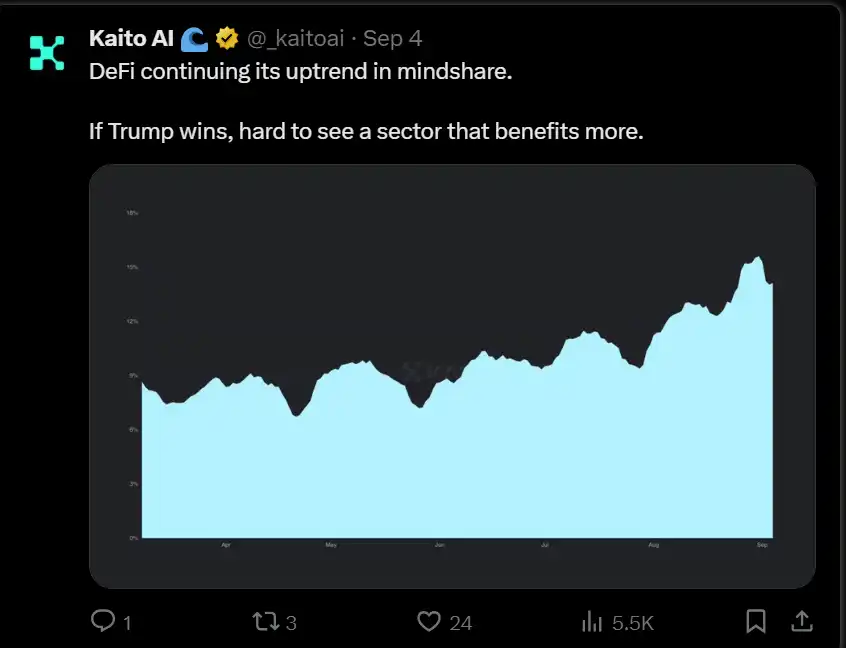

The DeFi sector’s influence in the entire crypto ecosystem has risen in recent months, and in a market where everyone is vying for attention, DeFi is attracting renewed attention.

The arrival of institutional players

The first wave of participants in the DeFi summer were mainly individuals trying to master this new technology, while a new wave of DeFi protocols began to attract several large players in the traditional financial field to enter the DeFi field.

In March, BlackRock, the world’s largest asset management company, launched its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL Fund), on the Ethereum blockchain, enabling investors to obtain returns on U.S. Treasury bonds directly on the chain. BlackRock’s DeFi initiative has apparently been successful, with the fund’s assets under management exceeding $500 million.

Another notable example of growing institutional interest is PayPal’s PYUSD stablecoin, which reached a major milestone just one year after its launch — surpassing $1 billion in market capitalization.

These examples show that the traditional financial industry is finally beginning to recognize the value proposition of building a financial system based on decentralized blockchain technology. As PayPals CTO said, if it can reduce my overall costs while bringing me benefits, why not accept it? As more institutional players begin to experiment with this technology, we can assume that this will become a powerful catalyst in the DeFi field.

The start of the Fed’s easing cycle

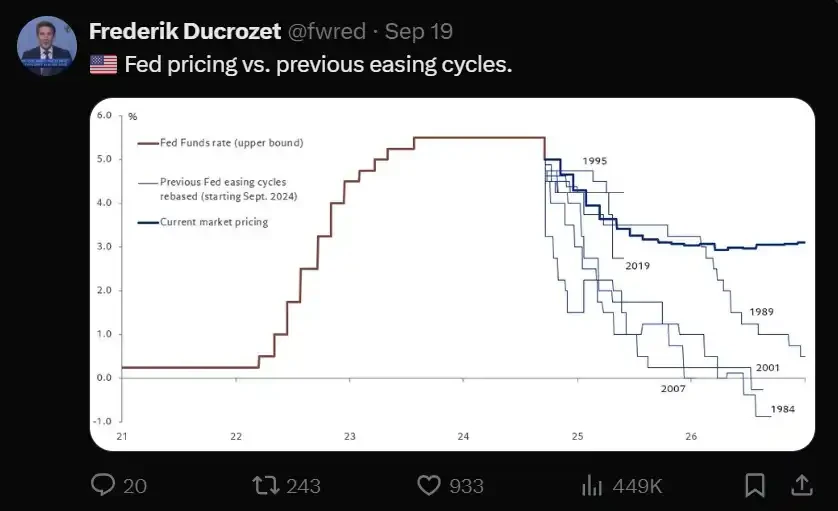

In addition to the previous points, the current path of US monetary policy is another potential catalyst for DeFi. In fact, we have just crossed an important inflection point in the economy. The recent September FOMC meeting of the Federal Open 市场 Committee (FOMC) delivered the first 50 basis point rate cut since the Fed launched its anti-inflation measures after the pandemic, which is an important signal that a new round of easing cycle is starting. The expected path of the federal funds rate further proves this point.

The start of this new monetary easing cycle provides two key arguments for the DeFi bullish case:

1. This easing cycle will inevitably increase liquidity in the system. Liquidity is a key element in financial markets. Excess liquidity means more funds are available to enter the market. Inevitably, DeFi and the entire crypto market should benefit from it.

2. The decline in the Fed Funds rate will also mechanically increase the relative attractiveness of DeFi returns. Simply put, as traditional risk-free rates decline, investors will begin to look for other opportunities for returns. This may lead to a market shift to DeFi, which offers a wide range of stablecoins and other more attractive strategy returns that are safer and more reliable than a few years ago.

Will history repeat itself?

Overall, there are multiple factors that point toward a DeFi recovery.

On one hand, we are witnessing the emergence of multiple new DeFi primitives that are more secure, scalable, and mature than they were a few years ago. DeFi has proven its resilience and established itself as one of the few sectors in crypto with real-world use cases and real adoption.

On the other hand, the current monetary environment is also supporting the revival of DeFi. This is similar to the background of the last DeFi summer, and the current DeFi indicators suggest that we may be at the starting point of a larger upward trend.

History does not simply repeat itself, but it always repeats itself in a strikingly similar way.

This article is sourced from the internet: DeFi revival is underway: What changes have taken place in the fundamentals of the track?

关键指标(9月19日凌晨12点->中午12点香港时间):BTC/USD现货+4.5%($ 59,400->$ 62,100) BTC/USD 9月27日ATM波动率-7.0 v(54.5->47.5);12月(年底)ATM波动率-1.4 v(59.6->58.2),12月25日风险逆转波动率-0.3 v(2.3->2.0) FOMC会议纪要 美联储开启降息周期,宣布降息50个基点,鲍威尔主席对美国经济状况充满信心(如果你问大多数市场参与者,他们会说经济状况良好) 立即的反应是美国股市上涨,美元下跌(相对法定货币和黄金),收益率下降。然而,大部分的收益和损失都被市场消化了……