原创|Odaily星球日报( @OdailyChina )

作者:Wenser( @wenser 2010 )

The capital dispute over the meme coin Neiro has once again put Binance at the center of controversy.

But this time, Binance co-founder He Yis response was unusually calm and restrained, which may also imply that the Meme coin project will be more cautious in its subsequent listing strategy on Binance. In the recently released article He Yi responded to the controversy over listing: Considering the voice of the community, several MEME tokens with relatively scattered tokens and low market value were launched , we can clearly see that the voice of the community still has a significant impact on Binances decision-making level. At the same time, Binances internal organization is not as grassroots as the outside world had previously imagined.

However, the simultaneous listing of two projects, the new 柴犬 coin Neiro and NEIRO, on Binance is indeed a rare grand occasion in the Meme coin track, and can also be regarded as a turning point in the Meme coin track to some extent. Odaily Planet Daily will briefly sort out and analyze the relevant events in this article. ( Odaily Note: For the pre-information about the Neiro token, it is recommended to read New Shiba Inu Neiro debuts, taking over DOGE as the new king of Meme coins? .)

Event review: The capitalized NEIRO contract was launched first, and the lowercase Neiro spot contract was launched later

If the initial Neiro token capitalization dispute was still a confrontation between the conspiracy group and the decentralized community, then the joining of Binance, which has the title of the largest exchange in the universe, has undoubtedly added fuel to the dispute.

NEIRO contract is launched first: Will the conspiracy group defeat the crypto community?

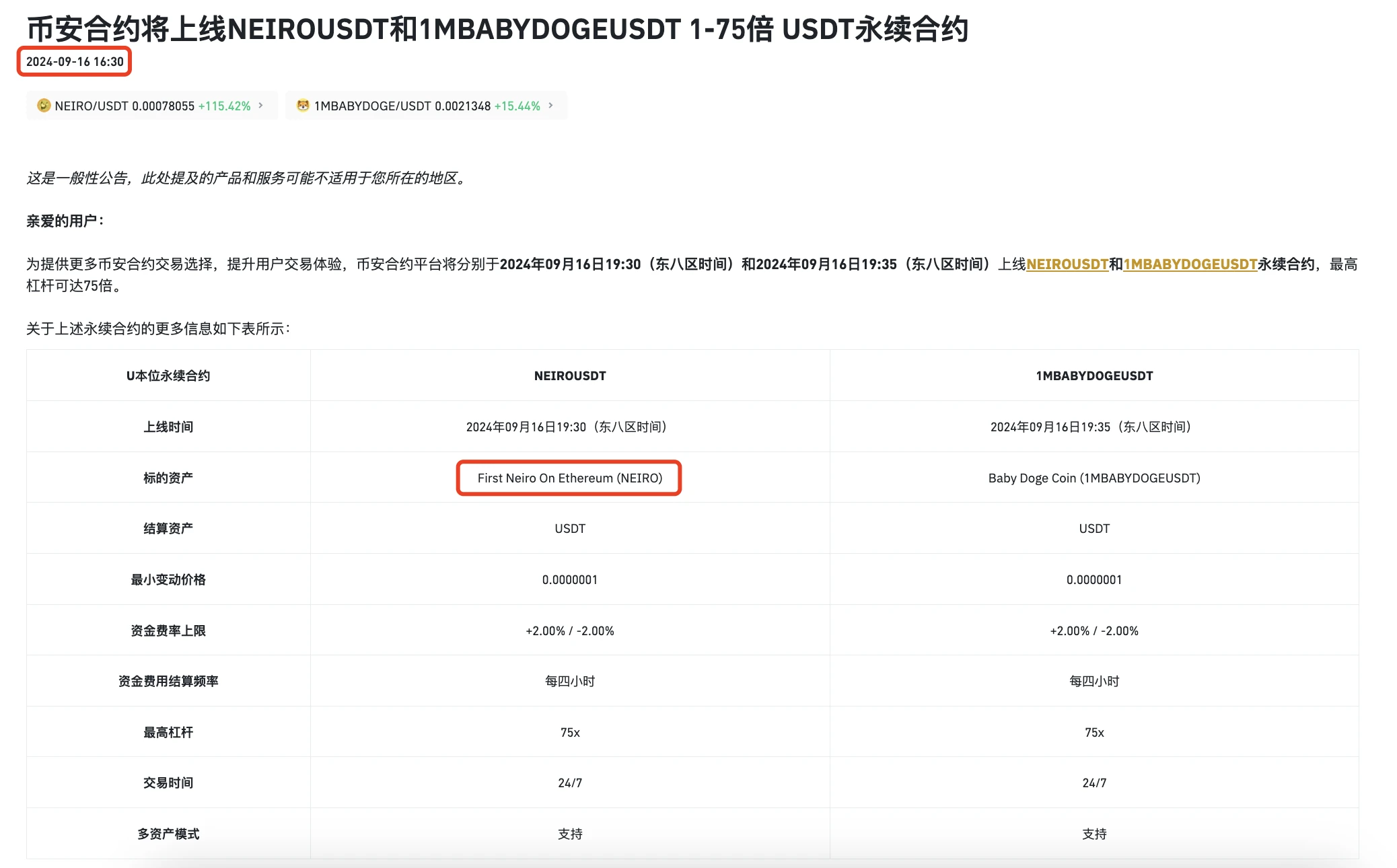

On September 6, Binance released an official announcement , saying that Binance Futures will launch NEIROETH 1-75x USDT perpetual contracts. As soon as the news came out, the market responded quickly – the price of NEIRO quickly broke through $0.16, with a 24-hour increase of up to 139.25%, and once broke through $0.2 in the following days.

Binance official announcement related information

It is worth mentioning that at that time, NEIRO tokens were bombarded by many X platform users, who claimed that the conspiracy group behind it had distributed tokens to multiple addresses earlier and gradually sold them, and then washed the market for 2 months; and before the launch of Binance contracts, NEIRO also had a small increase, which led some people to question whether there might be rat warehouse behavior.

Although NEIROs trading volume on exchanges such as Bybit has reached hundreds of millions of dollars, the project s internal holdings of up to 78% still made crypto players who joined because of the relatively fair participation threshold of Meme Coin sneer. Some voices in the market and community also criticized Binances listing behavior and expressed disappointment.

But soon, things took a turn for the better.

Lowercase Neiro spot contracts followed closely behind: Can the fire of the community set the whole prairie on fire?

On September 16, 10 days after the news of “NEIRO contract launched on Binance” was released, Binance officially 宣布 again that “Binance will list First Neiro on Ethereum (NEIRO), Turbo (TURBO) and 宝贝总督 Coin (1 MBABYDOGE) and add seed tags to them”.

Because the token ID in the official announcement was also capitalized NEIRO, many people mistakenly thought it was the NEIRO project that had already completed the contract launch and did not pay too much attention to it. However, the contract address showed that the project was actually a lowercase Neiro project, and the market value of the project was only about 20 million US dollars at the time .

Moreover, not only is the uppercase and lowercase Neiro confusing, Binances one-click three-coin operation also confuses many users – although in terms of trading volume, project operation and market recognition, TURBO and BABAYDOGE can indeed be classified as old Meme coin projects, but such a dense spot listing, and they are all Meme coins, is as rare as the previous BOME 3 days on Binance.

At 4:30 p.m. on the same day, Binance officially 宣布 again that Binance Futures will launch NEIROUSDT and 1 MBABYDOGEUSDT 1-75x USDT perpetual contracts. Not only that, the official Binance announcement also specifically reminded: Please note that this contract is First NeiroFirst Neiro On Ethereum (NEIRO), the address is 0x812ba41e071c7b7fa4ebcfb62df5f45f6fa853ee. It is a different token from the NEIROETHUSDT contract launched on September 6, 2024 (address: 0xee2a03aa6dacf51c18679c516ad5283d8e7c2637).

Many people just woke up from their dreams at this time: It is true that the lowercase Neiro token, supported by many Chinese community members, has landed on Binance in both spot and contract trading. The market value of Neiros project also rose rapidly in just a few hours, from 20 million US dollars to over 120 million US dollars; in contrast, the price of the uppercase NEIRO token fell rapidly, falling below 0.1 US dollars in just a few hours, and fell to a minimum of around 0.072 US dollars. The maximum daily decline exceeded 50%, and currently remains around 0.076 US dollars.

Many people exclaimed: In the end, the crypto community defeated the conspiracy group.

Binance announcement information interface

After Neiro successfully achieved both spot and contract listing on Binance, Binance also released two announcements in succession : Binance will launch NEIRO, TURBO and BABYDOGE in coin earning, flash exchange and leveraged trading 和 Binance pledge lending adds NEIRO, POL, TURBO and other borrowable assets. The support for the lowercase Neiro project far exceeds the previous uppercase NEIRO project.

Although some people have criticized Binance for lowering the currency listing standards again, in todays volatile market with increasingly tight liquidity, combined with the main demands of the exchange, Meme coin projects with market attention, active trading volume and stable operations are indeed within range, which is understandable.

Community voice: Some people acted quickly, some went all the way, and some got nothing.

The voice and reaction of the crypto community regarding the listing of both uppercase and lowercase NEIRO/Neiro tokens on Binance are also quite intriguing.

When the NEIRO contract was launched, some people wanted to become part of the conspiracy group, some people short-termed and made a successful profit; some people were too superstitious about the Binance effect and had no choice but to chase high prices and get trapped. After the Neiro spot and contract were launched, the previous diamond hands finally got the corresponding rewards and were all excited; there were also lucky people who took the lead in ambush and made hundreds of thousands of dollars in floating profits; of course, there were also people who sold their Neiro positions first and bought NEIRO tokens, but eventually missed the Neiro opportunity and could only sigh.

Lucky guy or insider? A whale built a Neiro position with more than 20 WET H coins, making a floating profit of $355,000

On September 16, according to the monitoring of Ai Yi, an analyst on the chain, an address that happened to open a position of 1.3 billion Neiro on September 15 earned a profit of 694% in one day. The lucky person 0x4bb previously withdrew 21.667 WETH from CEX, bought 1.3 billion Neiro tokens at an average price of $0.00003924 and has held them until now, with a floating profit of $355,000.

KOLs who are “numbed” by drilling: laser cats, philanthropists

根据 一篇帖子 on the X platform by Chinese crypto KOL and founder of Tinfun NFT, “Radio Cat”, he realized a profit of nearly $2 million from a single Meme coin project thanks to the increase in token prices brought about by the listing of the Neiro project on Binance. Previously, he also forwarded a tweet from the on-chain monitoring account Onchain Lens tracking the operation of his personal address buying Neiro tokens.

In addition, another Chinese crypto KOL Coin Circle Philanthropist also reaped a lot of benefits this time. He had previously expressed his optimism about the community-supported Neiro project, and he summarized it in his own article : I bought $50,000 of Neiro at the beginning, and the cost was about 17 million market value; when $50,000 rose to $100,000, I sold $50,000 for the consideration of recovering the cost, and the remaining $50,000 position was all profit. Recently, I checked the profit and it is now worth about $400,000 (equivalent to 9 times the profit), and I just sold half of the profit; now there is still $200,000 in profit left.

A victim of market news: $250,000 lost in just a few days

Of course, not everyone can enjoy the fruits of this feast, and some people pay for it. Crypto KOL San Francisco is not Paris 发布 on the X platform that I lost about $250,000 due to my participation in transactions related to uppercase and lowercase NEIRO/Neiro tokens.

SHIB early sellers enter the market, Neiro is still continuing

Of course, the dispute over the NEIRO/Neiro uppercase and lowercase token projects has come to an end for the time being, but the development of the Neiro project continues.

According to Spot On Chain 监控 , an early SHIB buyer exchanged 1,003 ETH (US$2.31 million) for 2.86 billion Neiro on September 18.

It is worth mentioning that although the whale earned $145 million from SHIB in 2021-2022, 2 of the last 3 transactions (including NEIROETH and the second SHIB transaction) have caused a loss of $13.48 million.

As of writing, the NEIRO token price is stable at around $0.073, with a market value of approximately $73.7 million; the Neiro token price was close to $0.0009, but has now fallen back to around $0.0008, with a market value of approximately $337 million.

Binance’s shift: multiple considerations, caring about the community, the second half of the Meme coin track is coming

Finally, we will briefly analyze the NEIRO/Neiro uppercase and lowercase token dispute, and from the attitude and operational shift of the industry leader Binance, we can get a glimpse of the subsequent direction of the Meme coin track from the beginning of this year to today. From some perspectives, the second half of the Meme coin track may have arrived.

Binance’s shift: from “you can short sell” to “consider hot spots” to “admitting insufficiency”

In March of this year, with the approval of the Bitcoin spot ETF, market sentiment was high, the price of Bitcoin broke a new high, and the price of Ethereum once approached US$4,000; coupled with the Solana Meme coin craze led by BOME, which completely detonated the entire market, and the market once entered a bull market sentiment stage with high liquidity and extremely high trading enthusiasm.

Taking this opportunity, Binance, as a leading exchange with over 200 million users and a bellwether of cryptocurrency, launched a wave of coin listings that now seems a little crazy – more than a dozen projects with high market capitalization were listed in just a few months. At that time, VC coins with high FDV and low circulation also became the focus of market discussion.

In addition, at the time when the US SEC launched a highly intense investigation into Binance, Binance eventually reached a settlement of up to US$4 billion with it. The founder CZ eventually temporarily left the market with a three-month prison sentence and a phased result of retreating to the front line of Binance management.

At that time, many people were extremely dissatisfied with Binances practice of crazily sucking blood from the market. In response to this, He Yi, the co-founder and the face of Binance, said bluntly: If you are not optimistic about a project, you can short sell it. This fully demonstrated the arrogance of the market leader and the ruthless style of the markets survival of the fittest.

Binance co-founder He Yis previous tweet

As time went on to September, the Fed’s interest rate cut information was still kept secret, and the market was showing signs of fatigue after experiencing waves of shocks. As one of Binance’s “talkers”, He Yi may have also realized the different impacts brought about by the change in the market environment. At the same time, he also paid more attention to “community feedback”. His speech was also contrary to his previous sharp and direct style, and instead was more like a heart-to-heart communication with community members.

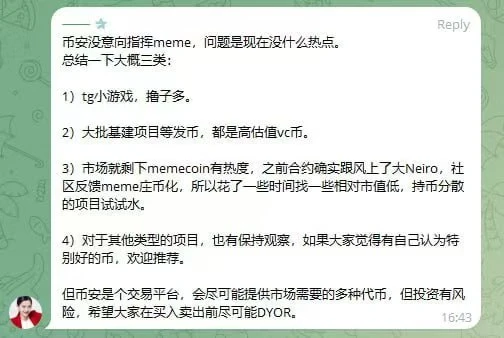

In the past two days, He Yi said in a Telegram group: Binance has no intention of directing memes, the problem is that there are no hot spots now. To sum up, there are roughly three categories:

-

tg mini game, lots of fun.

-

A large number of infrastructure projects and other token issuances are all highly valued VC coins.

-

Memecoin is the only hot coin in the market. The previous contract did follow the trend and launched Neiro. The community reported that meme was becoming a cryptocurrency, so we spent some time looking for some projects with relatively low market capitalization and dispersed coin holdings to test the waters.

-

We are also keeping an eye on other types of projects. If you think there are any coins that you think are good, you are welcome to recommend them.

But Binance is a trading platform and will try its best to provide a variety of tokens that the market needs. However, investment is risky, and we hope that everyone will do their best to DYOR before buying and selling. ”

On the one hand, the speech indirectly explained the recent launch of TON ecosystem project tokens such as DOGS, HAMSTER, and CATI; on the other hand, it also showed Binances goodwill and sincerity to the community: while considering hot topics, it will listen to community opinions and suggestions.

Moreover, He Yi’s latest post mentioned at the beginning expressed his sincere and humble attitude: “Everything I have achieved today is the product of the times, the rapid economic development brought about by globalization, the information flattening brought about by the rise of the Internet, and the opportunity for the blockchain industry to be created from scratch. It is not because I am gifted, but it is just that in the early days of the industry, ‘there are no heroes, but young men become famous.’ This means: ‘I am not necessarily right.’ ”

The second half of the Meme coin race is coming: active trading, market attention, and continued topicality are all indispensable

此外, the dispute over the uppercase and lowercase tokens NEIRO/Neiro may also mean that after experiencing the Solana Meme coin craze represented by BOME and SLERF, the PVP Meme coin craze led by pump.fun, the celebrity Meme coin craze such as MOTHER and DADDY, and the Meme coin craze led by New Shiba Inu Neiro, the Meme coin track has entered the second half.

On the one hand, there will be fewer and fewer Meme coins that quickly decline and decay, and Meme coin projects will also begin to pay attention to topic value, breaking the circle and short-term wealth-creating effect; on the other hand, Meme coins are no longer as attractive to outsiders as before. Now that liquidity is becoming increasingly tight, the final destination of Meme coin projects may enter the To VC and To Exchange entrepreneurial stage.

Just as we mentioned in 加密风险投资周期的演变(第一部分):重建一个新世界 – VC coins were once Meme coins, the current Meme coins and subsequent Meme coin projects may have to face the situation that Meme coins are also VC coins.

最新消息 节目 that according to The Data Nerd, Wintermute has accumulated NEIRO tokens worth about $3.4 million since September 10. As of now, the address holds a total of tokens worth about $4.55 million, accounting for about 6.2% of the total supply. (Odaily Planet Daily Note: Some people in the market speculate that Wintermute may be an exchange market maker for the NEIRO project, but the news has not been verified.)

After all, whether a successful Meme coin can stand out from thousands of projects depends not only on its original narrative, but also on powerful dealers, strong cohesive communities and project parties or volunteers who work hard for it. In other words, a Meme coin without fighting power has lost from the beginning, and it has lost completely.

This may also be an important reason why the Meme coin track has gradually cooled down after experiencing high-intensity PVP, despite the emergence of one-click coin issuance platforms in various ecosystems and platforms.

Conclusion: Meme Coin has left the “grassroots development stage”

Finally, please allow me to make a temporary and arbitrary conclusion: the era in which three or five people started a Meme coin project, and eventually with the help of the market and the community, the projects market value exceeded tens of millions of dollars or even hundreds of millions of dollars may be difficult to appear again. Meme coin has already left the previous grassroots team development period.

As we mentioned in the article After the Meme Summit, the Base Meme Coin Ecosystem Officially Entered the Second Half written in June this year, it is difficult for Meme coins that can succeed on their own to appear in the Base ecosystem . The representative Meme project DEGEN of the Base ecosystem and the NFT Artist Second Venture MFERCOIN that imitated BOME also indirectly confirmed our judgment.

Now, the scope of application of this view has expanded to the entire crypto industry – perhaps its time for the regular army to enter the Meme coin market.

This article is sourced from the internet: Neiro and NEIRO are listed on Binance together. Is the Meme coin track reaching a turning point?

Related: An article reviewing the changing stance of BlackRock founder on cryptocurrencies

Original translation: Wu said blockchain Larry Fink is the CEO and co-founder of BlackRock, the worlds largest asset management company. Born in 1952, Fink received a bachelors degree in political science and an MBA from UCLA. He began his career at First Boston in 1976 and later achieved early success developing mortgage-backed securities (MBS). In 1988, he founded BlackRock and grew it into a global giant that manages trillions of dollars in assets. His attitude towards Bitcoin and cryptocurrency can be divided into the following stages: 1. Early Views (2017-2018): Skepticism and Criticism In the early years, Fink was highly skeptical of Bitcoin. In 2017, he called Bitcoin an index of money laundering, indicating his concerns about its connection to illegal activities. During this period, Fink and BlackRock generally took…