OKX has teamed up with high-quality data platform AICoin to launch a series of classic strategy research, aiming to help users better understand and learn different strategies and avoid blind use through analysis of core dimensions such as data measurements and strategy characteristics.

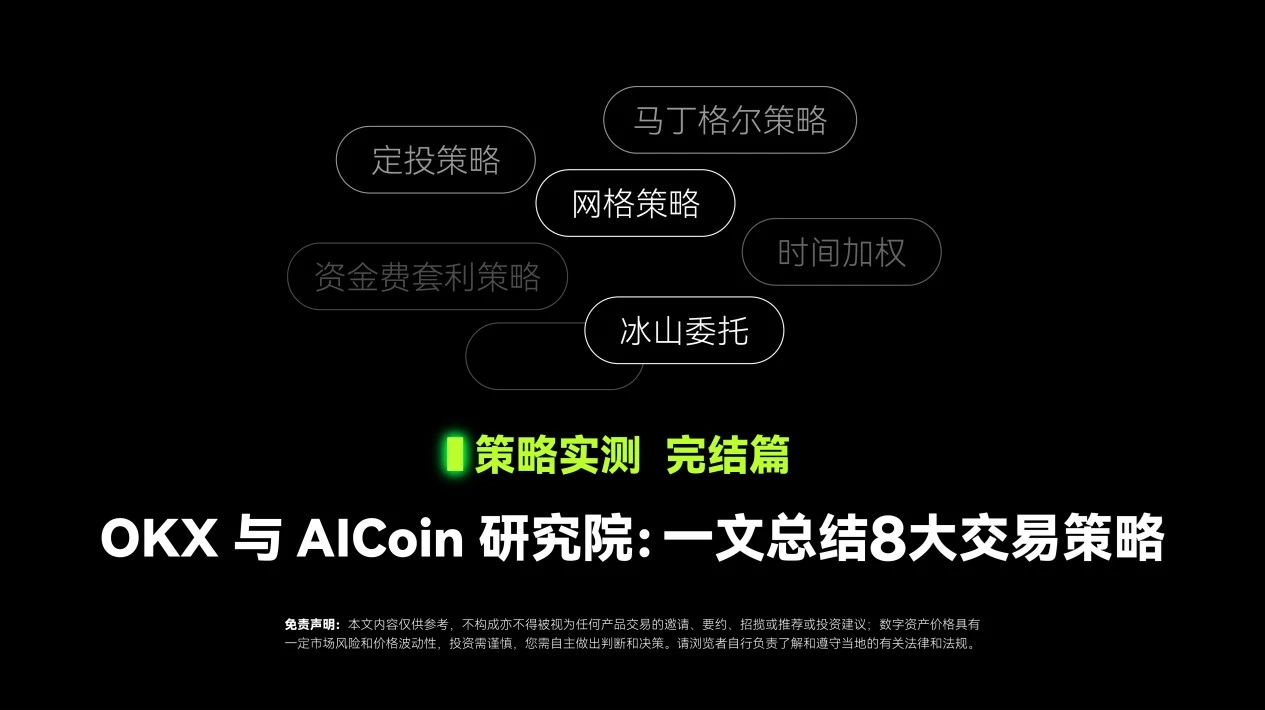

This article is the final chapter of strategy testing. It aims to help users understand 8 classic trading strategies in one article by summarizing the core content of the first 5 issues. These strategy summaries show the performance and application scenarios of different strategies in specific market environments. Traders should choose appropriate strategies based on their own risk tolerance and market judgment, and continue to optimize strategies to cope with market changes.

1. Fixed investment strategy

The fixed investment strategy is a strategy that diversifies the risk of one-time large transactions by trading a fixed amount at fixed time intervals, and maximizes returns by using the time compounding effect. This strategy is particularly suitable for long-term holders and aims to reduce the psychological pressure and trading risks caused by market fluctuations.

Data Sample

By analyzing the fixed investment returns of Bitcoin in different halving cycles, the results show that the winning rate of the fixed investment strategy in each cycle is more than 50%, especially during the second halving to the third halving, the fixed investment strategys return rate reached 170.03%. However, this return rate is still inferior to the overall increase in the Bitcoin market. For the fixed investment data sample of the past four years, the fixed investment return rate in 2022 is -48.75%, which shows the risks that the fixed investment strategy may bring in a bear market.

Advantages and Disadvantages

Advantages: The fixed investment strategy reduces the impact of market fluctuations by dispersing trading time, and is suitable for traders with low psychological stress tolerance. It is easy to operate and has low risks, and is especially suitable for long-term traders.

Disadvantages: The fixed investment strategy cannot maximize returns in a sharp rise in the market, and requires long-term persistence. When faced with a longer market downturn, the returns may be lower.

Strategy Summary

The fixed investment strategy provides a relatively stable trading method in a volatile market, but when the market trend is clear, the fixed investment strategy may not be able to capture the maximum increase. When using this strategy, traders need to adjust it according to the market environment and personal trading goals.

2. Grid strategy (spot and contract)

The grid strategy is a strategy that divides multiple grids within a preset price range and executes buy and sell operations when the price fluctuates. This strategy is mainly suitable for volatile markets and achieves stable returns through frequent small transactions.

Data Sample

In the actual test of neutral contract grid and spot grid, the data showed that the neutral contract grid had the highest return rate in the oscillating upward market, reaching 33.91%, while the spot grid had a return rate of 19.05% under the same market conditions. However, in the oscillating downward market environment, the spot grid suffered losses, showing its limitations in the falling market.

Advantages and Disadvantages

Advantages: Grid strategies perform well in volatile markets, especially neutral contract grids, which achieve higher returns by leveraging leverage and frequent trading. They are highly flexible and adaptable.

Disadvantages: Grid strategies do not perform well in unilateral markets, especially spot grids, which are prone to losses in falling markets. In addition, although the contract grid strategy has high returns, it is accompanied by higher risks.

Strategy Summary

Grid strategies provide an effective way to generate profits in volatile markets, especially neutral contract grids, which perform well in different market environments. However, traders should use leverage with caution and pay attention to the potential impact of unilateral market trends on strategies.

3. Martingale strategy (spot and contract)

The Martingale strategy is a high-risk strategy that spreads the cost by doubling the size of the trade after a loss, hoping to make up for all losses through the final profit. This strategy is suitable for traders with strong capital strength and performs better in volatile or rising markets.

Data Sample

The measured data of spot Martingale and contract Martingale in different market environments show that both can obtain considerable returns in rising markets, especially contract Martingale performs well in sideways and volatile markets. However, in falling markets, both face greater risk of loss, especially contract Martingale, which has more significant risks due to the use of leverage.

Advantages and Disadvantages

Advantages: The Martingale strategy reduces the average cost by continuously adding positions, and has a higher profit potential in volatile and rising markets, especially the contract Martingale strategy, which amplifies profits through the leverage effect.

Disadvantages: The main risk of this strategy is that it may lead to huge losses when the market continues to fall, especially the risk of liquidation in leveraged trading. In addition, the Martingale strategy requires strong psychological tolerance and financial support.

Strategy Summary

The Martingale strategy can bring significant returns in the right market environment, but its high-risk nature means that only traders with sufficient risk tolerance and financial strength can use it effectively. In a unilateral falling market, traders should use this strategy with caution or consider adjusting the strategy to reduce risk.

4. Funding arbitrage strategy

Funding arbitrage strategy is a strategy to profit by taking advantage of the difference in funding rates between futures contracts and spot contracts. This strategy is suitable for markets with low market volatility and significant funding rates, and aims to achieve stable returns by locking in funding rate differences.

Data Sample

The actual test of the funding arbitrage strategy under different market conditions shows that the strategy can achieve stable annualized returns when the funding rate is high. However, when the market fluctuates greatly or the funding rate fluctuates abnormally, the returns of the strategy may be affected.

Advantages and Disadvantages

Advantages: The funding arbitrage strategy provides a relatively stable way to earn income by locking in the difference in funding rates, especially when the market volatility is small. It has relatively low risk and is suitable for long-term transactions.

Disadvantages: This strategy is highly dependent on market conditions, and performs well in markets with low funding rate fluctuations. However, it may be difficult to achieve expected returns when funding rates fluctuate greatly or abnormally.

Strategy Summary

Funding arbitrage strategy provides a stable way to earn profits in a low-volatility market, suitable for risk-averse traders. However, traders need to pay close attention to changes in the funding rate in the market and adjust their strategies when necessary to cope with the risks brought by market fluctuations.

5. Time-weighted and iceberg order strategies

Time-weighted strategy and iceberg order strategy are two common trading strategies, which are suitable for splitting and executing large orders. Time-weighted strategy reduces market impact by spreading large orders over a specified period of time; iceberg order strategy hides the actual size of large orders by placing orders in batches to avoid drastic fluctuations in market prices.

Data Sample

The time-weighted strategy reduces market impact by buying in batches in a bull market, and obtains better returns; in a bear market, by setting a limit price for taking orders, it avoids taking orders at too high a price, thereby reducing the risk of losses. The iceberg strategy effectively hides the actual size of large buy orders in a bull market to prevent the market from pushing up prices; in a bear market, it hides the actual size of large sell orders to avoid panic selling in the market.

Advantages and Disadvantages

Advantages: The time-weighted strategy reduces market impact by dispersing order execution time, and the price is smooth and highly controllable. The iceberg entrustment strategy protects transaction privacy by hiding the order size and has strong adaptability.

Disadvantages: Time-weighted strategies may not be able to obtain the best price when the market fluctuates violently, and may be identified and sniped. Iceberg entrustment strategies have liquidity risks and are easily identified by advanced algorithms.

Strategy Summary

Time-weighted and iceberg order strategies provide effective solutions for the execution of large orders, especially in environments with large market fluctuations or poor liquidity. When using these strategies, traders need to flexibly adjust strategy parameters based on market conditions and personal needs to achieve better trading results.

How to access OKX Strategy Trading?

Users can enter the Strategy Trading mode in the Trading section through the OKX APP or official website, and then click on the Strategy Square or Create Strategy to start the experience. In addition to creating strategies by yourself, the Strategy Square currently also provides Quality Strategies and Quality Strategies with Strategy Leaders. Users can copy strategies or follow strategies.

OKX strategy trading has multiple core advantages such as easy operation, low fees and security. In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically; and provides graphic and video tutorials to help users quickly get started and master them. In terms of fees, OKX has comprehensively upgraded the fee rate system to significantly reduce user transaction fees. In terms of security, OKX has a security team composed of top global experts who can provide you with bank-level security protection.

How to access AICoins strategy?

Users can find grid trading strategies, all-currency DCA strategies, and funding fee arbitrage strategies in the Strategy option on the left sidebar of the AICoin product; find AI grid strategies and spot DCA strategies in the 市场 option on the left sidebar; find fixed investment strategies and contract DCA strategies in Custom Indicators/Backtesting/Real Trading on the Market interface; find smart order splitting strategies in Trading on the right sidebar of the Market interface

AICoin Strategy Plaza selects various high-quality strategies, among which the arbitrage robot has the characteristics of low risk and stable returns, the AI grid has the ability to capture price differences at high speed, and the all-currency DCA has the advantages of amortizing costs and bottom-fishing all market currencies in batches, so it is suitable for all types of investors.

Data measurement series summary

Strategy Test 01 | OKX and AICoin Research Institute: Fixed Investment Strategy

Strategy Testing 02 | OKX and AICoin Research Institute: Grid Strategy

Strategy Testing 03 | OKX and AICoin Research Institute: Martingale Strategy

Strategy Test 04 | OKX and AICoin Research Institute: Funding Arbitrage Strategy

免责声明

本文仅供参考,仅代表作者观点,不代表 OKX 的立场。本文不旨在提供 (i) 交易建议或交易推荐;(ii) 购买、出售或持有数字资产的要约或邀请;(iii) 财务、会计、法律或税务建议。我们不保证此类信息的准确性、完整性或实用性。持有数字资产(包括稳定币和 NFT)涉及高风险,可能会大幅波动。您应该根据您的财务状况仔细考虑交易或持有数字资产是否适合您。请针对您的具体情况咨询您的法律/税务/交易专业人士。请负责了解并遵守当地适用的法律法规。

This article is sourced from the internet: Final chapter of strategy testing | OKX and AICoin Research Institute: 8 major trading strategies summarized in one article

Related: Interpreting the story behind the Ethereum Foundations massive sale of ETH again

Original author: Ebunker Is the Ethereum Foundation a “top-escape master”? On August 23, the Federal Reserve released its expectations of a rate cut, and the cryptocurrency market ushered in a wave of upward trends. However, an on-chain operation followed – the Ethereum Foundation transferred 35,000 ETH to the Kraken exchange in the early morning of August 24. The last time the Ethereum Foundation transferred a large amount of ETH to Kraken was on May 6 last year, when the foundation transferred 15,000 ETH to the Kraken exchange. In the following 6 days, the price of ETH plummeted from $2,006 to $1,740, a drop of 13%. Due to the record of several large-scale shipments at relatively high points in the past, the Ethereum Foundation is nicknamed the Master of Escape by…